Drift alternatives (2026): the shortlist that actually replaces Drift

$2,500/month is a weird number to anchor your pipeline on. It's not "enterprise," but it's also not "try it and see." And when Drift's renewal lands, most teams realize they're paying for a motion they aren't actually running.

These Drift alternatives replace the motion, not just the widget.

Hot take: when your average deal size is in the low five figures and you don't have a dedicated owner for routing + playbooks, Drift's usually overkill. You'll get more pipeline by simplifying the chat layer and tightening the handoff to your CRM.

Our picks (TL;DR): 3 Drift alternatives to trial first

G2 lists Drift Premium starting at $2,500/month. That's the baseline. Your replacement should either (a) beat Drift on pipeline outcomes, (b) beat it on support deflection economics, or (c) beat it on predictability.

- Qualified - best for: enterprise B2B pipeline chat

- Use this if: you need Salesforce-friendly routing, real-time qualification, and an experience your AEs will actually trust.

- Skip this if: you want cheap. Qualified is a "replace Drift with something equally serious" move.

- Fin by Intercom - best for: AI support deflection

- Use this if: your biggest pain is ticket volume and you want a clean per-resolution model.

- Skip this if: your primary KPI's meetings booked from high-intent site traffic (Fin can do it, but it isn't the center of gravity).

- Prospeo - best for: after-the-chat follow-up that converts

- Use this if: chat's creating leads, but your follow-up's leaking because emails/phones are missing or wrong.

- Skip this if: you're trying to replace the chat widget itself. Prospeo's the data accuracy layer that turns chat intent into booked meetings.

Why teams replace Drift in 2026 (and what they actually need)

Drift isn't a bad product. It's a mature one. On G2 it sits at 4.4/5 with 1,256 reviews, which tells you plenty of real teams have made it work.

The churn pattern's simpler: Drift's optimized for a specific kind of org - sales + marketing + ops alignment, tight routing rules, and someone who owns the system like a mini-platform. When that ownership isn't there, the same themes show up in review summaries and internal post-mortems:

- Pricing feels opaque once you add seats, add-ons, and services.

- Implementation takes longer than expected (especially routing edge cases).

- Support responsiveness becomes a pain when chat's mission-critical.

- Notifications and handoff trust break down, and reps stop treating chat as "real."

That combo's brutal because chat's a real-time channel. If notifications are flaky, reps stop trusting it. If routing's confusing, you get the worst outcome: the buyer had intent, and you responded like you didn't.

Most teams don't need "a Drift replacement." They need one of three outcomes:

- Route high-intent buyers to the right seller in under 60 seconds. (Related: speed-to-lead)

- Deflect repetitive support questions without making customers hate you.

- Capture leads reliably and follow up fast with clean data. (See: B2B lead capture)

I've watched teams waste months chasing parity checkboxes (playbooks, bots, routing, calendars) and ignore the actual failure mode: the handoff from chat -> CRM -> sequence -> meeting. Fix the handoff and you can often downgrade the chat layer and still grow pipeline, because the real bottleneck isn't "getting chats," it's turning those chats into contactable records that hit the right owner fast enough to matter. (If this is a recurring issue, start with CRM hygiene.)

One more context point that matters in 2026: Drift living inside Salesloft pushed it further upmarket. That's great if you're running a fully-orchestrated revenue motion. It's a tax if you're not.

Drift alternatives pricing: models, math, and hidden costs

Drift's pricing is the first reason it ends up on a CFO's radar. G2 lists Drift Premium starting at $2,500/month. That's the entry point, not the fully loaded number.

Once you add seats, advanced routing, identity/visitor identification, intent layers, and services, the real budget bands look like this.

These are the budget ranges we see for conversational marketing platforms once you add seats, routing complexity, and services - anchored to Drift Premium's $2,500/mo starting point.

- Starter "serious SMB": $2,500-$4,000/mo

- Mid-market: $4,000-$8,000/mo

- Enterprise: $10,000+/mo

Budget scenarios that map to reality:

- Sales-led site motion (2-6 sellers + SDR coverage): plan for $3k-$7k/mo all-in.

- Support-led deflection (5-20 agents): you'll compare per-seat suites (Intercom/Zendesk) and pay based on agents + AI usage.

- "We just need chat + forms replacement": you should be under $100-$300/mo with Crisp/LiveChat/Tidio unless you're forcing enterprise routing.

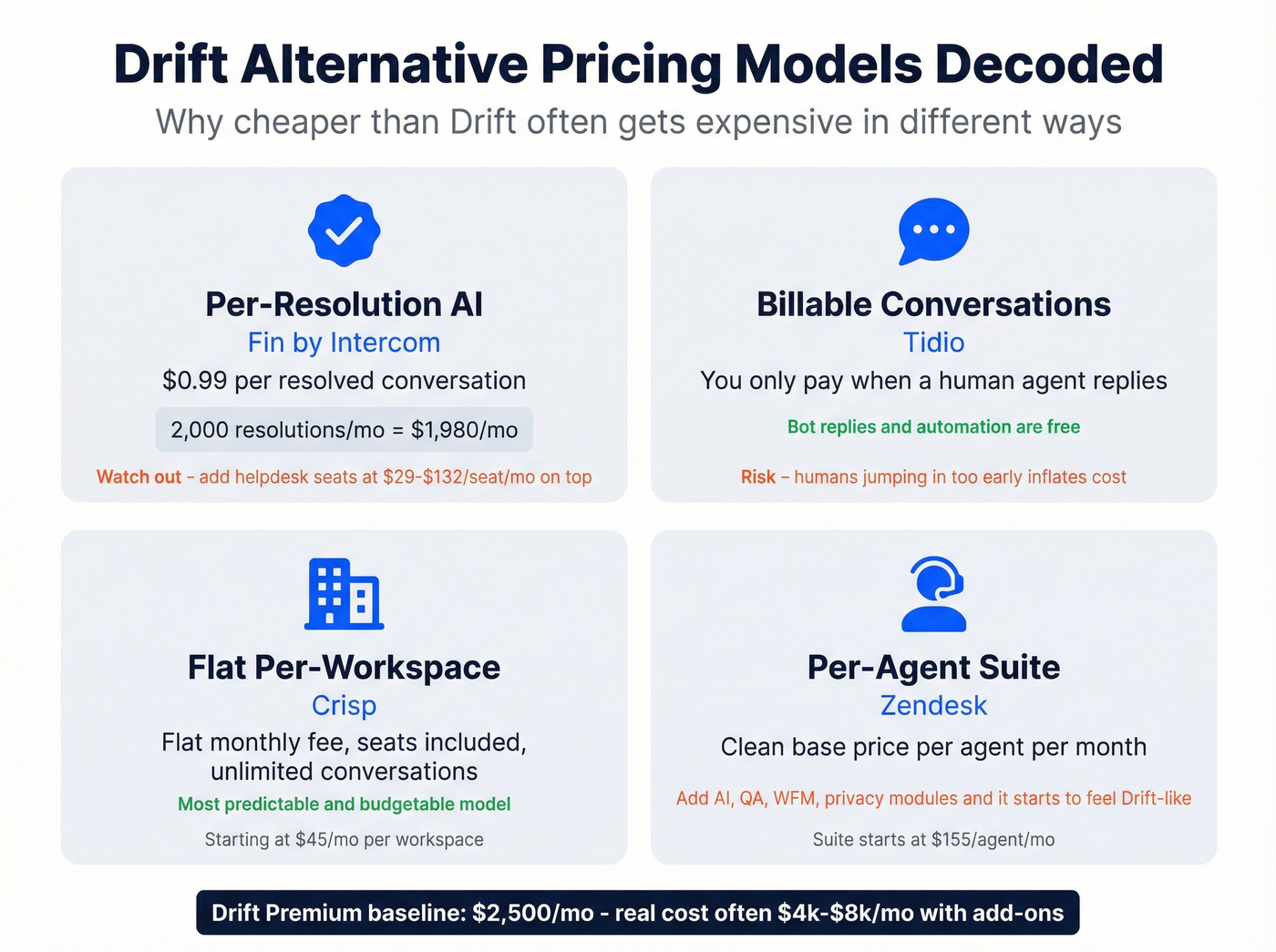

Pricing model decoder (why "cheaper than Drift" gets expensive)

"Cheaper than Drift" is a trap phrase because Drift's cost is mostly platform + complexity. Alternatives often shift cost into usage.

Per-resolution AI (Fin by Intercom) Fin charges $0.99 per resolution. That's clean and fair - until you do the math.

- 2,000 resolutions/month x $0.99 = $1,980/mo in resolution fees

Then add the helpdesk layer if you're using Intercom's support product: $29/helpdesk seat/month, and Intercom seat tiers commonly run $29/$85/$132 per seat-month depending on plan.

Billable conversations (Tidio) Tidio counts a billable conversation only when a human agent replies. Bot replies and automation don't count. That's the right incentive.

The only way teams blow this up is operational: humans jump in too early, and you start paying for conversations you could've automated.

Per-workspace flat pricing (Crisp) Crisp's the antidote to seat-tax chaos: flat per workspace, included seats, and unlimited conversations. It's the most budgetable model in the category.

Per-agent suites (Zendesk) Suite pricing looks clean until you add AI, QA, WFM, privacy, and contact center modules. Then it starts to feel Drift-like - just in a support wrapper.

Drift alternatives by use case (sales vs support vs budget)

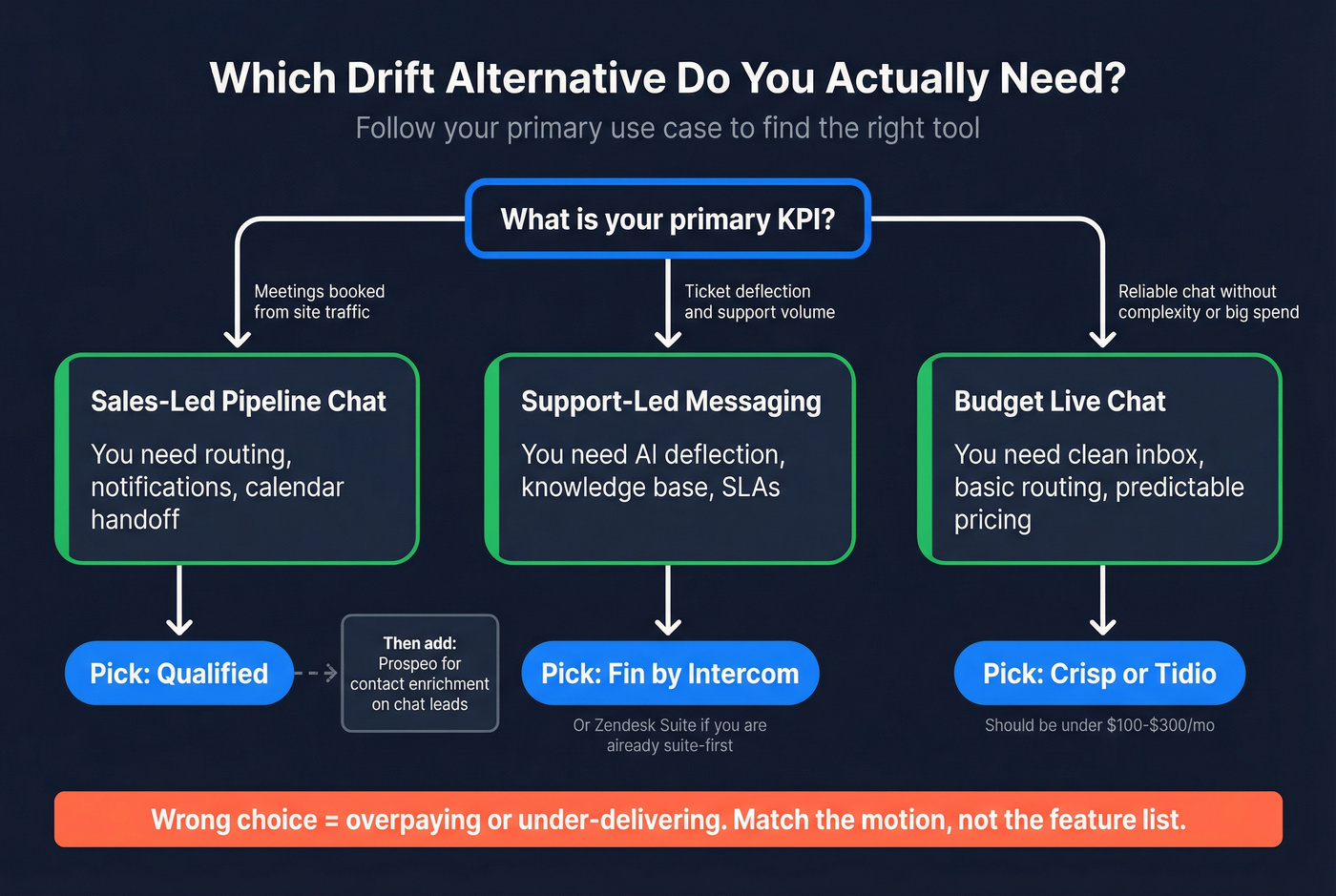

Use this like a decision tree. Pick the wrong motion and you'll overpay or under-deliver.

Sales-led conversational marketing (pipeline chat)

You care about:

- Lead routing + notifications sellers trust

- Meeting scheduler flows and instant handoff

- Website visitor identification and account context

- Attribution to pipeline and revenue (more on sales pipeline management)

Pick: Qualified first. It's the closest "swap Drift without changing your motion" option.

Support-led messaging (helpdesk + deflection)

You care about:

- Ticketing + conversation history

- Knowledge base deflection

- AI economics (per resolution, per agent, per usage)

- SLAs, QA, and reporting

Pick: Fin by Intercom (or Zendesk Suite + Copilot if you're suite-first).

Budget live chat (reliability + predictability)

You care about:

- A clean inbox

- Basic routing

- Predictable pricing

- Fast setup

Pick: Crisp or Tidio.

If chat's pipeline-driven, contactability's the silent killer.

Capturing intent's easy. Reaching the person quickly is what books meetings. (If you're benchmarking this, use speed to lead metrics.)

Drift alternatives fix the chat layer. Prospeo fixes the handoff. 83% of leads come back enriched with verified emails, direct dials, and 50+ data points - so your reps actually reach the buyer who just chatted.

Stop leaking pipeline between chat and your first follow-up email.

Drift parity checklist (what you must match vs what you can drop)

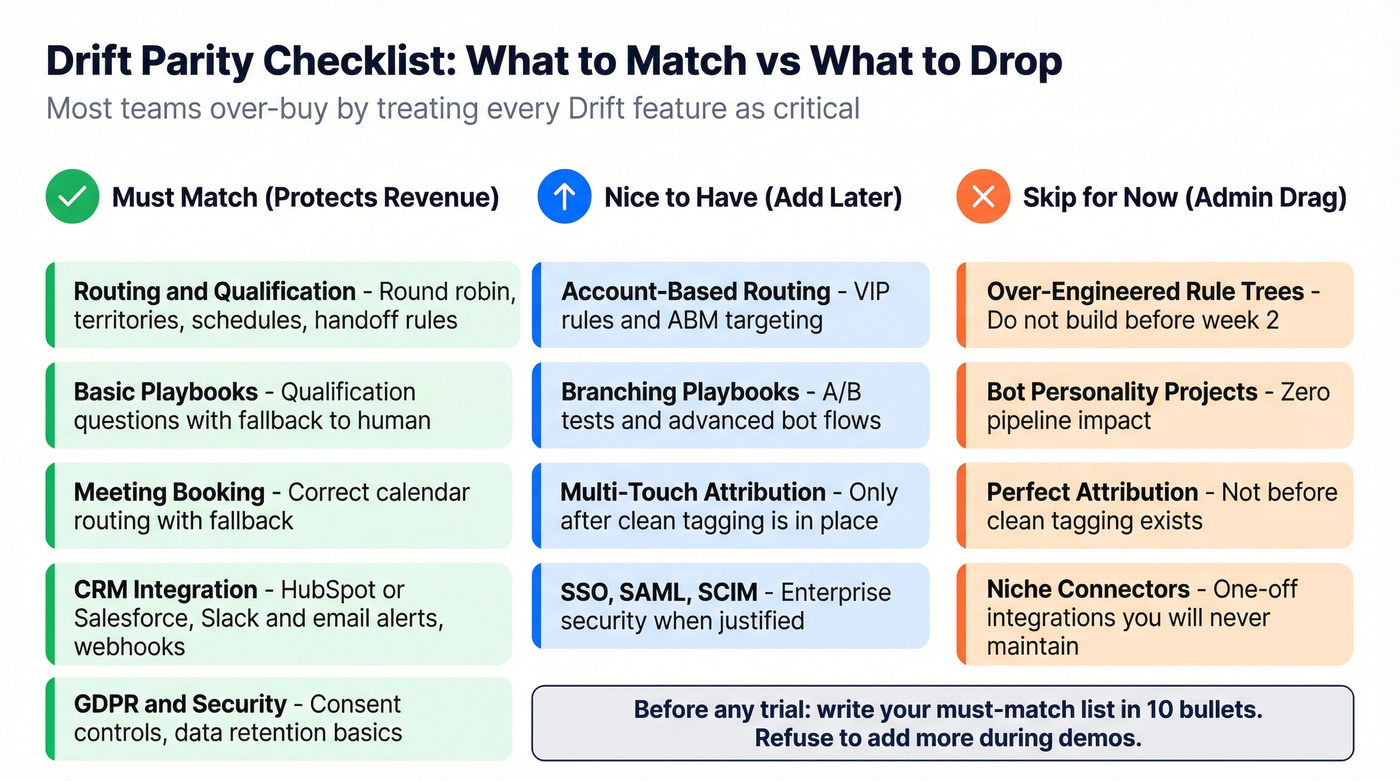

Most "Drift alternatives" lists fail because they treat every feature as equal. Don't. Match what protects revenue, and drop what creates admin drag.

| Category | Must match | Nice to have | Skip (for most teams) |

|---|---|---|---|

| Routing & qualification | Round robin, territories, schedules, handoff rules | Account-based routing, VIP rules | Over-engineered rule trees before week 2 |

| Playbooks & bots | Basic qualification questions, fallback to human | Branching playbooks, A/B tests | "Bot personality" projects |

| Meeting booking | Correct calendar routing + fallback | Multi-calendar logic | Fancy scheduling if reps won't use it |

| Visitor identification | Company-level identification | Person-level identity | Paying extra if you don't act on it |

| Integrations | CRM (HubSpot/Salesforce), Slack/email alerts, webhooks | Marketing automation, data warehouse | One-off niche connectors |

| Reporting & ROI | Chat-to-meeting + chat-to-pipeline | Multi-touch attribution | Perfect attribution before clean tagging |

| Admin & governance | Roles/permissions, audit trail basics | Advanced admin workflows | Custom governance if you're <50 seats |

| Security | GDPR controls, consent, data retention | SSO/SAML, SCIM | Enterprise security if you can't justify it |

| Support ops | Conversation history, tags, macros | SLAs, QA, WFM | Full helpdesk suite if you already have one |

| Multi-brand & localization | - | Multi-brand, languages | Only if you truly operate multi-site |

If you do one thing before a trial: write down your "must match" list in 10 bullets and refuse to add more during demos. That's how you avoid buying a platform you won't run.

Drift alternatives comparison table (shortlist + pricing signals)

Mobile-friendly on purpose: this is the "what should I trial?" view.

| Tool | Best for | Start (approx) | Pricing model | Trial |

|---|---|---|---|---|

| Qualified | Pipeline chat | $2,500/mo+ | Quote-based | 14 days |

| Fin (Intercom) | Support AI | $0.99/res | Per resolution + seats | 14 days |

| Crisp | Budgetable chat | $45/mo | Per workspace | Free plan |

| Tidio | SMB chat + AI | $24.17/mo | Billable convos | Free plan |

| Zendesk Suite | Support suite | $155/agent/mo | Per agent | Trial |

| LiveChat | Simple live chat | $19/user/mo | Per user | Trial |

| HubSpot Chat | HubSpot stack | $0-$1,200+/mo | Bundle tiers | Free tools |

| Freshchat | Support messaging | $19-$79/agent/mo | Per agent | Trial |

AI mechanic + decisive "pick if" notes

- Qualified: pick if meetings booked's the KPI and you need serious routing.

- Fin (Intercom): pick if ticket deflection's the KPI and you want per-resolution math.

- Crisp: pick if you want predictable cost and a clean inbox without seat-tax.

- Tidio: pick if you want modern automation on SMB pricing.

- Zendesk Suite: pick if chat must live inside a helpdesk + SLAs suite. Copilot is a $50/agent/mo add-on (annual) and is also available bundled in Suite + Copilot plans.

- LiveChat: pick if you want reliable live chat with minimal setup.

- HubSpot Chat: pick if HubSpot's your system of record and you want CRM-native conversations.

- Freshchat: pick if you're already in the Freshworks ecosystem and want a mid-market messaging layer.

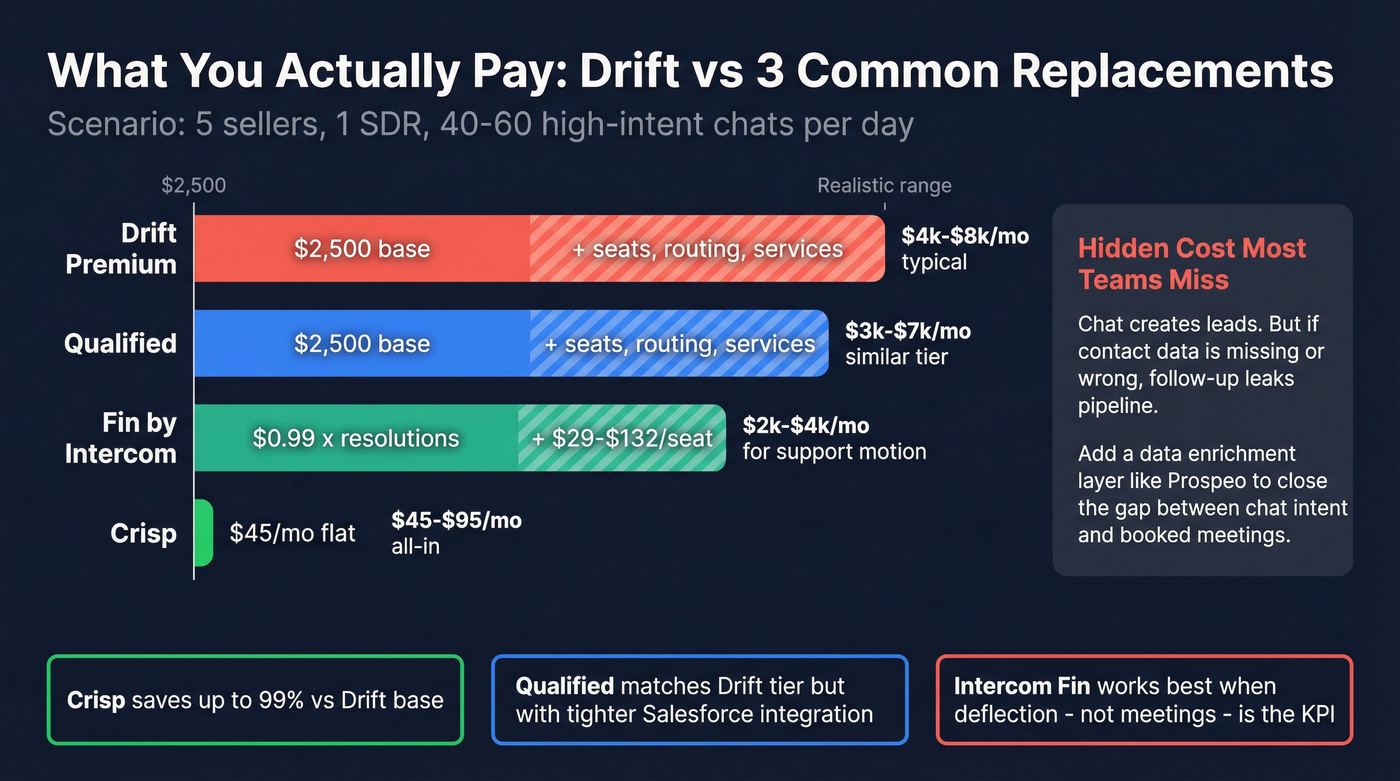

A worked cost comparison (Drift vs 3 common replacements)

Here's the math people avoid until procurement forces it.

Scenario A: Sales-led pipeline chat (5 sellers, 1 SDR, 40-60 high-intent chats/day)

- Drift: starts at $2,500/mo, and most teams land $4k-$8k/mo once they add seats, routing complexity, and services.

- Qualified: starts around $2,500/mo+ and climbs similarly, but you're paying for a tighter seller-trust experience (routing + handoff done right).

- Crisp: $95/workspace/mo (Essentials) often covers the whole team with included seats. You give up enterprise orchestration, but you gain predictability and speed.

In our experience, if you don't have someone who'll actively own routing and playbooks, Crisp beats both because it actually gets used.

Scenario B: Support deflection (10 agents, 2,000 AI resolutions/month)

- Fin: 2,000 x $0.99 = $1,980/mo in resolution fees Add helpdesk seats: 10 x $29 = $290/mo Total before any other Intercom seats/tier upgrades: $2,270/mo

- Zendesk Suite + Copilot: 10 x $155 = $1,550/mo (Suite + Copilot Professional) If Copilot's added separately in your packaging, add 10 x $50 = $500/mo Total typical band: $1,550-$2,050/mo before other modules.

Fin wins when your KB's strong and your deflection's real. If your KB's weak, you'll pay for "resolutions" that are basically glorified search, and that's the kind of invoice that makes everyone mad because it feels like you're paying twice for the same answer.

Scenario C: "We just need live chat that works" (3 agents, basic routing)

- LiveChat: 3 x $19 = $57/mo (annual billing)

- Tidio: $24.17/mo entry, then scales with billable conversations and add-ons

- Crisp: $45/mo flat per workspace (Mini)

Crisp's the cleanest budget pick because it avoids the "oops, we added seats" surprise.

How to run a Drift alternatives bake-off (without getting demo'd into a bad decision)

Demos are theater. Bake-offs are plumbing.

Step 1: Use a weighted scoring rubric (steal this)

Weights are tuned for most B2B SaaS teams replacing Drift.

| Criterion | Weight |

|---|---|

| Routing & qualification | 25 |

| Seller UX & notifications | 15 |

| Deflection & knowledge base | 15 |

| Integrations (CRM, Slack, webhooks) | 15 |

| Reporting & ROI | 10 |

| Admin & implementation | 10 |

| Pricing predictability | 10 |

| Total | 100 |

Step 2: Score the shortlist (top 5)

Scores are out of 10 per criterion, then weighted.

| Tool | Weighted score (/100) | Winner note |

|---|---|---|

| Qualified | 86 | Best sales-led replacement |

| Fin (Intercom) | 82 | Best support deflection economics |

| Crisp | 78 | Best predictable pricing |

| Tidio | 72 | Best SMB automation value |

| Zendesk Suite | 70 | Best if you're suite-first |

Step 3: Test the 3 failure points (this is where tools lose)

- Routing edge cases

Test: VIP account + after-hours + SDR overflow + "book meeting" fallback.

- Notification trust

Test: Slack + email + in-app alerts across 3 reps. If reps miss chats in week one, the tool's dead.

- CRM hygiene

Test: create contact + dedupe + associate to company + create deal + log transcript + preserve UTM/source. If this breaks, your attribution breaks, and marketing stops trusting chat-sourced pipeline. (Use a simple data quality scorecard to keep this honest.)

The best Drift alternatives (mini-reviews, less fluff)

Prospeo (Tier 1): the follow-up accuracy layer that turns chats into meetings

Prospeo is "The B2B data platform built for accuracy." It's not a chat widget, and that's the point: it plugs into whatever chat you pick and makes sure every high-intent conversation turns into a contactable lead in your CRM and sequences, fast.

Here's a scenario we've seen too many times: a VP requests pricing in chat, your rep replies, the buyer drops an email with a typo (or uses a personal inbox), and the lead gets created with no mobile number, no enrichment, and no clean company match. Two days later the rep finally follows up, it bounces, and everyone shrugs because "chat leads are flaky." They aren't. Your data is. (If this sounds familiar, read up on B2B contact data decay.)

Prospeo fixes that with verified contact data and enrichment you can run automatically:

- 300M+ professional profiles, 143M+ verified emails, 125M+ verified mobile numbers

- 98% email accuracy and a 7-day refresh cycle (industry average: 6 weeks)

- Used by 15,000+ companies and 40,000+ Chrome extension users

- 83% enrichment match rate and 92% API match rate, returning 50+ data points per enrichment

- GDPR compliant, self-serve, no contracts

If you're already paying for a big data contract, this is where people get annoyed: you're spending thousands to capture intent on-site, then you cheap out on the one thing that determines whether you actually talk to the buyer. Prospeo's credit pricing lands at about $0.01 per verified email, which makes it an easy add to any Drift replacement plan. (If you're evaluating vendors, compare against other lead enrichment tools.)

Useful links if you want to see the product surface area:

- Pricing: https://prospeo.io/pricing

- Data enrichment: https://prospeo.io/b2b-data-enrichment

- Chrome extension: https://prospeo.io/contact-finder-extension

- Integrations: https://prospeo.io/integrations

Qualified (Tier 1): the closest sales-led replacement

If your website's a revenue channel (not just a brochure), Qualified's the first trial.

What it does better than Drift: seller experience and routing execution. It's built for revenue teams that need qualification -> handoff -> meeting booking without weird gaps.

Implementation notes (read this):

- Start with one playbook for your highest-intent pages.

- Keep routing rules boring for 2 weeks (territory + schedule + fallback).

- Only then add account-based routing and fancy logic.

Pricing signal (2026): starts around $2,500/mo+ (quote-based). Trial: 14 days.

Fin by Intercom (Tier 1): the cleanest AI deflection math

Fin's the best option when the business problem is "support volume is eating us alive."

The model's simple: $0.99 per resolution. That's refreshingly measurable.

Cost math you should do before you buy:

- If you're at 500 resolutions/mo: ~$495/mo (plus seats) and it's a no-brainer.

- If you're at 5,000 resolutions/mo: ~$4,950/mo (plus seats) and you need to be sure those are real deflections, not "AI answered what the KB already said."

Pricing signal (2026): $0.99/resolution + (optional) $29/helpdesk seat/mo; Intercom seat tiers commonly run $29-$132/seat-mo depending on plan. Trial: 14 days, unlimited resolutions, no card.

Crisp (Tier 1): the "stop paying seat tax" pick

Crisp is what I recommend when teams say, "We want chat to work, we want a clean inbox, and we never want to argue about the invoice again."

Who'll love Crisp:

- teams that want predictable pricing

- teams that don't want a mini-implementation project

- teams that are tired of per-seat creep

Who should skip Crisp: orgs that genuinely need enterprise-grade conversational marketing orchestration and deep revenue reporting.

Pricing signal (2026): $45/$95/$295 per workspace per month (Mini/Essentials/Plus). Trial: Free plan available.

Tidio (+ Lyro AI): SMB-friendly chat with sane billing

Tidio's the best "modern chat + automation" pick when you want Drift vibes without Drift pricing.

What I like: "billable conversations" only count when a human replies. That's how you keep automation from inflating your bill.

Pricing signal (2026): Starter $24.17/mo, Growth from $49.17/mo, Plus from $749/mo; Lyro AI Agent add-on from $32.50/mo. Trial: Free tier available.

Zendesk (Suite + Copilot): suite-first support ops

Zendesk's the right answer when chat must live inside a full helpdesk with SLAs, QA, and reporting.

Pricing signal (2026): Suite + Copilot Professional $155/agent/mo (annual billing) and Enterprise $209/agent/mo (annual billing). Copilot's also available as a $50/agent/mo add-on (annual). Trial: Typically available.

LiveChat: simple, reliable, fast to launch

LiveChat's the "we need live chat this week" option.

Pricing signal (2026): $19/$49/$79 per user/mo (annual billing). Trial: Available.

HubSpot Chat / Conversations: best if HubSpot's your system of record

HubSpot chat's "good enough" when the real win is lifecycle + attribution staying inside HubSpot.

Pricing signal (2026): free tools exist; paid hubs drive cost - expect $0-$1,200+/mo depending on your bundle. Trial: Free tools; paid hubs vary.

Freshchat (Freshworks): ecosystem messaging for mid-market support

Freshchat's a practical middle ground if you're already on Freshworks.

Pricing signal (2026): typically $19-$79/agent/mo depending on tier and add-ons. Trial: Usually available.

If your team lives in Slack/Teams: pick chat that routes where work happens

A lot of replacements fail because the tool isn't the problem - the channel is. If your reps live in Slack (or your support team lives in Teams), you want a setup where:

- alerts are actionable (not noisy)

- ownership is obvious (who's taking this chat?)

- handoff is one click (not "go log into another tab")

Slack/Teams-native routing can be a better fit than a bigger conversational marketing platform, especially for lean teams. If your current Drift pain is "nobody responds fast enough," prioritize notification trust over feature depth.

Migration checklist: what breaks when you switch from Drift

Switching chat tools isn't hard. Switching chat operations is.

Core assets to migrate

- Playbooks / bot flows: replicate intent capture logic first, then iterate.

- Lead routing + notifications: rebuild rules, then test edge cases (round robin, coverage hours, VIP accounts).

- Meeting scheduler: confirm calendar permissions, routing to the right calendar, and fallback behavior.

- Conversation history: decide what you must retain for compliance vs what can be archived.

- Attribution / ROI reporting: define what counts as influenced pipeline and where it's reported (CRM vs chat tool).

- Integrations: CRM + marketing automation are non-negotiable. Also check Slack/email notifications and webhooks.

- Security: roles/permissions, audit logs, data retention, consent, and GDPR settings; add SSO/SAML if required.

Don't forget (this is where teams get burned)

- UTM + source tracking: if you lose it, marketing stops trusting chat-sourced pipeline.

- Playbook ownership: name a human owner. "Shared responsibility" means nobody owns it.

- Deduping rules: decide what happens when the same person chats twice or uses a different email.

- Speed-to-lead: define the SLA (for example, "respond in 60 seconds") and instrument it.

I've run bake-offs where the "best chat UI" lost because the CRM integration created duplicates and broke attribution in week one. Test the plumbing, not the demo.

The 2-tool stack most teams actually need (chat + follow-up)

Look, chat captures intent; follow-up converts it. Drift tries to do both, but most orgs do better with a focused stack.

Stack A: sales-led pipeline chat

- Chat layer: Qualified for routing + meeting booking.

- Follow-up layer: a contactability workflow that enriches every inbound lead and pushes it into sequences within minutes. (If you're building this, start from a CRM integration for sales automation checklist.)

Stack B: support-led deflection + escalation

- Chat layer: Fin by Intercom for deflection economics.

- Follow-up layer: a workflow that turns escalations into clean CRM records (so expansion and sales opportunities don't disappear into transcripts).

The biggest win isn't "more chats." It's faster, cleaner follow-up on the chats you already have.

You're evaluating $2,500/mo chat tools, but the real bottleneck is contactability. Prospeo delivers 98% email accuracy and 125M+ verified mobiles at $0.01/email - no contracts, no sales calls.

Turn every chat conversation into a booked meeting with clean data.

Final recommendation (do this, not more research)

If you're sales-led, trial Qualified. If you're support-led, trial Fin. If you're budget-conscious, pick Crisp and move on with your life.

Then spend your real energy on two things that actually move pipeline: notification trust (reps respond fast) and CRM hygiene (contacts, attribution, and sequences work without manual cleanup). Most Drift alternatives win or lose there, not in the widget.

FAQs about Drift alternatives

What's the closest like-for-like replacement for Drift for B2B pipeline chat?

Qualified's the closest like-for-like replacement because it's built for sales-led website conversion: qualification, routing, and meeting booking for revenue teams. It's also rated higher on G2 (4.9/5 with 1,426 reviews) than Drift (4.4/5 with 1,256), and that higher satisfaction tends to show up in the day-to-day experience.

Is Intercom Fin cheaper than Drift?

Fin can be cheaper than Drift when you're using it for real support deflection and your resolution volume's controlled. At $0.99 per resolution, 2,000 resolutions costs $1,980/mo, but helpdesk seats ($29/seat/mo) and Intercom seat tiers ($29-$132/seat-mo) can push total spend above Drift's $2,500/mo starting point.

What pricing model's most predictable: seats, per-resolution AI, or per-workspace?

Per-workspace pricing (like Crisp) is the most predictable because cost doesn't spike with usage or headcount changes inside the workspace. Per-seat suites (Zendesk) are predictable until add-ons stack up. Per-resolution AI (Fin) is predictable only if you can forecast resolution volume and avoid paying for "easy" resolutions.

Can I replace Drift with a cheaper live chat tool without losing routing?

Yes, but you'll need to simplify your routing expectations and be disciplined about coverage rules. Tools like Crisp, LiveChat, and Tidio handle basic routing and inbox workflows well, but they won't match Drift's enterprise-grade playbooks and reporting. If routing complexity's your moat, test Qualified before downgrading.

What should I pair with my chat tool to convert more chats into meetings?

Pair your chat tool with Prospeo as the follow-up accuracy layer: enrich inbound leads with 98% accurate verified emails, keep data fresh on a 7-day refresh cycle, and push clean records into your CRM and sequences so high-intent chats don't die after the conversation.