The Battle Card Template Guide That Makes Every Other Result on Google Look Like a Landing Page

Your rep has five seconds. A prospect just said "we're also looking at [competitor]" mid-demo, and your rep's eyes dart to a second monitor. She's hunting for the battle card. She finds a 5-page PDF in a shared drive folder called "Competitive Intel Q3." She scrolls. She scans. The prospect is waiting.

She wings it.

That scenario plays out thousands of times a day. 65% of sales content goes completely unused by reps. One PMM on r/ProductMarketing summed it up perfectly: they spent weeks crafting the perfect battlecard, and it sits in a shared drive, rarely opened - reps still ping them with the exact questions the card answers. No battle card template can fix a broken process, but the right one makes that scenario a lot less likely.

Here's the quick version of what actually works:

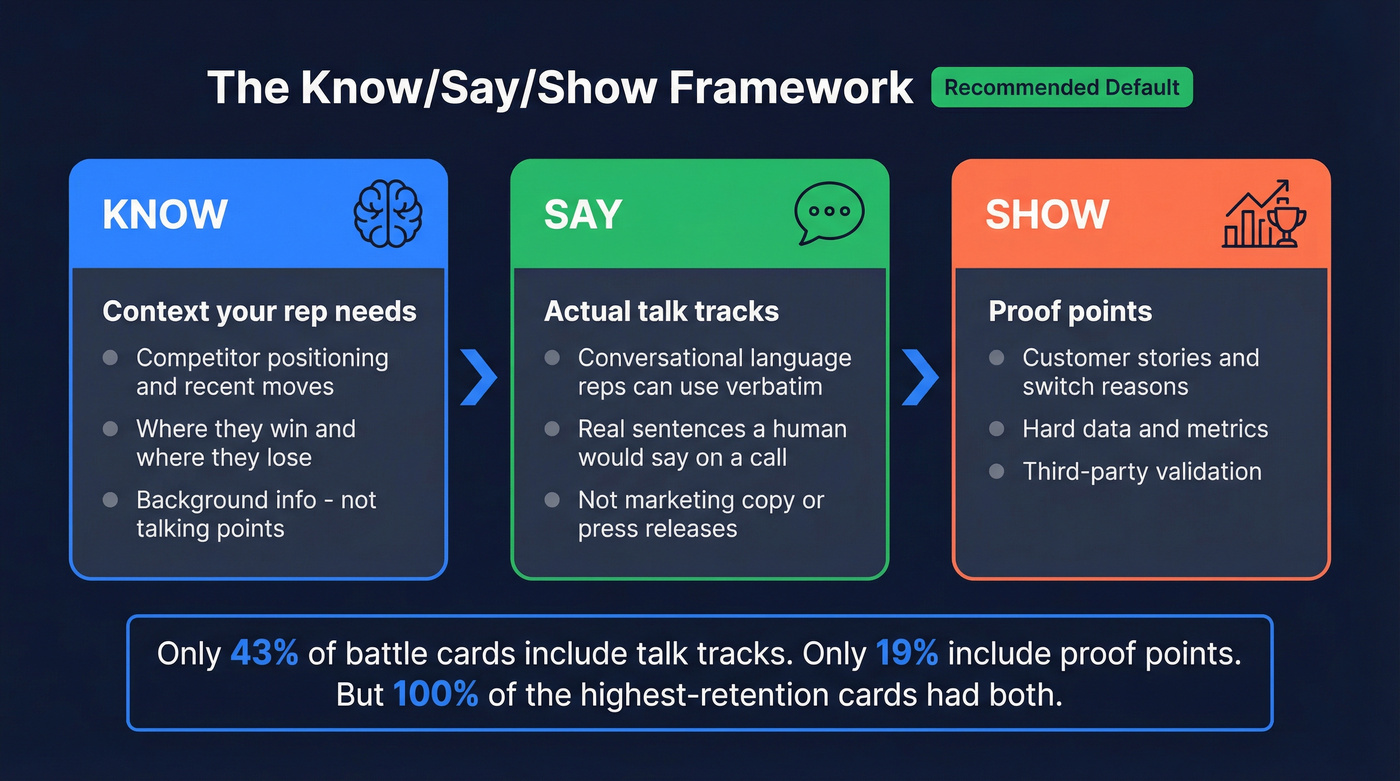

- Best framework: Know/Say/Show. Klue's audit of 150+ battle cards found that 100% of the highest-retention cards included both talk tracks and proof points. This framework forces both.

- Best format: Single page, three sections - talking points, objection responses, trap-setting questions. One SaaS company went from under 10% adoption to over 70% in a single quarter by condensing 5-page docs to this format.

- Best free tool: Google Docs for the template, Google Gemini for the first draft. Total time: 30 minutes per competitor.

What a Sales Battle Card Should (and Shouldn't) Include

A battle card is a single-page tactical reference designed for one scenario: a rep is in a live conversation and needs to respond to a specific competitor, right now. That's it. It's not a training document, not a competitive analysis, not a sales playbook.

The confusion between these three is where most programs go sideways.

| Battle Card | Sales Playbook | Competitive Analysis | |

|---|---|---|---|

| Purpose | Win a live deal | Train on process | Inform strategy |

| Length | 1 page | 10-50 pages | 5-20 pages |

| Audience | Reps mid-call | New hires, managers | PMMs, leadership |

| Update cycle | Monthly | Quarterly | As needed |

| When used | Prospect names competitor | Onboarding, QBRs | Planning, positioning |

Playbooks inform battle cards, not the other way around. Your playbook is the strategy. Your competitive analysis is the research. Your battle card is the weapon that goes into the field.

68% of sales opportunities are competitive. Companies with sales enablement programs achieve 49% higher win rates on forecasted deals. If your reps don't have a one-page answer for the top three competitors they face, they're improvising - and improvisation in competitive deals means discounting.

Before You Build - Tier Your Competitors

If you're a PMM staring at 10 competitors and feeling overwhelmed, you're not alone. One PMM on Reddit described exactly this: a list of ~10 competitors, no idea where to start, paralyzed by the scope.

Stop. You don't need full cards for all of them.

Tier your competitors before you build anything. Rank each one on three criteria:

- Product similarity - How much overlap exists in features and use cases?

- Target overlap - Are you competing for the same buyers at the same companies?

- Growth trajectory - Are they gaining share in your deals, or fading?

Then assign each competitor to a tier:

- Tier 1 (full battle card): You face them in 20%+ of competitive deals. Build a complete card with talk tracks, objection handling, proof points, and landmine questions. Expect 6-10 hours per competitor the first time, depending on how many rep interviews you do.

- Tier 2 (condensed one-pager): They show up occasionally. A stripped-down card with positioning, 2-3 key differentiators, and a quick-dismiss script. 3-4 hours each.

- Tier 3 (quick-dismiss paragraph): Rarely encountered. A single paragraph your rep can reference: who they are, why they lose to you, one sentence to move the conversation forward.

Most B2B companies have 2-3 Tier 1 competitors, 3-5 Tier 2, and the rest are Tier 3. Start with Tier 1. Ship those. Then build down.

3 Battlecard Frameworks (Pick One)

Every competitive card needs a structural framework - a consistent way to organize information so reps know exactly where to look. I've seen teams waste weeks debating formats. Pick one of these three and move on.

| Framework | Structure | Best For | Complexity |

|---|---|---|---|

| Know/Say/Show | Context -> Talk tracks -> Proof | Default for most teams | Medium |

| Fact/Impact/Act | Data -> Meaning -> Script | Prescriptive-language teams | Medium to build, Low to use |

| ABC | Accuracy/Brevity/Consistency | Quality review lens | Low |

Know / Say / Show (Recommended Default)

This is the framework we recommend for most teams, and the data backs it up.

Know = the context your rep needs. Competitor's positioning, recent moves, where they win and lose. This is background, not talking points.

Say = the actual talk tracks. Conversational language a rep can use verbatim or adapt. Not marketing copy - real sentences a human would say on a call.

Show = proof points. Customer stories, data, third-party validation. The evidence that makes the talk track credible.

Here's why this works: Klue's audit of 150+ battle cards found that only 43% include talk tracks and only 19% include proof points. But 100% of the highest-retention cards - the ones reps actually kept coming back to - contained both. Know/Say/Show forces you to include both by design.

Battle cards can also be role-specific. A BDR card for discovery calls looks different from an AE card for late-cycle depositioning, which looks different from an executive card for C-suite conversations. Know/Say/Show works for all three - you just adjust the depth and language for each audience.

Fact / Impact / Act

This framework works well for teams that want every line on the card to be prescriptive - no interpretation required.

Fact = an objective piece of competitive intel. "Competitor X was founded in 1998."

Impact = what that means for the prospect. "Legacy architecture limits modern integrations."

Act = the exact language to use. "Their platform wasn't built for today's API-first world. Ask them how long their last integration took to deploy."

The strength is that it eliminates the gap between knowing something and saying something. More work upfront for the PMM, but simpler for the rep. If your reps are experienced and prefer flexibility, Know/Say/Show gives them more room.

ABC (Accuracy, Brevity, Consistency)

Don't confuse this with a structural framework - it's a quality checklist. Crayon developed it as three principles every competitive card should meet:

- Accuracy: Every claim is verified and current

- Brevity: One page, scannable in seconds

- Consistency: Same format across all competitor cards

Use ABC as a review lens alongside Know/Say/Show or Fact/Impact/Act. It's not a replacement for either.

Every battle card needs a "Show" section - proof points that make your talk tracks credible. Prospeo gives your reps the ammo: 98% verified email accuracy, 7-day data refresh vs the 6-week industry average, and 125M+ direct dials with a 30% pickup rate. That's not marketing copy. That's the competitive differentiator your card is missing.

Build your battle card around data your reps can actually prove.

Section-by-Section Breakdown of a Winning Battle Card

Here's every section your card needs, what goes in each one, and the mistakes I see teams make over and over again.

Positioning Statement (2-3 Sentences)

This is not your elevator pitch. Gong's battlecard philosophy is explicit about this: elevator pitches encourage "steamroller mode" where reps dump features instead of having a conversation.

Your positioning statement answers three questions: What are we? Who do we serve? Why are we different from this specific competitor?

Example: "We're a data enrichment platform built for outbound teams that need verified contact data, not a CRM with a database bolted on. Unlike [Competitor], we refresh data weekly and verify every email before delivery."

Keep it to 2-3 sentences. If a rep reads this aloud, it should sound like something a human would actually say.

Competitor Overview + Landmine Questions

Start with a brief competitor summary - 3-4 sentences covering who they are, who they sell to, and their core positioning. Then add 2-3 landmine questions.

Landmine questions are strategically crafted to expose competitor weaknesses without naming them. They plant doubt without making your rep look like they're attacking.

Example: "Ask them about integrations the next time you chat. Specifically, ask how long their average customer spends on implementation." This works because you know the competitor's implementation takes 3x longer than yours - but you're letting the prospect discover that themselves.

The best landmine questions feel like genuine curiosity, not sabotage.

Talk Tracks (The Section Most Cards Are Missing)

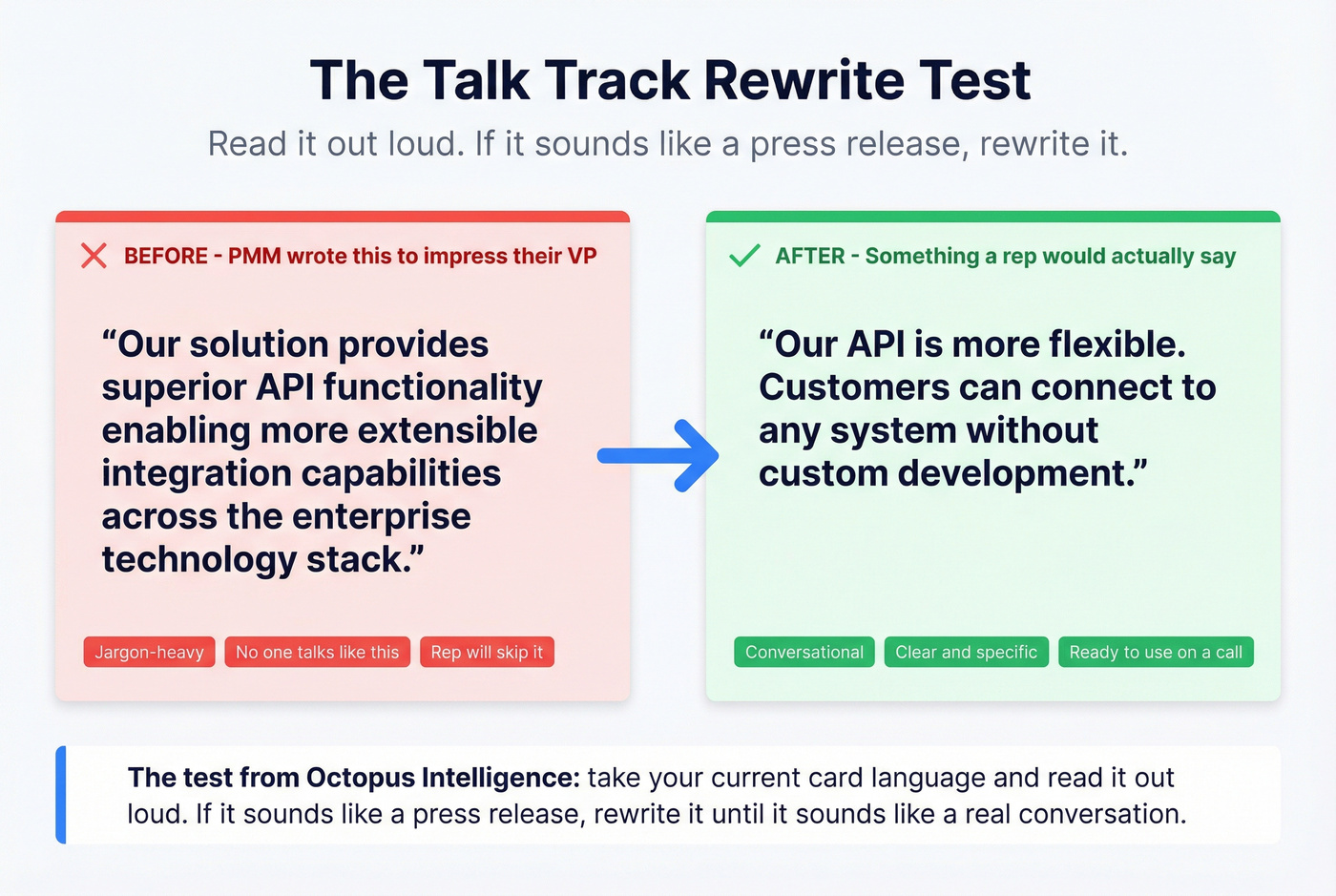

Here's the thing: this is the section that separates useful battle cards from decorative ones. Only 43% include talk tracks. That means more than half of all competitive cards are just... information. Information a rep has to translate into conversation on the fly, under pressure, while a prospect is waiting.

Talk tracks must be conversational. Here's the test from Octopus Intelligence: take your current card language and read it out loud. If it sounds like a press release, rewrite it.

Before: "Our solution provides superior API functionality enabling more extensible integration capabilities across the enterprise technology stack."

After: "Our API is more flexible. Customers can connect to any system without custom development."

The second version is something a rep would actually say. The first is something a PMM wrote to impress their VP.

Objection Handling with Proof Points

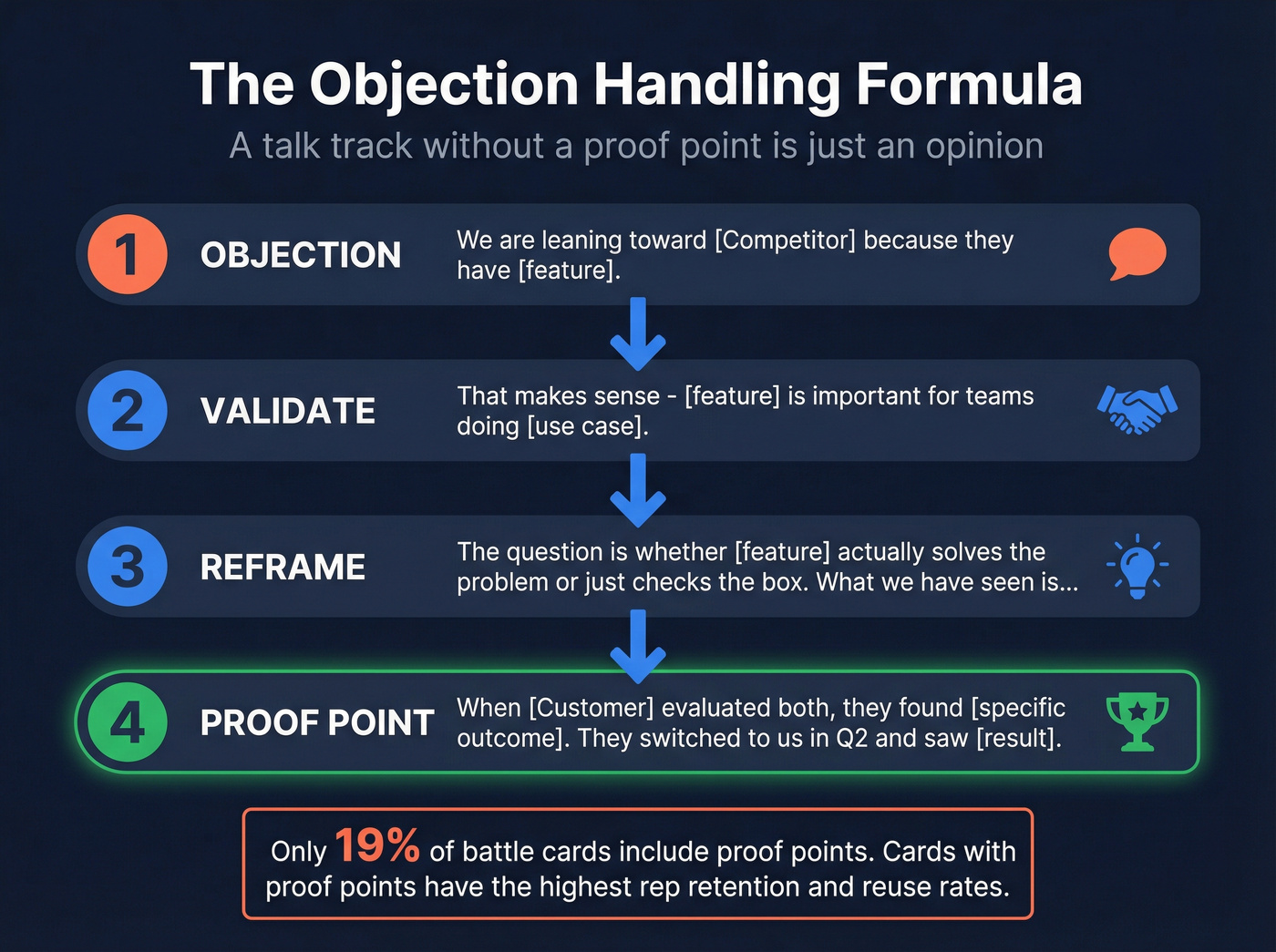

Only 19% of battle cards include proof points. This is criminal.

A talk track without a proof point is just an opinion. A talk track with a proof point is evidence. Use this format for every objection:

- Objection -> "We're leaning toward [Competitor] because they have [feature]."

- Validate -> "That makes sense - [feature] is important for teams doing [use case]."

- Reframe -> "The question is whether [feature] actually solves the problem or just checks the box. What we've seen is..."

- Proof point -> "When [Customer] evaluated both, they found that [specific outcome]. They switched to us in Q2 and saw [result]."

Gong calls these "boomerang stories" - customer stories where someone chose you over the competition, with specific reasons why. They're the most persuasive element on any competitive card.

Pricing Comparison + Demo Hooks

Don't just list prices. Frame them. If you're more expensive, explain why the total cost of ownership favors you. If you're cheaper, don't lead with price - lead with value and let the price be a pleasant surprise.

Demo hooks are specific moments in a demo where you can highlight advantages against this competitor. "When showing the integration setup, pause and say: 'This takes about 5 minutes. You might want to ask [Competitor] how long theirs takes.'"

The 10-second test: Hand your finished card to a new rep. Can they find the key differentiator within 10 seconds? If not, redesign it. Use color coding - green for your advantages, blue for neutral points, red for areas where the competitor is strong (with reframes). Everything stays on a single page.

What Real Battle Cards Actually Look Like

Companies guard their battle cards like state secrets. But enough have leaked or been published as examples that we can see what the best ones look like in practice.

Cisco Webex vs. Zoom

Cisco's Webex team built their Zoom battle card around a single persona: "Thema, Remote Worker." Instead of trying to out-feature Zoom on every dimension, they reframed the entire decision around end-to-end security - a dimension where Webex genuinely wins.

The card embeds specific coaching questions like "Ask about MFA for Apple Macs, Samsung devices, or general IoT machines." These aren't generic prompts. They're precision-targeted at gaps in Zoom's security posture that a rep can expose with a single question.

The insight: the best battle cards don't try to win everywhere. They pick the battlefield.

Parallels vs. Citrix

This one is blunt. Two pages, entirely table-driven. Checkmarks and short labels. No narrative, no storytelling - just a side-by-side comparison with a "30 seconds" pitch framing at the top.

It works because Parallels' advantage is straightforward: simpler, cheaper, faster to deploy. When your differentiation is that clean, a table is the right format. Not every card needs talk tracks and boomerang stories. Sometimes the data speaks for itself.

Salesforce Direct Connect

Salesforce's card opens with "fear statements" - the anxieties buyers already feel before a rep says a word. Instead of leading with features, it leads with empathy, addressing concerns buyers already have before the conversation starts. Then it reframes each fear into a Salesforce advantage, spelling out pricing, setup effort, and timing. This is the emotional inverse of a feature chart, and it works because it meets the buyer where they already are.

Netskope Partner Battle Card

Netskope took a different approach: lead with buyer questions. Instead of telling reps what to say, they gave reps questions to ask prospects that expose competitor gaps. "Can your SWG inspect SSL traffic?" sounds technical and neutral - but it's a landmine for competitors who can't.

The card includes micro case studies against Symantec, McAfee, and Zscaler, naming company size and the specific reason Netskope won. Proof-point-driven selling at its best.

The Dock.us collection of 24 real battle card examples is the best public resource I've found for seeing what completed cards actually look like in practice. (If you want more plug-and-play formats, see our battle card examples.)

What NOT to Put on Your Battle Card

Three anti-patterns that kill battle cards faster than anything else:

Feature comparison charts. This is the #1 mistake, and I'll die on this hill. Gong's philosophy is right: feature charts trigger spec wars that commoditize your product. The buyer either finds a winner on features (which might not be you) or concludes both products are basically the same - then grinds on pricing. Either outcome is bad. Instead of charting features side by side, detail how your features are different, not better at the same thing.

Marketing jargon. Andy McCotter-Bicknell from Klue put it perfectly: "I was using words like 'robust' and 'seamless,' these gross marketing words within all of these battlecards. Then a seller offered to give me feedback, and just tore it apart." If your card has the word "robust" on it, delete it right now. Use the exact words your reps use on calls.

Elevator pitches. Putting your company's elevator pitch on a competitive card encourages reps to launch into a monologue the moment a competitor is mentioned. That's the opposite of what you want. Treat competitor mentions as objections to address, not opportunities to pitch. Replace the pitch with a positioning statement and 2-3 landmine questions.

How to Populate Your Battle Card with Real Intel

Six Sources of Competitive Intelligence That Actually Work

Battle cards built from desk research alone are marketing exercises. The best cards are built from deal-level evidence. Here are the six sources that actually matter:

- Win/loss notes - Use structured templates, not free-form. Tag by competitor, deal size, and loss reason. (If you don't have a system, start with a simple win-loss analysis workflow.)

- Call transcripts - Filter for competitor mentions. Extract the exact objections, pricing references, and buyer language. When your card uses the same vocabulary buyers use, your reps sound like they're reading the prospect's mind. (A lightweight sales call checklist helps standardize what you capture.)

- Proposal feedback - What did the prospect say when they chose you? When they didn't? The specifics matter more than the summary.

- Deal post-mortems - Sit down with the rep within 48 hours of a competitive loss. Memory fades fast.

- Field intel from reps - Your reps hear things in calls that never make it into CRM notes. Build a lightweight submission process (Slack form, quick survey) so they can flag intel in 30 seconds.

- Competitive monitoring tools - Track pricing changes, new features, leadership shifts, and messaging updates. (More on building the program in our competitive intelligence for B2B sales guide.)

Interview 5-8 reps per competitor. Listen to 3-4 competitive calls. This is the discovery phase that most PMMs skip because it's time-consuming - and it's exactly why most battle cards read like they were written by someone who's never sold the product.

Keeping Cards Current - Update Cadence

An inaccurate battle card is worse than having no card at all. One wrong fact about a competitor's pricing, and your rep loses credibility with the prospect - and loses trust in the entire card.

Set a monthly signal review: pricing changes, new features, leadership shifts, major customer wins or losses. Then do a quarterly full refresh where you re-validate every claim on the card.

Assign one editor-of-record per competitor card. This person owns accuracy. Without a single owner, updates fall through the cracks and cards go stale within weeks.

Five Mistakes That Kill Battle Card Adoption (and the Data Behind Them)

Klue's audit of 150+ battle cards reveals a pattern: most cards fail for the same five reasons.

1. Missing talk tracks. Only 43% of battle cards include them. Without talk tracks, you're handing reps raw intelligence and expecting them to improvise under pressure. That's not enablement - that's a hope strategy.

2. Missing proof points. Only 19% include them. Here's the kicker: 100% of the highest-retention battle cards contained both talk tracks AND proof points. If your card has one without the other, you're leaving adoption on the table.

3. Information overload. The 10-second test is real. If a new rep can't find the key differentiator within 10 seconds of opening the card, they'll close it and never come back. One SaaS company had "masterpiece" 5-page cards per competitor. Sales never used them.

4. No sales input. Immature competitive programs are 3x less likely to collect feedback and intel from revenue teams. If reps didn't help build the card, they won't trust it.

5. No update process. Competitor pricing changes. Features launch. Messaging shifts. A card that was accurate in January is a liability by April. Without a defined update cadence and an editor-of-record, every card has an expiration date - and nobody's tracking it.

How to Get Reps to Actually Use Your Battle Cards

The Adoption Case Study

A SaaS company had beautiful, comprehensive 5-page battle cards for every competitor. The PMM team was proud of them.

Sales never opened them.

They condensed each card to a single page with three sections: key talking points, common objections with scripted responses, and trap-setting questions. That's it. Adoption went from under 10% to over 70% in one quarter.

The three-second rule drove the redesign: a rep should find the answer they need within three seconds of opening the card. Not ten seconds. Not thirty. Three. If your card requires scrolling, it's too long.

The Five-Step Adoption Playbook

Based on what we've seen work across multiple teams, here's the playbook:

1. Build with sales reps. Interview 5-8 reps per competitor before you write a single word. Ask them: what do prospects actually say when they mention this competitor? What objections come up? What do you wish you had in the moment? Their answers become your card's backbone.

2. Create using best practices. Single page. Know/Say/Show framework. Talk tracks in conversational language. Proof points with specific customer names and outcomes. Color coding. The 10-second test.

3. Integrate with CRM or enablement platform. If the card lives in a shared drive, it's dead. Put it in HubSpot, Salesforce, Highspot, Seismic - wherever your reps already work. The card should be one click away from the deal record. (If you're standardizing your process, use sales sequence best practices to keep enablement assets in the workflow.)

4. Keep updated always. Monthly signal reviews. Quarterly full refreshes. One editor-of-record per card. Enable reps to submit field intel - they'll use battle cards more if they're part of the CI process.

5. Measure by win quality, not downloads. Don't track how many times the card was opened. Track the metrics that actually matter:

- Competitive win rate by segment

- Whether battle card references appear in deal strategy notes

- Whether late-stage objection surprises decreased

Those tell you whether your cards are working - not open rates.

Pilot with your most seasoned reps first. Host a training session with 1-2 reps co-presenting alongside the PMM. When reps see their peers endorsing the card, adoption follows.

How to Build a Battle Card in 30 Minutes with AI

Here's my hot take: most teams don't need a $15,000/year competitive intelligence platform. They need a PMM who talks to reps, a free AI tool, and 30 minutes of focused work per competitor. The enterprise platforms are worth it at scale - but if you have fewer than 50 reps, you can build cards that are just as effective for $0.

Traditional creation takes 6-10 hours per competitor per quarter. Maintaining cards for 5 competitors means 150-300 hours per year. That's a full month of senior PMM capacity spent on maintenance alone. AI cuts that to 30 minutes per competitor.

Phase 1 - Competitive Intelligence Extraction (10 min)

Use an AI research tool to pull and synthesize competitive intel. The key is structured prompting across specific vectors - don't just ask "tell me about Competitor X."

Prompt across these dimensions: pricing and packaging changes in the last 90 days, new feature launches, customer complaints on review sites, leadership changes, messaging shifts on their website. Each vector gets its own prompt. The AI synthesizes; you validate.

Phase 2 - Buyer Voice Intelligence (10 min)

Filter your call transcripts (Gong, Chorus, or whatever you use) for competitor mentions. Extract the exact objections, pricing references, and buyer language.

This is the step most AI workflows skip, and it's the most important one. When your competitive card uses the same vocabulary buyers use in real conversations, your sales team sounds like they're reading the prospect's mind.

Phase 3 - Assembly and Validation (10 min)

Feed your research and buyer intel into an AI writing tool (ChatGPT, Claude, or Gemini all work). Generate the five core sections: positioning, competitor overview with landmines, talk tracks, objection handling with proof points, and pricing comparison with demo hooks.

Real talk: AI hallucinates specifics. It'll invent pricing, fabricate feature claims, and name customers that don't exist. Always validate pricing, feature claims, and customer names before publishing. The AI gets you 80% of the way in 10% of the time. The last 20% is human judgment - and it's the 20% that determines whether reps trust the card.

Budget option: Google Gemini's Deep Research feature generates a solid first draft in under 15 minutes. It's free. For a solo PMM at a startup, this is the move.

The ROI math: Traditional = 150-300 hours/year for 5 competitors. AI-assisted = 12.5-25 hours/year. That's an entire month of senior PMM capacity freed up for strategy, win/loss analysis, and the work that actually moves win rates.

Tools for Building and Managing Battle Cards

| Tool | Best For | Pricing | Key Feature |

|---|---|---|---|

| Google Docs | Solo PMMs, startups | Free | Collaborative, accessible |

| Notion | Structured templates | Free-$18/user/mo | Database organization |

| Figma | Design-forward teams | Free-$15/editor/mo | Visual templates |

| Playwise HQ | SMBs wanting AI | Free-$450/mo | AI card generation |

| Klue | Enterprise CI programs | ~$15,000+/yr | Full CI + win-loss |

| Crayon | Enterprise monitoring | ~$15,000+/yr | 300M+ source tracking |

If you're a team of 1-5 building competitive cards in Google Docs, your cost is $0 and your output can be just as effective as anything from an enterprise platform. The template matters more than the tool.

If you're scaling across 50+ reps and need version control, analytics, and CRM integration, expect $15,000-30,000/year for Klue or Crayon. The middle ground - Playwise HQ at $250-450/month - gives you AI-powered generation without enterprise pricing.

The tool doesn't determine adoption. The content does. I've seen teams on $30k/year platforms with 8% adoption and teams on Google Docs with 75%. Don't let tooling become a procrastination strategy.

Your reps face competitive objections about data accuracy every day. Give them a weapon they can use mid-call: Prospeo customers cut bounce rates from 35% to under 4% and book 26% more meetings than ZoomInfo users. At $0.01 per email, your battle card practically writes itself.

Stop arming reps with claims - arm them with receipts.

FAQ

How long does it take to create a battle card from scratch?

Expect 6-10 hours per competitor manually, including rep interviews and validation. With AI tools like Gemini or ChatGPT, the first draft takes about 30 minutes. Budget 2-3 weeks for a full program covering your top 5 competitors, including sales interviews, drafting, and feedback cycles.

How often should battle cards be updated?

Run monthly signal reviews for pricing changes, new features, and leadership shifts, plus quarterly full refreshes to re-validate every claim. Assign one editor-of-record per card. An outdated card actively damages rep credibility - it's worse than having none at all.

What's the difference between a battle card and a sales playbook?

A playbook is strategic and comprehensive - built for training, onboarding, and long-term process documentation (10-50 pages). A battle card is tactical and compact - built for the exact moment a prospect mentions a competitor mid-call (1 page). Playbooks inform battle cards; battle cards don't replace playbooks.

Do battle cards actually improve win rates?

A 2021 CI industry report found 93% of businesses using battle cards report over a 20% win rate increase - but only when cards include talk tracks and proof points. Since just 43% include talk tracks and 19% include proof points, most aren't delivering their potential.

How do I get accurate competitor and prospect data for my battle cards?

Combine internal sources - win/loss notes, call transcripts, deal post-mortems - with external competitive monitoring. For prospect outreach targeting competitive accounts, a verified data platform like Prospeo with 98% email accuracy and a 7-day refresh cycle ensures your contact information is current so outreach actually lands.