Best 6sense Alternatives for 2026 (With Real Pricing)

You just got the renewal quote. $55,000 for another year of 6sense - and that's the median. Your CFO is asking why the marketing team needs a platform that costs more than two headcount when half the dashboards haven't been opened since onboarding. Meanwhile, the intent data that justified the purchase is flagging companies that never convert.

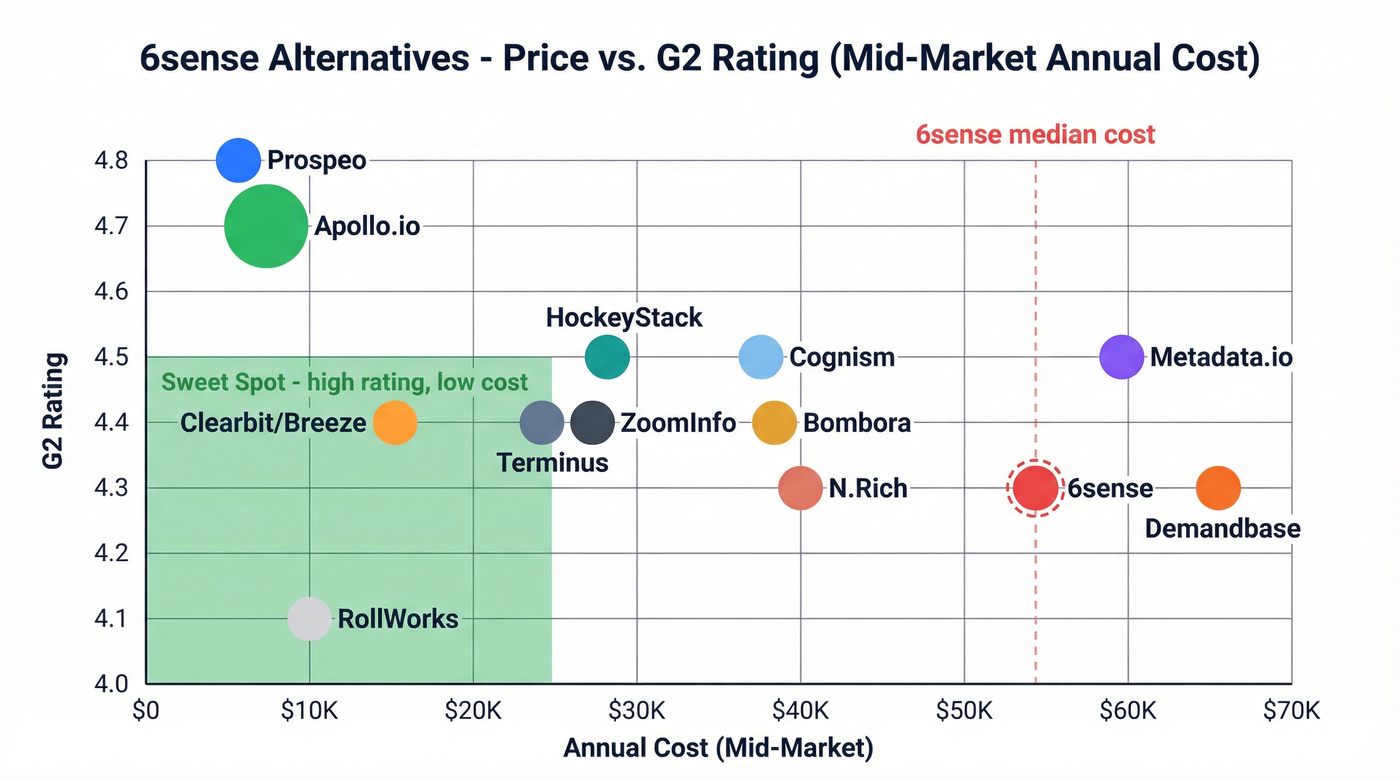

Hot take: If your average deal size is under $25K, you almost certainly don't need 6sense-level orchestration. You need accurate contact data, a basic intent signal, and a sequencer. That stack costs $5K/year, not $55K.

Best 6sense Alternatives at a Glance

| Use Case | Pick | Why | Starting Price |

|---|---|---|---|

| Budget teams | Apollo.io | Free tier, $49/user/mo paid, 275M+ contacts | Free |

| Enterprise ABM | Demandbase | Closest like-for-like 6sense replacement | $18.1K-$31.7K/yr (small org) |

| EMEA teams | Cognism | 180% more UK contacts, phone-verified mobiles | ~$22.5K/yr (5 users) |

| Standalone intent | Bombora | Standalone intent data via the Data Co-op | ~$2,500/seat |

What Does 6sense Actually Cost?

6sense has four tiers, but the pricing page doesn't show numbers. Here's what companies actually pay based on Vendr transaction data:

| Tier | Annual Cost | What You Get |

|---|---|---|

| Free | $0 | 50 credits/mo, basic company ID |

| Team | $15K-$20K/yr | Basic buyer intent |

| Growth | $25K-$60K/yr | Advanced intent, predictive analytics |

| Enterprise | $60K-$100K+/yr | Custom AI models, dedicated CSM |

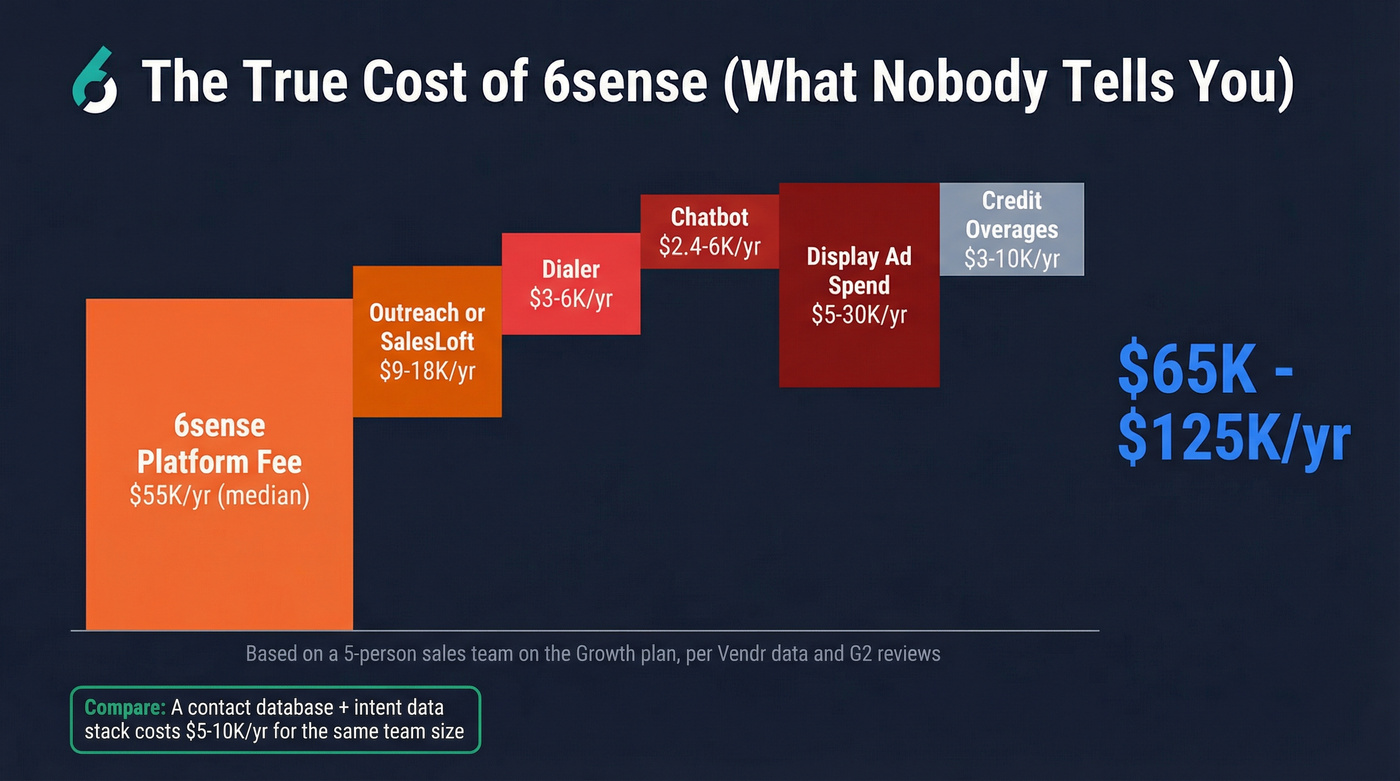

The median across all contracts is $55,211/year. The high end hits $130,483/year. For a 5-person sales team on the Growth plan, expect to pay around $58,000/year once you factor in credit overages, extra seats, and the partial RevOps specialist allocation you'll need to keep the thing running.

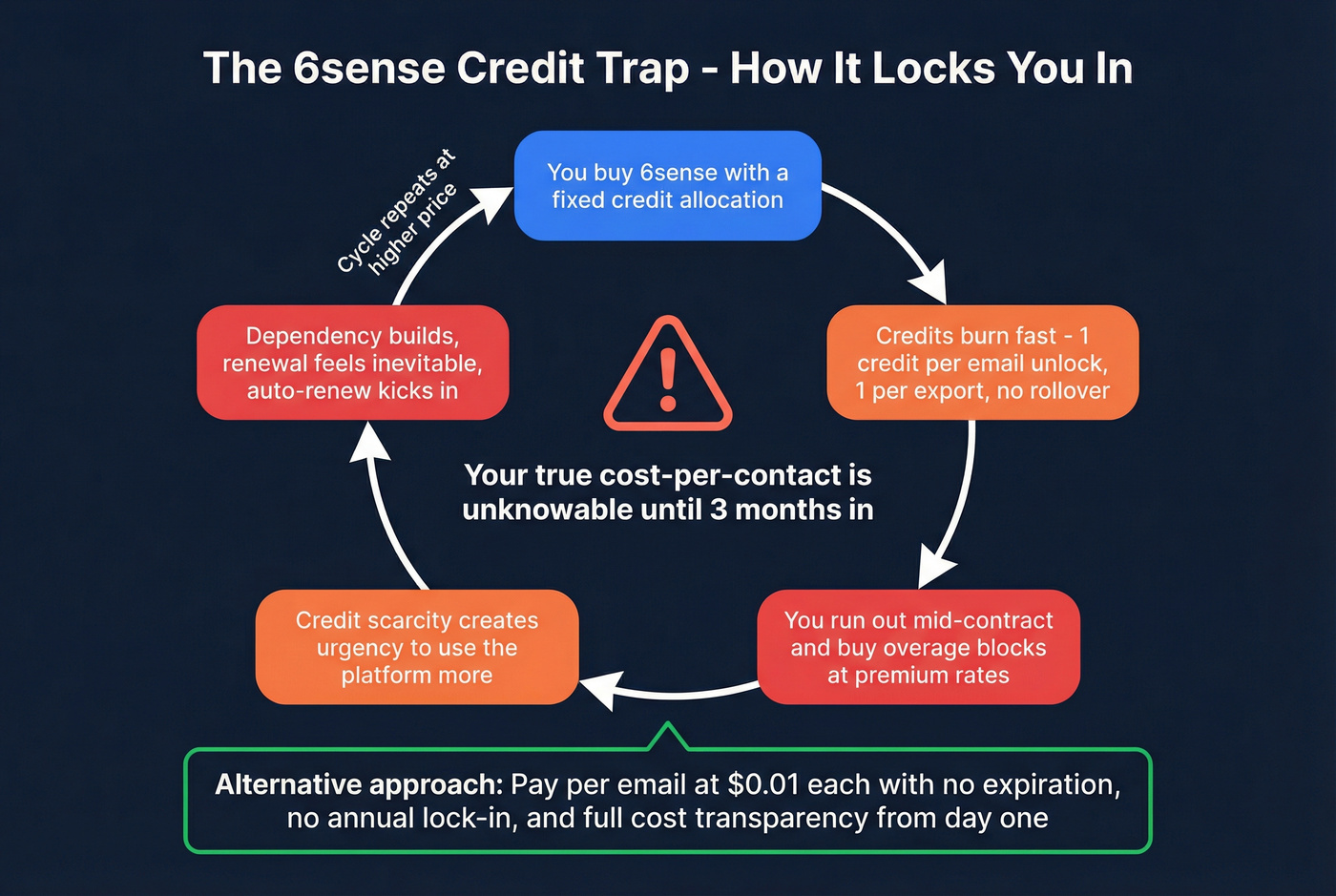

The Credit Trap

6sense runs on credits. One credit to unlock an email and phone number. One credit per data export. Credits don't roll over - unused ones evaporate at the end of each billing cycle.

Run out mid-contract? You're buying additional blocks at premium overage rates. This is the part that catches teams off guard. You budget for the platform fee, but the credit burn rate is unpredictable. Unlike tools with transparent per-lead pricing, you won't know your true cost-per-contact until you're three months in.

The psychology here is deliberate: credit scarcity creates urgency to use the platform, which creates dependency, which makes renewal feel inevitable. Brilliant retention mechanism. Terrible pricing model.

The Hidden $10-20K Nobody Mentions

Stack cost alert: 6sense doesn't include a dialer, email sequencer, or chat widget. You'll need Outreach or SalesLoft ($100-$150/user/month), a dialer ($50-$100/user/month), and potentially a chatbot ($200-$500/month). For a 5-person team, that's another $10-20K/year on top of your 6sense contract.

Display ad costs stack separately too: 1,000 target accounts = ~$5,000; 5,000 accounts = ~$20,000; 10,000 accounts = ~$30,000.

So your "$55K platform" is really a $65-95K stack. That's real money for any company under 500 employees.

Auto-Renewal Warning

6sense contracts auto-renew, and the cancellation windows are tight. Multiple G2 reviewers have flagged this. If you're evaluating alternatives, start 90 days before renewal - not 30.

The good news: discounts of 15-37% are achievable. One user negotiated down from a two-year minimum to an 18-month term. More on negotiation tactics below.

6sense costs $55K/year and still doesn't give you verified contact data. Prospeo gives you 300M+ profiles, 98% email accuracy, Bombora intent data across 15,000 topics, and 125M+ verified mobiles - all refreshed every 7 days. No annual contracts. Emails start at $0.01 each.

Replace your $55K stack with a $5K one that actually connects you to buyers.

Why Teams Leave 6sense

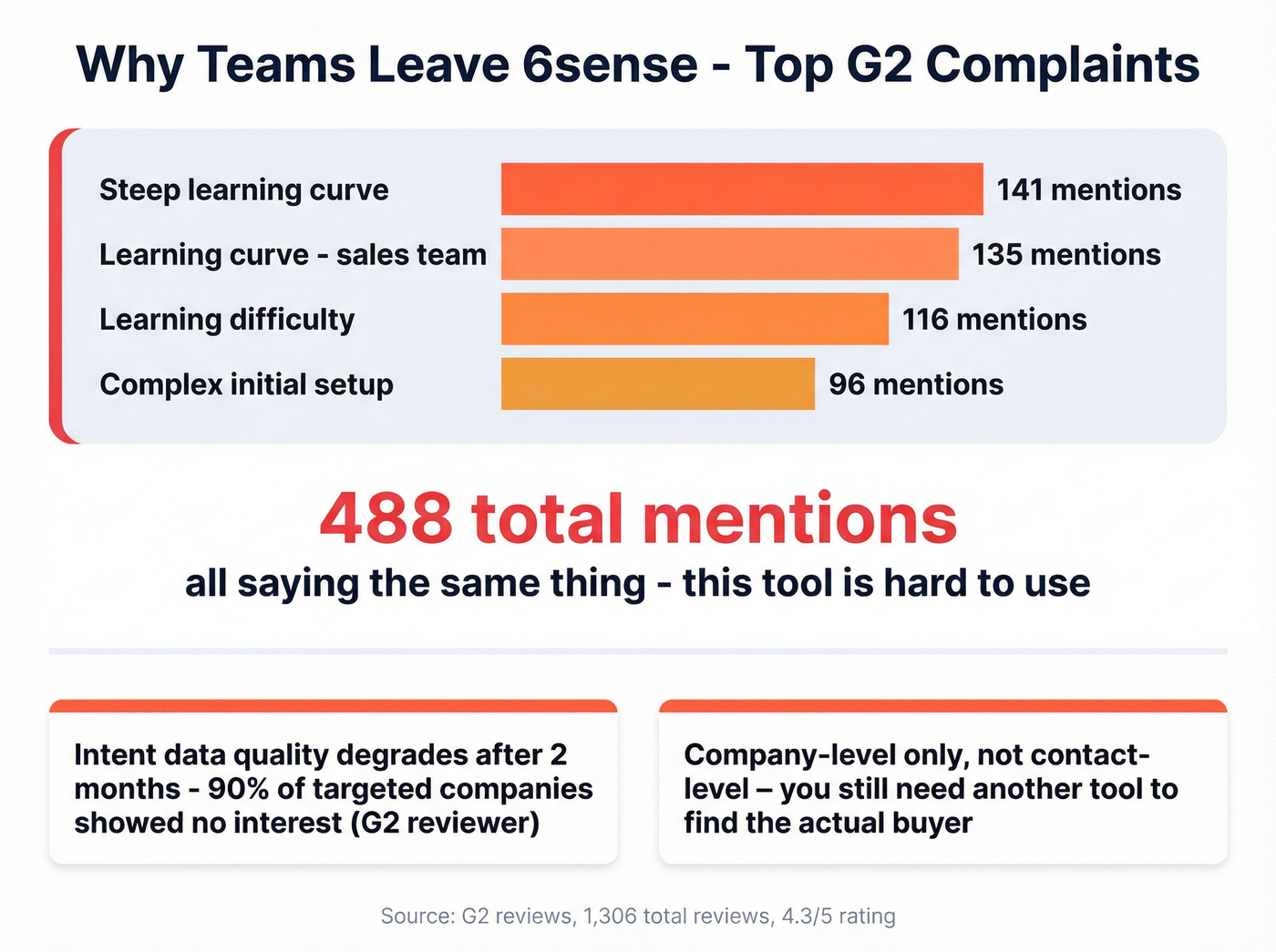

6sense has a 4.3/5 on G2 with 1,306 reviews. That's solid. But the pattern in the negative reviews tells a clear story.

The Learning Curve Is Brutal

The #1 complaint on G2 isn't price - it's complexity. The numbers across four variations of the same problem: "Steep learning curve" (141 mentions), "Learning curve - sales team" (135), "Learning difficulty" (116), and "Complex initial setup" (96). That's 488 combined mentions saying the same thing.

This tool is hard to use.

Implementation takes 4-8 weeks typically, up to 12 for complex deployments. Even after that, teams report feeling overwhelmed by the UI and data interpretation. If you don't have a dedicated RevOps person to own 6sense, it'll become expensive shelfware.

Intent Data Quality Degrades

Here's the thing: 6sense's intent data is genuinely powerful when it works. It has 273 positive G2 mentions - the most-mentioned pro. But the quality doesn't hold.

One G2 reviewer put it bluntly: "Initially, 6sense Intent delivered high-quality leads for the first two months. However, the quality drastically declined thereafter, with about 90% of targeted companies showing no interest."

A Reddit user with 15+ years of experience echoed this in r/LeadGeneration: "Between 2021 and 2022, we spent a lot of money and time trying intent data from different suppliers such as 6Sense, ZI, [Bombora] and the like... we were mostly disappointed with the quality of data." The core frustration? "Mysterious intent scores" without supporting evidence.

Company-Level, Not Contact-Level

6sense identifies companies visiting your website. It doesn't identify the actual stakeholders. You'll know that "Acme Corp is researching your category," but you won't know if it's the VP of Engineering or an intern writing a report. For contact-level data, you need a separate tool anyway - see B2B email lookup tools.

Where 6sense Still Wins

I'm not going to pretend 6sense is bad. Its visual dashboards (202 G2 mentions), predictive analytics, and buyer journey mapping are genuinely best-in-class. The ad targeting capabilities are unique in the sales intelligence space. If you're an enterprise marketing team running sophisticated ABM plays across channels, 6sense earns its price tag.

The problem is that most teams buying 6sense aren't that team. They're mid-market companies that wanted intent data and ended up with a $55K platform they use at 20% capacity.

There's also been chatter about internal instability - a Reddit thread in r/sales titled "What's going on at 6sense?" noted significant employee departures. Worth monitoring if you're signing a multi-year deal.

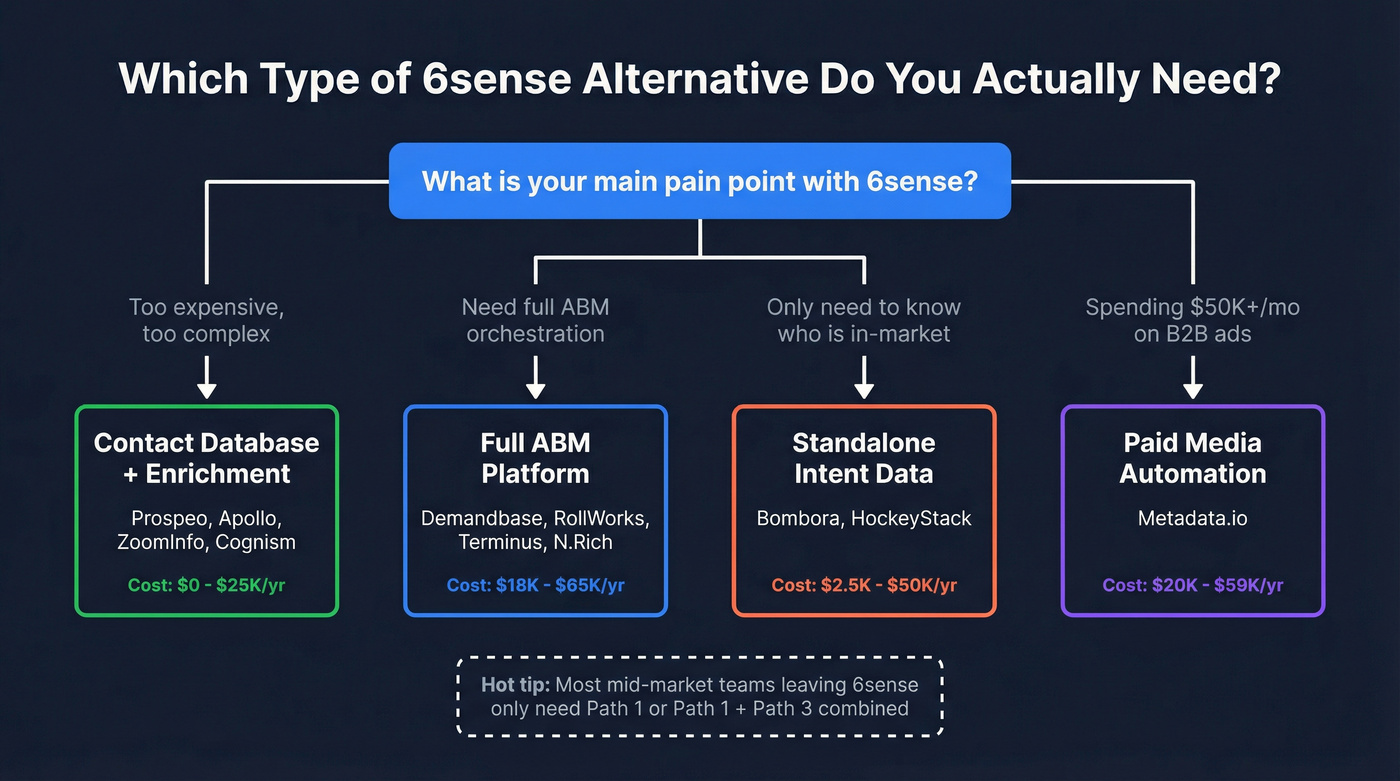

What Type of Tool Do You Actually Need?

Before you start comparing 13 tools, figure out which category solves your problem. Most 6sense buyers actually need one or two of these, not all four:

Full ABM Platforms

You need this if you're running coordinated marketing + sales plays across display ads, email, and direct mail at the account level. Tools: Demandbase, RollWorks, Terminus, N.Rich. If you’re building a program from scratch, use an ABM campaign planning template.

Intent Data Providers

You need this if you want to know which accounts are researching your category, but you'll activate that data in your existing stack. Tools: Bombora, HockeyStack. More on definitions and models in accounts in-market intent data.

Contact Databases & Enrichment

If your pain is bounce rates and missing direct dials, start with lead enrichment tools and a clean-list workflow like an email verification list SOP.

Paid Media Automation

You need this if you're spending $50K+/month on B2B ads and want AI to optimize targeting and budget allocation. Tool: Metadata.io.

Real talk: if you're leaving 6sense because of price and complexity, buying Demandbase (which costs more) isn't the answer. Most teams are better served unbundling - grab a contact database for prospecting and a standalone intent feed for prioritization. One interesting counterpoint from N.Rich: 95% of your target accounts aren't actively in-market at any given time, so a pure intent-data strategy misses the majority of your TAM. Keep that in mind when deciding how much to invest in intent vs. outbound coverage.

Master Comparison Table

| Tool | Starting Price | Mid-Market Annual | G2 | Best For |

|---|---|---|---|---|

| Demandbase | $18.1K-$31.7K/yr | ~$65K/yr | 4.3/5 | Enterprise ABM |

| Apollo.io | Free | ~$7K/yr | 4.7/5 | Budget teams |

| ZoomInfo | ~$15K/yr | ~$25K/yr | 4.4/5 | US database scale |

| Cognism | ~$22.5K/yr | ~$37.5K/yr | 4.5/5 | EMEA teams |

| Bombora | ~$2,500/seat | ~$25-50K/yr | 4.4/5 | Standalone intent |

| HockeyStack | ~$1,400/mo | ~$28K/yr | 4.5/5 | Attribution |

| RollWorks | Free | ~$1-20K/yr | 4.1/5 | SMB ABM |

| Terminus | ~$18K/yr | ~$23K/yr | 4.4/5 | Mid-market ABM |

| Metadata.io | ~$20K/yr | ~$59K/yr | 4.5/5 | B2B ad automation |

| Clearbit/Breeze | $45/mo (+HubSpot) | ~$14.2K/yr with HubSpot Pro | 4.4/5 | HubSpot shops |

| N.Rich | ~$20-40K/yr | ~$30-50K/yr | 4.3/5 | ABM advertising |

| Dealfront | Free | From $99/mo | 4.3/5 | European compliance |

The Best 6sense Competitors, Reviewed

Contact Data & Enrichment

Prospeo - Best for Data Accuracy

Best for: Teams whose real problem is bounced emails, wrong phone numbers, and stale data - not a lack of dashboards.

Skip if: You need a full ABM orchestration platform with display advertising. Pair Prospeo with an ABM tool for that.

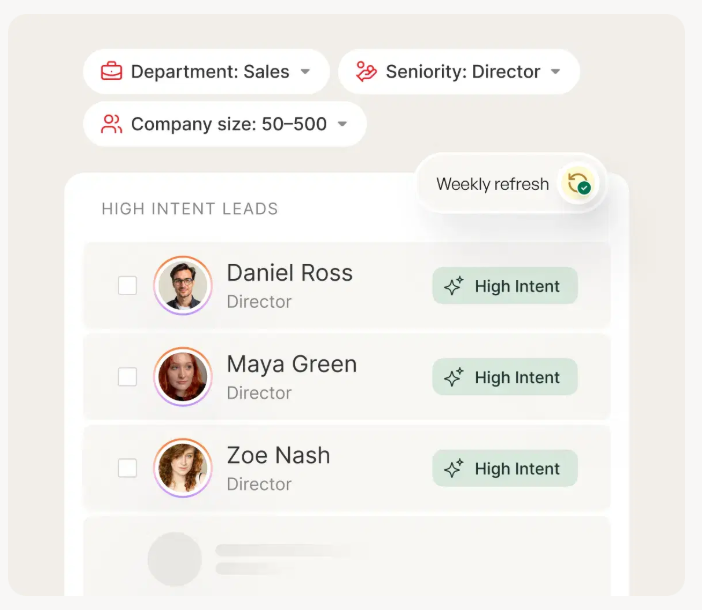

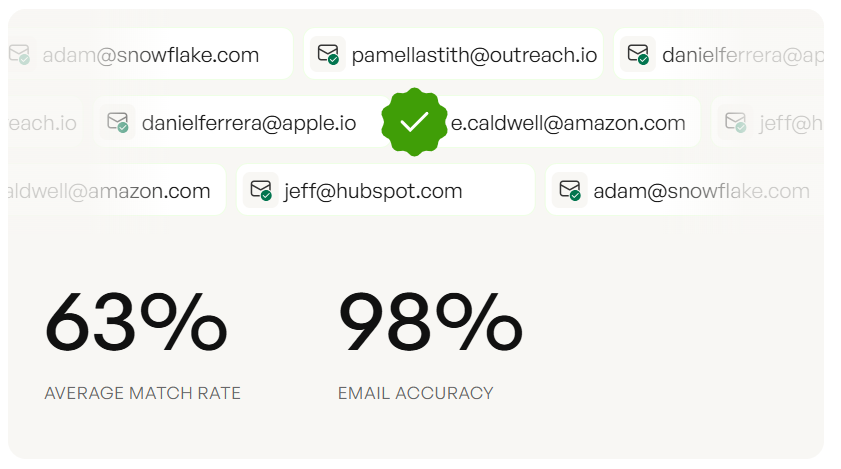

Prospeo's B2B database covers 300M+ professional profiles with 98% email accuracy and 125M+ verified mobile numbers. The 7-day data refresh cycle is the headline differentiator - the industry average is six weeks, which means most databases are serving you contacts who changed jobs last month. The Chrome extension (40K+ users) works on any website, and the 30% mobile pickup rate outperforms industry averages.

Search filters go deep: 30+ options including buyer intent data across 15,000 Bombora topics, technographics, job changes, headcount growth, and funding signals. The proof points: Snyk's 50-person AE team went from a 35-40% bounce rate to under 5%, generating 200+ new opportunities per month. Meritt tripled pipeline from $100K to $300K/week.

Pricing: Free tier gives you 75 verified emails and 100 Chrome extension credits per month. Paid plans run about $0.01 per email. No annual contracts, no sales calls, no credit expiration games. If you want the full breakdown, see Prospeo pricing.

Apollo.io - Best for Budget Teams

Best for: Teams that need a large contact database with built-in sequencing and don't want to spend more than $10K/year.

Skip if: You need EMEA-quality data, enterprise-grade intent signals, or phone numbers that actually connect above the director level.

Apollo is the obvious starting point for SMB and early-stage teams moving away from 6sense. The free tier alone - 10,000 email credits, 5 mobile credits, 250 emails/day - is more generous than 6sense's free plan. Paid plans start at $49/user/month (annual), and a 5-person team on Professional runs about $7,140/year. That's 87% less than the 6sense median.

The database covers 275M+ contacts across 73M+ companies. Built-in sequencing and an auto-dialer mean you don't need Outreach or SalesLoft on top. G2 rating: 4.7/5 - the highest on this list. The tradeoff: email bounce rates can hit 15-20% on some segments, and mobile numbers for mid-market/enterprise contacts are unreliable. Apollo also has zero website visitor identification. If you’re evaluating deliverability impact, start with B2B contact data decay.

Pricing: Free / $49 / $79 / $119 per user/month (annual).

ZoomInfo - Best Contact Database at Scale

| ZoomInfo | 6sense | |

|---|---|---|

| Database size | 321M professionals | Company-level focus |

| Intent data | Paid add-on | Built-in |

| Contact-level data | Strong | Weak |

| Predictive analytics | Basic | Best-in-class |

| Starting price | ~$15K/yr | ~$15K-$20K/yr |

| Typical mid-market | ~$25K/yr | ~$55K/yr |

ZoomInfo's database is the biggest in the space: 321 million professionals across 104 million companies. If you're prospecting into US mid-market and enterprise accounts, the coverage is hard to beat. But intent data isn't included in the base plans - it's a paid add-on. If you're switching from 6sense specifically for intent signals, you'll pay extra on top of an already expensive platform. If you want to compare cost mechanics, see ZoomInfo pricing.

Skip if: You're leaving 6sense because of price. ZoomInfo's cost structure is similar, and renewal increases of 10-20% are common. One Reddit user burned through 10,000 credits in two months with just three sales reps. Credits don't roll over, and additional credits cost $0.20-$0.60 each.

Pricing tiers:

- Professional: ~$15-18K/year (1-3 users, ~5,000 credits)

- Advanced: ~$22-28K/year (3-5 users, ~10,000 credits)

- Elite: ~$35-45K+/year (5+ users, ~15-20K credits)

Annual contracts only. No monthly option.

Cognism - Best for EMEA Teams

I watched a team try to run European outbound with ZoomInfo data last year. Connect rates were abysmal. They switched to Cognism and their UK connect rates doubled in the first month.

Why it happened: Cognism's Diamond Data phone-verified mobiles are human-verified as connecting to the right person - not just "we found a number in a database." The claimed connection rate is 87%. EMEA coverage is unmatched: 180% more contacts in the UK and 250%+ more in France and Germany versus competitors.

The Elevate tier includes Bombora intent data, so you get intent signals without buying a separate platform. A 5-user Grow plan runs ~$22,500/year; Elevate ~$37,500/year. If you’re deciding between tools, see Clay vs Cognism.

G2 rating: 4.5/5 with 1,294 reviews. Top praise: ease of use (206 mentions) and EMEA contact quality (182 mentions). Top complaint: inaccurate data (90 mentions) - ironic given the verification claims, but "unlimited" access runs under a fair-use policy of roughly 2,000 records per user per month.

Clearbit / Breeze Intelligence - Best for HubSpot-Native Enrichment

Clearbit got acquired by HubSpot and rebranded as Breeze Intelligence. It's now an add-on, not a standalone product.

The good: 200M+ profile database enriches existing records with firmographic and technographic data. If you're already all-in on HubSpot, it's the most convenient enrichment option. For cost details, see Clearbit pricing.

The bad: It doesn't find new contacts, doesn't provide phone numbers, and credits don't roll over. The real cost is ~$1,184/month with HubSpot Professional underneath the $45/month credit pack. The HubSpot lock-in is the real cost here - if you're not already committed to that ecosystem, look elsewhere.

Dealfront - Best for European Compliance

Formerly Leadfeeder, Dealfront offers a free plan and paid tiers from $99/month for website visitor identification. It's built for European data compliance from the ground up - GDPR isn't an afterthought, it's the foundation. If you're an EU-based team that used 6sense primarily for web deanonymization, Dealfront is the focused alternative. The cookieless tracking capabilities also future-proof it against browser privacy changes that'll degrade other tools' visitor identification.

ABM Platforms

Demandbase - Best Enterprise ABM Replacement

Best for: Enterprise teams that genuinely need a full ABM platform and want the closest like-for-like 6sense replacement.

Skip if: You're a mid-market team that bought 6sense for intent data and regretted the complexity. Demandbase is equally complex and costs more.

Demandbase is the only tool on this list that truly replaces 6sense feature-for-feature. Its ABX approach unifies marketing, sales, and customer success into a single platform - and it's stronger than 6sense on advertising and cross-channel engagement specifically. The vendor claims 3x conversion rates and 83% faster pipeline velocity, though those are self-reported figures.

For a ~200-employee company, expect $18,100-$31,700/year. Mid-market lands at $42,800-$60,800/year. Enterprise deals push $70K-$300K/year. Add-ons stack fast: Advertising Cloud (~$30K), Orchestration (~$20K), onboarding (~$29K). Implementation takes 2-8 weeks - often faster than a typical 6sense deployment.

I've seen teams switch from 6sense to Demandbase and end up with the same complaints about complexity and cost. If those are your pain points, Demandbase isn't the answer.

RollWorks - Best Free ABM Entry Point

RollWorks (now AdRoll ABM) is the only ABM platform with a genuinely free tier. The self-serve plan includes retargeting campaigns, CTV campaigns, contact targeting, and Facebook/Instagram campaigns - no monthly subscription. Paid plans range from $1-20K/year.

The ICP Fit grading system (A-D) uses firmographic, technographic, and CRM criteria to score accounts. It's simpler than 6sense or Demandbase, and that's the selling point. Onboarding takes days, not weeks.

Terminus - Enterprise ABM With DemandScience

Terminus is now part of DemandScience, which adds content syndication and demand gen capabilities to the ABM core. The median contract runs ~$23,000/year, with a range from $18,000 to $266,000/year depending on modules and account volume.

Implementation takes about a month, and users report ~12 months to see real ROI. Some users report a 60% drop in CAC, though that timeline matters. The consistent user feedback: "great ABM features but overkill if you only need a few functions." If you're buying Terminus, make sure you'll use at least three modules.

N.Rich - ABM Advertising Without Seat-Based Pricing

N.Rich offers non-seat-based ABM pricing focused on advertising - a refreshing model compared to 6sense's per-user credit system. Their argument about reaching the 95% of accounts not currently in-market through programmatic ABM ads is compelling if your strategy extends beyond intent-driven outbound. Pricing isn't public, but expect ~$20-40K/year based on market positioning.

Intent Data

Bombora - Best for Standalone Intent Data

Bombora is the engine behind many ABM platforms' intent data. The difference is you can buy it directly.

The Data Co-op model aggregates consent-based research behavior from 5,000+ B2B websites across 13,000+ topics. Company Surge reports tell you when an account's research activity spikes significantly above baseline. It's not scraping or bidstream data - it's actual content consumption signals.

Standalone pricing starts around $2,500/seat, with mid-market deals typically running $25-50K/year. That's steep for intent data alone, which is why most teams access Bombora through integration partners at lower price points. Implementation takes days, not weeks. If you want the head-to-head, see Bombora vs ZoomInfo.

Skip if: You want contact data alongside intent signals. Bombora tells you which companies are in-market, not who to call.

Analytics & Paid Media

HockeyStack - Best for Attribution & Analytics

HockeyStack isn't an ABM platform or a contact database - it's a revenue analytics engine. If your 6sense frustration is "we can't prove what's working," HockeyStack is the answer.

The platform does full lifecycle attribution with a no-code dashboard builder. Firstup consolidated $140,000 in fragmented tools (including 6sense) into HockeyStack. Growth plans start around $1,400/month, with a median contract around $28,000/year. Expect 3-4 weeks to first dashboards and 5-6 weeks for full setup.

The learning curve is steep - this isn't a tool for small businesses or teams without a dedicated analytics person. But for mid-market and enterprise marketing teams that need to connect ad spend to pipeline to revenue, it's one of the best options available.

Metadata.io - Best for B2B Paid Media Automation

Metadata.io automates B2B paid media across Facebook, professional ad networks, and Google Ads using AI agents. The MetaMatch technology maps business profiles to personal emails for ad targeting - solving the "I can't target B2B buyers on consumer ad platforms" problem.

The median contract is $59,425/year. Spotlight starts at $20,000/year; Campaigns at $43,200/year. One user saved ~$112K by committing to a multi-year deal with strict budgets. Best fit: B2B tech companies with 50-5,000+ employees spending serious money on paid media.

Honorable mentions: Seamless.AI and Lusha both appear in other comparisons. They're solid for basic contact lookup but lack the intent data and enrichment depth of the tools above.

6sense tells you Acme Corp is in-market. Prospeo tells you the VP of Engineering's verified email and direct dial. Layer Bombora intent signals with 30+ filters - technographics, funding, headcount growth - and export contacts with 98% email accuracy. No credit traps, no auto-renewal games.

Stop paying enterprise prices for company-level signals you can't act on.

How to Negotiate Your 6sense Renewal

If you're not ready to switch tools, at least stop overpaying. Discounts of 15-37% are achievable with the right approach.

Get competing quotes first. Request pricing from Demandbase and Bombora before your renewal conversation. 6sense's sales team knows exactly who their competitors are, and a credible alternative quote is your strongest lever.

Time it right. End-of-quarter conversations yield the best discounts. One user reported: "6Sense offered us a discount of 37% by using end-of-quarters as main levers."

Push on term length. 6sense defaults to two-year commitments. One user successfully negotiated down to an 18-month term with a price reduction. Don't accept the first offer.

Negotiate credit rollover. Credits expiring monthly is the default. Push for quarterly or annual rollover - it's a low-cost concession for 6sense that saves you thousands in overage charges.

Watch the auto-renewal window. 6sense contracts auto-renew, and the cancellation window is tight. Set a calendar reminder 90 days before renewal. By 30 days out, you've lost all leverage.

Use the free plan as a bridge. If you're evaluating alternatives, downgrade to 6sense's free plan (50 credits/month) while you test other tools. It's not enough for production use, but it keeps your historical data accessible during the transition.

Look, I've seen teams panic-renew because they started evaluating alternatives two weeks before the deadline. Don't be that team. Start now.

FAQ

What's the cheapest alternative to 6sense?

Apollo.io's free tier (10,000 email credits/month) and RollWorks' free ABM plan both cost $0. For contact data with verified emails, Prospeo's free plan includes 75 emails/month with 98% accuracy - better data quality than Apollo's free tier at zero cost.

Does 6sense have a free plan?

Yes - 6sense offers a free plan with 50 credits per month, basic company identification, and limited intent data. It's useful for evaluation but insufficient for production use. Most teams hit the credit ceiling within the first week.

Is Demandbase really better than 6sense?

Demandbase is different, not universally better. It's stronger on advertising and cross-channel engagement; 6sense is stronger on predictive analytics and intent scoring. Both cost $55-65K/year median. Expect similar complexity and implementation overhead from either platform.

Can I get intent data without paying for a full ABM platform?

Yes. Bombora sells standalone intent access starting around $2,500/seat. Cognism's Elevate tier bundles Bombora-powered intent at ~$37.5K/year for five users. Prospeo also layers Bombora intent data across 15,000 topics into its contact database starting on its free plan.

How accurate is 6sense contact data compared to dedicated data tools?

6sense excels at identifying companies showing buying signals but struggles with individual stakeholder data - it identifies the account, not the person. Dedicated platforms like Prospeo (98% email accuracy, 30% mobile pickup) and Cognism (87% phone connection rate) significantly outperform 6sense for verified emails and direct dials.