The Best AI Email Outreach Tools in 2026: Honest Reviews, Real Benchmarks, and the Truth About "AI"

Your SDR team sent 12,000 emails last month. 28% bounced. Your primary domain just landed on a blocklist, and now even your CEO's emails to existing customers are hitting spam. The "AI-powered" outreach tool you're paying $200/month for didn't flag a single bad address before you hit send.

That's not a hypothetical - it's the story I hear every quarter from teams who picked their ai email outreach tools based on feature lists instead of data quality.

Cold email still works - spectacularly well, actually. Email marketing delivers a 261% ROI, and teams running tight outbound operations report $25-75 per meeting booked versus $150-500+ for LinkedIn ads. But the gap between teams printing pipeline and teams burning domains comes down to a handful of decisions most "best tools" articles never cover.

Every tool on this list advertises "AI." Most of them are GPT wrappers with better grammar. The ones that actually move the needle use AI where it matters - deliverability optimization, send-time intelligence, and data verification. I'll tell you which is which.

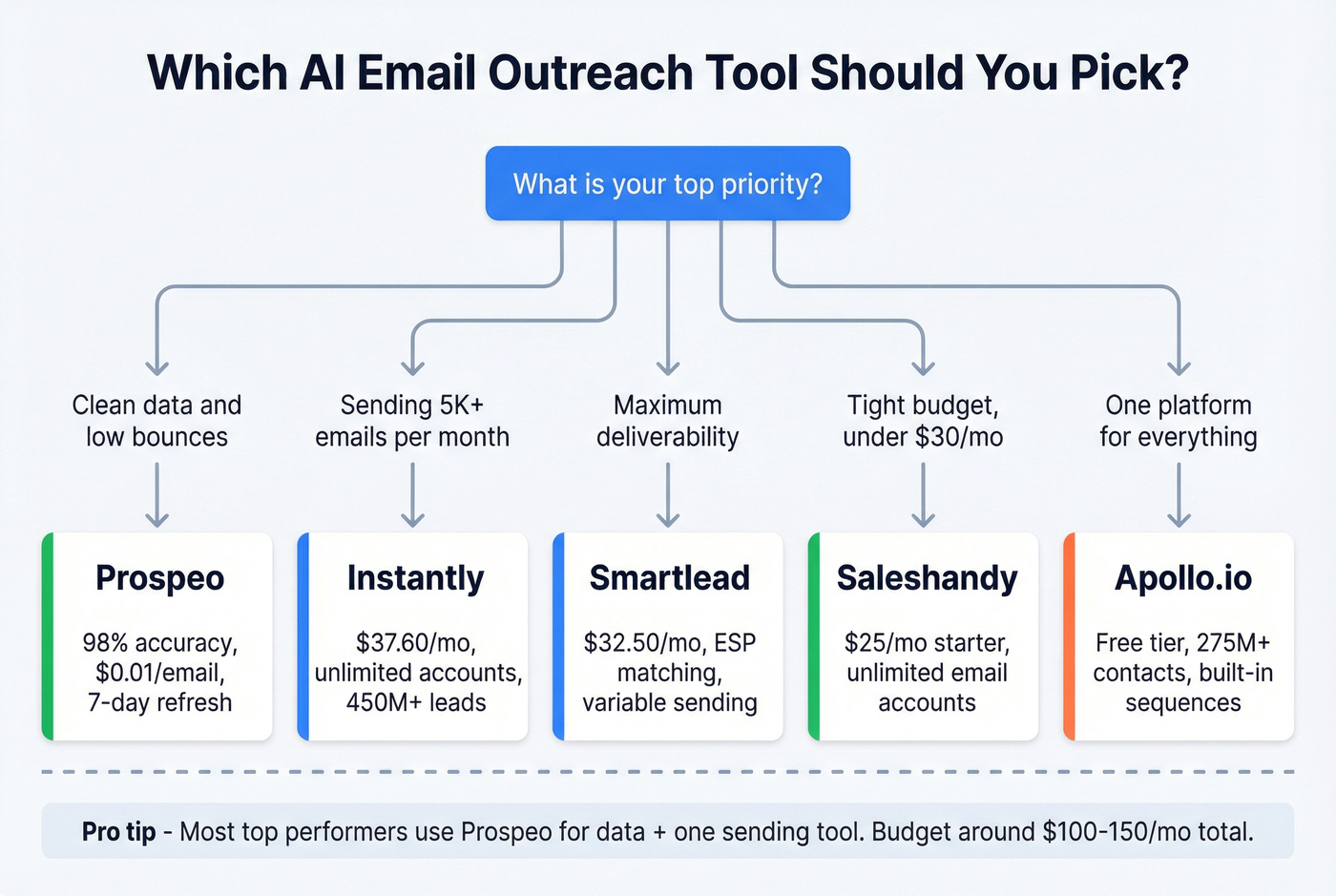

Our Picks (TL;DR)

If you don't want to read 5,000 words, here's the cheat sheet:

| Use Case | Tool | Why |

|---|---|---|

| Best data accuracy | Prospeo | 98% email accuracy, 7-day refresh, feeds every tool below |

| Best high-volume sending | Instantly | Unlimited accounts, 450M+ leads, $37.60/mo |

| Best deliverability | Smartlead | ESP matching, variable sending, unlimited accounts |

| Best for budget teams | Saleshandy | Starts at $25/mo, unlimited email accounts |

| Best all-in-one | Apollo.io | 275M+ contacts + sequences in one platform |

If I had to pick 3 to trial first: Prospeo for data, Instantly or Smartlead for sending, Apollo for prospecting. That stack covers the full workflow for under $150/month.

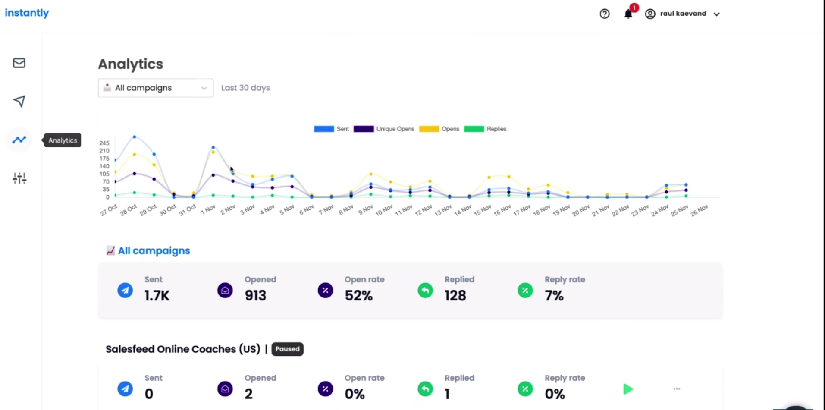

What "Good" Actually Looks Like - Cold Email Benchmarks in 2026

Before you pick a tool, you need to know what success looks like. Otherwise you're optimizing blind.

Instantly's 2026 benchmark report, analyzing billions of emails sent throughout 2025, paints a clear picture:

- Average reply rate: 3.43%

- Top 25%: 5.5%+

- Top 10%: 10.7%+

If you're hitting 5% reply rates, you're already outperforming three-quarters of senders. And 58% of all replies come from the first email - your follow-ups matter, but that initial message does the heavy lifting. Close.com's research found cold prospects now require 20-50 touchpoints to respond, which is 3-4x more than warm leads.

What separates the top 10% from everyone else?

| Pattern | Detail |

|---|---|

| Email length | Under 80 words outperforms longer emails |

| CTA count | Single CTA beats multiple asks |

| Follow-up style | Replies beat formal reminders by ~30% |

| Sequence length | 4-7 emails over 14-21 days |

| Best send times | Tuesday and Thursday, 9:30-11am local time |

Here's the thing: the Reddit cold email community has some of the most useful practitioner data out there. One high-volume sender reported sending 464,000+ emails at a 1.6% reply rate - and described it as "prints money." Volume at a solid rate beats a high rate on a tiny list. A solo consultant booked 47 meetings from cold email, converted 11 to clients, and generated $528K in new ARR by offering a free "burn rate audit" instead of pitching retainers. 40% converted to ongoing work.

The tool matters. But the offer, the list, and the data quality matter more.

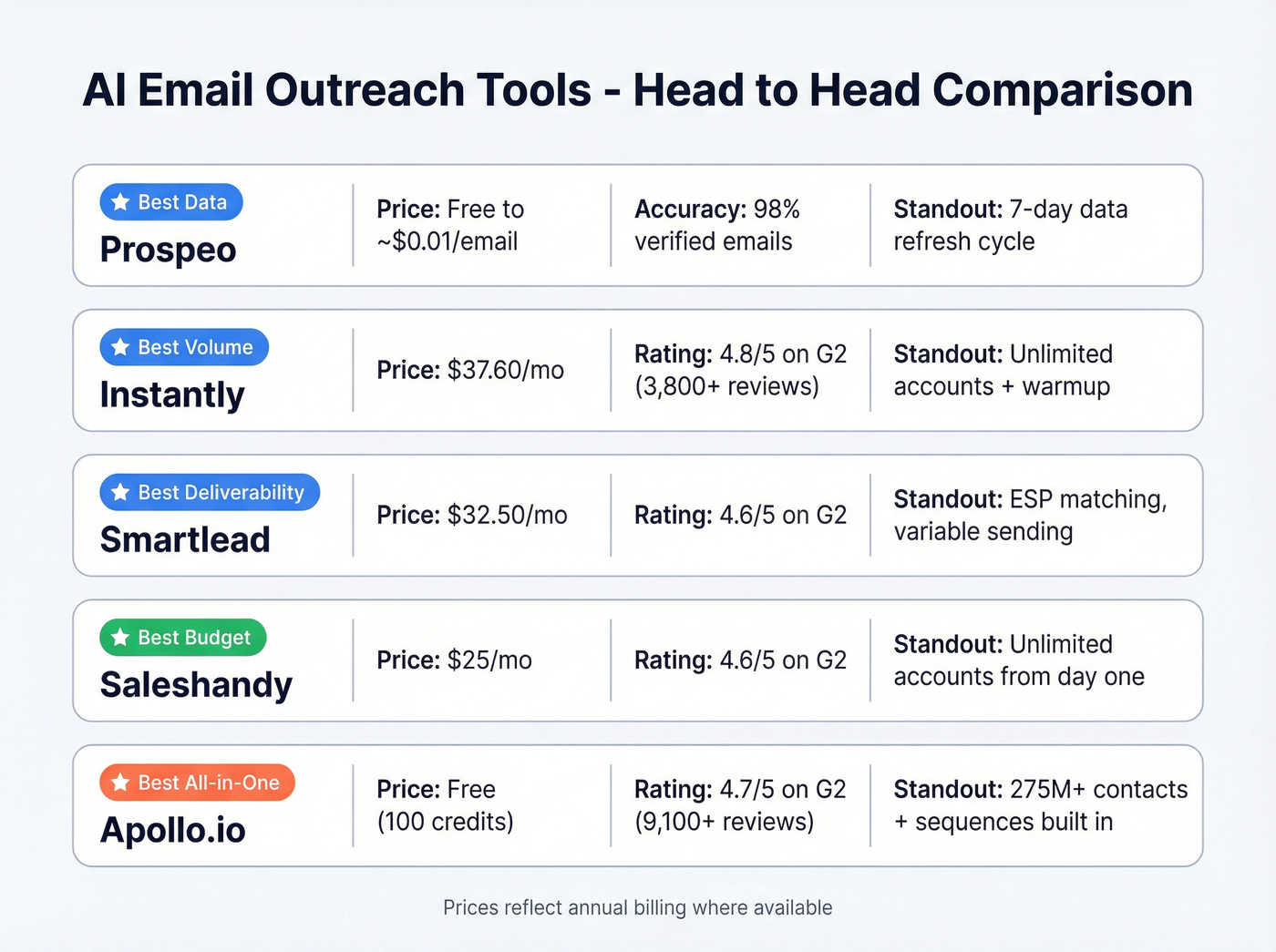

Master Comparison: AI Email Outreach Software Side by Side

Here's every tool at a glance. Pricing reflects annual billing where available.

| Tool | Best For | Entry Price | G2 Rating | Unlimited Accounts |

|---|---|---|---|---|

| Prospeo ★ | Data accuracy | Free (75 emails/mo) | - | N/A (data layer) |

| Instantly ★ | High volume | $37.60/mo | 4.8/5 (3,800+) | Yes |

| Smartlead ★ | Deliverability | $32.50/mo | 4.6/5 (296) | Yes |

| Saleshandy | Budget teams | $25/mo | 4.6/5 (772) | Yes |

| Apollo.io | All-in-one | Free (100 credits) | 4.7/5 (9,100+) | No (1-15 inboxes) |

| Lemlist | Personalization | $63/mo | 4.6/5 (1,220) | No (3-5/user) |

| Reply.io | Multichannel + AI SDR | $49/user/mo | 4.6/5 (1,522) | No |

| Woodpecker | SMB simplicity | $24/mo | ~4.3/5 | Yes |

| Outreach.io | Enterprise | ~$100-160/user/mo | 4.3/5 (3,499) | No |

| Mailshake | Simple email-first | $29/mo | 4.7/5 (338) | No |

★ = Editor's pick

Pricing details worth knowing:

- Prospeo: ~$0.01/email. Self-serve, no contracts. 5-step verification with catch-all handling.

- Instantly: Mid-tier $77.60/mo (100K emails). Modular pricing - outreach, leads, CRM sold separately. Built-in warmup + send optimization.

- Smartlead: Mid-tier $78.30/mo (Pro). ESP matching + variable volume sending. SmartSenders add-on for domain management.

- Saleshandy: Mid-tier $69/mo (Pro). Per-workspace pricing. TrulyInbox warmup included.

- Apollo.io: Mid-tier $99/user/mo (Professional). Per-user pricing. Intent signals + built-in sequences.

- Lemlist: Mid-tier $87/user/mo (Multichannel Expert). Per-user pricing. Image/video personalization + deliverability hub.

- Reply.io: Mid-tier $89/user/mo (Multichannel). Per-user pricing. Jason AI SDR agent ($500/mo add-on).

- Woodpecker: Mid-tier $126/mo (10K prospects). Per-prospect pricing. Built-in catch-all verification via Bouncer.

- Outreach.io: ~$72K/year for 60 seats. Annual contracts only. Revenue intelligence + call recording.

- Mailshake: Mid-tier $99/mo (Sales Engagement). Flat pricing. AI email writer included.

Every sending tool in this guide - Instantly, Smartlead, Lemlist - is only as good as the contacts you feed it. Prospeo's 98% email accuracy and 7-day data refresh mean fewer bounces, zero domain flags, and more replies from your first email.

Stop burning domains. Start with data that actually connects.

The Best AI Email Outreach Tools in 2026

Prospeo - Best for Data Accuracy and Email Verification

Every sending tool on this list is only as good as the data you feed it. Prospeo is the data layer that makes the rest of the stack work.

The database covers 300M+ professional profiles with 143M+ verified emails and 125M+ verified mobile numbers. The headline number: 98% email accuracy, powered by a proprietary 5-step verification process that includes catch-all handling, spam-trap removal, and honeypot filtering.

What sets it apart is the data refresh cycle: every 7 days versus the 6-week industry average. Fewer bounces from job changes, fewer emails to people who left the company two months ago. Native integrations with Instantly, Smartlead, Lemlist, Saleshandy, HubSpot, and Salesforce mean verified contacts flow directly into your sequences without manual exports.

The proof: Stack Optimize built from $0 to $1M ARR using Prospeo data, maintaining 94%+ deliverability and zero domain flags across all clients. At ~$0.01 per email with a free tier of 75 emails/month, it's the cheapest insurance policy your domain reputation can buy.

Best for: Any team running outbound. Prospeo sits upstream of your sending tool and keeps your data clean.

Instantly - Best for High-Volume Sending

Use this if: You're sending 5,000+ emails/month across multiple domains and need unlimited sender accounts with built-in warmup.

Skip this if: You want an all-in-one platform. Instantly's modular pricing means outreach, lead finder, and CRM are separate subscriptions.

The Growth plan starts at $37.60/mo on annual billing - 5,000 emails, 1,000 contacts, unlimited email accounts and warmup. Hypergrowth ($77.60/mo) jumps to 100K emails and 25K contacts. Light Speed ($286.30/mo) unlocks dedicated IP pools via SISR.

Here's the trap: the SuperSearch database is a separate $47/mo subscription. Add the CRM at another $47/mo, and your "$37 tool" costs $130+/month. This modular pricing bait-and-switch is the #1 frustration I hear from Instantly users.

G2: 4.8/5 (3,800+) reviews - the highest-rated tool on this list. One deliverability concern worth flagging: Instantly sends exact volumes when you set daily limits, creating detectable patterns for sophisticated spam filters.

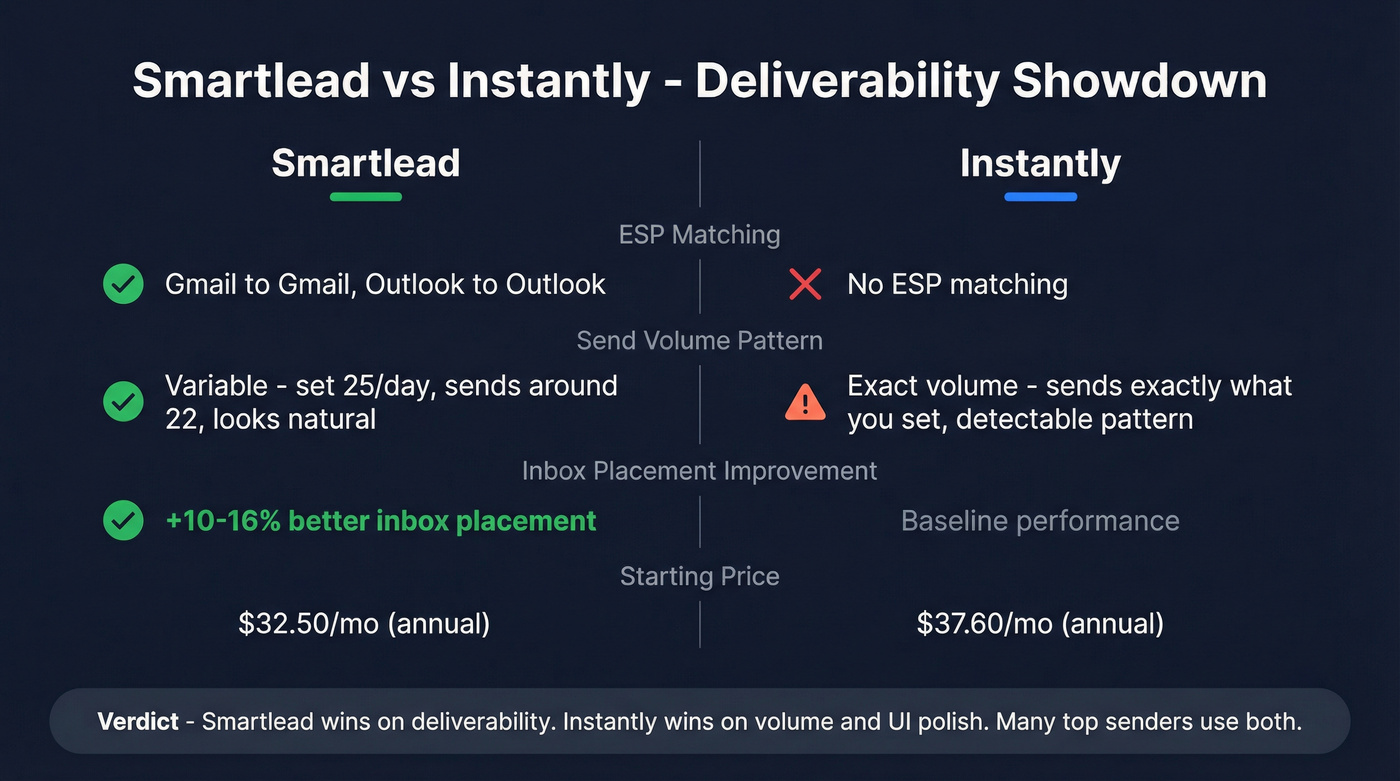

Smartlead - Best for Deliverability

Smartlead is the tool deliverability nerds recommend to each other. Here's why:

| Feature | Smartlead | Instantly |

|---|---|---|

| ESP matching | ✅ Gmail→Gmail, Outlook→Outlook | ❌ |

| Variable sending | ✅ Set 25/day, sends ~22 | ❌ Exact volume |

| Inbox improvement | +10-16% placement | Baseline |

| Base price | $32.50/mo | $37.60/mo |

The Base plan ($32.50/mo annual) includes 2,000 contacts, 6,000 emails, unlimited sender accounts and warmup. Pro ($78.30/mo annual) adds API access, ChatGPT-4 integration, and unlimited seats. The catch: Smart ($174/mo) and Prime ($379/mo) plans are monthly-only with no annual discount. SmartSenders ($4.50/mailbox/month) lets you buy domains and mailboxes inside the platform.

Where Smartlead falls short: the campaign editor is basic with limited dynamic branching, and there's no built-in B2B data - you'll need a separate data layer feeding it clean contacts. Reddit users consistently recommend Smartlead over Instantly for warmup and deliverability.

G2: 4.6/5 from 296 reviews.

Saleshandy - Best for Budget-Conscious Teams

Saleshandy at $25/mo is a solo founder tool. Saleshandy at $69/mo is a legitimate team platform. Budget accordingly.

Pros:

- Starter at $25/mo (annual): unlimited email accounts, 6,000 emails/month, 2,000 active prospects

- TrulyInbox warmup included free on all plans

- AI Sequence Copilot generates sequences from website insights - genuinely useful for first drafts

- Scale plan ($139/mo annual) adds whitelabel for agencies

Cons:

- Starter is deceptively limited: no team members, no A-Z testing, no API, no CRM integrations

- Most teams need the Pro plan ($69/mo) for Salesforce/HubSpot integrations and API access

- Lead Finder credits are stingy - 50 on Starter, 100 on Pro (one-time, not monthly)

G2: 4.6/5 from 772 reviews.

Apollo.io - Best All-in-One Prospecting and Outreach

Apollo is the Swiss Army knife of outbound. 275M+ contacts, built-in sequences, intent data, and a free tier that actually lets you do real work (100 credits/month). For teams that want one login instead of three, it's the obvious starting point.

Basic plan runs $59/user/mo, Professional at $99/user/mo adds 15 sending inboxes and advanced intent signals. G2: 4.7/5 from 9,100+ reviews - the most-reviewed tool in this category.

But here's the problem nobody in Apollo's marketing will tell you: the data is overused. Reddit's cold email community calls this out constantly - "competitor follower scraping consistently outperforms generic Apollo pulls." You're limited to 1 inbox on Free/Basic and 15 on Professional, a far cry from unlimited accounts on Instantly, Smartlead, or Saleshandy. When everyone's pulling from the same database, you're competing with 50 other SDRs who emailed the same person this week.

Best for: Teams that want prospecting and outreach in one platform. Skip this if: You're sending 10,000+ emails/month and deliverability is your top concern. If you're evaluating Apollo specifically, see our deeper breakdown on Apollo cold email and Apollo.io accuracy.

Lemlist - Best for Personalization

Use this if: Your outreach strategy depends on standing out visually - personalized images, video thumbnails, dynamic landing pages. Lemlist's personalization engine is genuinely best-in-class.

Skip this if: You're a team of 5+ and budget-sensitive. Email Pro starts at $63/mo per user (annual), Multichannel Expert at $87/mo per user. That's $435/mo for a 5-person team on the basic email plan - and prices went up $10/user in early 2025 with no sign of a rollback. You're also limited to 3-5 sending addresses per user.

The deliverability hub and built-in warmup are solid. The 600M+ leads database is a nice addition. But per-user pricing makes Lemlist expensive at scale compared to per-workspace tools like Instantly or Smartlead.

G2: 4.6/5 from 1,220 reviews.

Reply.io - Best AI Outreach Email Assistant for Multichannel

Reply.io's pitch is true multichannel: email, LinkedIn, SMS, and calls in unified sequences. The email plan starts at $49/user/mo, multichannel at $89/user/mo. The standout feature is Jason AI SDR - an autonomous AI agent that handles outreach, follow-ups, and meeting booking for $500/mo. Think of it as an outreach assistant that actually runs campaigns end-to-end rather than just suggesting copy tweaks.

Jason is expensive, but it's one of the few AI SDR products that works autonomously rather than just generating draft emails. For teams running genuine multichannel plays (not just email with a LinkedIn connection request bolted on), Reply.io is the most complete option under $100/user.

G2: 4.6/5 from 1,522 reviews.

Woodpecker - Best for SMB Simplicity

Woodpecker takes a unique approach: pricing by contacted prospect, not by email or seat. Starter runs $24/mo (annual) for 500 prospects, with emails calculated at 12x your prospect count. The built-in catch-all verification (powered by Bouncer) is free - a nice touch most competitors charge extra for.

The simplicity is the selling point. Setup takes minutes, not hours. But pricing scales steeply - Growth at $126/mo for 10,000 prospects, Scale at $903/mo for 100K. AI features are minimal compared to Instantly or Smartlead.

G2: ~4.3/5. Best for small teams wanting something that just works without a learning curve.

Outreach.io - Enterprise Only

Outreach.io runs ~$100-160/user/month billed annually. A 60-seat deployment prices around $72K/year based on Vendr procurement data. If you have to "talk to sales" to learn the price, expect a 6-week procurement cycle and a contract you'll need legal to review.

Overpriced for teams under 50 reps.

G2: 4.3/5 from 3,499 reviews.

Mailshake - Simple Email-First Outreach

Mailshake starts at $29/mo for basic email outreach, $99/mo for full sales engagement with multichannel. No free trial. G2: 4.7/5 from 338 reviews. In our experience, Mailshake works best for teams that find Instantly overwhelming and want dead-simple email sequences without the complexity. If that's not you, the tools above offer more for similar money.

The Data Quality Truth Nobody Talks About

Here's my hot take that'll save you more money than any tool switch: if your average deal size is under $10K, you probably don't need a $200/month sending tool. But you absolutely need verified data.

Every tool on this list - Instantly, Smartlead, Saleshandy, all of them - will happily send emails to dead addresses, spam traps, and people who left the company six months ago. They don't know the difference. They just send.

The priority hierarchy from practitioners who've actually scaled cold email:

- Deliverability - can your emails reach the inbox?

- List quality - are you emailing real people at current addresses?

- Relevance - does your message match their situation?

- Offer - is what you're offering compelling?

- Personalization - the least important factor (controversial, but the data backs it up)

Two of the top three factors are about data, not copy.

The numbers tell the story. Snyk's 50-person AE team was running a 35-40% bounce rate before switching to verified data - it dropped to under 5%, and AE-sourced pipeline jumped 180%. Meritt tripled their pipeline from $100K to $300K/week after fixing data quality with verified contacts. GreyScout cut their bounce rate from 38% to under 4% and saw pipeline climb 140%.

The difference between 98% email accuracy and 79% (Apollo's average) isn't academic - it's the difference between a 3% bounce rate and a 21% bounce rate, which is enough to get your domain blocklisted in a week. Every dollar you spend on Instantly or Smartlead is wasted if a quarter of your list bounces.

And the Apollo data overuse problem is real. Scraping competitor followers, building custom lists from job postings, and verifying everything before it hits your sequences consistently outperforms generic database pulls. If you're building lists from multiple sources, use an email verification list SOP and track B2B contact data decay so your bounce rate doesn't creep back up.

Stack Optimize built a $1M agency on Prospeo data with under 3% bounce rates across every client. At ~$0.01 per verified email, it's cheaper than a single blocklist recovery - and it integrates natively with Instantly, Smartlead, and Saleshandy.

Feed your outreach stack verified data - 75 free emails to prove it.

Deliverability Reality Check - What the Numbers Say

Global inbox placement averages about 84%. That means 1 in 6 emails you send never reaches the inbox - and cold outreach senders face even worse odds because recipients haven't opted in.

| ISP | Inbox Rate | Spam Rate | Notes |

|---|---|---|---|

| Gmail | 87.2% | 6.8% | Engagement-driven. Spam complaints <0.3% |

| Yahoo/AOL | 86% | 4.8% | Most forgiving with clean auth |

| Apple Mail | 76.3% | 14.3% | Privacy updates reduce visibility |

| Outlook | 75.6% | 14.6% | Toughest for cold outreach |

Outlook is the cold emailer's nightmare. Nearly 1 in 4 emails to Outlook addresses hits spam or disappears entirely. This is where Smartlead's ESP matching becomes critical - routing Outlook-sent emails to Outlook recipients instead of sending everything from Gmail accounts.

The basics still matter more than any tool feature. Proper SPF, DKIM, and DMARC authentication improves deliverability by 20-30%. Domain warmup takes 4-6 weeks starting at 5-10 sends/day - there's no shortcut. Bounce rate needs to stay under 2%. One manufacturing company improved inbox placement from 76% to 94% just by implementing proper authentication and engagement-focused sending strategies. If you want the technical checklist, start with SPF DKIM & DMARC and monitor your spam rate threshold as you scale volume.

We've tested this across dozens of client deployments: verified data is the foundation of all of it. Sending to unverified lists means 25-40% bounce rates, which tanks your domain reputation within days. Verified lists consistently keep bounce rates under 3-5%, well within safe thresholds for every ISP.

Five Mistakes That Kill Your Outreach Before It Starts

1. Choosing tools by features instead of workflow fit. A tool with 47 features you'll never use costs more than a focused tool that does 5 things well. Map your actual workflow first - data sourcing, verification, sequencing, sending, tracking - then pick tools that fit each step.

2. Ignoring data quality. I've seen teams spend $500/month on Instantly and $0 on data verification. Then they wonder why their domain is blocklisted after two weeks. Bad data is the #1 outreach killer, and it's the easiest to fix.

3. Skipping warmup. Jumping to full volume on a fresh domain is like sprinting a marathon from the starting line. Four to six weeks of gradual warmup, starting at 5-10 sends/day, is non-negotiable. Every tool on this list includes warmup features. Use them.

4. The "set and forget" mentality. AI campaigns need check-ins every 2-4 weeks. Reply patterns shift. Bounce rates creep up. Subject lines fatigue. The teams hitting 10%+ reply rates review performance biweekly and iterate - they don't launch a sequence in January and forget about it until April.

5. Confusing AI personalization with real personalization. "Hey {first_name}, I noticed {company} is growing fast" isn't personalization. It's a mail merge with better grammar. Real personalization means referencing something specific - a recent podcast appearance, a job posting that signals a pain point, a competitor they just lost to. AI can help draft it, but a human needs to direct it. For common failure modes, see AI cold email personalization mistakes.

One more that deserves its own line: every tool advertises unlimited email accounts like it's a feature. It's table stakes. If a tool in 2026 charges per email account, walk away. The real differentiators are deliverability engineering, data quality, and workflow integrations.

How to Choose the Right Tool - Decision Framework

Here's what I keep seeing: teams agonize over which sending tool to pick, then feed it garbage data and wonder why nothing works. Your budget and team size narrow the field fast, but data quality is the constant.

Solo founder or 1-person team ($50-100/mo): Saleshandy Starter ($25/mo) or Woodpecker Starter ($24/mo) for sending, plus a free tier for verified data. Total: under $50/mo. This gets you 6,000 emails/month with clean contacts.

Growth team, 3-10 reps ($150-500/mo): Instantly Growth ($37.60/mo) or Smartlead Pro ($78.30/mo) for sending, plus a paid data verification plan. Total: $100-150/mo for the core stack. Add Apollo's free tier for supplemental prospecting if you need more top-of-funnel.

Agency managing multiple clients: Smartlead Pro or Prime for whitelabel sending infrastructure, plus Saleshandy Scale ($139/mo) as a backup. Smartlead's SmartSenders add-on lets you buy domains and mailboxes inside the platform - saves hours of setup per client. Verified data across all client campaigns is non-negotiable.

Enterprise, 50+ reps: Outreach.io or Salesloft if you need revenue intelligence, call recording, and deep CRM workflows. But here's what actually happened at one company I worked with: their finance team flagged the Outreach.io renewal at $96K for 40 seats. Can you get 80% of the functionality for 20% of the cost? Yes. Smartlead Pro (unlimited seats at $78.30/mo) plus verified data plus your existing CRM covers most of what Outreach does for a fraction of the price.

The "trial 3 first" recommendation holds: a data verification tool, a dedicated sending platform, and Apollo for prospecting. Run them in parallel for two weeks. Measure bounce rates, reply rates, and time-to-first-meeting. The data will tell you which stack wins for your specific ICP.

Alternatives Worth Considering

If you've tested the tools above and they don't fit your workflow, a few other approaches are worth exploring. Some teams find that pairing a lightweight sending tool like Woodpecker with a strong data layer outperforms an all-in-one platform. Others discover that a multichannel-first tool - like Reply.io's Jason AI SDR - better matches their sales motion than a pure email sender. The key is matching the tool to your actual process rather than forcing your process into someone else's software.

FAQ

What's a good cold email reply rate in 2026?

The average is 3.43% based on Instantly's 2026 benchmark of billions of emails. Top 25% hit 5.5%+, top 10% exceed 10.7%. If you're consistently above 5%, you're outperforming most senders. Focus on list quality and email brevity (under 80 words) to move up tiers.

Do I need a separate email warmup tool?

No. Every modern outreach platform - Instantly, Smartlead, Saleshandy, Lemlist - includes email warmup on all paid plans. Standalone warmup tools are only necessary if your sending platform doesn't bundle it, which is increasingly rare.

Is AI email personalization actually worth it?

AI-generated first lines and subject lines lift reply rates 15-25% when paired with good data. But AI personalization on bad data is just well-written spam sent to the wrong people. Verify your list first, segment by ICP, then let AI personalize within those segments.

How much does a cold email outreach stack cost?

A competitive stack runs $75-200/month for most teams. Verified data at ~$0.01/email plus Instantly or Smartlead ($32-78/month) covers sourcing, verification, and sending. Add Apollo's free tier for supplemental prospecting. Enterprise stacks with Outreach.io run $40-100K+/year.

Can I use the same tool for prospecting and sending?

Apollo and Instantly both offer prospecting databases and sending in one platform, but dedicated tools outperform all-in-ones at each step. Pair a data verification platform with a dedicated sender like Instantly or Smartlead for the best results. Testing two or three options side by side for two weeks is the fastest way to find the right fit for your ICP and sales motion.