ActiveCampaign vs RD Station (2026): Which Marketing Automation Tool Fits You?

Pick the wrong platform and you won't just waste budget - you'll burn a quarter rebuilding automations, re-tagging contacts, and redoing reporting the moment you cross 5k, 25k, or 50k contacts.

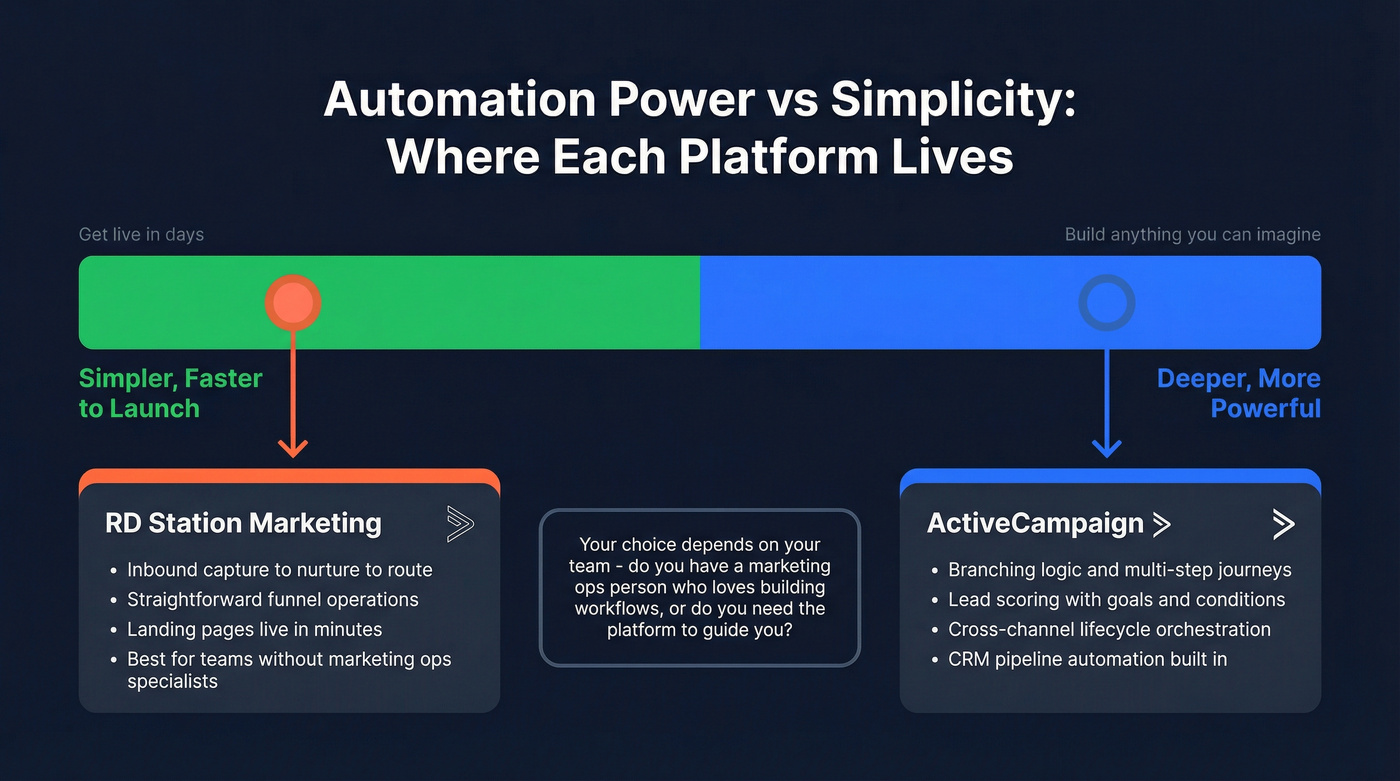

Here's the thing: ActiveCampaign wins on automation power. RD Station wins on LATAM-first inbound execution and "get it live" simplicity. Everything else is pricing mechanics and operational reality.

I've watched teams "save money" on the cheaper-looking plan, then spend weeks cleaning up contact messes and broken handoffs. That's the expensive part nobody puts on the pricing page.

30-second verdict (and "Skip both if...")

Use ActiveCampaign if...

- You want a real automation engine (branching logic, multi-step journeys, lifecycle orchestration) and you're fine paying more as complexity grows.

- You'll use scoring, segmentation, and cross-channel workflows - not just newsletters plus a drip.

- You can manage contact-based pricing like an adult: clean lists, suppression rules, and tight imports.

Use RD Station Marketing if...

- You're LATAM-first and want the smoothest path to landing pages + lead capture + nurturing + reporting without a marketing ops specialist.

- You value local ecosystem support and a guided implementation motion more than building intricate journeys.

- You're comfortable with Pro being the "real" tier for many teams - and the annual contract + implementation fee that comes with it.

Skip both if...

- Your real problem's bad data. Contact-based billing plus dirty lists is a tax: you pay for dead records and you hurt deliverability. Fix the data layer first, then pick the automation tool. (If you want a framework, start with data quality.)

One sentence that saves a lot of pain: if you can't explain how contacts are counted and how automations are capped, you aren't done evaluating.

Micro-scenarios:

- Agency running multiple client funnels: ActiveCampaign for flexibility; RD Station for LATAM SMB clients who want speed and simplicity. (If you're building this motion, see white label outreach platform.)

- B2B outbound + nurture: ActiveCampaign paired with a dedicated data layer wins. (Related: multi-channel sales automation.)

- Inbound-heavy LATAM SMB: RD Station's the path of least resistance. (Related: website lead generation.)

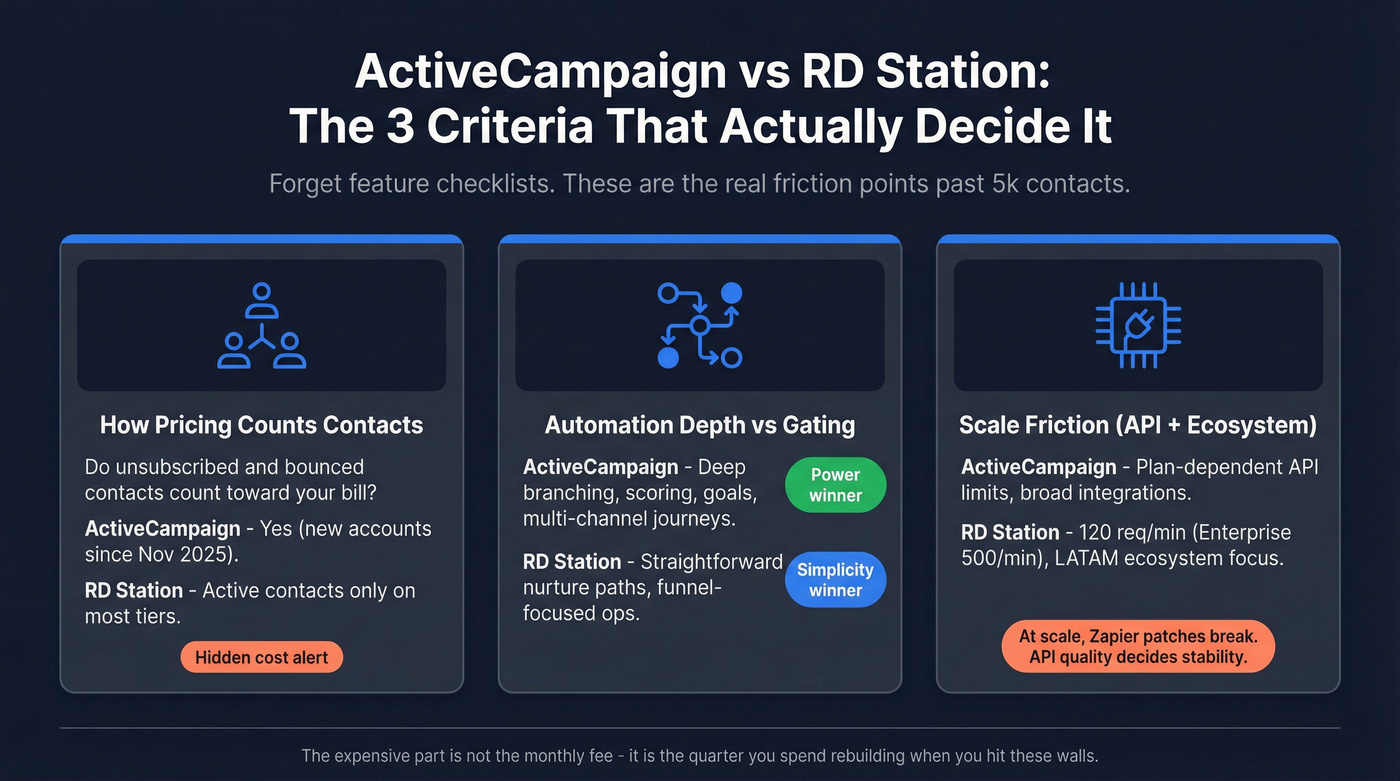

What actually decides this matchup (not the feature checklist)

Most comparisons obsess over "does it have landing pages?" and "does it have lead scoring?" That's table stakes.

The real deciders are limits, contracts, API caps, and action caps - especially past 5k / 25k / 50k contacts. That's when pricing gotchas stop being theoretical and start showing up on your invoice, and it's also when "we'll just connect it with Zapier" turns into a brittle mess of retries, duplicates, and silent failures.

Three criteria that actually matter:

- How pricing counts contacts. If unsubscribed/bounced/unconfirmed contacts count, your bill grows even when your business doesn't. (This is why B2B contact data decay matters more than people think.)

- Automation depth vs gating. "Automation" can mean a simple nurture path... or a branching journey with scoring, goals, and channel handoffs. The gap's massive.

- Scale friction (API + ecosystem). At small scale, Zapier patches everything. At real scale, API limits and integration quality decide whether your stack's stable or constantly breaking. (If you're stitching systems, read CRM integration for sales automation.)

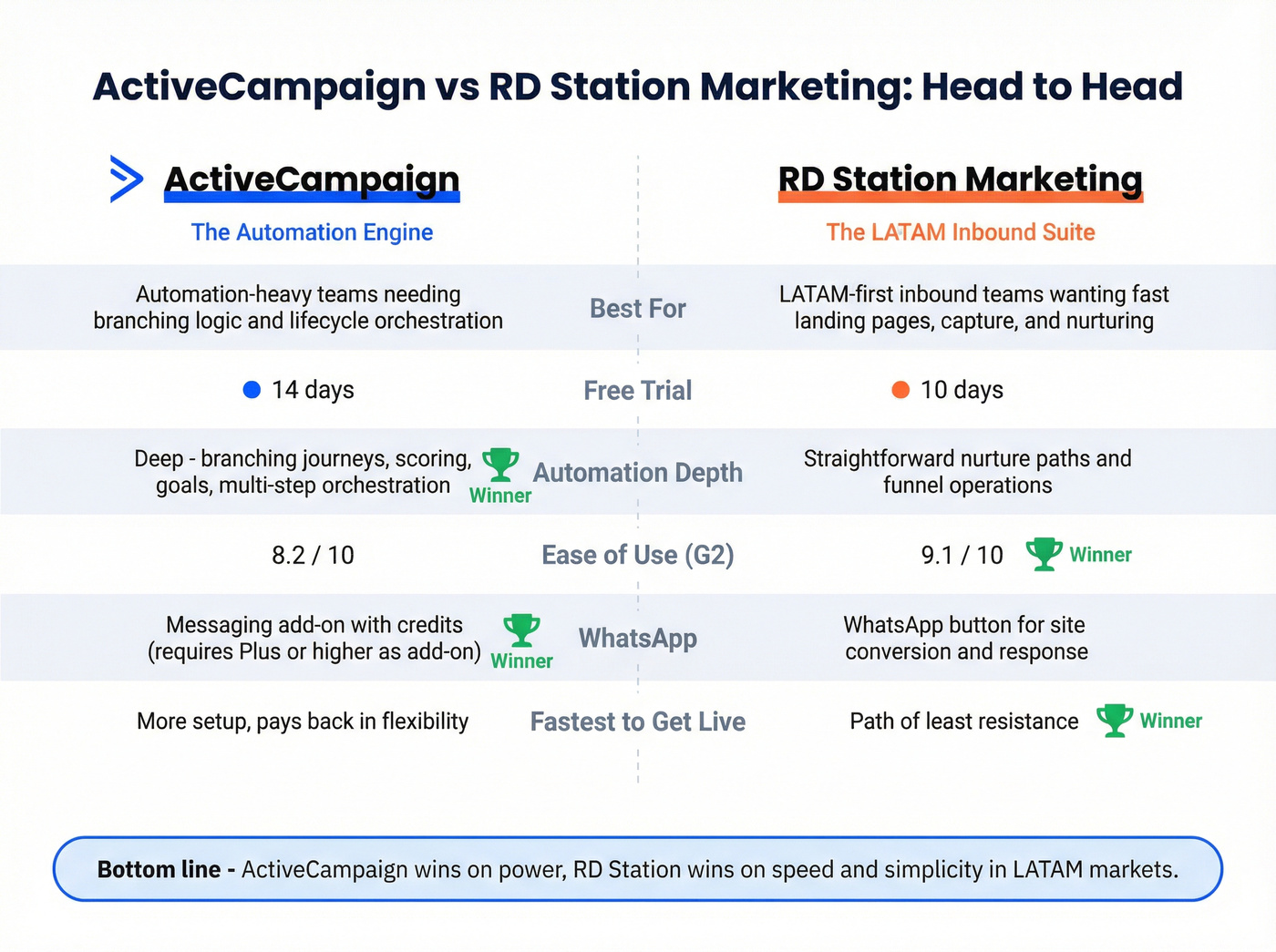

ActiveCampaign vs RD Station: side-by-side comparison (features, limits, trials, best for)

RD Station is the simpler, LATAM-optimized inbound suite. ActiveCampaign is the stronger automation engine with more knobs - and more ways to get pushed up-tier.

| Category | ActiveCampaign | RD Station Marketing |

|---|---|---|

| Best for | Automation-heavy teams | LATAM-first inbound teams |

| Free trial | 14 days | 10 days |

| Automation depth | Deep journeys + orchestration | Straightforward nurture + funnel ops |

| Early-tier constraints | Starter: 1 seat; 5 actions per automation | Tiers are feature-bundled; Pro is where most teams "arrive" |

| WhatsApp approach | WhatsApp messaging add-on (credits) | WhatsApp button (site conversion + response) |

| API limits | Plan-dependent | 120/min (Enterprise 500/min) |

Important WhatsApp note: ActiveCampaign's WhatsApp Messaging can be purchased standalone or as an add-on; as an add-on it requires Plus/Professional/Enterprise.

Winners (so you don't have to guess):

- Automation winner: ActiveCampaign

- LATAM inbound suite winner: RD Station

- WhatsApp campaigns winner: ActiveCampaign (if you can manage credits)

- "Fastest to get live" winner: RD Station

You just read that contact-based pricing turns dirty lists into a hidden tax. The fix isn't picking the cheaper automation tool - it's fixing your data layer first. Prospeo's 5-step verification delivers 98% email accuracy, refreshed every 7 days, so every contact you import actually counts.

Stop paying automation fees on dead records. Start with verified data.

Ratings snapshot (G2, Capterra) + the sub-scores that actually matter

Raw star ratings are fine. The useful part is who reviews the product and which sub-scores move with real-world friction.

| Site | ActiveCampaign | RD Station Marketing |

|---|---|---|

| G2 | 4.5/5 (14,579) | 4.7/5 (367) |

| Capterra | 4.6/5 (2,555) | 4.3/5 (53) |

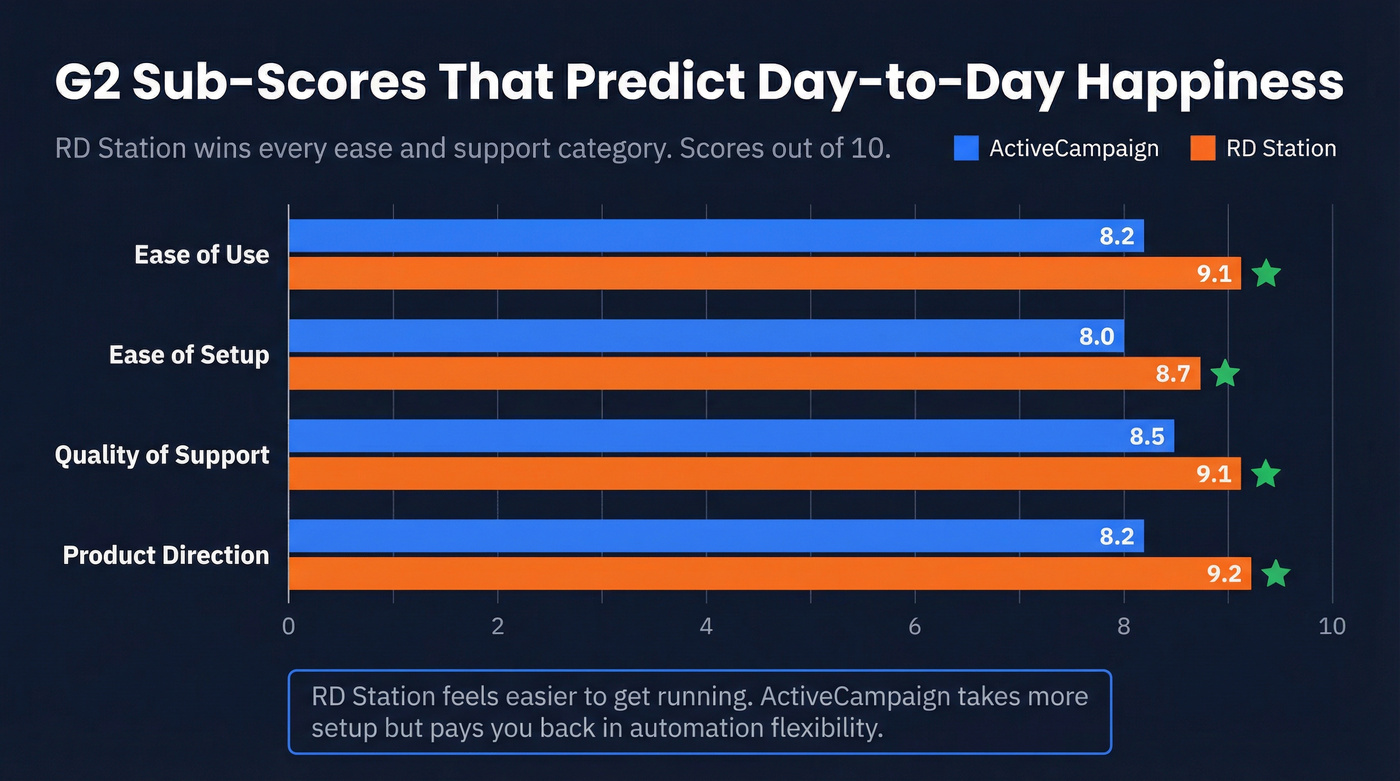

G2 sub-scores that predict day-to-day happiness

RD Station wins the "it's easier" categories. ActiveCampaign wins when teams care about power and breadth.

| G2 sub-score | ActiveCampaign | RD Station Marketing | Winner |

|---|---|---|---|

| Ease of Use | 8.2 | 9.1 | RD Station |

| Ease of Setup | 8.0 | 8.7 | RD Station |

| Quality of Support | 8.5 | 9.1 | RD Station |

| Product Direction | 8.2 | 9.2 | RD Station |

Review mix (this matters more than people admit)

- ActiveCampaign's reviews skew heavily small business (92%), which matches its sweet spot: SMB teams that want serious automation without enterprise suites.

- RD Station's mix is less skewed (61.9% small business), reflecting broader adoption across SMB and mid-market in its core regions.

In our experience, the reviews map to a simple truth: RD Station feels easier to get running; ActiveCampaign takes more setup but pays you back in automation flexibility.

If you want one place to sanity-check the head-to-head, G2's comparison page is solid: https://www.g2.com/compare/activecampaign-vs-rd-station-marketing

Market footprint (technographics estimate)

6sense technographics estimates in the Marketing Automation Platforms category put ActiveCampaign at 58,676 customers and RD Station at 11,699 customers.

Pricing & total cost of ownership in 2026 (where the decision gets made)

This is where the decision gets made.

- RD Station is transparent - but Pro is contract-bound and includes a mandatory implementation fee.

- ActiveCampaign looks cheap at the floor - but contact bands and "what counts as a contact" can spike TCO fast.

Table: pricing at common contact bands (what you'll actually budget around)

Country/currency caveat (don't ignore this): RD Station's USD pricing is published for specific countries (listed as Argentina, Chile, Ecuador, and Peru). Brazil pricing/contracting can differ. Budget with that in mind.

| Contact band | ActiveCampaign (typical) | RD Station Marketing | Contract / fees reality | Winner (cost predictability) |

|---|---|---|---|---|

| 1,000 | Starter $19/mo; Plus $59/mo | Light $18 -> $16/mo (first 3 months); Basic $112 -> $72/mo (first 3 months) | RD Light/Basic: no lock-in | RD Station |

| 2,500 | Starter $49/mo; Plus $119/mo | You'll feel pressure to move beyond Light/Basic if you need deeper ops | RD: Pro is where many teams land | ActiveCampaign (if you stay on Starter/Plus) |

| 5,000 | Starter $99/mo; Plus $179/mo | Pro $269/mo (<=5,000 active contacts) | Pro requires annual contract + mandatory implementation fee (R$ 2,699 one-time) | ActiveCampaign |

| 10,000 | Starter $189/mo; Plus $239/mo | Enterprise (custom; sales-led) | Enterprise pricing varies by region and scope | ActiveCampaign |

Look, the "cheapest monthly price" is a trap metric. What you want is predictable spend as your list grows and as your team starts asking for the second, third, and fourth automation that touches the same lead.

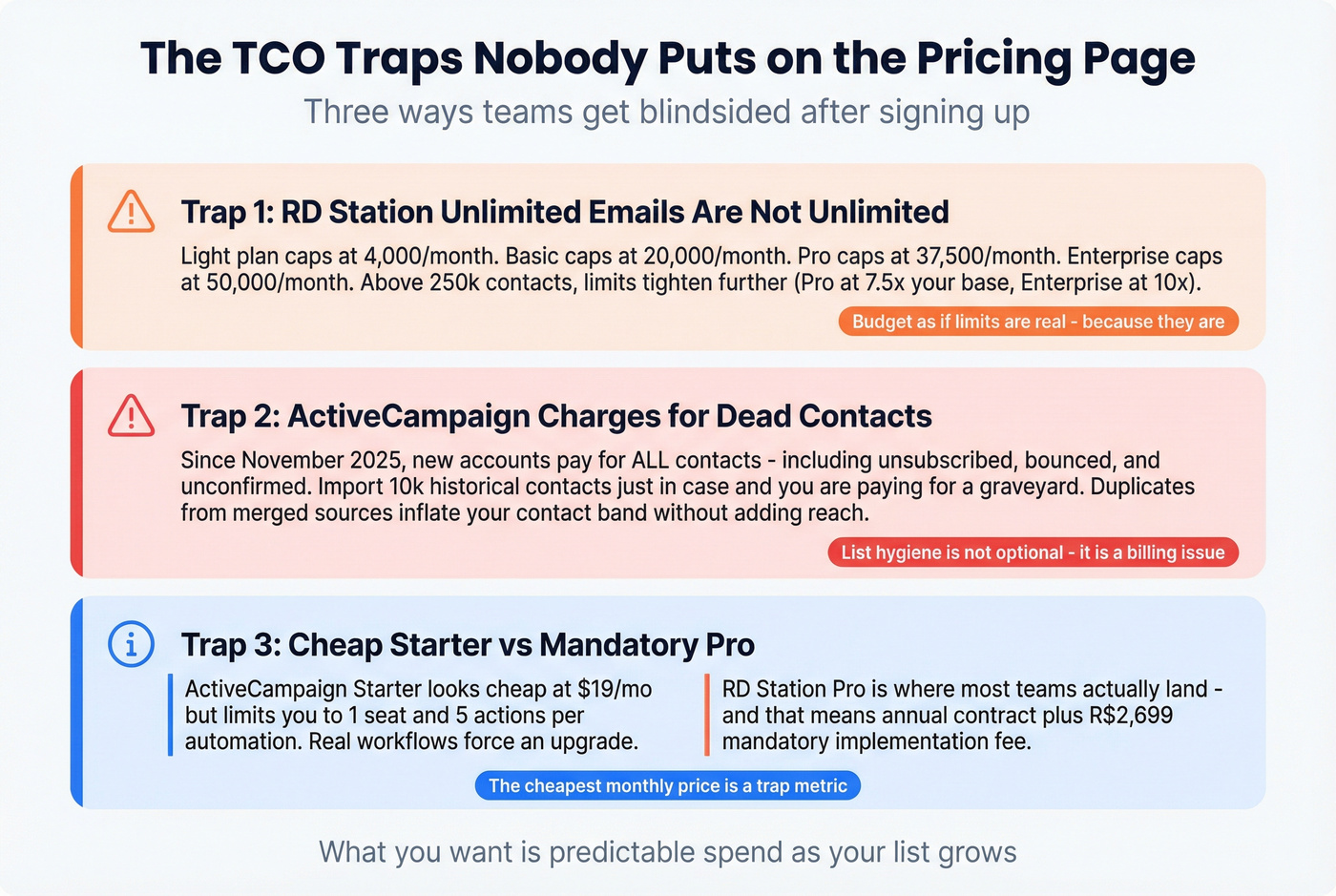

The two TCO traps that hit teams in real life

1) RD Station "unlimited" emails: treat it as a policy, not a slogan

RD Station presents "unlimited sends" in multiple ways on the same pricing surface. Here's the practical interpretation that keeps you safe:

- There are plan-based monthly send caps shown in the plan comparison table (Light "Unlimited up to 4,000/month"; Basic "Unlimited up to 20,000/month"; Pro "Unlimited up to 37,500/month"; Enterprise "Unlimited up to 50,000/month").

- There's also a separate rule set tied to database size (bases up to 250k contacts are treated as "unlimited," and above that, limits apply - often expressed as a multiple of your contact base, such as Pro at 7.5x and Enterprise at 10x).

Operationally: budget as if limits are real, because they are. If your strategy includes high-frequency newsletters plus segmented nurtures, you can hit caps faster than you'd expect, and the worst time to learn that is mid-launch when sales is waiting on leads.

2) ActiveCampaign contact billing: list hygiene isn't optional

EmailTooltester documents a policy change in November 2025: new ActiveCampaign users get charged for all contacts, including unsubscribed, bounced, and unconfirmed. That's not a minor footnote - it's the difference between a clean 10k list and a bloated 25k bill. (If you need a process, use an email verification list SOP.)

Where teams get blindsided:

- They import historical contacts "just in case," and pay for a graveyard. (See: how to import leads.)

- They keep unsubscribed contacts for compliance/history (normal), and those records still count.

- They merge multiple sources and create duplicates, inflating contact bands without adding reach.

3) The "Starter is cheap" illusion (ActiveCampaign) vs the "Pro is mandatory" reality (RD Station)

This is the part that annoys me, because it wastes people's time.

- ActiveCampaign Starter is priced to get you in the door, but the constraints (like 1 seat and 5 actions per automation) push upgrades when collaboration and real workflows show up.

- RD Station lets you start lighter, but many serious teams end up on Pro because that's where the platform feels fully operational - and Pro means annual contract + R$ 2,699 implementation fee.

Automation and WhatsApp in 2026: what you can actually build

Automation winner: ActiveCampaign. If your growth plan depends on lifecycle orchestration, branching journeys, and multi-step logic, ActiveCampaign's the safer bet.

Simplicity winner: RD Station. If your plan is inbound capture -> qualify -> nurture -> route, RD Station stays calmer and gets teams to "working" faster.

What ActiveCampaign's AI actually means in practice

ActiveCampaign includes Active Intelligence and AI agents. In real terms, that means AI help across the workflow: drafting campaign content, speeding up segmentation and personalization, and helping teams iterate on automations and reporting without starting from a blank canvas every time. (Related: AI lead scoring vs traditional lead scoring.)

It doesn't replace strategy. It does cut the busywork.

Workflow build examples (where each tool shines - and where it breaks)

Workflow A: inbound lead -> qualification -> sales handoff (simple, high-volume)

Goal: Convert form fills into qualified meetings without over-engineering.

RD Station build (fastest path):

- Form/landing page capture

- Lead scoring + qualification rules

- Nurture emails based on interest

- Route to sales / CRM with clear funnel reporting

RD Station wins here because the platform's built for this exact motion: inbound ops, reporting, and a clean funnel.

ActiveCampaign build (more flexible):

- Capture + tag

- If/else logic by page visits, form fields, and engagement

- Score updates + lifecycle stage changes

- Sales task creation + multi-branch follow-up

ActiveCampaign wins if you want more branches, more conditions, and tighter lifecycle control.

Workflow B: lifecycle orchestration (the one that exposes gating)

Goal: Trial user -> activation nudges -> expansion -> churn prevention.

ActiveCampaign (where it's strong):

- Branching journeys by product events, engagement, and stage

- Multiple paths that re-join, goal steps, and scoring-driven routing

- Cross-channel orchestration when you add messaging

Starter gating reality: with 5 actions per automation, you can burn the entire allowance on: trigger -> wait -> email -> tag -> field update. That's not "no branching," but it is a practical constraint that forces an upgrade once you build real lifecycle logic.

RD Station (where it's weaker):

- You can run solid nurtures and funnel flows

- You'll feel boxed in when you try to model complex lifecycle states and re-entry logic across many segments

WhatsApp reality check: button vs messaging automation

WhatsApp campaigns winner: ActiveCampaign (if you can manage credits). WhatsApp capture winner: RD Station.

RD Station: WhatsApp button (conversion + response speed)

RD Station's WhatsApp feature is positioned as a site button: visitors click, you respond faster, and the platform captures the lead. For LATAM inbound, this is exactly what you want - simple, visible, and tied to conversion.

ActiveCampaign: WhatsApp messaging with credits (credits reset and expire)

ActiveCampaign's WhatsApp is built for templated messaging automation, but the cost model is the whole game:

- Outbound templated messages cost credits

- Credits reset monthly and expire (no rollover)

- Credit cost varies by country and message type

Brazil example (from ActiveCampaign's credit table):

- Marketing: 5 credits

- Utility: 0.5 credits

- Authentication: 0.5 credits

Simple WhatsApp cost math (so you can budget without guessing)

Let's say you run a modest WhatsApp motion in Brazil:

- 2,000 leads/month get one marketing template message

- 600 of them also get one utility message (confirmation/reminder)

Credits/month:

- Marketing: 2,000 x 5 = 10,000 credits

- Utility: 600 x 0.5 = 300 credits

- Total: 10,300 credits/month

That's the number you plan around. If you don't do this math up front, you'll either overspend or throttle campaigns mid-month.

Integrations, API limits, and ecosystem signals (what breaks at scale)

Integration breadth winner: ActiveCampaign. LATAM partner ecosystem winner: RD Station.

The scale constraints that matter

RD Station's API caps are explicit:

- 120 requests/minute on Light/Basic/Pro

- 500 requests/minute on Enterprise

That's fine for normal CRM sync and form events. It becomes a bottleneck if you're pushing high-volume product events, running heavy custom telemetry, or doing frequent enrichment writes.

RD Station's partner ecosystem is a real advantage where it's strongest: 2,000+ partner agencies in 40+ countries. If you want "someone local who implemented this 50 times," RD Station makes that easy.

ActiveCampaign's ecosystem is broader and more developer-friendly in practice, especially when you're stitching together a modern stack and want more flexibility in how data moves.

Implementation & onboarding reality (timelines, support, performance)

Here's the timeline that matches reality, not vendor demos:

- Week 1-2: domains + authentication, imports, templates, basic forms/landing pages, core lists/tags

- Week 3-6: core automations, scoring, routing, reporting, CRM handoffs

- Month 2-3: stabilization: naming conventions, lifecycle definitions, UTM discipline, dedupe rules, suppression logic

On G2, RD Station's "Value at a Glance" shows time to implement: 3 months and ROI: 11 months. That's honest. Marketing automation pays back when the funnel's real and the data's clean.

Performance reality:

- Both tools get "slowdowns" complaints when accounts get heavy (lots of automations, segments, and history).

- RD Station also gets recurring feedback about rigidity in email/landing page customization.

Deliverability: stop chasing a single percentage - control inputs instead

Deliverability "benchmarks" are seductive and mostly useless as buying criteria.

EmailTooltester's historical testing showed ActiveCampaign at 94.2% deliverability (Jan 2024), and they later paused bi-annual deliverability tests due to external testing tool and provider inconsistencies. The lesson's simple: don't buy either tool because of one number.

Buy based on what you can control:

- SPF/DKIM/DMARC done correctly (use this SPF DKIM & DMARC guide)

- Domain warm-up and complaint-rate discipline

- Engagement-based segmentation and suppression

- Clean lists before import and before sends

If you ignore list quality, both platforms will punish you: higher bounces, worse inbox placement, and inflated contact-based bills.

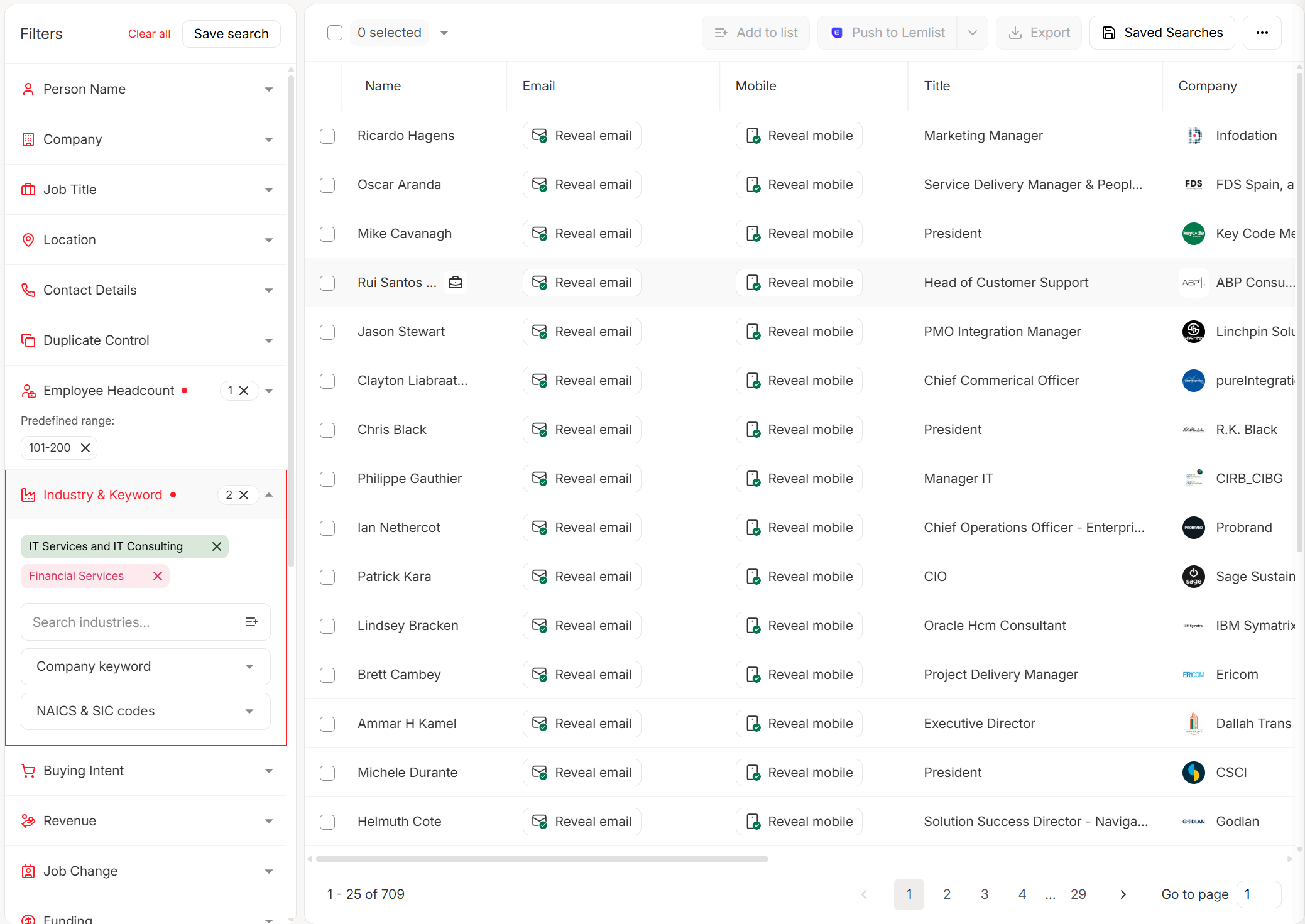

The "skip both" third option: add a data layer (Prospeo) to either stack

If you're migrating platforms or scaling contact-based billing, a data layer is the unsexy fix that saves you real money.

Prospeo ("The B2B data platform built for accuracy") fits cleanly alongside either ActiveCampaign or RD Station: you verify, dedupe, and enrich before you import, then you keep the database fresh so automations and segmentation don't rot over time. Prospeo has 300M+ professional profiles, 143M+ verified emails, 125M+ verified mobile numbers, and 98% email accuracy, with a 7-day refresh cycle (industry average: 6 weeks), so you're not paying to store dead records or sending campaigns to addresses that were wrong six months ago. (If you're comparing tools, see our email verifier websites roundup.)

A scenario I've seen too many times: a team moves to a new automation tool, imports "everything we've ever collected," hits a higher contact band on day one, then spends the next month fighting bounces and spam complaints while wondering why performance dropped. Cleaning the list first avoids that whole mess.

On the screen, you'll see each record labeled Valid / Invalid / Catch-all, enrichment fields filled in (role, company, location, etc.), and an Export / push option to send clean contacts to CSV or your CRM.

Whether you pick ActiveCampaign or RD Station, your automations are only as good as the contacts feeding them. Prospeo gives you 300M+ verified profiles, 125M+ direct dials, and CRM enrichment that returns 50+ data points per contact - at $0.01/email.

Fix the data layer before you pick the automation layer.

FAQ

Is RD Station Pro really an annual contract, and what's the mandatory fee?

RD Station Marketing Pro requires an annual contract and includes a mandatory one-time implementation fee of R$ 2,699. Pro is $269/month for up to 5,000 active contacts, so plan for both the recurring subscription and the upfront onboarding cost.

Why do ActiveCampaign costs jump as your list grows (and what counts as a contact)?

ActiveCampaign scales by contact bands, so moving from 5,000 to 10,000 contacts can sharply increase your monthly bill. For new users, all contacts can count toward billing - including unsubscribed, bounced, and unconfirmed - so deduping and suppressing inactive records is a direct cost-control lever.

Does RD Station include WhatsApp messaging automation or just a site button?

RD Station's WhatsApp feature is primarily a site button for faster response and lead capture, not a full templated messaging automation engine. If you need automated WhatsApp campaigns, ActiveCampaign's typically the better fit, but you must budget for credits that reset monthly and expire.

What's a fast, low-cost way to reduce bounces before importing contacts?

Summary: choosing between the two

If you're deciding on activecampaign vs rd station in 2026, don't let the "feature checklist" drive the purchase - let contracts, contact counting, automation gating, and WhatsApp cost mechanics drive it.

Pick ActiveCampaign when automation depth and lifecycle control are the point. Pick RD Station when you're LATAM-first, inbound-heavy, and you want the fastest path to a working funnel with local ecosystem support.

Then do the boring part: keep your data clean. That's what keeps TCO and deliverability from quietly blowing up later.