Surfe pricing (2026): Plans, Credits, Top-Ups, and What You'll Really Pay

Surfe pricing looks simple right up until you hit a credit wall mid-quarter and someone panic-buys top-ups that expire before you can use them.

The seat price is the easy part. The real cost is credit consumption plus top-up timing.

We've rolled out credit-based enrichment tools across SDR teams and RevOps workflows, and the pattern's always the same: if you don't put basic guardrails in place, automation and duplicate enrichment quietly turn "nice per-seat pricing" into a recurring surprise line item.

Surfe pricing at a glance (2026)

Surfe's current self-serve editions commonly shown on review sites are:

- Free: $0/seat/month

- Essential: $39/seat/month

- Pro: $79/seat/month

- Annual billing: 25% discount vs monthly

One quick cleanup: some listings still show "last updated Oct 30, 2025." For 2026 budgeting, trust what you see in Surfe's checkout and pricing page over any review-site snapshot.

Surfe isn't "a giant database subscription." It's an in-workflow prospecting/enrichment layer (extension + CRM actions) with waterfall enrichment and credits as the meter.

| Plan | Monthly | Annual (25% off) | Best for |

|---|---|---|---|

| Free | $0 | n/a | Testing the workflow |

| Essential | $39/seat | $29.25/seat (effective) | Most outbound teams |

| Pro | $79/seat | $59.25/seat (effective) | Ops-heavy scale + API/CSV |

Surfe plans compared: Free vs Essential vs Pro

Below is a comparison using only limits that are clearly stated in common public snapshots (Surfe pricing pages and review listings). If a limit isn't clearly published, I'm not guessing.

| Feature / limit | Free | Essential | Pro |

|---|---|---|---|

| CRM adds | 3/day | Not clearly specified publicly | Not clearly specified publicly |

| Email finder credits | 20/month | 1,800 email finder credits | 12,000 email finder credits |

| Mobile credits | Not clearly specified publicly | 600 mobile credits | 1,200 mobile credits |

| Email validation | 80/month | Unlimited ZeroBounce email validation | Unlimited ZeroBounce email validation |

| Search results | Not clearly specified publicly | 100/week | Not clearly specified publicly |

| Templates | 1 | Not clearly specified publicly | Not clearly specified publicly |

| CSV download | Not clearly specified publicly | No | Yes |

| API access | No | No | Yes |

Free plan (who it's for) Use Free to confirm Surfe fits your reps' day-to-day: quick enrichment, fast CRM pushes, fewer tab-switches. The caps are tight by design (notably 3 CRM adds/day, 20/month find credits, 80/month validations, and 1 template).

Essential plan (who it's for) Essential is the default choice for SMB outbound. You get 1,800 email finder credits + 600 mobile credits per seat and Unlimited ZeroBounce email validation, plus the published 100 results/week.

Pro plan (who it's for) Pro is for teams that need CSV export and API access. The moment you're doing anything ops-like (bulk enrichment, routing, scoring, list hygiene), Pro stops being optional.

Here's the thing: credit limits are the #1 complaint theme you'll see in reviews for tools like this, and it's not because the tool's "bad." It's because teams treat credits like an abstract number until the day they run out.

Annual vs monthly billing: when the 25% discount is actually worth it

Surfe's annual discount is simple: 25% off when you pay yearly.

Effective monthly pricing:

- Essential: $39 x 0.75 = $29.25/seat/month

- Pro: $79 x 0.75 = $59.25/seat/month

My take: annual is worth it only when your usage is stable and you know your enrichment run-rate. If your outbound motion is bursty, the "savings" disappear the first time you buy a top-up pack you don't fully burn before expiry.

Real talk: if your team can't forecast enrichment volume within about +/-20%, don't lock annual yet. Fix the workflow first, then optimize the bill.

Surfe's 3-month credit expiry turns unused top-ups into wasted budget. Prospeo's credit-based pricing has no expiry traps - you pay ~$0.01 per verified email with 98% accuracy, and credits don't vanish if your campaign pauses.

Stop racing the clock. Pay per result, not per deadline.

Surfe pricing and credits: how metering works (and what gets charged)

The true cost is driven by two things:

- How many successful lookups you run

- How often you buy top-ups

The two credit types

- Email credits: used to retrieve email addresses (and landline/HQ numbers).

- Mobile credits: used to retrieve mobile phone numbers.

The rules that actually matter

Surfe's credit mechanics are refreshingly straightforward:

- No match = no charge. If Surfe can't find contact info, it doesn't deduct a credit.

- Mobile search includes email. When you run a mobile search, you get email in the same motion.

- Waterfall enrichment charges once. Surfe can query multiple providers behind the scenes, but it charges one credit per successful result, not per attempt.

That last point is why your "attempt volume" can be huge without being expensive, but your "success volume" can still spike costs fast if you suddenly broaden targeting (or enrich the same people repeatedly).

API throughput (why Pro changes the math)

Surfe positions its API for bulk enrichment - up to 500,000 enrichments/hour with sub-500ms response times. That's great, and it's also how teams accidentally burn a month's worth of credits in an afternoon if someone runs a job against a messy CSV with duplicates, old leads, and no throttling.

Assume API enrichment consumes the same email/mobile credits as manual enrichment unless Surfe shows a different meter in your billing screen.

What consumes what (forecasting cheat sheet)

- Finding a verified email -> 1 email credit (only when successful)

- Finding a mobile number -> 1 mobile credit (only when successful; includes email)

- Validating emails (ZeroBounce) -> Unlimited on paid plans (Free has a monthly cap)

- "No data found" outcomes -> 0 credits

Top-ups, overages, and the 3-month expiry trap

Surfe sells extra credits once you exhaust what's included.

Top-up pack sizes:

- 100-500,000 email credits

- 500-50,000 mobile credits

Operationally, here's what matters:

- Top-ups are purchased at the account level

- They're shared across the team

- They expire 3 months after purchase

That 3-month expiry is the whole game. It turns "buying safety" into wasted spend if your pipeline shifts, a campaign gets paused, or you simply overestimated how mobile-heavy you'd be.

I've watched a team buy a big mobile pack for a "two-month blitz," then switch ICP halfway through because deliverability dipped and replies were weak. They ended up racing the expiry clock, enriching people they didn't even plan to contact, just to avoid wasting credits. That's not a strategy. That's a billing artifact driving behavior.

If you hate expiring top-ups, tools with predictable self-serve unit economics (Prospeo's one example) are easier to budget because you can treat enrichment like a clean cost-per-result line item instead of a "use it or lose it" scramble.

What it costs in real workflows (3 scenarios)

Seat price is fixed. Your variable cost is top-ups when your run-rate exceeds included credits - or when automation quietly multiplies usage.

Quick top-up cost ranges (so you can model dollars)

Surfe doesn't publish a universal $/credit table publicly, so you need a budgeting estimate. Market ranges are good enough to sanity-check the risk:

- Email top-ups: $0.01-$0.03 per verified email (typical market range)

- Mobile top-ups: $0.05-$0.20 per mobile (typical market range)

What that means in practice:

- A 10,000-email spike adds ~$100-$300

- A 1,000-mobile spike adds ~$50-$200

Those numbers won't match your invoice perfectly, but they'll keep you from pretending top-ups are "basically free."

Scenario 1: Solo SDR (steady outbound)

Assume 1 SDR enriches ~800 contacts/month:

- Emails needed: 800

- Mobiles needed: 150 (top accounts only)

Best fit: Essential (1 seat)

| Item | Monthly need | Essential includes |

|---|---|---|

| Email credits | 800 | 1,800 |

| Mobile credits | 150 | 600 |

What you'll pay: $39/month (or $29.25/month annualized). You won't touch top-ups unless you go mobile-heavy or start enriching every inbound lead automatically.

One sentence of advice: don't enrich junk.

Scenario 2: 5-person SDR team (campaign bursts)

Assume each SDR enriches ~900 contacts/month:

- Emails: 4,500/month

- Mobiles: 800/month (team is mobile-forward)

Per-seat, Essential covers this comfortably. The overspend usually happens when you run blitz months, reps enrich the same accounts in parallel, or someone turns on "enrich everything" without dedupe.

Budget a burst month as:

- +5,000 emails -> ~$50-$150

- +500 mobiles -> ~$25-$100

If you want one operational fix that pays for itself: assign account ownership before you assign credits.

Scenario 3: 20-person team (RevOps + automation)

Assume:

- 20 reps enriching 1,000 contacts/month each = 20,000 emails/month

- Mobiles for 25% of contacts = 5,000 mobiles/month

- Plus RevOps runs bulk enrichment via API

On paper, Essential's included credits look generous at this seat count. In reality, automation is the multiplier: routing, scoring, inbound enrichment, and re-enrichment can double consumption without anyone noticing, especially if your CRM has duplicates or your "re-enrich after X days" rule is too aggressive.

What you'll pay is seat cost plus a recurring top-up line item unless you enforce governance: dedupe rules, enrich only ICP, don't re-enrich the same lead repeatedly, and throttle API jobs so a bad input file doesn't turn into a five-figure mistake.

And yes, it's frustrating that billing often becomes the forcing function for data hygiene. But that's how it goes.

Why pricing looks different on G2 vs TrustRadius (and what to trust)

You'll see conflicting numbers online.

- G2 commonly shows $0 / $39 / $79 per seat per month and the 25% annual discount.

- TrustRadius often shows annual per-seat tier numbers like $23 / $29 / $59 and notes monthly subscriptions are available.

The rule that keeps you out of trouble: trust Surfe checkout and surfe.com/pricing first. Treat review-site pricing as outdated unless it matches what you see today.

Before you buy: renewal, cancellation, and data-retention checklist

Unless Surfe's checkout or terms say otherwise, treat the following as default SaaS behavior and confirm it before you roll out company-wide.

Confirm-before-you-pay checklist

- Auto-renew: assume it's on; turn it off if you don't want it.

- Cancellation timing: cancellation usually ends access at end of term, not immediately.

- Proration: expect no proration on monthly; annual proration is uncommon.

- Data retention: confirm what happens to mappings, templates, enrichment history, API keys, and exports after cancellation.

- Credit balance: confirm what happens to unused included credits and unused top-ups on cancellation.

- Top-up expiry: calendar the 3-month expiry the day you buy a pack.

- Included credits pooling: confirm whether included plan credits pool across seats in your workspace billing (don't guess; check the billing screen).

Procurement note (security + compliance)

If Surfe becomes mission-critical, ask for the basics: GDPR/DPA paperwork, security documentation, and a clear explanation of data sourcing (especially for mobile numbers).

Support quality matters more than people think. If this tool sits in the middle of your outbound engine, get support expectations in writing.

What I'd do (simple decision framework)

- Pick Free if you're still validating workflow fit and enrichment quality.

- Pick Essential if reps are doing normal day-to-day prospecting and you don't need exports or API.

- Pick Pro the moment RevOps touches it: CSV exports, API enrichment, automation, or any "data supply chain" workflow.

- Skip annual unless your usage is steady and you're disciplined about top-ups. The 25% discount is real, but expiring top-ups erase it fast.

- Buy top-ups late, not early. Expiry makes "just in case" packs the most expensive credits you'll ever purchase.

If Surfe's pricing model doesn't fit: a more predictable self-serve option (plus benchmarks)

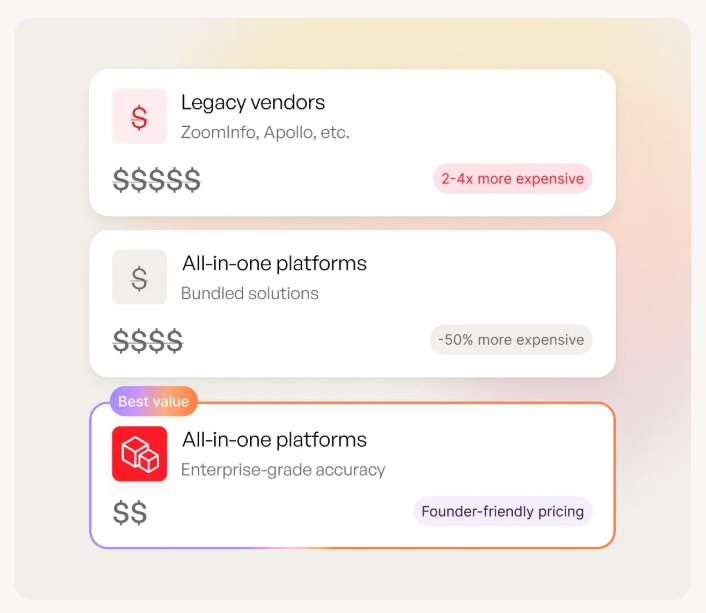

For quick benchmarks (typical market ranges, varies by tier and packaging):

- Apollo.io: ~$49-$99/user/month (higher tiers when bundling engagement features)

- Lusha: ~$39-$99/user/month plus contact credits

- Kaspr: ~$30-$80/user/month with region-dependent credit packaging

If you're doing a real comparison, start with lead enrichment tools and then sanity-check email lookup tools vs dedicated email verifier websites (because verification is usually where the hidden cost shows up).

Before you lock into annual seats and top-up packs, compare the unit economics. Prospeo delivers 143M+ verified emails at 98% accuracy with a 7-day refresh cycle - no seat fees, no expiring credits, no surprise line items.

Get enterprise-grade enrichment data without the enterprise billing complexity.

FAQ

Does Surfe have a free plan and what are the limits?

Surfe has a $0 Free plan with tight caps, including 3 CRM adds/day, 20/month find credits, 80/month email validations, 30 Sales Navigator export credits, and 1 message template. You'll hit limits quickly if you're prospecting daily, but it's enough to validate workflow fit before paying.

What's the difference between email credits and mobile credits in Surfe?

Email credits are deducted when Surfe successfully finds an email address (and landline/HQ numbers), while mobile credits are deducted when it finds a mobile number. Mobile searches include email, and unsuccessful searches cost 0 credits.

Do Surfe top-up credits expire?

Yes. Surfe top-up packs expire 3 months after purchase, are bought at the account level, and are shared across the team. If your outbound volume is spiky, buy packs late and track burn weekly so you don't donate money to the expiry clock.

Is Surfe cheaper on annual billing?

Annual billing is 25% cheaper than monthly, making Essential $29.25/seat/month and Pro $59.25/seat/month on an effective monthly basis. It's worth it when your enrichment volume is predictable and you aren't constantly buying expiring top-ups.

What's a good free alternative if I'm trying to avoid expiring top-ups?

If you want a predictable free tier, Prospeo includes 75 emails + 100 Chrome extension credits/month and charges only for successful finds, with 98% verified email accuracy and a 7-day refresh cycle. If you're comparing options, sanity-check Apollo and Lusha too, but watch for credit-heavy packaging and add-ons.

Summary: how to think about Surfe pricing in 2026

Surfe pricing is straightforward on seats (Free, Essential, Pro). The budget risk is credit burn plus top-ups that expire after 3 months.

If your usage is stable, annual billing can be a clean 25% win. If your volume spikes, model top-ups explicitly and put guardrails on automation so "cheap per seat" doesn't turn into surprise spend.