The Multi Channel Social Selling Playbook: Sequences, Tools, and Data for B2B Teams in 2026

84% of sales reps missed quota last year. Meanwhile, Gartner reports buyers now use 10+ interaction channels before they'll talk to a vendor - up from 5 in 2016. Your SDR sends 200 emails, gets 3 replies, calls it a day, and blames "the market." The market isn't the problem. The architecture is.

Most B2B teams treat email, phone, and social as separate activities run by separate people with separate goals. Multi channel social selling flips that - it's a coordinated system where every touchpoint reinforces the last, and social engagement is the connective tissue that makes cold outreach feel warm.

Here's the thing: every article ranking for this topic on the first page of Google is written for eCommerce marketers running Facebook ads and selling on Shopify. This isn't that. This is a B2B playbook with a day-by-day sequence, 15 specific tools with pricing, and the data to justify the investment to your VP of Sales.

Social selling leads convert 7x more frequently than other lead types. If that number doesn't get your attention, the rest of this article won't either.

What You Need to Run Multichannel Social Selling (Quick Version)

Coordinated multichannel outreach yields 250% higher conversion rates than single-channel. To get there, you need three layers working together:

- Data layer: Verified emails and direct dials that don't bounce on Day 1. Prospeo handles this - 98% email accuracy, 143M+ verified emails, 125M+ verified mobiles, no contracts. (If you’re evaluating vendors, start with these email lookup tools and a dedicated email verifier website.)

- Engagement layer: A platform for warm social interactions before and during outreach. Sales Navigator is the standard.

- Execution layer: A sequencer that coordinates email, social, and phone touches on a timeline. LaGrowthMachine or Klenty handle this.

The core deliverable is a 12-day multichannel sequence you can steal and run this week. Jump to that section if you're already bought in on the "why."

What Is Multi Channel Social Selling (and What It Isn't)

Multi channel social selling is the practice of using multiple coordinated channels - email, phone, social platforms, retargeting - with social engagement as the primary relationship-building mechanism. It's not just "being on LinkedIn." It's a system where your LinkedIn comment on Tuesday makes your cold call on Thursday feel like a warm conversation.

If you searched this term and got articles about selling on Amazon and Etsy, you're not alone. The SERP is dominated by eCommerce guides. This is the B2B version.

75% of B2B buyers use social media to research vendors. [80% of B2B sales interactions happen](https://www.gartner.com/en/newsroom/press-releases/2020-09-15-gartner-says-80 - of-b2b-sales-interactions-between-su) through digital channels. And here's the stat that should reframe your entire approach: 75% of B2B buyers prefer a rep-free buying experience. They don't want to talk to your reps. So you need to build trust and familiarity through social channels before they'll ever agree to a call.

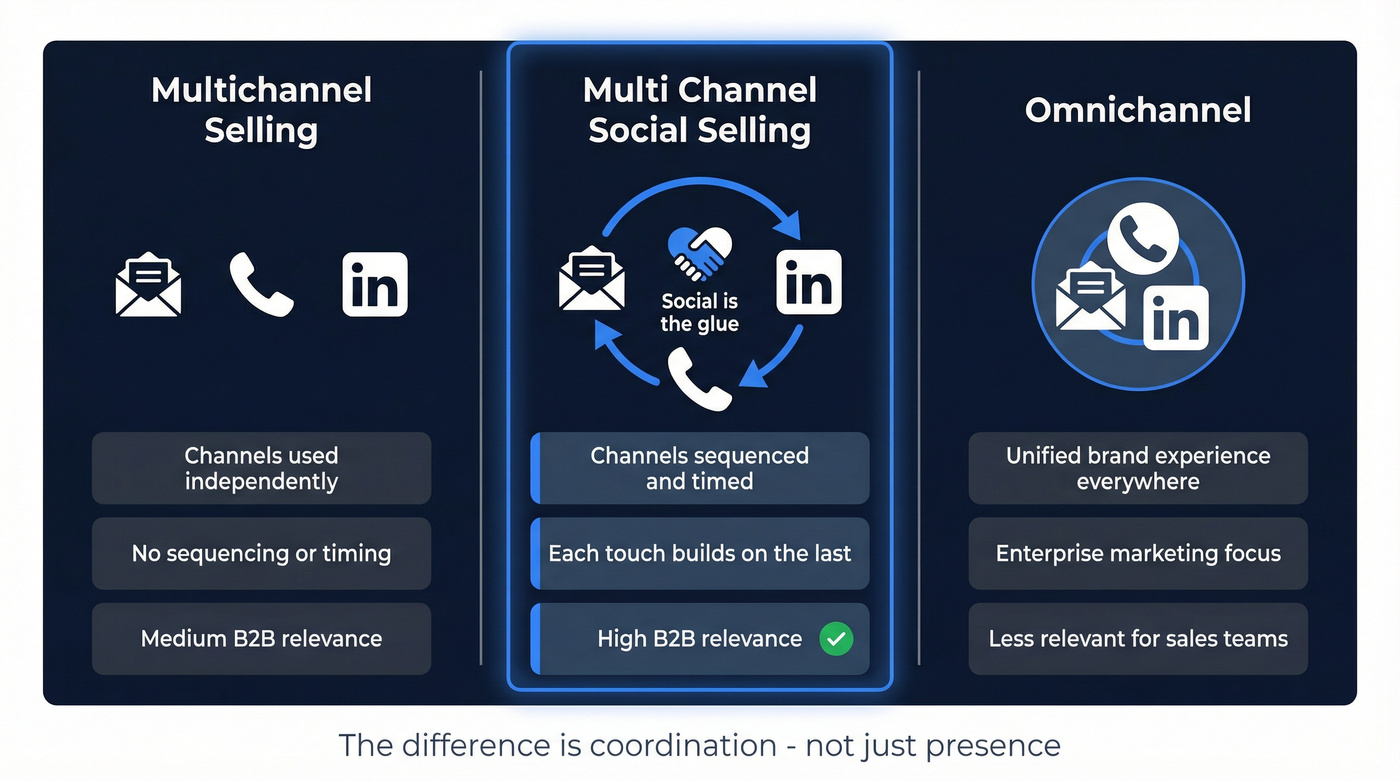

| Approach | Definition | B2B Relevance |

|---|---|---|

| Multichannel selling | Using multiple channels independently | Medium - no coordination |

| Multi channel social selling | Coordinated sequences with social as the glue | High - this article |

| Omnichannel | Unified experience across all channels | Enterprise marketing, less sales |

The critical difference: multichannel selling means you email AND call AND post on LinkedIn. Multichannel social selling means those activities are sequenced, timed, and designed so each one builds on the last. The profile view before the email. The comment on their post before the call. That's what creates the "mere exposure effect" - familiarity builds preference before you ever pitch.

The Numbers - Why Coordinated Social Outreach Works

Social Selling Leads Convert 7x More

IBM's data is unambiguous: social selling leads convert at 7x the rate of other lead types. Social media outreach generates a 42% response rate versus 26% for email and 23% for phone. Reps who master LinkedIn are 51% more likely to hit quota.

But here's what most people miss: the 42% response rate isn't because social is magic. It's because social interactions feel less transactional. A comment on someone's post doesn't trigger the same "this person wants something from me" reflex that a cold email does. When you layer social engagement into a sequence, every subsequent touchpoint benefits from that lower-resistance first impression. (If you want more benchmarks to defend the program internally, pull from these social selling statistics.)

Multichannel Compounds the Effect

Multi-channel campaigns achieve a 287% higher purchase rate than single-channel. Companies with strong omnichannel strategies retain 89% of customers versus 33% without. B2B buyers using 3+ channels spend roughly 30% more per transaction.

Social selling also reduces sales cycles by up to 20%. Deals close faster because prospects arrive more educated and with higher trust.

The RAIN Group puts the average at 8 touches to get an initial meeting. McKinsey's data is more aggressive: B2B buyers engage with an average of 27 touchpoints before purchase, and 8-12 of those are social.

If you're only running email sequences, you're covering maybe 4-5 of those 27 touchpoints. You're structurally incapable of reaching the buyer where they actually make decisions.

The ROI Is Measurable

HubSpot research shows companies with strategic social media programs achieve 40-60% lower customer acquisition cost than outbound-only approaches. Multichannel campaigns deliver 31% lower average cost-per-lead. And companies using hybrid selling see up to 50% higher revenue growth.

I've seen teams cut their CAC in half within two quarters of implementing a coordinated multichannel cadence. The hard part isn't the math - it's getting reps to actually follow the sequence instead of defaulting to "blast 200 emails and hope." (If your team’s struggling operationally, these sales pipeline challenges are usually the real bottleneck.)

Your 12-day multichannel sequence falls apart on Day 1 if emails bounce. Prospeo delivers 98% email accuracy and 125M+ verified mobile numbers - so every social touch, email, and cold call in your cadence actually reaches a real person.

Bad data kills multichannel sequences. Fix your data layer for $0.01 per email.

The 5 C's of Social Selling

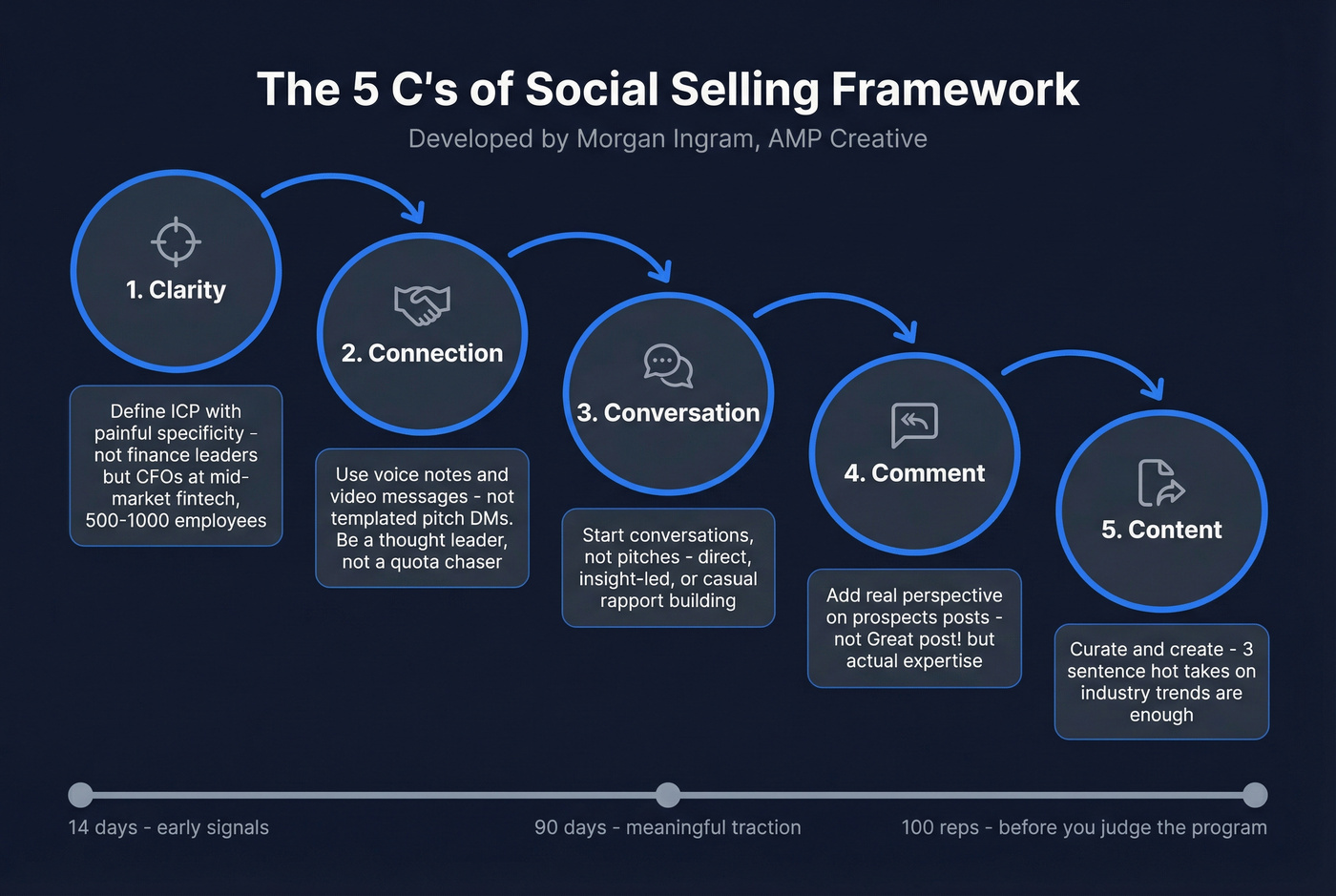

Morgan Ingram - founder of AMP Creative, who's built GTM programs for Salesforce, Slack, and Google - developed the best mental model I've found for structuring a social selling program.

Clarity

You can't sell to everyone. Define your ICP with painful specificity: "CFOs at mid-market fintech firms with 500-1,000 employees" is a target. "Finance leaders" is a wish. The tighter your targeting, the more relevant every social interaction becomes. (If you need a quick template, start with these buyer persona examples and then validate your ideal customer.)

Connection

Stop cold-pitching in connection requests. Use video messages, voice notes, or written messages that reference something specific about the prospect. Reddit's B2B sales communities consistently flag voice notes as the highest-converting connection format right now - they stand out in a sea of templated text DMs.

92% of B2B buyers engage with salespeople recognized as industry thought leaders. Your connection request is the first signal of whether you're a thought leader or a quota-chaser.

Conversation

Once connected, start conversations - not pitches. Three types:

- Direct: "We help fintech CFOs cut close times by 30%. Worth a 15-minute call?"

- Insight-led: "Saw you just raised Series C - congrats. Most CFOs at your stage are wrestling with [specific problem]."

- Casual: Build rapport through shared interests. Feels unnatural to most reps, but it's the highest-converting long-term play.

Comment

Engage on prospects' posts with substantive comments that demonstrate expertise. Not "Great post!" - actual perspective. Employee-authored posts earn roughly 9x higher engagement than curated brand content. Your reps' comments carry more weight than your company page ever will.

Content

Be a curator, not just a creator. Share podcast takeaways, react to industry news, offer opinions. A 3-sentence hot take on a relevant trend is enough.

Timeline expectations: 14 days for early signals, 90+ days for meaningful traction, and 100 reps of your sequence before you judge whether the program works. Aim for 20% adoption when rolling out to a team - don't try to convert every rep at once.

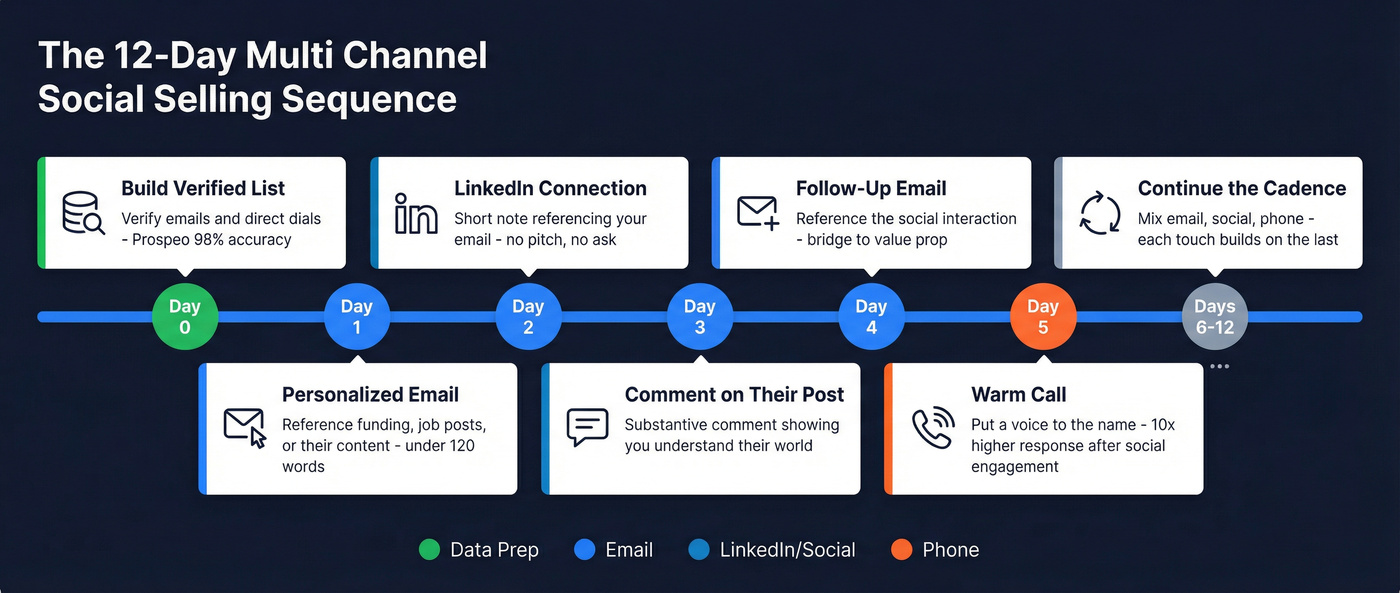

Your 12-Day Multi Channel Social Selling Sequence

This is the core deliverable. Steal it, adapt it, run it this week.

Step 0: Build Your Verified Prospect List

Your sequence dies on Day 1 if emails bounce and phone numbers are disconnected. When Snyk rolled out verified data across 50 AEs, their bounce rate dropped from 35-40% to under 5%, and AE-sourced pipeline jumped 180%. (If you’re building this as a repeatable workflow, use an email verification list SOP and monitor B2B contact data decay.)

Day 1: Personalized Email

Open with value, not a pitch. Reference a recent funding round, a job posting that signals a pain point, or content they published. Keep it under 120 words. The goal is a reply, not a meeting. (For structure, borrow from a proven B2B cold email sequence.)

Day 2: LinkedIn Connection Request

Send a connection request with a short note that references your email - but doesn't repeat it. "Hey [Name], sent you a note yesterday about [topic]. Would love to connect here too." No pitch. No ask. You're now in two channels, and the mere exposure effect is working.

Day 3: Comment on Their Post

Find a recent post and leave a substantive comment that adds to the conversation and demonstrates you understand their world. This is the social selling differentiator - you're showing up as a peer, not a seller.

Day 4: Follow-Up Email

Reference the social interaction. "Saw your post about [topic] - really resonated with what we're seeing at [your company]." Bridge to your value prop. This email converts at dramatically higher rates than a standard follow-up because you're not cold anymore.

Day 5: Warm Call

Call the direct dial. Open with: "Hey [Name], we've been trading messages on LinkedIn and email - wanted to put a voice to the name." Warm calls within 24-48 hours of social engagement see up to 10x higher response rates. Voicemails plus calls increase conversion by 33%. (If your team needs tighter phone fundamentals, use a modern B2B cold calling guide.)

Days 6-7: Rest

No outreach. Let the prospect breathe. Overcadencing kills deals.

Day 8: Retargeting Ad

Add the prospect to a retargeting audience on LinkedIn or Meta. A thought leadership ad - not a product ad - keeps you visible without requiring any action from them. Passive reinforcement.

Days 9-10: Social Engagement

Like or comment on another post. Share a relevant piece of content and tag them if appropriate. Keep it light.

Day 11: Final Email

Direct ask. "I've reached out a few times - if the timing isn't right, no worries. But if [specific pain point] is on your radar, I'd love 15 minutes." Give them an easy out. Paradoxically, this increases response rates.

Day 12: Phone + Voicemail

One last call. If no answer, leave a voicemail referencing the email. "Hey [Name], just left you an email about [topic]. If it's not a fit, totally understand."

This sequence hits the RAIN Group's 8-touch benchmark across 4 channels with natural escalation from low-commitment (email, profile view) to high (direct ask). Nothing feels random.

The 6 Channels That Matter (and When to Use Each)

Pick 3-4 channels max. A focused 3-channel sequence beats a scattered 7-channel presence every time.

| Platform | Funnel Stage | Best Format | When to Use |

|---|---|---|---|

| Full-funnel | Posts, DMs, voice notes | Always - top B2B platform | |

| Nurture + follow-up | Personalized sequences | Pair with social touches | |

| Phone | Mid-to-late funnel | Warm calls, voicemails | After social engagement |

| YouTube | Mid-funnel | Explainer videos, demos | Education-heavy cycles |

| X (Twitter) | Awareness | Threads, real-time takes | Tech/startup audiences |

| Meta | Top-of-funnel | Retargeting, lookalikes | Paid amplification only |

LinkedIn is non-negotiable. It's 277% more effective than Facebook or X for B2B lead generation, and 97% of B2B marketers include it in their content strategy. If you're only on one social platform, it's this one.

Email is the backbone of every multichannel sequence. It's where you make direct asks and share detailed value props that don't fit in a DM.

Phone is the closer. 50% of sales go to the first vendor to respond, and warm calls to previously engaged leads convert at dramatically higher rates. Don't skip this channel because "nobody answers the phone anymore." They do - when they recognize your name.

Reddit and Quora deserve a mention for mid-funnel vendor evaluation. Buyers actively researching problems hang out in subreddits and Quora threads. Answering questions there - genuinely, not as a pitch - builds credibility that compounds over months.

Real talk: most teams should ignore YouTube, Meta, and X entirely for social selling and focus exclusively on LinkedIn + email + phone. If your average deal size is under $50K, you almost certainly don't need more than three channels. Add a fourth only when you've mastered three.

Social Selling Tools - What to Use and What It Costs

Data & Verification

Sales Navigator is the engagement layer for LinkedIn prospecting. Core runs $120/mo, Advanced $180/mo. A Forrester study found 312% ROI over three years, with 42% larger deal sizes. Sales Navigator doesn't verify emails or provide mobile numbers on its own - you need a data tool alongside it. (If you’re pressure-testing accuracy claims, start with how to verify an email address.)

Cognism plays in the enterprise space with phone-verified mobiles and strong EMEA coverage. Typically $1,000-3,000/mo for small teams. Overkill for most SMBs, but worth it if your ICP is heavily European.

Engagement & Automation

LaGrowthMachine is the standout here. It orchestrates multichannel sequences across LinkedIn, email, and phone - including AI voice cloning for LinkedIn voice messages and social warming (auto-liking posts before outreach). Basic plan runs EUR60/mo, Pro EUR120/mo. 14-day free trial, no credit card.

Skip Klenty if you're not already on HubSpot or Salesforce. Its strength is native CRM integration, and without that, you're paying $50-100/user/mo for a sequencer that doesn't differentiate much. But if you are on those CRMs, it's the cleanest integration in this category.

Dripify vs. Expandi - the quick version:

| Dripify | Expandi | |

|---|---|---|

| Price | $39/user/mo | $99/mo |

| Best for | Simple LinkedIn automation | Advanced multi-account LinkedIn |

| Skip if | You need multi-channel | You want budget simplicity |

folk CRM is a lightweight CRM with AI icebreakers and suggested next actions. $20/user/mo. Good for small teams that don't need Salesforce.

Meet Alfred handles LinkedIn + email + Twitter automation in one dashboard. Starter at $29/mo - the budget option for teams that want multi-platform automation without LaGrowthMachine's price tag.

Warmly monitors social signals and triggers intent-based outreach. From $10,000/year - enterprise-focused and priced accordingly.

Content & Scheduling

Taplio captures warm leads from LinkedIn post engagement and schedules content. $39/mo. Someone who engaged with your content is 10x warmer than a cold prospect - Taplio makes sure you don't lose them.

MagicPost generates LinkedIn posts from briefs or URLs using AI. $39/mo. Won't replace a great writer, but it removes the blank-page problem.

Buffer handles cross-platform scheduling at $6/mo per channel. The budget pick.

Hootsuite is enterprise social management at EUR149/mo per user. You know if you need it.

Sprout Social combines social management with analytics at $199/seat/mo. The analytics are genuinely best-in-class.

Pricing Comparison

| Tool | Category | Starting Price | Best For |

|---|---|---|---|

| Prospeo | Data & Verification | Free (75 emails/mo) | Email/mobile accuracy |

| Sales Navigator | Engagement | $120/mo | LinkedIn prospecting |

| Cognism | Data & Verification | ~$1,000/mo | Enterprise, EMEA |

| LaGrowthMachine | Automation | EUR60/mo | Multichannel sequences |

| folk CRM | CRM | $20/user/mo | Small team CRM |

| Meet Alfred | Automation | $29/mo | Budget multi-platform |

| Dripify | Automation | $39/user/mo | LinkedIn automation |

| Expandi | Automation | $99/mo | Advanced LinkedIn |

| Klenty | Engagement | ~$50/user/mo | CRM-integrated sequences |

| Warmly | Signal monitoring | ~$833/mo | Intent-based outreach |

| Taplio | Content | $39/mo | LinkedIn lead capture |

| MagicPost | Content | $39/mo | AI post generation |

| Buffer | Scheduling | $6/channel/mo | Budget scheduling |

| Hootsuite | Social management | EUR149/user/mo | Enterprise social |

| Sprout Social | Social management | $199/seat/mo | Analytics + social |

Real Results - 3 B2B Case Studies

Manufacturing: $2.8M from LinkedIn in 18 Months

Situation: A $45M industrial equipment manufacturer had zero social selling presence. All leads came from trade shows and cold calls.

Approach: They built a multichannel program centered on LinkedIn thought leadership from their engineering team, paired with targeted email sequences and warm calling.

Results: 127 marketing-qualified leads from LinkedIn. 43 closed deals. $2.8M total contract value. 412% ROI. Deal sizes ran 23% higher than leads from other sources - because social-sourced prospects arrived more educated and with higher intent. Similar results have been documented at companies like NetApp and Universal Robots through ModumUp's social selling programs.

Professional Services: 89% CAC Reduction

Situation: A $12M consulting firm was spending $28,600 per customer acquisition through cold outreach and events.

Approach: They shifted to a social-first model where consultants published insights, engaged with target accounts on LinkedIn, and used multichannel sequences for warm follow-up.

Results: Social-sourced leads grew to 34% of new client acquisition. CAC dropped to $3,200 - an 89% reduction. Sales cycle shortened by 31%. Companies with aligned sales and marketing teams see 36% higher customer retention and 38% higher win rates, and this firm proved it.

SaaS: $4.1M Pipeline from a $47K Investment

A mid-market SaaS company invested $47K over 12 months in a structured social selling program. They trained reps on the 5 C's framework, implemented a 12-day multichannel sequence, and tracked social touchpoints in their CRM.

342 qualified opportunities. $4.1M pipeline. 78 closed deals. $1.2M in new ARR. The most telling stat: 67% of closed-won deals had at least one social media touchpoint in the buyer journey. Social wasn't the only channel - but it was the one that tipped deals from "maybe" to "yes."

5 Social Selling Mistakes That Kill Your Pipeline

1. Treating social like cold email. Blasting generic pitches via LinkedIn DMs is just cold email with a different UI. LinkedIn is cluttered with sellers, and templated personalization isn't fooling anyone anymore.

Fix: Lead with engagement (comments, shares, genuine interactions) before any outreach.

2. Pitching before building trust. Buyers overwhelmingly say the most influential factor is when salespeople listen to their needs. If your first DM is a pitch, you've already lost.

Fix: Follow the 5 C's. Connection and Conversation come before any ask.

3. Using a corporate tone. LinkedIn isn't a boardroom. Formal, stiff messaging gets ignored. Posts with employee perspectives earn 9x higher engagement than polished brand content.

Fix: Write like a human. Use contractions. Share opinions. Be a person, not a brand.

4. Being on the wrong platforms. Not every audience lives on LinkedIn. If you're selling to developers, they're on Reddit and GitHub. If you're selling to marketers, they're on X and LinkedIn.

Fix: Audit where your buyers actually spend time. Then pick 3 channels and go deep.

5. Giving up too early.

50% of sellers who use social media spend less than 10% of their time on it. That's not a strategy - it's a checkbox. Social selling compounds over months, not days.

Fix: Commit to 30-60 minutes per day for 90 days before judging results. Track leading indicators (profile views, connection acceptance rates, comment engagement) while you wait for pipeline to materialize.

AI Tools That Supercharge Your Multichannel Sequences

78% of companies now use AI in at least one function to enable omnichannel experiences. Here's where AI actually moves the needle:

Social signal monitoring: Warmly's AI tracks keywords, mentions, and engagement signals across social platforms, then auto-builds lead lists and triggers outreach sequences. This turns passive social activity into active pipeline.

AI content generation: MagicPost turns call notes, briefs, or URLs into LinkedIn posts. It removes the "blank page" problem that stops most reps from posting at all.

Voice cloning: LaGrowthMachine's AI voice messages let you send personalized LinkedIn voice notes at scale. Voice notes have dramatically higher open rates than text DMs - and AI cloning means you're not recording 50 messages a day.

AI icebreakers: folk CRM's Magic Fields suggest conversation starters based on real interactions and prospect data. Better than the generic "I noticed you..." templates most reps default to.

Warm lead capture: Taplio pulls likers and commenters from your LinkedIn posts into contact lists automatically. Someone who engaged with your content is already warm - Taplio makes sure you don't lose them.

The pattern is simple: AI does the monitoring, drafting, and scheduling. Your reps do the talking.

Buyers need 27 touchpoints before purchase, and you need verified contact data to cover all of them. Prospeo's 143M+ verified emails and 30+ search filters let you build hyper-targeted lists by intent, technographics, and job changes - the exact signals that make social selling sequences convert 7x better.

Layer intent data on top of your ICP filters and reach in-market buyers first.

FAQ

How long does it take to see results from multi channel social selling?

Early signals like profile views, connection acceptances, and reply rate improvements appear within 14 days. Meaningful pipeline impact takes 90+ days of consistent execution. Social selling compounds - don't kill the program in week three before the flywheel spins up.

What's the ideal number of channels for a B2B social selling sequence?

Three to four coordinated channels outperform both single-channel and scattered five-plus-channel approaches. The 12-day sequence above uses email, LinkedIn, phone, and retargeting. Master three before adding a fourth.

What's a good free tool to start building a multichannel prospecting stack?

Prospeo's free tier (75 verified emails/month) paired with a free LinkedIn account covers your data and engagement layers at zero cost. Add a free Buffer plan for content scheduling, and you've got a functional three-channel stack without spending a dollar.

How do I get my sales team to actually adopt social selling?

Start with a 20% adoption target - roughly one in five reps. Give them a specific day-by-day sequence, not a vague "be more active on LinkedIn" mandate. Track leading indicators like connection acceptance rates and celebrate early wins publicly. The reps who see results pull the rest along.

What's the most important tool for running multichannel social sequences?

Verified contact data. Your entire sequence breaks on Day 1 if emails bounce or phone numbers are disconnected. The best cadence in the world is worthless when it's built on bad data - aim for 98%+ email accuracy and verified direct dials.