SalesRipe vs ZoomInfo: the 2026 reality (SalesRipe is discontinued)

"SalesRipe vs ZoomInfo" is a trap keyword. One of these products hasn't existed since June 5, 2020.

If you're a 1-10 person outbound team, you're not choosing between two tools. You're choosing between a suite you'll underuse (and still pay for) and verified contact data you'll use every day.

This distinction matters more than feature checklists.

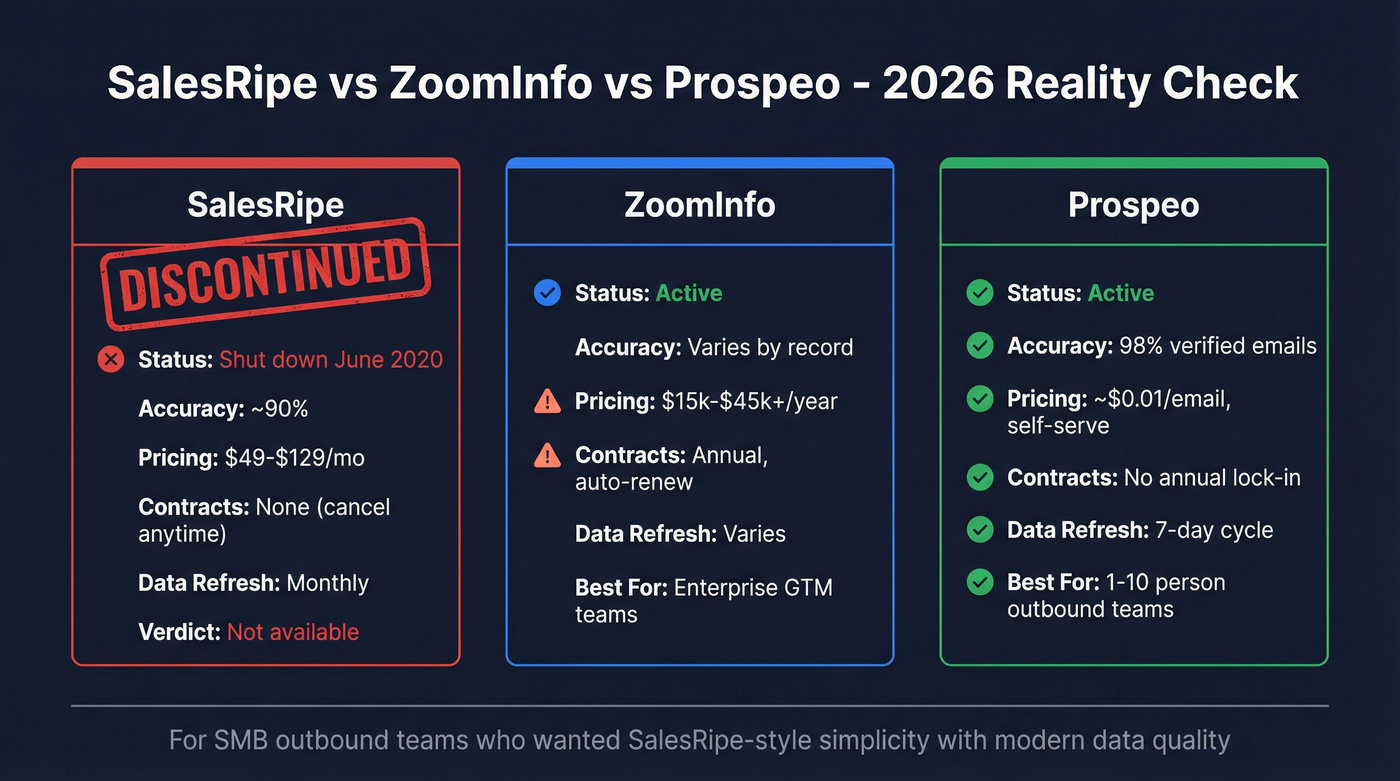

30-second verdict (and the "skip both" option)

- Choose ZoomInfo if... you're running a real GTM platform motion: Sales + Marketing alignment, territory planning, intent + web visitor workflows, and you can budget $15k-$45k+/year plus add-ons. ZoomInfo pays off when you actually implement modules, governance, and reporting - not when reps only export lists.

SalesRipe reality: it's discontinued as of June 5, 2020. The only useful comparison is economic: SalesRipe's old credit pricing vs ZoomInfo's suite pricing and contracts.

Skip both if... you wanted SalesRipe-style affordability but you need modern, verified data you can trust in sequences. Tools like Prospeo give you the "data layer" approach: 98% verified email accuracy, a 7-day refresh cycle, and verified mobile numbers (with a 30% pickup rate) on self-serve, credit-based pricing with no contracts.

Why this isn't a real head-to-head in 2026

Search results still recycle SalesRipe copy from 2019 like it's a live product. It isn't.

SalesRipe is only useful as a reference point for a buyer type: someone who wanted straightforward list building, clear monthly pricing, and a download-to-Excel workflow.

So the honest comparison is: SalesRipe's old economics vs ZoomInfo's current economics--and then what you should buy now.

SalesRipe vs ZoomInfo: is SalesRipe still active?

Use this checklist and stop wasting time:

- SalesRipe's own pricing page shows a shutdown banner: "Beginning June 5, 2020, SalesRipe will be shutting down... automated payments will be automatically deleted and deactivated... download previous downloads before June 5th 2020."

- The banner includes customer instructions (download what you already paid for because billing and access are going away).

- ZoomInfo's company profile lists the same closure date, showing SalesRipe's closure as effective June 5, 2020.

What it means for buyers: don't evaluate SalesRipe features. Evaluate the workflow you need now - list building, enrichment, verification, and how you'll keep Salesforce/HubSpot clean (see how to keep CRM data clean).

SalesRipe gave SMBs simple credit-based pricing with 90% accuracy. Prospeo gives you the same self-serve simplicity - but with 98% email accuracy, a 7-day data refresh, and verified mobiles with a 30% pickup rate. All at ~$0.01/email with no annual contract.

Get SalesRipe's simplicity with data quality ZoomInfo can't match.

Pricing reality in 2026 (and what SalesRipe's credits taught us)

SalesRipe's pricing was refreshingly simple. And it explains why so many SMBs loved it.

It also shows why "credits" can look cheap while hiding the real cost of usable contact data.

Historical plans and overages (SalesRipe) vs ZoomInfo today

| Item | SalesRipe (historical) | ZoomInfo (2026) | Contract |

|---|---|---|---|

| Status | Discontinued | Active | Annual |

| Base price | $49-$129/mo | $15k-$45k+/yr | Quote |

| Credit unit | Excel download | Export | Bundled |

| Refresh | Monthly | Varies | Varies |

| Cancel | Yes | No | Auto-renew |

SalesRipe monthly tiers (from its pricing page at the time):

- Basic: $49/mo for 200 credits

- Plus: $79/mo for 1,000 credits

- Ultimate: $129/mo for 2,500 credits

- Enterprise: Contact Us

Overages (from the terms):

- Basic: $0.10/credit

- Plus: $0.05/credit

- Ultimate: $0.03/credit

And the credit definition was blunt: "A credit equals a contact downloaded to excel."

Why SalesRipe felt "fair" to SMBs

SalesRipe leaned into buyer-friendly terms:

- No setup fee

- Unlimited lead search/view (you paid when you downloaded)

- Unused credits rolled over

- No contract + cancel anytime

- Try free (no card)

That's exactly why ZoomInfo feels like whiplash for former SalesRipe buyers: you go from "monthly + rollover + cancel anytime" to "annual + bundles + renewal windows."

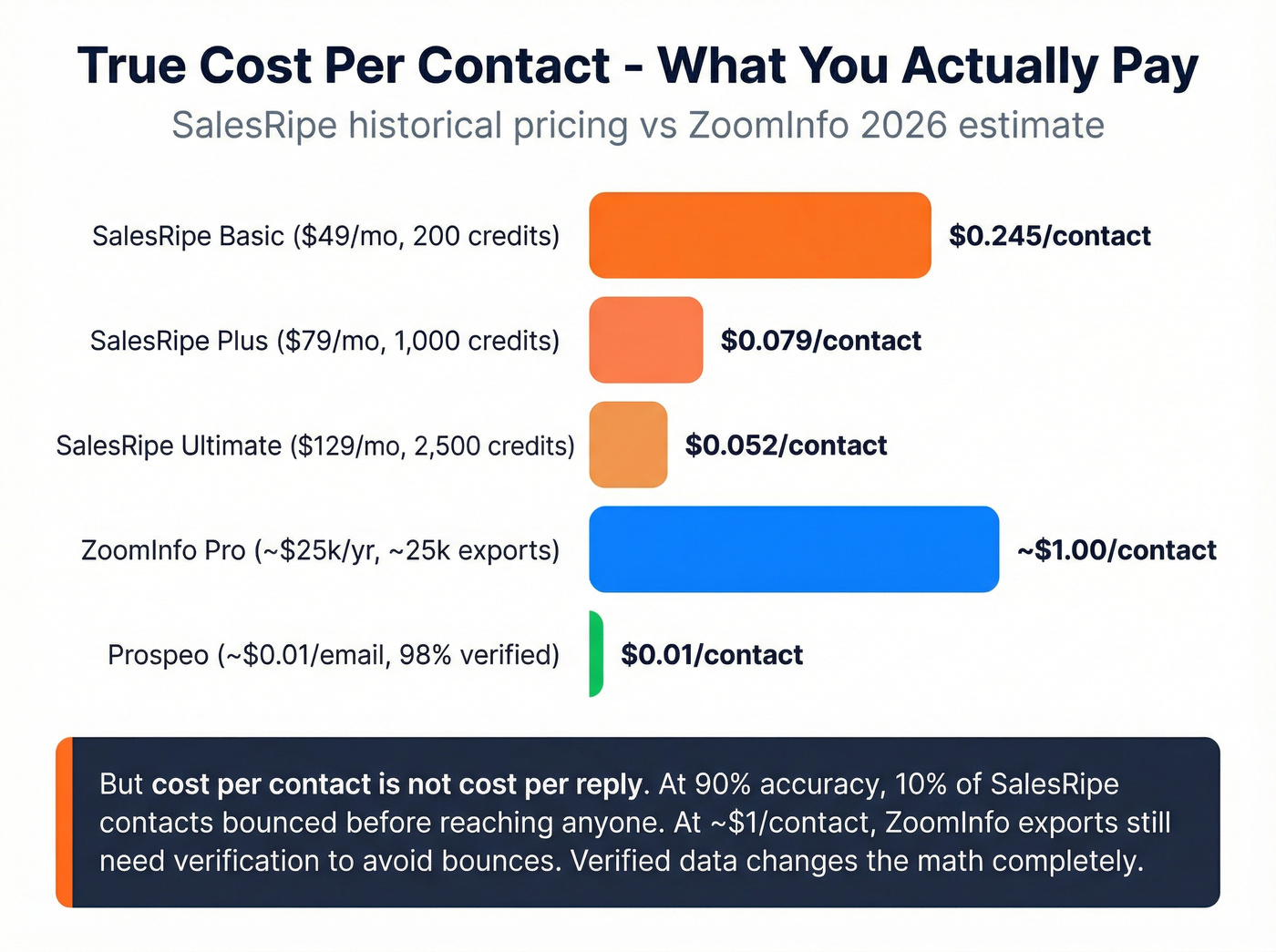

The "true cost per contact" callout (SalesRipe)

SalesRipe looked cheap because the unit was "a downloaded contact," not "a verified, deliverable email + reachable mobile."

- Ultimate: $129 / 2,500 = ~$0.052 per contact

- Plus: $79 / 1,000 = $0.079 per contact

- Basic: $49 / 200 = $0.245 per contact

SalesRipe also said its business and consumer data was updated monthly, and its pricing-page FAQ put average accuracy at 90%.

I've seen teams learn this lesson the hard way: they buy "cheap" data, load it into sequences, and then spend the next three weeks cleaning up bounces, angry replies, and a deliverability mess that didn't need to happen in the first place.

ZoomInfo overview - what you're actually buying

ZoomInfo isn't "a database." It's a suite packaged across Sales, Marketing, and Talent--and that packaging is the whole point.

You don't just pay for contacts. You pay for a system that tries to change how your org finds, prioritizes, routes, and measures accounts, which is great if you have the ops muscle to implement it and a nightmare if you're hoping it behaves like a simple list tool.

Two examples that show where the platform's going:

- Copilot: an AI layer for reps (signals, talking points, workflow prompts).

- WebSights: website visitor identification and "reveal" workflows that pull marketing and sales into the same motion.

If you're a RevOps lead, the question's simple: are you buying contacts, or are you buying a GTM operating system?

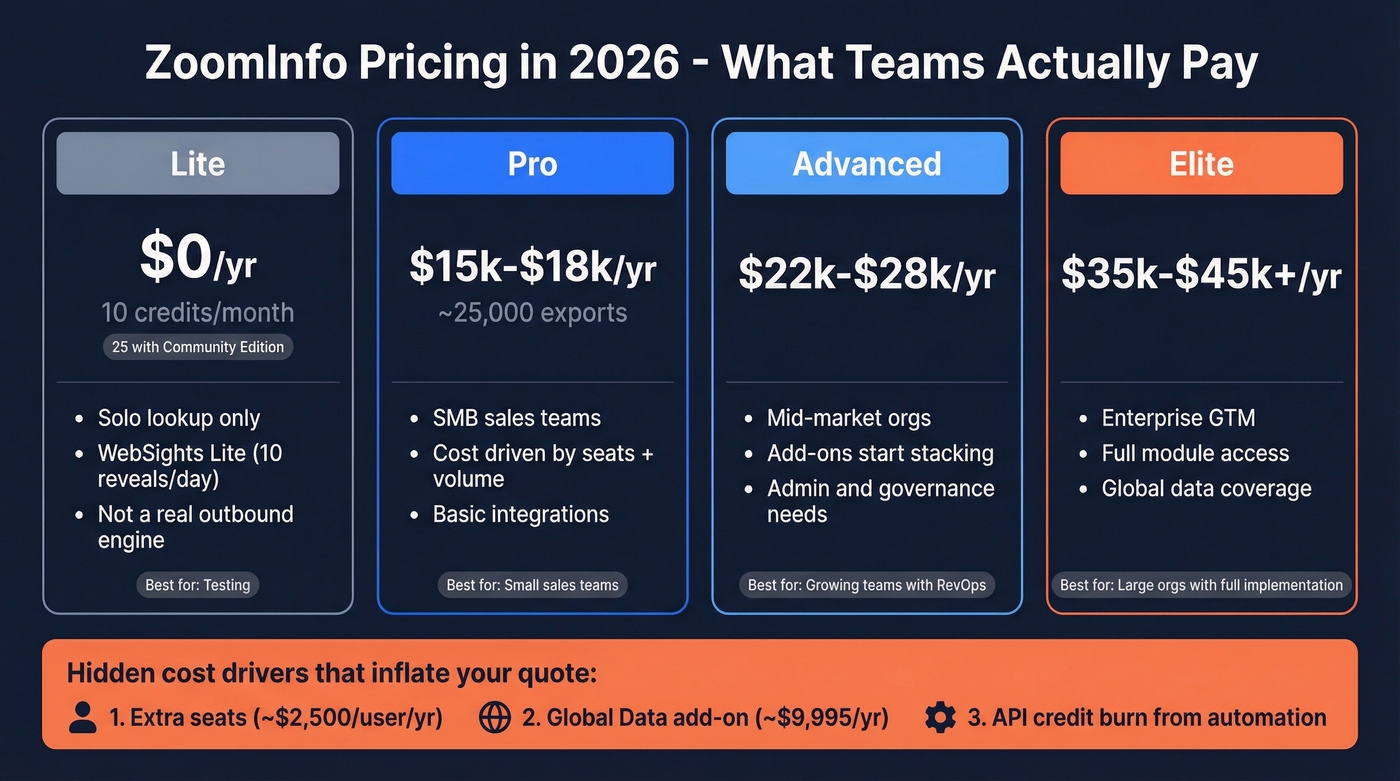

ZoomInfo pricing reality in 2026 (Lite, paid tiers, add-ons, and negotiation)

ZoomInfo pricing is frustrating because it's not "one number." It's seats + credits + modules + term length, bundled in ways that hide unit economics.

Look, this is where people get burned.

Here's a clean way to budget it.

ZoomInfo pricing table (what teams actually pay)

| Tier | Typical annual | Best fit | What drives cost up |

|---|---|---|---|

| Lite | $0 | Solo lookup | Credit cap |

| Pro | $15k-$18k | SMB sales team | Seats + export volume |

| Advanced | $22k-$28k | Mid-market | Add-ons + admin needs |

| Elite | $35k-$45k+ | Enterprise | Modules + global coverage |

ZoomInfo Lite is free with 10 credits/month (or 25 with Community Edition) and includes WebSights Lite with up to 10 reveals/day. It's a trial lane, not a real outbound engine.

Benchmarks you'll see in procurement datasets

Benchmarks from a procurement dataset (Jan 2026) put list pricing around:

- $14,995/year (Professional+ benchmark)

- $29,995/year (Advanced+ benchmark)

- $35,995/year (Elite+ benchmark)

Treat those as benchmarks. Your quote moves based on seats, modules, and term length.

Add-ons that change the math fast

These two line items show up constantly in quotes:

- Additional users: benchmark ~$2,500/user/year

- Global Data: benchmark ~$9,995/year

If you're buying ZoomInfo for international coverage, assume Global Data lands in the deal somewhere. If you're buying it for a bigger team, seats are the silent budget killer.

Negotiation reality (where most teams leave money on the table)

If your annual budget is closer to five figures than six, you probably don't need ZoomInfo-level suite pricing. You need verified contactability and a clean workflow.

If you do need ZoomInfo, negotiate like you mean it. Discounts in the 30-65% range are common in procurement-led motions (Jan 2026 benchmark). The easiest levers:

- Cut modules first, not price first. Remove anything you won't implement in 60 days.

- Trade term length for discount (only if you're confident you'll use it).

- Lock seat counts and add seats later at a pre-negotiated rate.

- Cap credit overages or get a written true-up policy.

- Ask for an exit clause tied to data quality (see the contract section below).

If you accept the first quote, you're paying the "no-procurement tax."

Pricing math (sanity checks that prevent regret)

Use these quick checks before you sign:

- Cost per exported contact: $25k/year ÷ 25,000 exports = $1/contact before you factor duplicates, decay, and bounces.

- Seat creep: 5 extra seats × $2,500 = +$12,500/year without increasing credits.

- Automation tax: if API calls burn credits like manual exports, RevOps automation gets expensive fast.

SalesRipe vs ZoomInfo: data quality, freshness, and verification (what actually moves reply rates)

Database size isn't the KPI. Contactability is.

ZoomInfo's strength is breadth plus workflow context. On G2, ZoomInfo Sales sits at 4.5/5 with 8,997 reviews, and the average time to implement is ~1 month (accessed Feb 2026). That tracks: it's not "sign up and go" once you care about governance.

Where ZoomInfo is genuinely strong

- US coverage depth is still the main reason teams buy it.

- Company intelligence (org context, signals, web visitors) is powerful when you operationalize it.

- Integrations and admin controls are built for bigger orgs with governance.

What users complain about (in plain English)

The negative themes are consistent across review sites: stale records, wrong titles, wrong emails, duplicates, and support friction.

A few short excerpts that capture the vibe:

- Data staleness: "A lot of contacts are outdated, and we still have to verify before sending."

- Pricing friction: "It's expensive, and the contract makes it hard to justify for a small team."

- Cancellation/renewal pain: "Auto-renewal caught us off guard - set calendar reminders or you'll pay for another year."

Those aren't edge cases. They're the normal failure modes of big databases at scale.

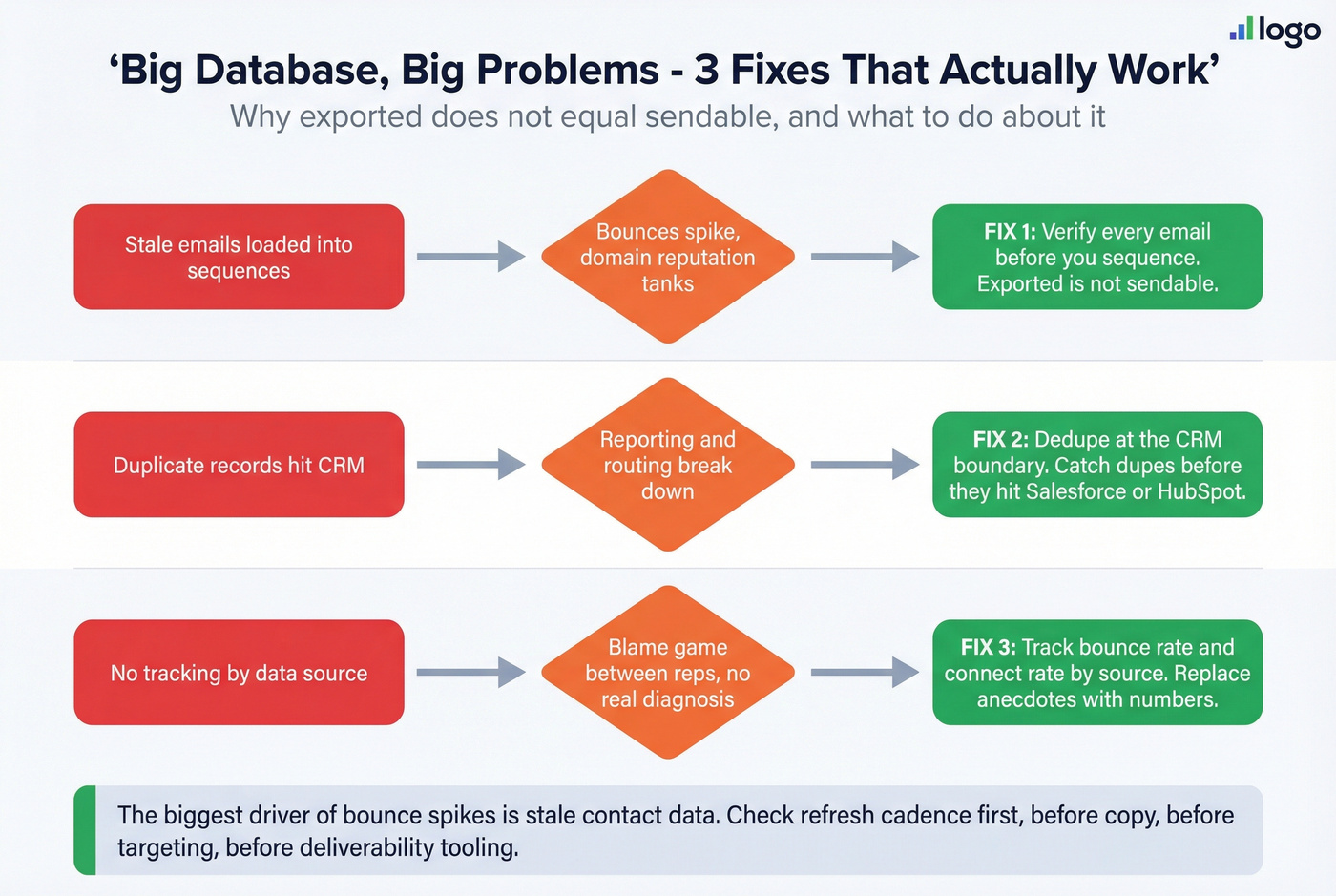

The failure modes - and the fixes that work

Large databases decay. Your workflow has to assume decay.

- Fix #1: verify before you sequence. "Exported" isn't the same as "sendable." (If you need a process, use this email verification list SOP.)

- Fix #2: dedupe at the CRM boundary. If duplicates hit Salesforce/HubSpot, reporting and routing rot fast.

- Fix #3: track bounce + connect rate by source. Don't let this devolve into rep anecdotes.

In our outbound audits, the biggest driver of bounce spikes is stale contact data - refresh cadence is the first thing we check, before copy, before targeting, before deliverability tooling (see B2B contact data decay).

Contract & cancellation reality check (what to ask for before you sign)

ZoomInfo's a procurement decision, not a swipe-your-card tool. Don't sign until you can answer these questions in writing.

The three clauses that matter most

- Availability: ZoomInfo's legal terms include a 99.9% monthly availability commitment. If availability drops below that and repeats within three months after notice, you can terminate and get a prorated refund.

- Accuracy remedy mechanics: there's a defined remedy if >5% of contacts aren't employed by the specified company. ZoomInfo gets 30 days to correct to 95% accuracy; if they can't, you can terminate and receive a prorated refund.

- Renewal window discipline: set internal reminders 90 days before renewal. Treat it like a revenue deadline.

What to ask for on the order form (copy/paste checklist)

Ask these directly - most "surprises" happen because they were never written down:

- Define what counts as a credit (export, reveal, API enrichment, extension lookup).

- Confirm whether API usage burns credits and at what rate.

- List every module included (by name) and confirm what's excluded.

- Seat add-on pricing locked for the term (no mid-year surprises).

- Overage policy (hard cap vs true-up vs pay-as-you-go).

- Support tier included (and response times if you can get them).

- Data replacement policy for bad records (how you submit, how fast they replace).

My opinion: if a vendor won't put credit rules and renewal mechanics in writing, they're telling you exactly how the relationship's going to feel after signature.

Best replacements if you were considering SalesRipe (or if ZoomInfo is overkill)

SalesRipe itself pointed people to UpLead, ZoomInfo, and Sales Navigator as replacements. That's a good hint at the original buyer intent: list building, straightforward prospecting, modern workflows.

Below's the shortlist I'd actually consider in 2026, with pricing ballparks and the tradeoffs that matter.

Quick comparison table (replacements)

| Tool | Best for | Pricing ballpark | Key tradeoff |

|---|---|---|---|

| Prospeo | Verified contactability | Free -> ~$39+ | Not a GTM suite |

| Apollo | All-in-one outbound | Free -> ~$59-$99/seat | Data varies by geo |

| Cognism | EU/UK compliance + phones | ~$12k-$40k/yr | Annual contract |

| UpLead | Simple list buying | ~$99-$399/mo | Fewer platform workflows |

| Lusha | Fast enrichment | ~$39-$99/seat/mo | Credits burn fast |

| Hunter | Email find/verify | ~$49-$199/mo | No direct dials focus |

| LeadIQ | Capture + workflow | ~$75-$150/seat/mo | Not a primary database |

| RocketReach | Broad lookup | ~$60-$300/mo | Mobile quality varies |

| Demandbase | ABM + intent | ~$50k-$200k/yr | Heavy RevOps lift |

| Factors.ai | Pipeline + intent analytics | ~$12k-$60k/yr | Needs clean CRM data |

Prospeo (Tier 1) - best "skip both" option for verified emails + mobiles

Prospeo is The B2B data platform built for accuracy. It includes 300M+ professional profiles, 143M+ verified emails, and 125M+ verified mobile numbers, all refreshed on a 7-day cycle (the industry average is 6 weeks). You also get 30+ search filters, real-time email/mobile verification, and enrichment that returns 50+ data points with a 92% API match rate (and 83% of leads coming back with contact data).

Here's the scenario where it shines: you've already got a CRM and a sequencer you like, you don't want an annual contract, and you're tired of paying for "platform" features you won't roll out this quarter. You just want accurate emails, reachable mobiles, and a clean export/enrichment loop that doesn't torch your domain reputation (more on domain reputation).

Apollo (Tier 1) - fastest way to get an SMB outbound motion running

Apollo's the default pick when you want database + sequencing in one tool and you don't want to stitch a stack together. Budget $59-$99/seat/month for most real SMB setups (free to start, then you pay once you need volume and team features).

I've watched this play out a dozen times: a founder buys a big database, exports 5,000 contacts, and the team spends the next week arguing about duplicates and bounced emails instead of booking meetings. Apollo can work well, but you still need basic hygiene.

2-minute setup path (do this, in order):

- Define ICP filters (industry, headcount, geo, titles) and save them.

- Create one "do-not-touch" master list for your ICP; clone it for campaigns.

- Connect your inbox + domain settings before you send anything at scale.

- Export a small batch, run a bounce check, and only then ramp volume.

- Set a dedupe rule in your CRM before the first import.

Skip Apollo if you already pay for Outreach/Salesloft and only want best-in-class data. Paying for overlapping engagement features is a quiet budget leak.

Cognism (Tier 1) - the compliance-first choice for EU/UK prospecting

Cognism's the pick when you care about EMEA coverage, compliance posture, and phone data in regulated environments. Expect $12k-$40k/year for most teams, depending on seats and regions.

Compliance checklist (what to confirm before you buy):

- Do they support DNC/TPS screening for your target regions?

- Can you enforce suppression lists across teams?

- Is there a clear GDPR/legal basis workflow for outreach? (Use this GDPR for sales and marketing playbook.)

- Can RevOps audit exports and user activity?

- Do they provide a DPA and clear opt-out handling?

Skip Cognism if you're US-only and your main pain is bounced emails rather than international dialing.

UpLead (Tier 1) - closest to old SalesRipe "buy lists, move on" simplicity

UpLead's the closest modern equivalent to SalesRipe's original appeal: straightforward list building, clear packaging, and minimal suite sprawl. Budget $99-$399/month depending on credits and features.

Mini decision tree (choose fast):

- If you want monthly, predictable list buying -> pick UpLead.

- If you want a full GTM suite and can handle annual contracts -> pick ZoomInfo.

- If you want verified contactability + self-serve and you already have a sequencer/CRM workflow -> pick a data-layer tool instead of a suite.

Skip UpLead if you need intent + web visitor workflows and want Sales + Marketing running in one platform. UpLead's a list tool first.

Lusha (Tier 2) - the "I need a number right now" extension tool

Lusha's great for lightweight enrichment when reps just need an email/phone quickly and don't want a heavy platform. Budget $39-$99/seat/month for typical small-team usage.

Where it shines: opportunistic lookups and quick enrichment. Where it hurts: credits disappear fast when you scale outbound volume.

Hunter (Tier 2) - clean email finding + verification for domain-based prospecting

Hunter's the no-drama option for "find emails for these domains" workflows and basic verification. Budget $49-$199/month depending on volume.

It's email-first by design. If direct dials are core to your motion, you'll want something else alongside it.

LeadIQ (Tier 3) - capture + push-to-sequencer workflow

LeadIQ's best when reps live in Sales Nav and need fast capture, light enrichment, and clean handoff into Outreach/Salesloft. Budget ~$75-$150/seat/month; treat it as workflow glue, not your source-of-truth database.

RocketReach (Tier 3) - broad lookup when you need coverage fast

RocketReach is a generalist contact lookup tool with wide coverage for quick "find someone at this company" needs. Budget ~$60-$300/month depending on lookups/exports; expect variability in mobile quality and plan accordingly. (If you want the cost mechanics, see RocketReach pricing.)

Demandbase (Tier 3) - enterprise ABM and intent orchestration

Demandbase is for true enterprise ABM: intent, advertising, account orchestration, and measurement across teams. Budget ~$50k-$200k/year and expect a real implementation effort with RevOps and marketing ops involved.

Factors.ai (Tier 3) - intent + pipeline analytics layer

Factors.ai connects site/product signals and intent to pipeline reporting for teams that want tighter revenue attribution. Budget ~$12k-$60k/year; it works best when your CRM hygiene's already solid.

ZoomInfo's $15K+ annual contracts make sense if you need a full GTM platform. If you need verified contact data you can trust in sequences - 143M+ verified emails, 125M+ verified mobiles, 300M+ profiles refreshed every 7 days - you need Prospeo. No sales calls. No renewal traps.

Stop overpaying for contacts. Start sending to emails that land.

FAQ

Is SalesRipe discontinued?

Yes - SalesRipe is discontinued, and the shutdown date is June 5, 2020. Its pricing page posted a shutdown banner telling customers automated payments would be deleted and to download prior exports before access ended.

How much does ZoomInfo cost for a small team in 2026?

Most small teams should budget $15k-$45k+/year once seats, credits, and common add-ons are included. A Jan 2026 procurement benchmark also shows extra users at ~$2,500/user/year and Global Data at ~$9,995/year, which can push totals up quickly.

What do you actually get with ZoomInfo Lite?

ZoomInfo Lite is free and typically includes 10 credits/month (or 25 with Community Edition) plus WebSights Lite with up to 10 reveals/day. It's best for occasional lookups and testing workflows, not for running consistent outbound volume.

What's a good free alternative if I just need verified emails?

Prospeo includes a free tier with 75 email credits + 100 Chrome extension credits per month, and you only pay for valid addresses. For lightweight email-only workflows, Hunter's free tier can also work.

If you came here hoping for a clean "which is better" verdict, here it is: SalesRipe isn't a choice anymore. In "salesripe vs zoominfo" terms, the real decision in 2026 is whether you're buying a GTM suite (ZoomInfo) or buying verified contactability you can trust in production - and building your workflow around that choice.