Demand Generation Campaigns: The Full-Funnel Playbook for B2B Teams in 2026

Your CMO just walked out of a board meeting where the CEO asked a simple question: "We spent $1.2 million on marketing last quarter - how much pipeline did it create?" The VP of Marketing pulled up a dashboard showing 14,000 MQLs and a 22% increase in webinar registrations. The CEO stared at it for ten seconds and said, "That's not what I asked."

The room went quiet.

That's the demand generation campaigns problem in a nutshell: most teams run campaigns without a system, measure activity instead of outcomes, and wonder why the board treats marketing as a cost center. These programs fail not because the tactics are wrong - they fail because teams skip the strategy and jump straight to "let's run some LinkedIn ads."

One clarification before we go further: if you Googled "demand gen campaigns" looking for help with Google's Demand Gen ad campaign type, that's a different animal entirely. One advertiser on Reddit accidentally burned $1M in five days on Google's Demand Gen product with zero measurable sales - the campaign reported more conversions than their entire web shop generated from all sources combined. Google's ad product and demand generation as a B2B strategy share a name and nothing else. This guide is about the strategy.

What You Need to Run Effective Demand Generation Campaigns

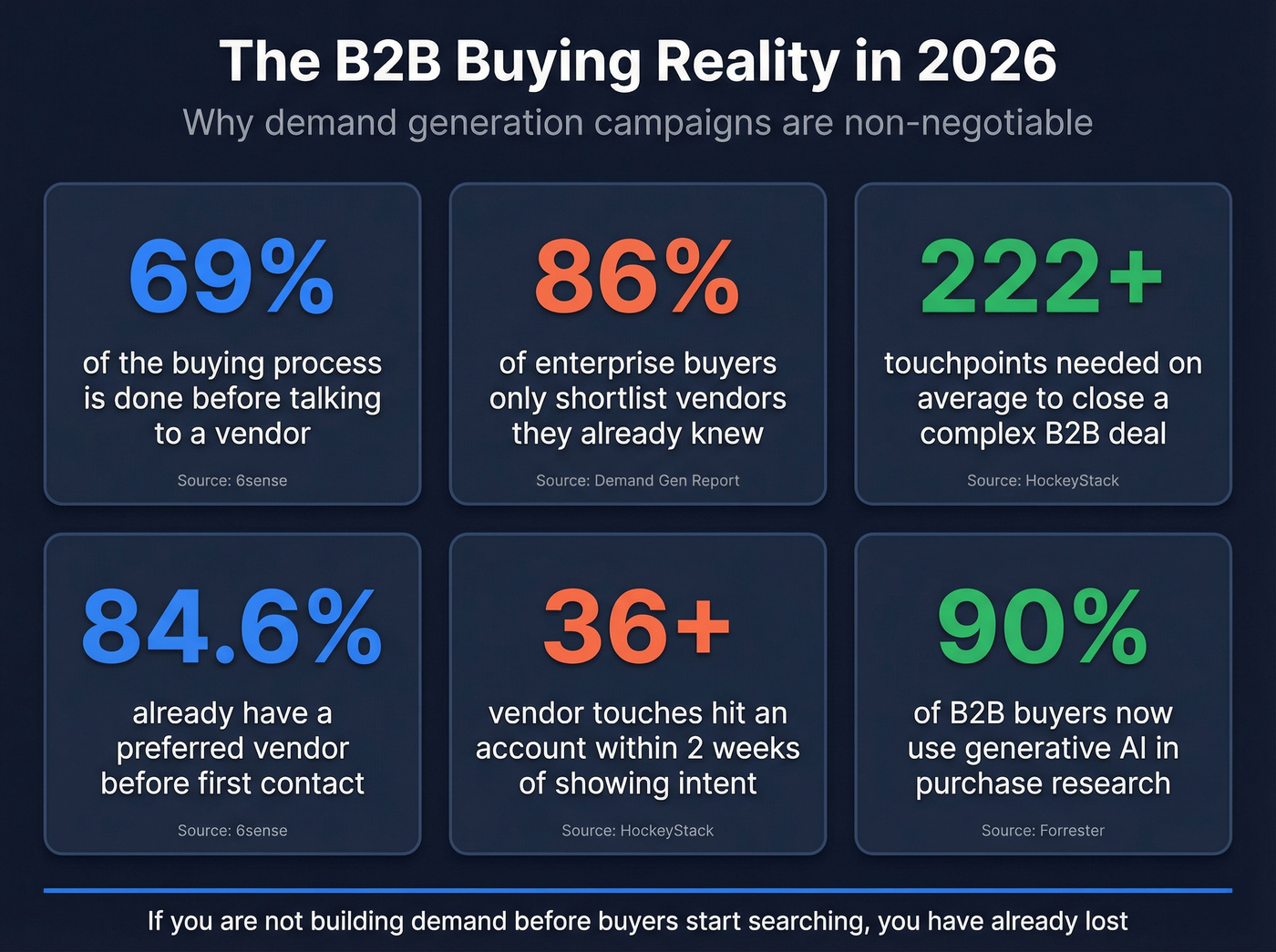

Buyers are 69% through their purchasing process before they ever talk to a vendor - that's from 6sense's study of 2,509 buyers. Even more brutal: 86% of enterprise buyers shortlist only vendors they'd already heard of before starting research. If you're not on that shortlist, your demo request form doesn't matter.

Three things separate teams that build pipeline from teams that build dashboards:

- A strategic framework, not more tactics. You need the 3-level buyer demand model (Content → Solution → Vendor) to sequence campaigns that match where buyers actually are. Most teams only run Vendor-stage campaigns and wonder why conversion rates are terrible.

- A data foundation built on verified contacts. Every campaign in this guide - ABM, webinars, content syndication, direct mail - depends on reaching the right people with accurate contact info. Bad data silently kills campaigns before they launch.

- One measurement system that tracks pipeline, not MQLs. If your primary metric is "leads generated," you're optimizing for the wrong thing. Track cost per sales-qualified opportunity and revenue attribution.

Why B2B Demand Gen Matters More Than Ever

The B2B buying process shifted, and most marketing teams haven't caught up.

6sense's Buyer Experience Study quantifies the problem. Buyers don't just prefer to research independently - they insist on it. 82.9% of North American buyers initiate first contact themselves. 84.6% already have a preferred vendor when they do. And 85% have largely established their requirements before any vendor conversation happens.

This means the vast majority of your "pipeline" is won or lost before your SDRs ever pick up the phone.

The complexity is accelerating. HockeyStack analyzed 1.5M+ contacts across 50+ B2B SaaS companies and found it takes 222+ touchpoints on average to close a complex deal - 222 touches across multiple channels, stakeholders, and months. And once an account shows intent, they receive 36+ vendor touches in just two weeks. If you're not in that first wave, you're already behind.

Those touches are happening in places you can't track. Slack channels. Internal meetings. Group chats. A colleague forwarding your podcast episode with "you should check these guys out." Nearly 90% of B2B buyers now use generative AI in their purchasing research - which means they're getting answers from sources that never show up in your attribution model.

The market reflects this shift. The demand generation market is projected to hit $8.35B by 2028. The math backs it up: teams that invest in early-stage awareness programs see 2x higher shortlist consideration and 23% faster sales cycles. Regional differences matter too - APAC buying cycles run 13.2 months with buying groups of 12.8 people evaluating 5+ vendors, while EMEA cycles are shorter at 10.2 months but still involve nearly 10 stakeholders. If you're running the same playbook globally, you're leaving pipeline on the table.

The teams winning right now aren't the ones with the biggest ad budgets. They're the ones who understood two years ago that demand gen is infrastructure, not a campaign.

Demand Gen vs. Lead Gen - The Distinction That Changes Everything

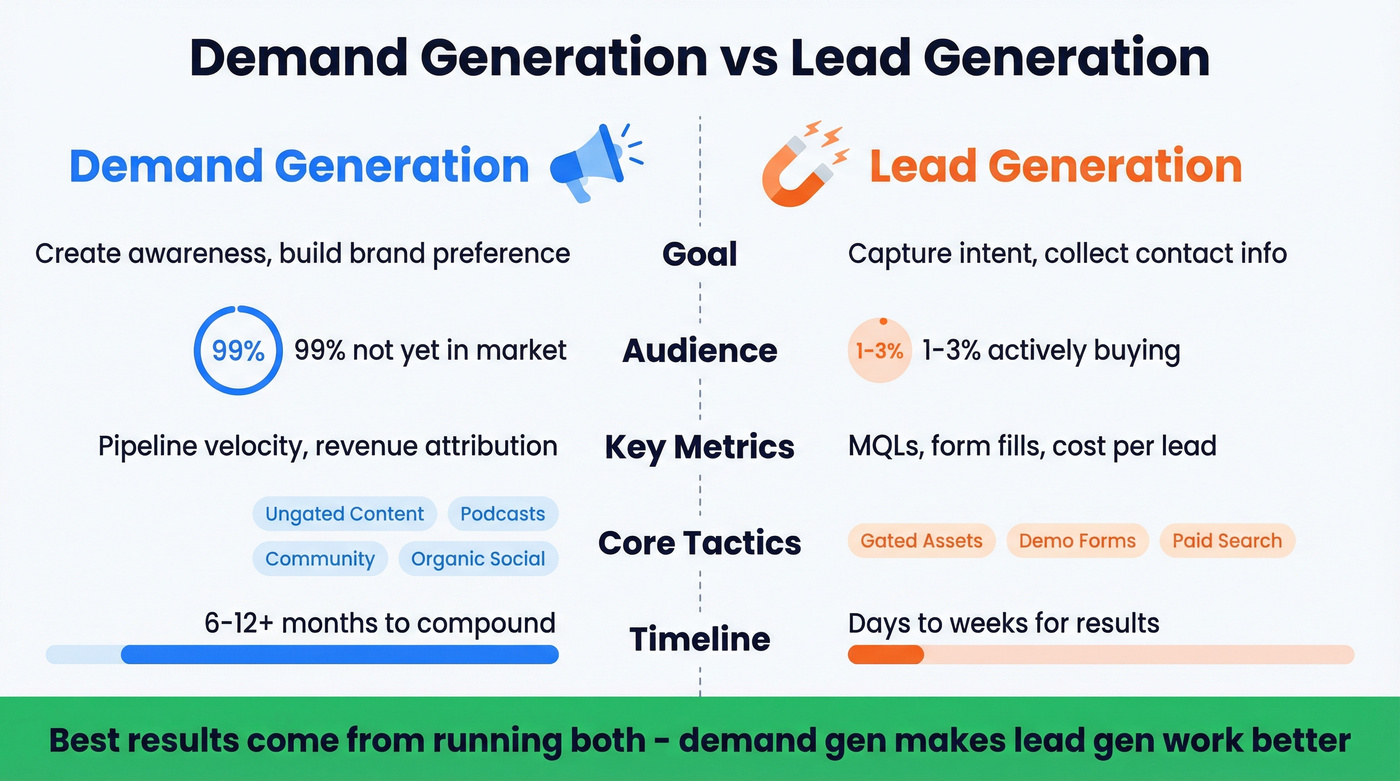

Most B2B teams use "demand gen" and "lead gen" interchangeably. They're not the same thing, and confusing them is expensive.

Lead gen captures existing demand. Someone's already looking for a solution - you put a form in front of them and collect their info. Demand gen creates demand. It makes people aware they have a problem, educates them on solutions, and builds preference for your brand long before they're ready to buy.

| Demand Generation | Lead Generation | |

|---|---|---|

| Goal | Create awareness, build preference | Capture intent, collect info |

| Audience | 99% not yet in-market | ~1-3% actively buying |

| Metrics | Pipeline velocity, revenue | MQLs, form fills, SQLs |

| Tactics | Ungated content, podcasts, community | Gated assets, demo forms, paid search |

| Timeline | 6-12+ months to compound | Days to weeks for results |

Cognism's own pivot tells the story better than any framework. Fran Langham described the old model: "With the lead-generation mindset, campaigns were e-books on landing pages... they took a long time to convert - or didn't convert at all." Their CMO Alice de Courcy framed the shift: "Convert the 1% already in-market, but focus on generating demand in the 99% who aren't." After making that shift - ungated content, thought leadership, building audience trust - Cognism saw a 4x increase in inbound pipeline with higher win rates and faster sales cycles.

The ceiling problem is real. Teams relying exclusively on lead gen eventually max out. You can only capture so much existing demand. When every competitor is bidding on the same intent keywords and gating the same whitepapers, CPLs climb and conversion rates drop. I've watched teams pour $50K/month into paid search, hit a plateau, and have no idea why pipeline flatlined.

Demand gen breaks that ceiling by expanding the total addressable audience. When you invest in creating demand, lead gen gets easier - forms convert higher because prospects already trust you, sales conversations start further down the funnel, and win rates improve. The two aren't opposing strategies. They're sequential. Demand gen makes lead gen work better.

222 touchpoints to close a deal - and every one needs to reach a real person. Prospeo's 98% email accuracy and 7-day data refresh mean your demand gen campaigns hit verified contacts, not dead inboxes. Bad data silently killed your last campaign. Don't let it kill the next one.

Stop building pipeline on a foundation of bounced emails.

The 3 Stages of Buyer Demand (And Why Most Teams Only Track One)

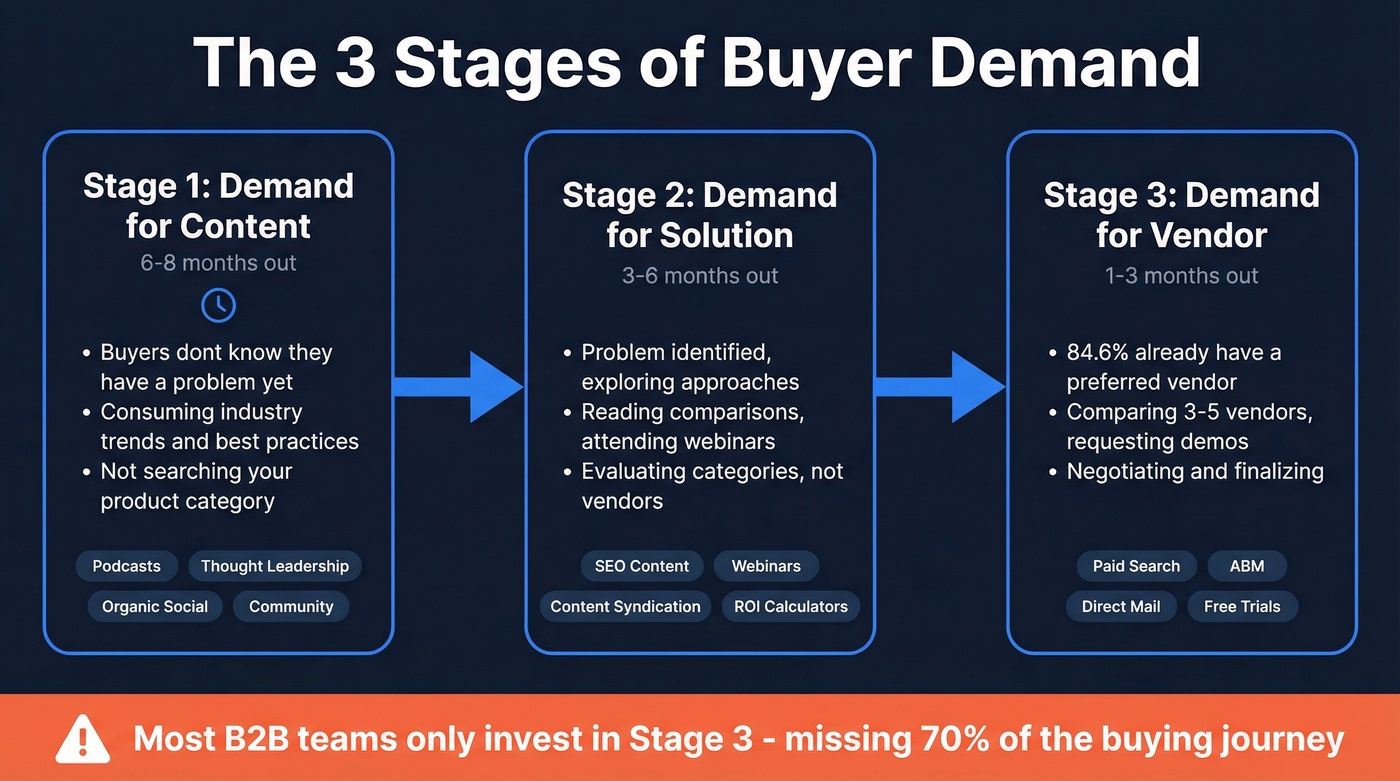

Here's the framework that changes how you think about campaign sequencing. It comes from FullFunnel's demand gen playbook, and it's the most practical model I've seen for mapping campaigns to buyer readiness.

Stage 1: Demand for Content (6-8 Months Out)

Buyers at this stage don't know they have a problem - or they know but aren't prioritizing it. They're consuming content about industry trends, best practices, and emerging challenges. They're not Googling your product category yet.

Your job: be the source they trust. Publish ungated insights. Build a newsletter. Show up in the communities where they hang out. The goal isn't leads - it's mental real estate.

Here's a distribution cadence that works: Day 1, publish on relevant platforms and communities. Day 2, repurpose into short-form clips or threads. Day 3, send to your newsletter list. Day 4, DM the piece directly to target accounts with a personalized note. Repeat weekly.

Programs: thought leadership, podcasts, organic social, community engagement.

Stage 2: Demand for Solution (3-6 Months Out)

Now they've identified the problem and they're exploring solution categories. They're reading comparison posts, attending webinars, and asking peers for recommendations. They're not evaluating vendors yet - they're evaluating approaches.

Your job: frame the problem in a way that leads to your category. If you sell intent data, publish content about why outbound without signals is broken. Shape how they think about the solution space.

Programs: SEO content, webinars, content syndication, interactive tools, ROI calculators.

Stage 3: Demand for Vendor (1-3 Months Out)

This is where most companies start - and it's the shortest stage. Buyers are comparing 3-5 vendors, requesting demos, and negotiating. By this point, 84.6% already have a preferred vendor.

Your job: make it easy to buy. Fast demo scheduling, clear pricing, strong case studies, frictionless trials.

Programs: paid search, ABM, direct mail, free trials, sales enablement.

Here's the insight most teams miss: the vast majority of B2B companies only measure and invest in Stage 3. They run demo request ads, track MQLs, and wonder why pipeline is thin. Meanwhile, 50-70% of the touches that influenced the deal happened in dark social channels - Slack groups, private messages, internal meetings - that never show up in attribution.

The fix isn't better attribution. It's investing in Stages 1 and 2 with the understanding that you won't be able to track every touch. Focus on 1-2 core programs per stage rather than spreading thin across 50 tactics.

10 Demand Generation Campaign Ideas That Actually Drive Pipeline

Not all campaigns are created equal. Some drive pipeline in 90 days. Others take a year to compound but become your most efficient channel. Here's what's working in 2026, with honest assessments of each.

1. Ungated Thought Leadership Content

88% of B2B buyers trust brands more when they receive valuable content. But here's the part most teams get wrong: gating that content behind a form destroys the very trust it's supposed to build.

Edelman and LinkedIn's research on "hidden buyers" found that people outside formal buying committees consume thought leadership at similar rates to known buyers - and strong perspectives increase their openness to future engagement. You can't capture these people with a form. You can influence them with ideas.

The verdict: This is the highest-leverage play for any team with genuine expertise. Commit to 6+ months of consistent publishing. Teams abandon narratives just as they start resonating externally because they feel familiar internally. Don't be that team. If you're looking for pipeline in 30 days, start elsewhere - but start this in parallel.

2. Webinars and Virtual Events

73% of webinar attendees become leads. Conversion rates hover around 55%, and 40-50% of registrants show up live.

Use this if: You have subject matter experts who can teach, not just pitch. The best webinars feel like free consulting. SaaS programs that pair product experts with customer co-presenters consistently outperform solo-pitch formats.

Skip this if: Your webinars are thinly veiled product demos. Attendees can smell a pitch from the title slide.

3. Content Syndication

Underrated. Content syndication leads convert to pipeline at 6-8% within 90 days - 3-4x higher than paid advertising. CPLs run about 50% lower than intent-only programs.

Use this if: You have strong mid-funnel assets (guides, reports, frameworks) and want to reach new audiences at scale. Skip this if: Your only asset is a product datasheet. Syndication amplifies quality content; it can't fix bad content.

4. SEO and Organic Search

49% of marketers report declining traditional search traffic due to AI-generated answers. The game shifted from "rank for keywords" to "be the answer that AI models cite."

I'll be blunt: if your SEO strategy is still "publish 500-word blog posts targeting long-tail keywords," that era is over. The teams winning organic now create genuinely original content with proprietary data, deep frameworks, and practitioner insights that AI can't easily replicate.

5. Paid Social and Paid Search

Cognism built matched audiences from their own verified database and watched CTR jump from 0.54% to 1.04% without changing a single creative. The targeting was the variable, not the ad. This is why your contact data quality matters even for paid campaigns - better lists mean better matched audiences, lower CPMs, and higher conversion rates.

Expect CPLs of $200-500 for paid social and $300-700+ for intent-based programs. These aren't cheap channels, but they're fast.

Skip this if: Your budget is under $5K/month. You won't generate enough data to optimize effectively.

6. Interactive Demos, Free Trials, and Calculators

GetResponse A/B tested "Buy Now" against "Free Trial" buttons. The free trial generated 158% more account creation. Letting people experience your product without a sales conversation is the ultimate demand gen move for product-led companies.

Tools like Guideflow and Storylane let you build interactive demos without engineering resources. ROI calculators are another underused format - Xoxoday uses them to let prospects quantify the value before ever talking to sales.

Use this if: Your product has an "aha moment" visible within minutes, or your value prop is quantifiable. Skip this if: Your product requires complex implementation to show value.

7. ABM (Account-Based Campaigns)

4 in 10 teams say their most effective shift was moving from broad platforms to niche ABM-style communities. ABM isn't a channel - it's a targeting philosophy that makes every other channel more effective.

The key is intent data as the targeting layer. Tools that track buying signals across thousands of topics let you concentrate spend on accounts showing active research behavior before they ever hit your website.

Use this if: You sell to a defined universe of accounts (under 5,000) with deal sizes that justify the per-account investment. Skip this if: You're selling a $29/month tool to millions of potential users. ABM economics don't work at low ACVs.

8. Podcasts, Video, and Creator Partnerships

78% of B2B marketers already use video, and short-form video saw 104% more marketers name it their most valuable channel compared to 2024. About 30% of B2B decision-makers consume work-related content during their commute - that's podcast territory.

Here's the angle most teams miss: 55% of B2B marketers now partner with creators and industry voices. Brands combining video with influencer partnerships are 2.2x more likely to be trusted and 1.8x more likely to be well known. You don't need a celebrity - a respected practitioner with 5,000 engaged followers in your niche outperforms a generic campaign every time.

Use this if: You have a unique perspective and can commit to a consistent schedule. A mediocre podcast that runs for 50 episodes beats a great one that dies after 8.

9. Personalized Direct Mail and Gifting

Giftpack's data shows personalized gifts can reduce prospect response time by up to 70%. In a world of overflowing inboxes, a physical package stands out.

Use this if: You're targeting high-value accounts with deal sizes above $50K. The unit economics need to support $50-200 per touch. Skip this if: You're running volume outbound. Direct mail at scale gets expensive fast and loses the personalization that makes it work.

10. Community and Dark Social

Most touchpoints happen outside the funnel. Slack groups, private communities, internal meetings, peer DMs - these are where buying decisions actually get influenced. FullFunnel's own newsletter hit 25,000+ subscribers with a 31% open rate, proving that owned communities become pipeline engines.

Use this if: You're willing to invest without expecting direct attribution. The ROI is real but invisible to most analytics tools. Skip this if: You need every dollar tied to a tracked conversion. Community is a long game that rewards patience.

Choosing the Right Campaign Mix

Not sure where to start?

| Fast Results (1-3 months) | Compounding Results (6-12 months) | |

|---|---|---|

| Higher Budget ($10K+/mo) | Paid social + ABM + Direct mail | Thought leadership + Podcast + Community |

| Lower Budget (<$10K/mo) | Content syndication + Webinars | SEO + Organic social + Newsletter |

Hot take: if your average deal size sits below $10K annually, you probably don't need ABM or intent data platforms. A strong content engine plus one paid channel will outperform a complex multi-tool stack that nobody has time to operate properly.

How to Build a Digital Demand Generation Engine in 90 Days

Demand gen isn't a campaign you launch. It's a system you build.

Phase 1: Days 1-30 - Foundation

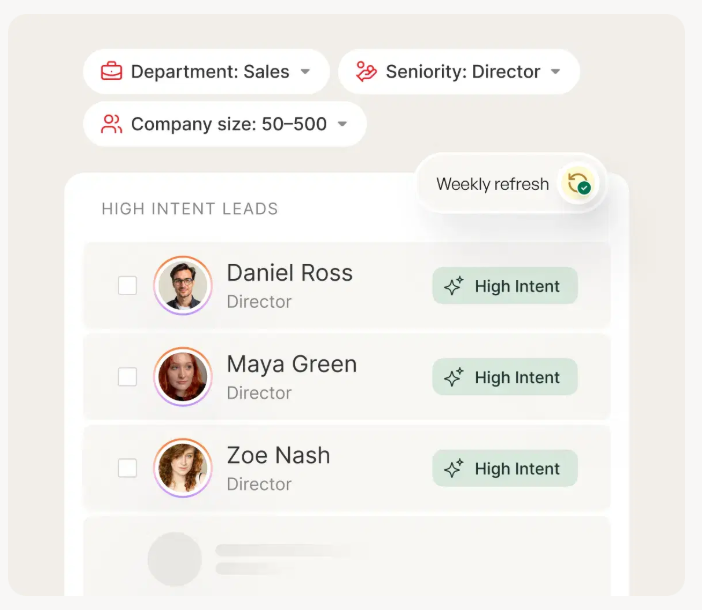

Before you launch a single campaign, audit your data. If your CRM has contacts older than 90 days, expect 20-30% to be stale - people change jobs, companies get acquired, emails go dead. Start with a verified B2B database that refreshes weekly, not quarterly. That's the difference between a webinar invite that lands and one that bounces.

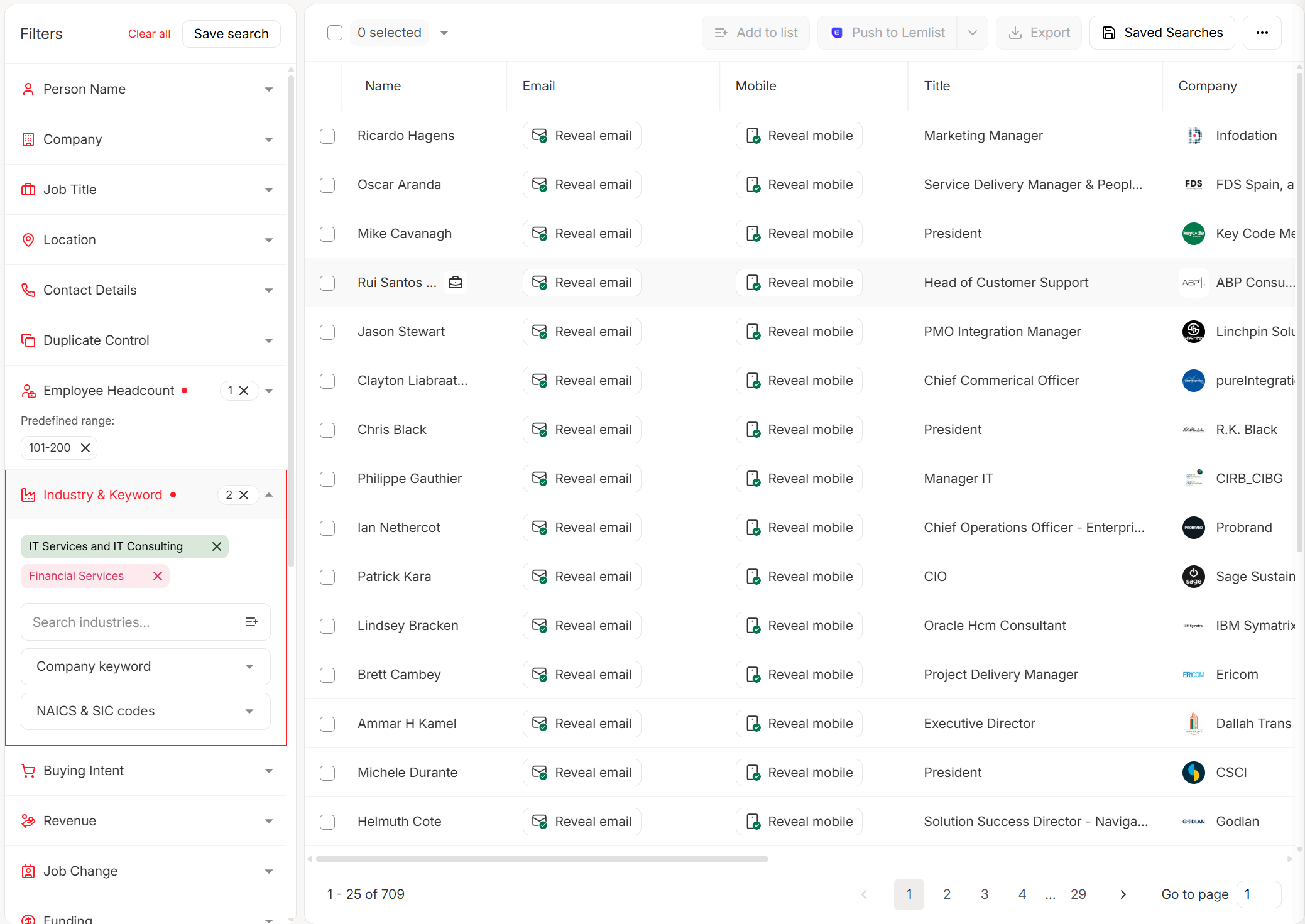

Define your ICP with precision. Not just firmographics - layer in intent signals, technographics, and hiring patterns. Use 30+ search filters to build your initial target account list. Know which accounts are showing buying behavior right now.

Set SLAs between marketing and sales. Agree on what "qualified" means. Document it. Speed-to-lead target: 5 minutes or less for high-intent actions (demo requests, pricing page visits). (If you need benchmarks, use speed-to-lead metrics.)

Build your core assets. One executive guide that positions your point of view. Two case studies with specific numbers. These are the foundation everything else builds on.

Phase 2: Days 31-60 - Launch Capture Channels

Now you turn on the channels. But not all of them - pick 2-3 based on where your ICP actually spends time.

70% of marketing-sourced pipeline comes from events, search engines, and social platforms. Start there. Launch your first webinar or virtual event. Publish SEO content targeting solution-stage keywords. Run paid social to your target account list. For context, high-growth B2B companies average ~50% of new business pipeline sourced from marketing. That's your benchmark.

The metric that matters now is cost per sales-qualified opportunity (SQO), not cost per lead. If you're generating 500 leads at $50 each but only 3 become opportunities, your real cost per SQO is $8,333. Track that number from day one.

AI-driven hyper-personalized email campaigns achieve 15-25% reply rates vs. the 1-5% baseline for generic cold outreach. If you're running outbound alongside demand gen, personalization isn't optional. (See AI cold email campaigns for a workflow that doesn’t break deliverability.)

Target: event-sourced pipeline within 60 days.

Phase 3: Days 61-90 - Optimize and Scale

This is where most teams stall. They launched channels in Phase 2 and now they're waiting for results instead of actively optimizing.

Reallocate 20-30% of resources to your top-performing channels. Cut the underperformers ruthlessly. If content syndication is converting at 6% and paid search is at 1.5%, the math is obvious. Test AI-assisted audience targeting - 65% of companies using it report positive results. Use intent data to refine your account lists weekly, not quarterly.

Here's the thing: this isn't a 90-day campaign. It's a 90-day system build. After day 90, you don't stop - you've built the engine that runs continuously. Teams that treat demand gen as a campaign with a start and end date will always underperform teams that treat it as infrastructure.

Demand Gen Maturity Self-Assessment

Before you optimize tactics, figure out where you actually stand. Score yourself 0-2 on each question (0 = no, 1 = partially, 2 = yes).

| # | Question | Score (0-2) |

|---|---|---|

| 1 | Do you have a documented ICP with behavioral signals (not just firmographics)? | |

| 2 | Is your primary marketing metric tied to pipeline or revenue (not MQLs)? | |

| 3 | Do you invest in content for buyers 6+ months from purchase? | |

| 4 | Can you identify which target accounts are showing buying intent right now? | |

| 5 | Do marketing and sales share a written definition of "qualified"? | |

| 6 | Do you track self-reported attribution ("how did you hear about us?")? | |

| 7 | Is your contact data refreshed at least monthly? | |

| 8 | Do you run campaigns across all 3 buyer demand stages? |

0-5: Foundation stage. Start with Phase 1 of the 90-day playbook. Fix your data and ICP before spending on campaigns.

6-11: Growth stage. You have the basics. Focus on expanding to Stage 1 and 2 campaigns and tightening measurement.

12-16: Scale stage. You're running a system. Optimize channel mix, test AI-assisted targeting, and push into dark social.

How to Measure Demand Gen ROI (Without Lying to Your CFO)

Here's the core formula:

Demand Gen ROI = (Revenue attributed to demand gen - Total demand gen cost) / Total demand gen cost

Simple in theory. Brutal in practice. B2B sales cycles run 6-12 months, a single deal involves hundreds of touches, and executives now prioritize pipeline quality and revenue attribution over traditional volume metrics.

The fastest diagnostic metric is your MQL-to-SQL conversion rate. Well-aligned teams see 15-30%. If yours is below 10%, marketing and sales disagree on what "qualified" means. Fix the definition before you optimize the funnel.

Here's what conversion rates actually look like across industries:

| Industry | Conversion Rate |

|---|---|

| Legal Services | 7.4% |

| Staffing & Recruiting | 2.9% |

| Industrial IoT | 2.6% |

| Manufacturing | 2.2% |

| Financial Services | 1.9% |

| IT & Managed Services | 1.5% |

| B2B SaaS | 1.1% |

| Software Development | 1.1% |

The cross-industry average is 2.9%. That means 97 out of every 100 visitors leave without converting. Even Salesforce converts less than 5% of traffic into qualified leads. If your B2B SaaS company is converting at 1.1%, you're not broken - you're average. The opportunity is in moving from average to top-quartile.

With 222+ touchpoints per deal and 50-70% of influence happening in unmeasurable channels, no attribution model gives you the full picture. The best teams supplement multi-touch tracking with self-reported attribution - a simple "how did you hear about us?" field on demo request forms. It's imperfect, but it captures the podcast episode, the Slack recommendation, and the conference conversation that no pixel can track.

7 Demand Gen Mistakes That Kill Pipeline

1. Optimizing for MQLs Over Revenue

MQLs become vanity metrics the moment they're disconnected from business outcomes. I've seen marketing teams celebrate hitting 200% of their MQL target while sales pipeline actually declined. The incentive structure was broken - marketing optimized for form fills, not for revenue.

Fix: Make cost per SQO and pipeline contribution your primary metrics. MQLs can be a leading indicator, but they're never the goal.

2. Running Campaigns on Bad Data

3. Launching Too Many Channels Simultaneously

Focus on 1-2 core programs per funnel stage. Teams that launch seven channels in month one end up with seven underperforming channels instead of two that actually work. Depth beats breadth every time. When brainstorming B2B marketing campaign ideas, resist the urge to execute all of them at once.

4. Skipping Buyer Research Before Ad Spend

Only 52% of organizations have a clearly defined value proposition. Generic copy comes from skipped positioning work. If you haven't talked to 10 recent buyers about why they chose you (and why they almost didn't), your messaging is guesswork.

5. Static ICP Definitions Without Behavioral Signals

Firmographics tell you who could buy. Intent signals tell you who's buying right now. Only 1-3% of your target market is in-market at any given time. If your ICP is "VP of Marketing at SaaS companies with 200-1,000 employees," you're targeting thousands of people who won't buy for another 18 months. Layer behavioral data on top.

6. Neglecting Middle-of-Funnel Nurture

The gap between "they know we exist" and "they requested a demo" is where most pipeline dies. Teams invest heavily in top-of-funnel awareness and bottom-of-funnel conversion, then wonder why the middle is a black hole. Webinars, case studies, comparison content, and lead nurturing emails bridge this gap.

7. Evaluating Demand Gen on Campaign Timelines

Organizations are structurally impatient. Demand gen gets funded on quarterly campaign timelines, but its effects compound over 6-12 months. If you're evaluating a thought leadership program after 60 days, you're measuring a marathon at the 2-mile marker.

The Demand Gen Tech Stack - What You Actually Need

Most teams use 6-8 disconnected marketing tools. You don't need all of these on day one. Start with data + CRM + one channel tool, then add as you scale.

| Category | Tool | Pricing | G2 |

|---|---|---|---|

| CRM | HubSpot | Free CRM; paid tiers vary | 4.4/5 |

| Intent Data | 6sense | $30-100K+/year | - |

| Attribution | Dreamdata | Custom | - |

| Conversation Intel | Gong | Custom | - |

| Meeting Automation | Chili Piper | Custom | 4.6/5 |

| Interactive Demos | Guideflow | Free + $35/mo | 5.0/5 |

| Website Analytics | Hotjar | Free + $39/mo | 4.3/5 |

| Data Orchestration | Clay | Free + $149/mo | 4.9/5 |

| Visitor ID | Leadfeeder | Free + $99/mo | 4.6/5 |

| SEO | Semrush | ~$130+/mo | - |

The Data Foundation

Every tool on this list depends on one thing: reaching the right people with accurate contact information. That's where your data platform sits - and it's the one category where cutting corners costs you everywhere downstream. (If you want a QA workflow, start with data quality and B2B contact data decay.)

Prospeo covers 300M+ professional profiles with 143M+ verified emails at 98% accuracy and 125M+ verified mobile numbers. The 7-day data refresh cycle matters here - the industry average is 6 weeks, which means most databases serve you contacts that changed jobs a month ago. The 30+ search filters go beyond basic firmographics: 15,000 intent topics, technographics, job changes, headcount growth, department size, funding rounds, and revenue. That maps directly to the ICP definition work in Phase 1 of the 90-day playbook.

Integrations are native with HubSpot, Salesforce, Smartlead, Instantly, Lemlist, Clay, Zapier, and Make - so data flows into whatever sequencing or CRM tool you're already using. Pricing starts free (75 emails + 100 Chrome extension credits/month), with credit-based plans at roughly ~$0.01 per email. No contracts, no annual commitments, self-serve onboarding. Check the full B2B database feature set.

FAQ

What's the difference between demand generation and lead generation?

Demand generation creates awareness and educates the 99% of your market not yet in-market; lead generation captures intent from the small percentage ready to buy now. Cognism saw a 4x pipeline increase when they shifted from gated lead gen to ungated demand gen. The two work best together: demand gen builds trust and preference so that lead gen forms convert at higher rates.

How long does it take for demand generation campaigns to show ROI?

Expect 3-6 months for initial pipeline impact and 6-12 months for full revenue attribution, since B2B buying cycles average 10-13 months depending on region. Teams that evaluate on 30-day timelines almost always abandon the program before it compounds. Build a 90-day system, then give it two more quarters to mature.

What's a good MQL-to-SQL conversion rate?

Well-aligned teams see 15-30%. Below 10% typically signals that marketing and sales disagree on what "qualified" means. Fix the shared definition before optimizing the funnel - no amount of campaign spend compensates for a broken handoff between teams.

How much should a B2B company budget for demand gen?

Most B2B companies allocate 8-12% of revenue to marketing, with roughly 40-50% going to demand gen programs. CPLs range from ~$100 for content syndication to $700+ for intent-based programs. Start with one channel, prove pipeline impact, then scale what works.

What's a good free tool to start building demand gen contact lists?

Prospeo's free tier includes 75 verified emails and 100 Chrome extension credits per month - enough to build initial target account lists and test outbound alongside your demand gen programs. HubSpot's free CRM handles the pipeline tracking side. Together they cover data and CRM without upfront cost.

86% of buyers shortlist vendors before research begins. To be on that list, you need to reach decision-makers across 222+ touches with data that's actually current. Prospeo refreshes 300M+ profiles every 7 days - not the 6-week industry average - so your ABM, content syndication, and outbound campaigns land where they should.

Build your demand gen on data that refreshes weekly, not monthly.