Best MightyCall Alternatives (2026): Pick by Your "Failure Mode"

Switching phone systems isn't a vibe shift. It's an outage you schedule.

Most teams don't leave MightyCall because they got bored. They leave because something broke, and it broke in a way that cost them money.

Pick the tool that fixes what failed first, or you'll recreate the same pain on a different invoice.

Teams leave MightyCall for three reasons:

- Call reliability under load (drops, jitter, "can you hear me?")

- Texting + A2P 10DLC friction (registration limbo, throttling, broken workflows)

- Total cost of ownership (seat minimums, number slots, taxes/telecom fees, surprise add-ons)

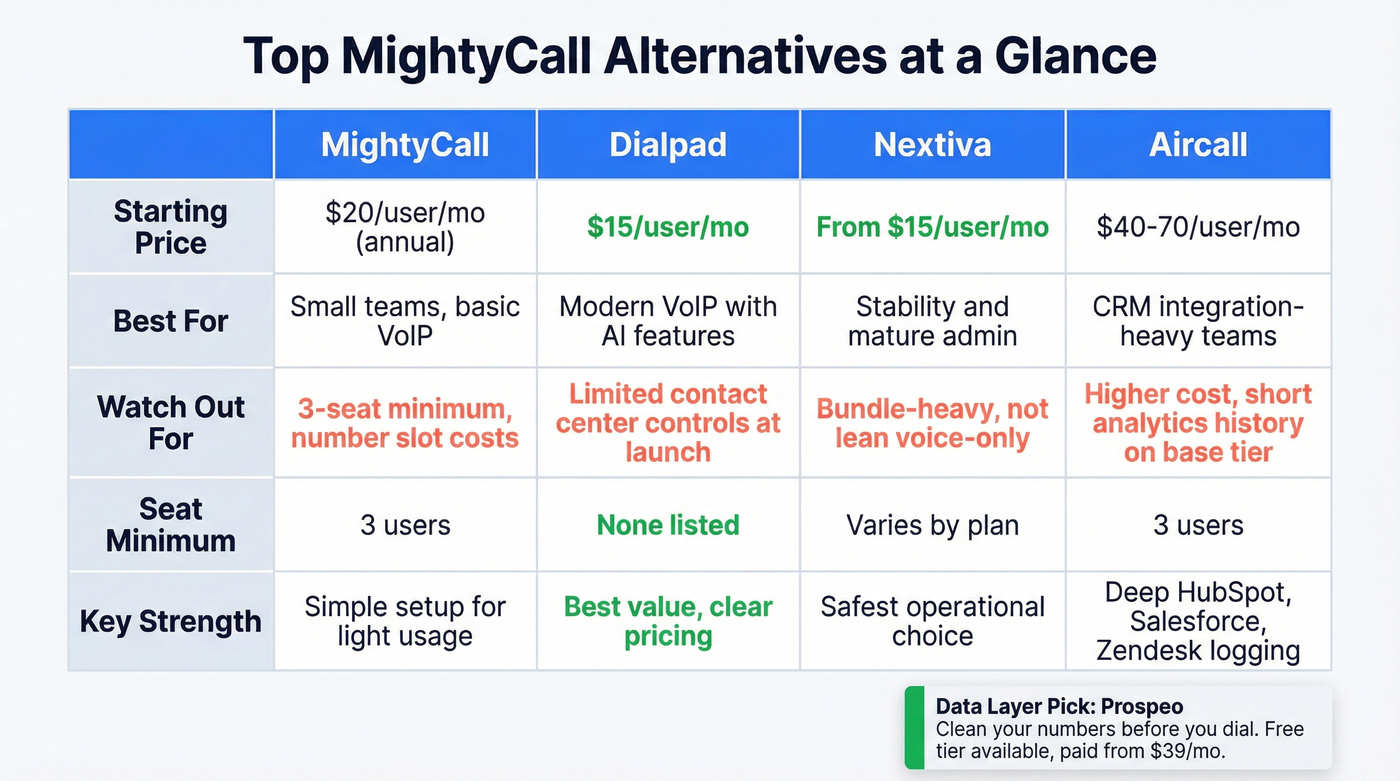

Our picks (TL;DR): the 3 to trial first (+ data layer pick)

Dialpad - best value with clear pricing

- Use this if you want a modern VoIP with AI features and pricing you can understand without a spreadsheet.

- Skip this if you need contact-center controls and QA workflows on day one.

- Pricing anchor: $15/user/mo (Standard), $25/user/mo (Pro).

Nextiva - safest operational choice

- Use this if you want stability, mature admin, and a vendor that's seen every SMB edge case.

- Skip this if you hate bundles and want a lean "voice + SMS only" setup.

- Pricing anchor: from ~ $15/user/mo (Core).

Aircall - best for integration-heavy teams (but mind the minimums)

- Use this if your calling workflow lives inside HubSpot/Salesforce/Zendesk and you want calls logged cleanly.

- Skip this if you're cost-sensitive or you need long analytics history without upgrading.

- Pricing anchor: expect $40-$70/user/mo depending on tier/term; if your quote lands outside that band, ask for line items and a reason.

Prospeo (data layer pick) - clean your data before you dial

- Use this if your "call issues" are really "we're dialing bad numbers and burning reputation."

- Skip this if you never do outbound and only handle inbound support.

- Pricing anchor: free tier; paid plans from ~ $39/mo.

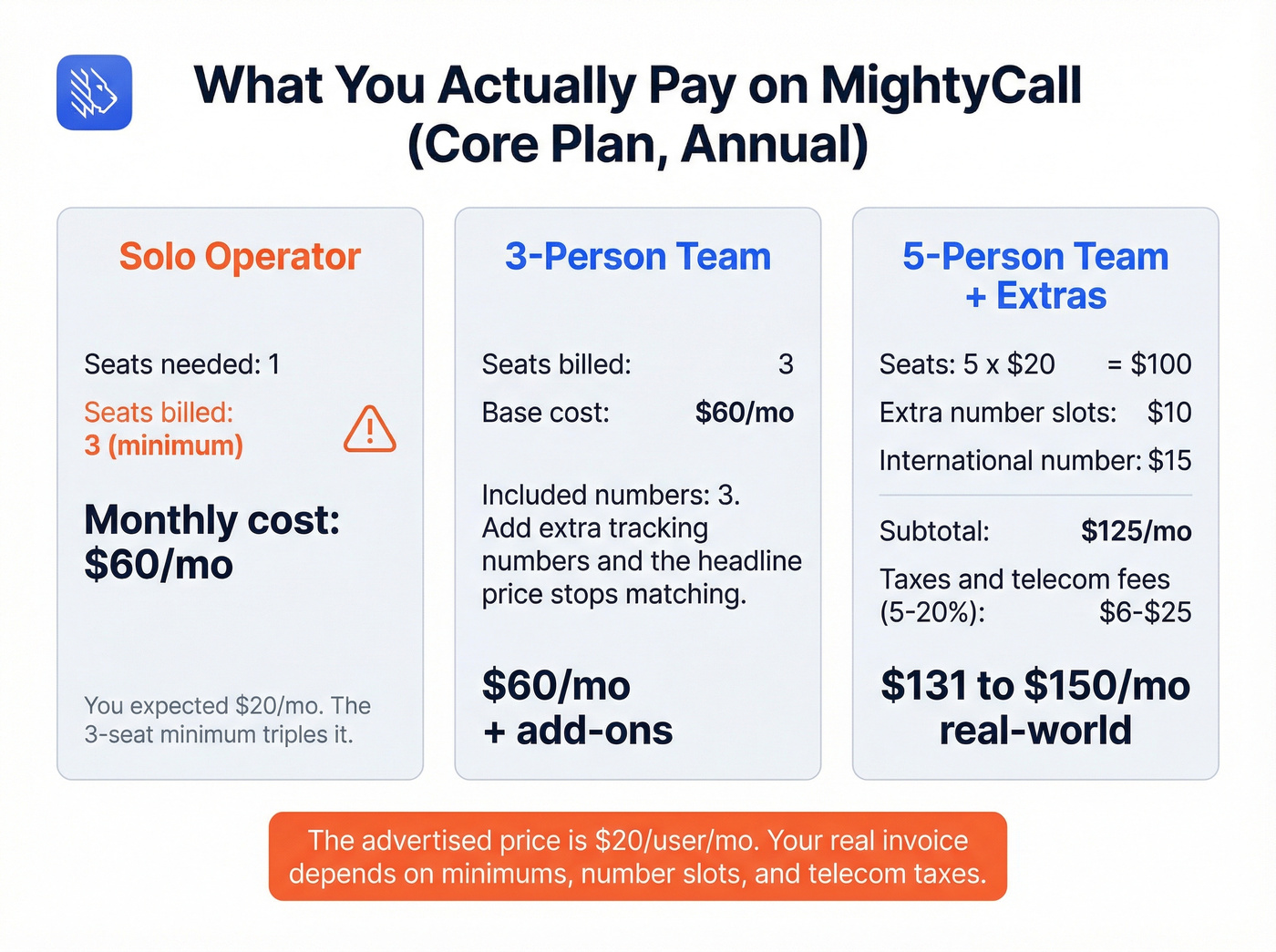

MightyCall pricing in 2026 - what you actually pay (baseline)

MightyCall looks simple until you run the math with the 3-user minimum, number slots, and telecom taxes/fees. If you're a 1-2 person team, the minimum is the whole story. If you're 3-10 seats, the minimum fades, but the add-ons start quietly inflating your invoice.

Baseline pricing (from MightyCall's pricing page):

| Plan | Annual price | Monthly price | 3-user min | Best for |

|---|---|---|---|---|

| Core | $20/user/mo | $25/user/mo | Yes | Basic VoIP + SMS |

| Pro | $38/user/mo | $45/user/mo | Yes | Supervisor + analytics |

| Power | $65/user/mo | $65/user/mo | Yes | Preview/progressive dialer + AI answering machine detection |

| Enterprise | Custom | Custom | Yes | Predictive dialer + SIP trunking support |

Three concrete invoice examples (so you can sanity-check your own)

Example A - Solo operator (gets burned by the minimum): You want one line, one number, basic calling/texting. You still pay 3 seats.

- Core annual: 3 x $20 = $60/mo (before taxes/fees)

If you expected "$20/mo," this is where MightyCall stings.

Example B - 3-person team (minimum stops hurting, add-ons start): You have 3 reps and want a main line + a couple of extra numbers for tracking. Core includes 3 business phone numbers, so you might be fine until you add extra number slots, international numbers, or additional brands. That's when the "$20/user" headline stops matching the invoice.

Example C - 5-person team with one international number + extra tracking numbers:

- Seats: 5 x $20 = $100/mo

- Add-ons (common): +2 number slots ($10) +1 international number ($15) = $25/mo

- Subtotal: $125/mo

- Plus taxes/telecom fees (often ~5-20% depending on jurisdiction) -> ~$131-$150/mo real-world

Trial limits (why teams "test" and still get surprised later)

MightyCall's trial is 7 days and capped at 100 minutes, plus 5 SMS + 5 MMS. That's enough to click around the UI. It's not enough to validate peak-hour call quality, SMS deliverability and opt-out handling, or the A2P 10DLC workflow speed (the part that actually causes churn).

What users praise vs what breaks (G2 snapshot)

MightyCall holds a 4.4/5 rating on G2 (321 reviews). The pattern's consistent:

- What users like: simple setup, small-business-friendly features, and straightforward day-to-day calling when usage is light.

- What breaks: recurring complaints about call drops/connection issues - the kind of problem that kills rep trust fast.

Here's the thing: if calling is revenue-critical, reliability drama isn't "annoying." It's existential.

I've seen teams lose an entire week of outbound momentum because reps stopped believing the line would work, and once that trust is gone, you don't get it back with a pep talk.

Switching VoIP providers won't fix your connect rate if your contact data is rotten. Prospeo gives you 125M+ verified mobile numbers with a 30% pickup rate - so every minute on your new phone system counts. At $0.01/email and 10 credits per mobile, you'll spend less on clean data than one month of phantom number slots.

Fix the data layer before you swap the dialer.

The "unlimited" calling reality (Fair Use) + what breaks when you hit caps

"Unlimited" in SMB VoIP always has an asterisk. The only question is how ugly the enforcement is.

MightyCall enforces overages through refill minutes. If you exceed the monthly talk-minute limit (or do international calling/forwarding) and you don't have refill balance:

- Outbound calls fail with an "insufficient funds... call cannot be placed" message.

- Inbound callers can hear "temporarily unavailable" and get routed to voicemail.

Minimum refill purchase: $5.

Important boundary: the cap number isn't the point - enforcement is

MightyCall's refill-minutes doc doesn't publish the numeric Fair Use cap. Across SMB VoIP, Fair Use caps often land around 3,000-5,000 minutes/user/month. Treat that as a planning range, not a promise.

What matters is simple: calls can fail mid-month if you don't manage refill balance.

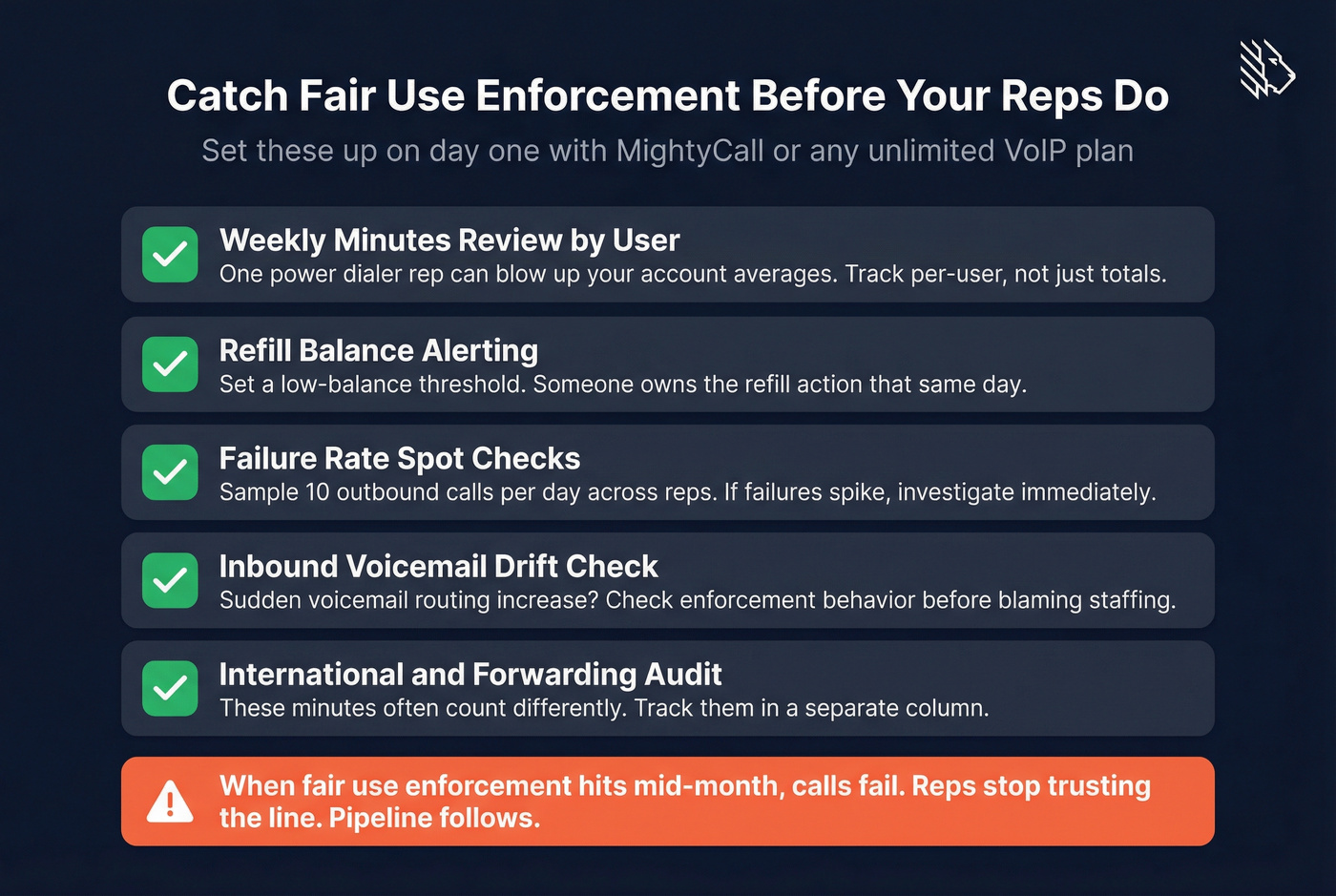

Monitoring checklist (catch cap enforcement before reps notice)

If you're staying on MightyCall - or evaluating any "unlimited" plan - set these up on day one:

- Weekly minutes review by user (not just account total). One power dialer rep can blow up your averages.

- Refill balance alerting: if balance hits a low threshold, someone owns the action that day.

- Failure-rate spot checks: pick 10 outbound calls/day across reps; if failures spike, investigate immediately.

- Inbound "voicemail drift" check: if inbound suddenly routes to voicemail more often, don't blame staffing - check enforcement behavior first.

- International/forwarding audit: those minutes often get treated differently; track them separately.

Risk callout (what actually breaks): When Fair Use enforcement hits mid-month, it doesn't degrade gracefully. Calls fail. Reps stop trusting the line. Pipeline follows.

Real talk: phone systems should fail loudly and predictably. Anything else is a RevOps tax.

Hidden costs & gotchas (the stuff that changes your invoice)

This is where buyers get burned: they budget for seats, then discover the numbers economy, porting mechanics, and compliance fees.

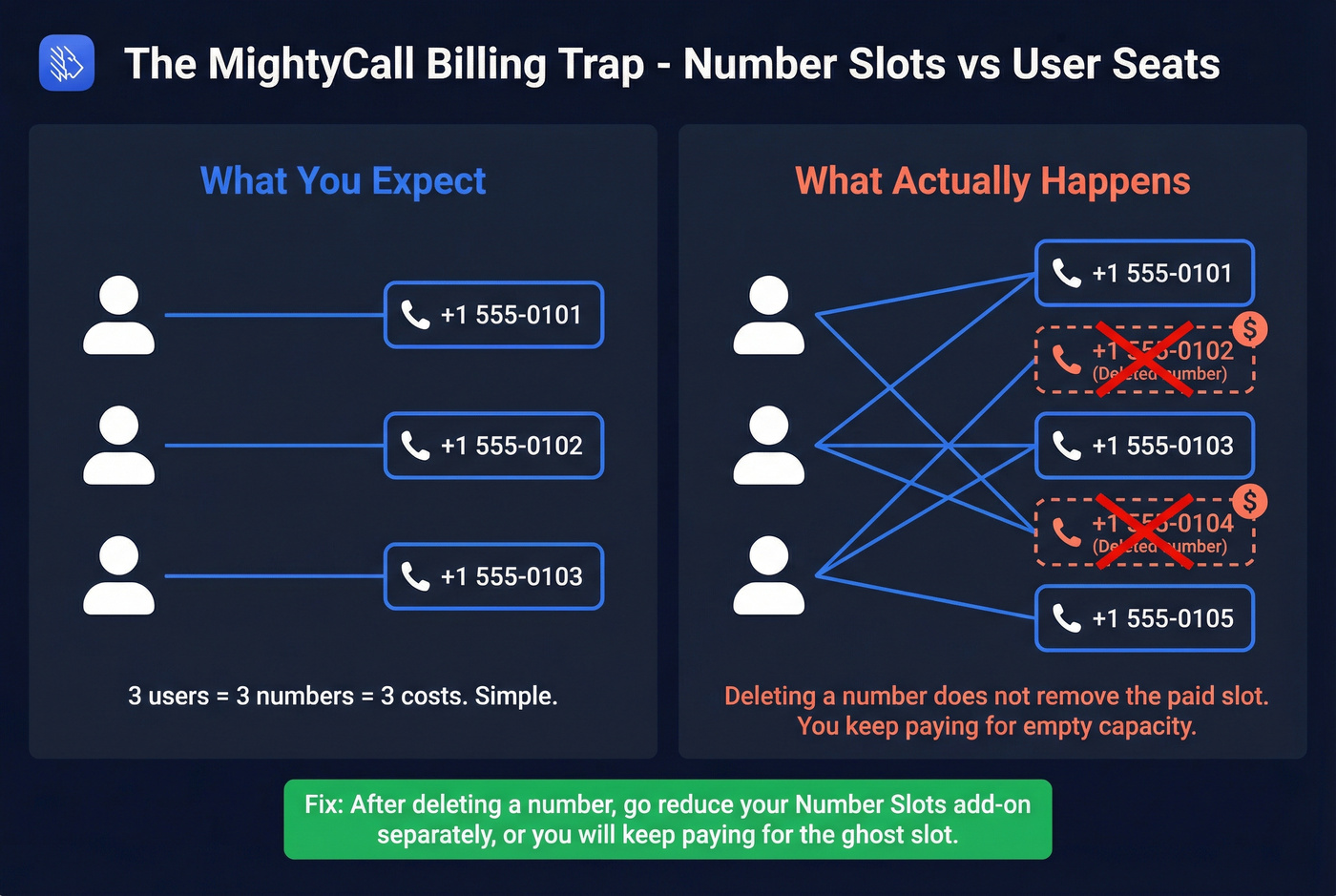

The big gotcha: number slot != user seat

MightyCall sells add-ons as User Seats and Number Slots. One user can access multiple numbers, so "5 reps = 5 numbers" isn't a rule. It's a guess.

The most common waste pattern: a team deletes a number (campaign ended, brand retired) and assumes the cost disappears. It doesn't, because deleting a number doesn't remove the paid slot. You have to reduce the number slots add-on separately, or you'll keep paying for empty capacity.

The costs that sneak in (MightyCall-specific)

From MightyCall's support docs and pricing details:

- Extra number slot: $5/mo + applicable taxes

- International number: $15/mo + applicable taxes

- Some destinations: $15 one-time activation fee for international numbers

- Extra phone number add-on activation fee: $15 (one-time)

Credit where it's due: add-ons are removable and you get prorated credit back to your account balance. Plenty of vendors don't do that.

Porting scenario that changes your TCO

Porting itself is often "free," but the hidden cost is capacity:

- Porting is free if you already have available number slots.

- If you don't, you add slots at $5/mo each.

So if you're porting 6 numbers into an account that only has capacity for 3, you just created a permanent monthly add-on unless you later consolidate and actually remove the slots.

CFO-style checklist (print this before you sign anything)

If you want invoice predictability, get these answers in writing:

- Minimum seats (and whether you can drop seats mid-term)

- Included numbers (local + toll-free) and the cost of extras

- International number pricing + activation fees by country

- SMS pricing model (included vs metered) and A2P 10DLC fees

- Analytics window (6 months vs 12+ months)

- Recording retention (how long visible in dashboard; export options)

- Integrations: native vs Zapier-only (and whether call logging is automatic)

- Taxes/telecom fees: whether the vendor adds separate service fees on top

I'm opinionated about this: if a vendor won't put these in a clean order form, they're planning to win on confusion.

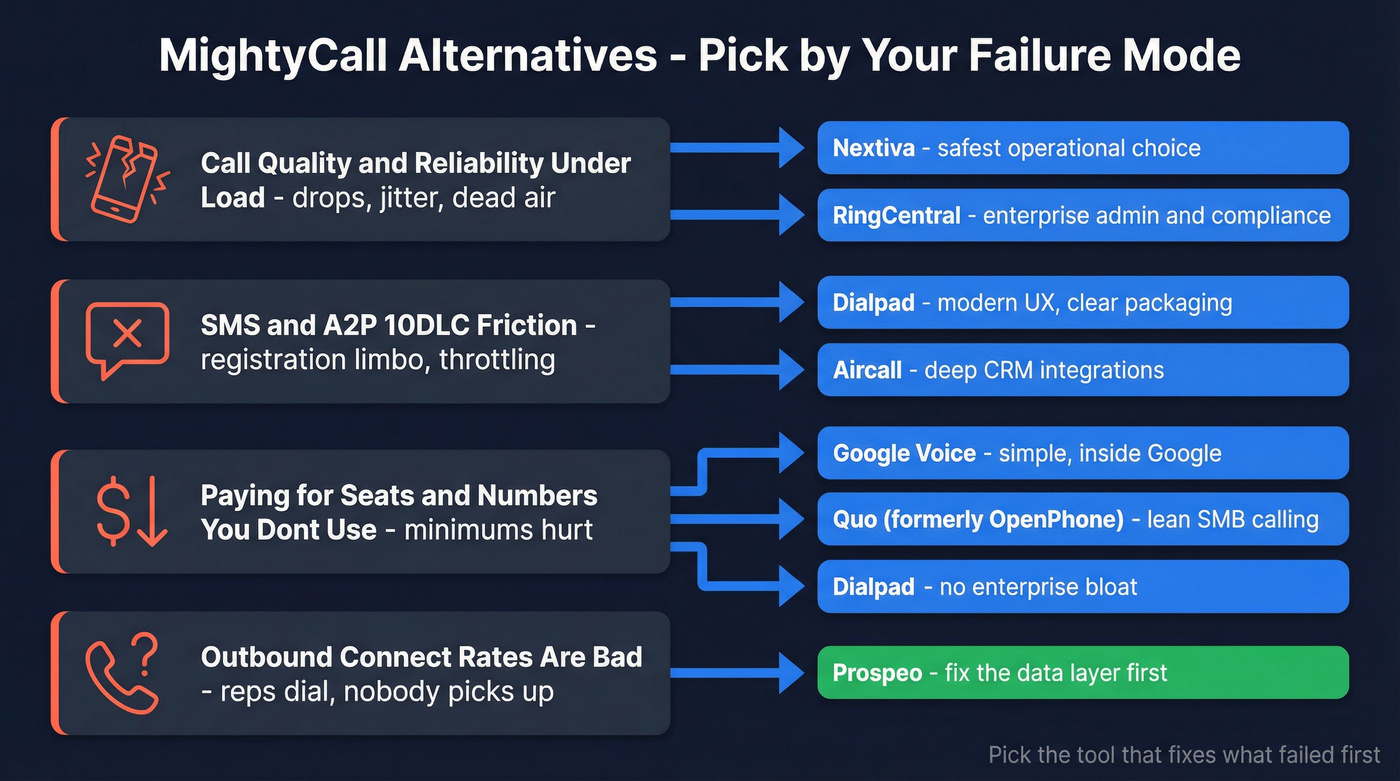

MightyCall alternatives: which one fits your failure mode?

Use this decision map and you'll pick faster, with fewer regrets.

Failure mode #1: Call quality/reliability under load

You're seeing drops, jitter, or "it works until it doesn't."

- Pick Nextiva if you want the safest operational choice for most SMB/midmarket teams.

- Pick RingCentral if you need enterprise-grade admin/compliance and you're fine with a more complex invoice.

Failure mode #2: SMS/A2P 10DLC friction

You need texting to work and you can't afford months of limbo.

- Pick Dialpad if you want modern UX + clear packaging.

- Pick Aircall if integrations are the product and you're willing to pay for it.

Only buy vendors that run A2P registration end-to-end and give you a written timeline. If they can't commit to a timeline, they can't control the process.

Budget reality: in the US, A2P 10DLC commonly adds $4-$15/mo per brand/campaign in registry/carrier fees.

Failure mode #3: You're paying for seats/numbers you don't use

You're small, usage is spiky, and minimums hurt.

- Pick Google Voice if you want simple calling inside a productivity suite.

- Pick Quo (formerly OpenPhone) if you want modern SMB calling/texting without call-center complexity.

- Pick Dialpad if you want a real business phone system without enterprise bloat.

Failure mode #4: Outbound connect rates are bad

Your reps dial all day and nobody picks up.

Hot take: if your average deal size is modest and your connect rate is awful, you probably don't have a phone-system problem - you have a list problem.

Fix the data first, then pick the dialer you like.

Policy + compliance gotchas (the stuff competitors mention for a reason)

Before you switch, decide what you need to be true operationally:

- TCPA/time-zone scheduling: your system should enforce quiet hours and time-zone-aware dialing for outbound. If it can't, you'll eventually ship a compliance incident.

- Opt-out handling: SMS opt-outs must be automatic and auditable. "We'll train reps to do it" fails in real life.

- Throughput + throttling: if you text at scale, you need clear throughput rules post-A2P approval.

- Use-case restrictions: some providers restrict cold outreach or certain verticals. If outbound's core, get the policy in writing before you migrate numbers.

- Audit trail: if you're regulated, you need retention, exports, and admin logs that don't require begging support.

Integrations depth: native vs Zapier (what breaks at scale)

At 3 reps, Zapier's fine. At 30 reps, Zapier becomes a second phone system you maintain, and the failure modes get weird: duplicate activities, missing recordings, mismatched contacts, and "it worked yesterday" bugs that waste hours because nobody owns the integration end-to-end.

- Native integrations win when you need reliable call logging, dispositions, recordings, and lifecycle automation.

- Zapier-only setups break when you need consistent object mapping, high volume, and low-latency workflows.

The best MightyCall alternatives (2026)

Dialpad (Tier 1)

Best for: SMB-to-midmarket teams that want clear pricing, fast rollout, and AI-forward calling. Starting price: $15/user/mo (Standard), $25/user/mo (Pro). Standout: Pricing's unusually clean, and the product's built around AI features instead of bolting them on later. Enterprise includes a 99.9% uptime commitment. Watch-outs: If you need deep contact-center QA, workforce management, and advanced routing, you'll move up tiers quickly. Budget for that early so you don't end up re-approving spend three months in.

For a tighter head-to-head, see Dialpad vs MightyCall.

Nextiva (Tier 1)

Best for: Teams that want a proven, conservative choice with lots of operational maturity. Starting price: From ~ $15/user/mo (Core), with lower effective rates on annual billing. Standout: Nextiva's "boring" in the best way: widely deployed, heavily reviewed, and built for day-to-day reliability. If you're a RevOps lead who hates surprises, this is the safe pick. Watch-outs: Bundles and tiering can push you into paying for features you don't use. Push for a clean quote that separates voice, SMS, numbers, and any suite add-ons.

Aircall (Tier 1)

Best for: Integration-heavy sales/support teams that want calling to live inside their stack. Starting price: Expect $40-$70/user/mo depending on tier/term; 3-seat minimum. Standout: Aircall shines when your phone system is basically a workflow engine: logging, tagging, routing, and syncing cleanly with CRMs/helpdesks. Watch-outs:

- Analytics: 6 months on Essentials/Professional; unlimited on Custom.

- Recordings: 6 months visible in the dashboard; longer retention available by request.

Also budget extra numbers (often ~ $6/mo each) and treat "SMS rates by country" as a real cost line, not a footnote.

If you're comparing stacks, this breakdown helps: 3CX vs Aircall.

Prospeo (Tier 1) - The B2B data platform built for accuracy

Prospeo isn't a MightyCall replacement. It's what you pair with any phone system when outbound performance matters.

Best for: Outbound teams switching phone systems who want higher pickup rates by dialing verified contact data. Starting price: Free tier; paid plans from ~ $39/mo (credit-based, self-serve). What it does (and why it matters): Prospeo gives you 300M+ professional profiles, 143M+ verified emails, and 125M+ verified mobile numbers, refreshed every 7 days. Email verification runs in real time at 98% accuracy, and verified mobiles average a 30% pickup rate across regions. If your reps are burning hours on wrong numbers, no VoIP vendor fixes that. Clean the list, then judge the dialer.

In our experience, the fastest "win" during a phone-system migration is running enrichment on the accounts you're actively working, then re-running your top outbound sequences with verified mobiles so you're not measuring a new phone tool with old, broken inputs. If you need the workflow, start with data quality and a simple email verification list SOP.

RingCentral (Tier 2)

Best for: Teams that want enterprise-grade UCaaS admin controls and can tolerate a more complex invoice. Starting price: Expect ~ $20-$35+/user/mo depending on tier and annual vs monthly billing; add-ons push this higher fast. Standout: Strong admin, compliance posture, and scale. This is the "standardize and move on" choice when you're done experimenting. Watch-outs: Fees inflate the invoice. RingCentral's Emergency Service Fee is a monthly recurring service fee and not government-mandated (per its own E911 fee policy). Budget for taxes/telecom fees and insist on a full line-item estimate.

CloudTalk (Tier 2)

Best for: International teams that need outbound-friendly calling and flexible dialer add-ons. Starting price: €19/user/mo billed annually (Lite) or ~ €27 billed monthly; add-ons increase cost. Standout: Clear add-on packaging for dialer modes, so you can pay for outbound power only when you need it. Watch-outs: Fair usage policy applies. If you're scaling outbound, get the enforcement behavior in writing and confirm international number availability for your target countries.

Ringover (Tier 2)

Best for: SMBs that want a modern all-rounder: VoIP + SMS + integrations without enterprise complexity. Starting price: Expect ~ $25-$45/user/mo; the range is driven by annual vs monthly billing and analytics/dialer add-ons. Standout: Hits a practical middle ground: modern features, solid integrations, and less procurement theater than enterprise UCaaS. Watch-outs: Advanced analytics, dialer modes, and higher SMS volume often land in higher tiers or add-ons. Price it as a workflow, not a seat.

8x8 (Tier 2)

Best for: Orgs that want UCaaS + contact center under one vendor and one contract. Starting price: UCaaS tiers often land ~ $24-$45/user/mo; contact center bundles commonly run ~ $85-$150/agent/mo depending on routing/QA features. Standout: Legit "one throat to choke" option when you need both phone system and contact center capabilities. Watch-outs: Packaging gets confusing fast. If you only need sales calling + basic SMS, you'll pay for platform weight you won't use.

Quo (formerly OpenPhone) (Tier 3)

Best for: Small teams that want modern calling + texting with minimal setup. Pricing: Expect ~ $15-$30/user/mo, with the range driven by tier features and annual billing. If you're evaluating options, compare Quo alternatives.

Google Voice (Tier 3)

Best for: Simple business calling inside a productivity suite. Pricing: Expect ~ $10-$30/user/mo depending on tier and whether you need advanced features.

Grasshopper (Tier 3)

Best for: Solo founders who want a second line and basic routing. Pricing: Expect ~ $18-$70/mo depending on plan and included numbers.

Zoom Phone (Tier 3)

Best for: Teams already standardized on Zoom that want one vendor for meetings + voice. Pricing: Expect ~ $10-$20/user/mo plus add-ons for advanced capabilities.

Vonage (Tier 3)

Best for: Businesses that want a known UCaaS brand with lots of add-ons. Pricing: Expect ~ $20-$40/user/mo, with the range driven by add-ons and contract terms.

3CX (Tier 3)

Best for: Technical teams that want PBX-style control and can manage it. Pricing: Expect ~ $150-$1,000/year depending on edition, hosting, and call volume.

Ooma Office (Tier 3)

Best for: Budget-conscious SMBs that want straightforward VoIP. Pricing: Expect ~ $20-$30/user/mo, with the range driven by tier features.

JustCall (Tier 3)

Best for: Sales teams that want calling + SMS with a sales-tool vibe. Pricing: Expect ~ $25-$60/user/mo, with the range driven by tier features and SMS/number add-ons.

Comparison table: MightyCall alternatives pricing + TCO (2026)

Two quick tables: one for fit, one for operational reality. Then a TCO table with fee estimates that match how invoices show up.

Table 1A: Quick fit (make-a-call matrix)

| Tool | Min seats | Starting price | SMS posture (rule) | Best for |

|---|---|---|---|---|

| MightyCall | 3 | $20/user/mo (annual) | Buy only if SMS volume's light | Simple SMB routing |

| Dialpad | 1 | $15/user/mo | Buy only if vendor owns A2P end-to-end | Best value + AI |

| Nextiva | 1 | ~ $15/user/mo | Buy only if A2P timeline's written | Safest ops choice |

| Aircall | 3 | $40-$70/user/mo | Buy only if SMS pricing's line-itemed | Best integrations |

| RingCentral | 1 | $20-$35+/user/mo | Buy only if fees are fully disclosed | Enterprise admin |

| CloudTalk | 1 | €19/user/mo (annual) | Buy only if fair-use terms fit outbound | Intl outbound teams |

| Ringover | 1 | $25-$45/user/mo | Buy only if SMS throughput's clear | SMB all-rounder |

| 8x8 | 1 | $24-$45/user/mo | Buy only if you need suite breadth | UCaaS + CC suite |

Table 1B: Ops reality (retention + integrations + gotchas)

| Tool | Analytics window | Recording retention | Integrations depth | Gotcha to price in |

|---|---|---|---|---|

| MightyCall | Plan-dependent | Plan-dependent | Basic | Number slots + taxes/fees |

| Dialpad | Strong SMB reporting | Strong | Strong | Higher tiers for CC depth |

| Nextiva | Strong | Strong | Strong | Bundles inflate spend |

| Aircall | 6 months (Ess/Pro) | 6 months visible; longer by request | Excellent | 3-seat min + extra numbers |

| RingCentral | Strong | Strong | Strong | Invoice fees > headline |

| CloudTalk | Solid | Solid | Good | Dialer add-ons + fair use |

| Ringover | Solid | Solid | Good | Add-ons for analytics/dialer |

| 8x8 | Strong | Strong | Strong | CC bundle pricing jumps |

Table 2: TCO scenarios (monthly totals you can budget)

Assumptions (kept simple on purpose):

- MightyCall on Core annual pricing ($20/user/mo)

- Add-ons: +2 extra number slots ($5/mo each) + +1 international number ($15/mo)

- One-time activation fees (often $15) not included in monthly totals

- Taxes/telecom fees estimate: +5-20% depending on jurisdiction (shown as a range)

| Scenario | MightyCall Core (pre-fee) | MightyCall Core (w/ +10% fee est.) | Dialpad Std | Nextiva Core | Aircall (mid) |

|---|---|---|---|---|---|

| 3 users + add-ons | $85 | ~ $94 | $45 | ~ $45 | ~ $150 |

| 5 users + add-ons | $125 | ~ $138 | $75 | ~ $75 | ~ $250 |

| 10 users + add-ons | $225 | ~ $248 | $150 | ~ $150 | ~ $500 |

How MightyCall math works here:

- Seats: users x $20

- Extra numbers: 2 slots x $5 = $10

- International: 1 x $15 = $15

- Total add-ons: $25/mo (plus taxes/fees)

So: 3 users = $60 + $25 = $85 (pre-fee)

One non-MightyCall reality check (why "starting price" isn't TCO): Aircall's "mid" number assumes you land around $50/user/mo. At 5 users, that's $250/mo before extra numbers and SMS costs. Aircall can be worth it if integrations are your lifeblood, but it's not a budget move.

Skip the phone-system bake-off if your list is trash. Fix the data first, then re-test. If you need benchmarks, start with answer rate and the B2B phone number workflow.

Your reps aren't losing trust because of jitter - they're losing trust because 1 in 3 numbers they dial is wrong. Prospeo's 7-day data refresh cycle means your call lists stay current, not stale. Teams using Prospeo book 35% more meetings than Apollo users.

Clean numbers first, new phone system second.

FAQ

How hard is it to port numbers from MightyCall to another provider?

Porting's straightforward when you treat it like a mini-project: keep the number active until the port completes, gather a recent invoice and account details, and schedule cutover outside peak hours. Expect 5-10 business days for simple ports and 10-20 business days if you're moving multiple numbers or complex routing.

What should I ask about A2P 10DLC before choosing a new provider?

Get three things in writing: who owns the workflow end-to-end, the expected approval timeline, and the fallback plan when registration stalls. Budget $4-$15/mo per brand/campaign for ongoing A2P fees, and confirm throughput rules so you don't get throttled after approval.

What does "unlimited calling" really mean in SMB VoIP plans?

"Unlimited" typically means unmetered until Fair Use enforcement kicks in, and enforcement can be abrupt rather than gradual. On MightyCall, if you exceed limits without refill balance, outbound calls fail for insufficient funds and inbound can route to voicemail after a "temporarily unavailable" message. Plan around 3,000-5,000 minutes/user/month as a common SMB range.

What's a good free alternative for improving outbound results before switching phone systems?

Prospeo's a strong free starting point because it improves outcomes without changing your VoIP vendor: the free tier includes 75 verified emails + 100 Chrome extension credits/month, with 98% real-time email verification accuracy and 125M+ verified mobile numbers. Clean and enrich your list first, then trial a phone system once your connect-rate baseline's real.

Summary: how to choose between MightyCall alternatives in 2026

If you're comparing MightyCall alternatives, don't start with feature checklists. Start with the failure mode.

For reliability, Nextiva (or RingCentral at enterprise scale) is the conservative move. For clean pricing and modern UX, Dialpad is hard to beat. For integration-first workflows, Aircall earns its premium.

And if pickups are the real problem, fix the data layer first, then judge the phone system. If you're building the motion, pair it with a modern outbound calling strategy and a B2B cold calling guide.