Cognism vs LeadGenius: The Buyer's Guide Neither Vendor Wants You to Read

You've spent two hours Googling "cognism vs leadgenius" and every result is a vendor page telling you their tool is better. Cognism publishes its own comparison page. LeadGenius fires back with blog posts attacking Cognism's data quality. Neither side links to independent benchmarks - because there aren't any.

So we dug through 1,308 G2 reviews, Vendr transaction data, Reddit threads, class action filings, and both vendors' marketing claims. What follows is the comparison neither sales team wants you to read.

30-Second Verdict

Choose Cognism if you sell primarily into Europe and need phone-verified mobiles with GDPR compliance baked in. It's a self-serve platform your SDRs can use daily, and the Diamond-tier mobile numbers genuinely connect.

Choose LeadGenius if you need bespoke, human-curated datasets for niche verticals - think supply chain decision-makers in LATAM or buying committees at 200 target accounts globally. You'll need patience (2-4 week delivery) and budget ($22K+/year).

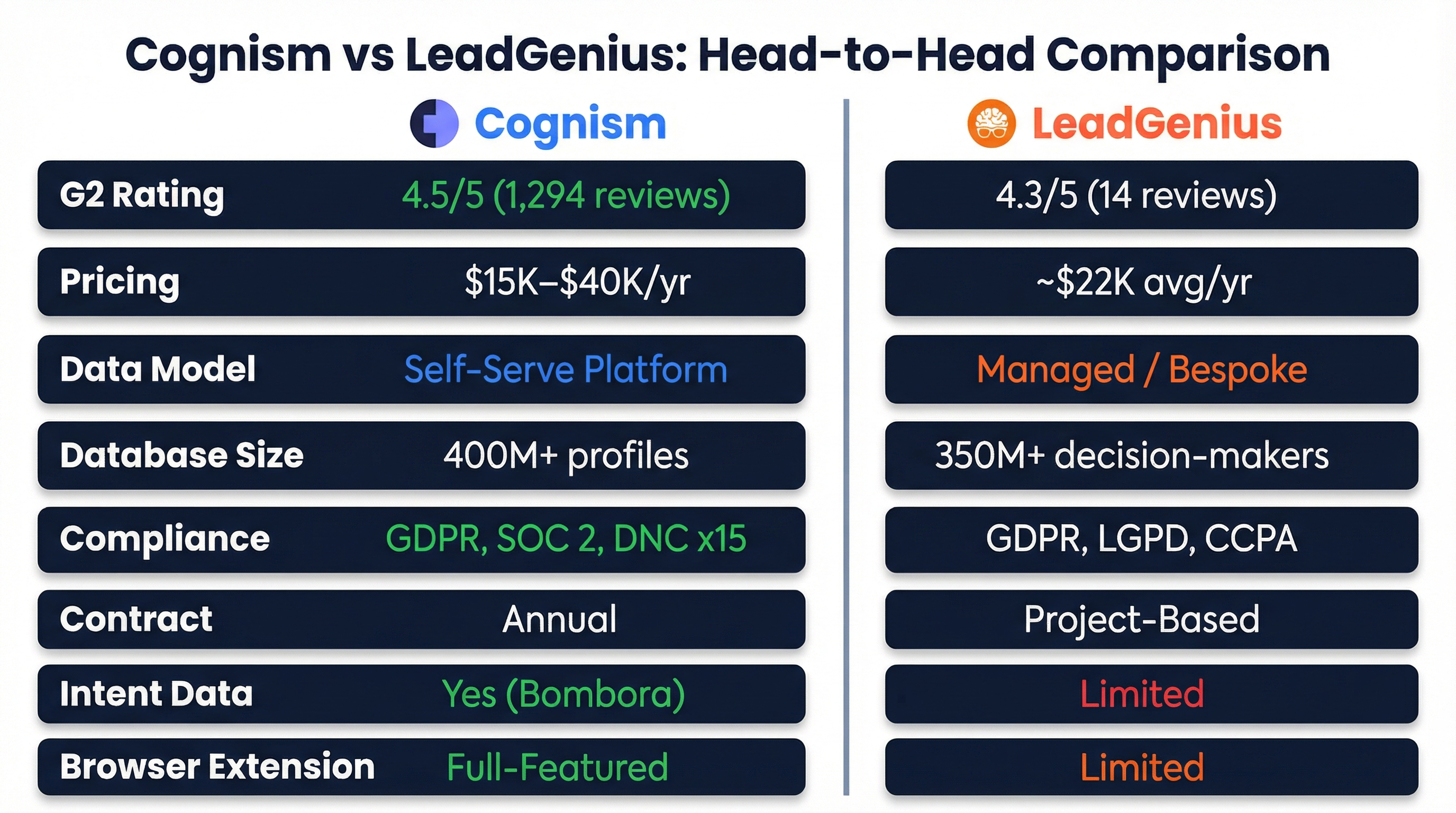

How Do Cognism and LeadGenius Compare at a Glance?

These two tools solve fundamentally different problems. Cognism is a self-serve platform your reps log into daily. LeadGenius is a managed data service where you scope a project and wait for delivery. Comparing them is like comparing a SaaS tool to a consulting engagement - and that architectural gap shapes everything from pricing to data freshness to how your team actually uses the product.

| Feature | Cognism | LeadGenius |

|---|---|---|

| G2 Rating | 4.5/5 (1,294 reviews) | 4.3/5 (14 reviews) |

| Pricing | ~$15K-$40K/yr | ~$22K avg/yr |

| Data Model | Self-serve platform | Managed/bespoke |

| Database Size | 400M+ profiles | 350M+ decision-makers |

| Compliance | GDPR, SOC 2, DNC x15 | GDPR, LGPD, CCPA |

| Contract Terms | Annual | Project-based |

| Browser Extension | Yes | Limited info |

| Intent Data | Yes (Bombora) | Limited |

The review count gap matters. Cognism has 92x more G2 reviews than LeadGenius. Drawing statistical conclusions from 14 reviews is like calling an election with 14 votes counted. The market segment split is telling too: Cognism skews mid-market (52.9%) while LeadGenius skews small business (46.2%) and enterprise (35.7%) - a surprisingly bimodal distribution for a tool that positions itself as enterprise-grade.

Cognism charges $25K+/year for Diamond-tier data. LeadGenius makes you wait 2-4 weeks for delivery. Prospeo gives you 300M+ profiles with 98% email accuracy and 125M+ verified mobiles - refreshed every 7 days, not every 6 weeks. Self-serve, no annual contract, starting at $0.01/email.

Stop paying enterprise prices for data you can get for a penny per lead.

Data Quality - Where Each Tool Actually Delivers

Cognism's European Strength (and American Weakness)

Cognism's pitch is simple: best European B2B data on the market. For EMEA, that pitch holds up. Diamond-verified mobile numbers connect at rates that justify the premium, and DNC screening across 15 countries is genuinely unmatched. Cognism's 2024 acquisition of Kaspr added roughly 30% more mobile coverage in key markets and introduced a product-led growth purchasing option - a sign they're investing in breadth.

But the US story is different.

European accuracy runs around 85%+ per Cognism's own reporting. US accuracy drops to roughly 60-70%, based on consistent patterns across G2 reviews and Reddit threads. One Reddit user in r/automation put it bluntly: "Cognism: Better in EU, worse in US."

The G2 data backs this up. Across 1,294 reviews, "Inaccurate Data" appears 90 times. "Incorrect Numbers" shows up 55 times. "Outdated Contacts" gets 54 mentions. That's not a handful of complainers - it's a pattern. Melanie W.'s January 2026 G2 review captures the specific failure mode: prospects listed who've already left companies, emails that look pattern-generated rather than verified, and phone numbers that ring through to gatekeepers instead of direct lines. On the flip side, Thomas F. praised Diamond-verified mobiles as "highly accurate" for cold calling. The gap between Diamond and non-Diamond data is real and measurable.

Here's the thing: Cognism's 4.5-star G2 rating is largely driven by its strongest market. Roughly 75% of reviewers are European. A US-only rating would almost certainly be lower.

LeadGenius's Human-in-the-Loop Model

LeadGenius doesn't give you a login and a search bar. You scope a project with their team, they deploy AI crawling across 40M+ live web sources, then human researchers verify and enrich the results.

When it works, it works well. Alexandre B., an enterprise user on G2, praised the "global footprint with consistent data accuracy" and highlighted the value of "targeting specialists who understand the challenges of Demand Generation Campaigns." LeadGenius claims one client engagement produced 4,521 records where 35% of contacts were identified as having already left their roles - catching stale data before it hit the CRM. They also cite 2x bookings increases and 190x ROI for certain campaigns. These are vendor-claimed results without independent verification, but they illustrate the model's potential.

The problem? The evidence base is thin. LeadGenius has 14 G2 reviews. Within those 14, users still report receiving "dead leads." A Capterra reviewer noted they "need to clearly explain to customers which geographical areas they have customers" - suggesting coverage gaps that aren't disclosed upfront.

I can't recommend LeadGenius with the same confidence I'd recommend a tool backed by 1,000+ reviews. The service model sounds compelling, but 14 data points isn't enough to validate it.

Diamond Data - Marketing or Reality?

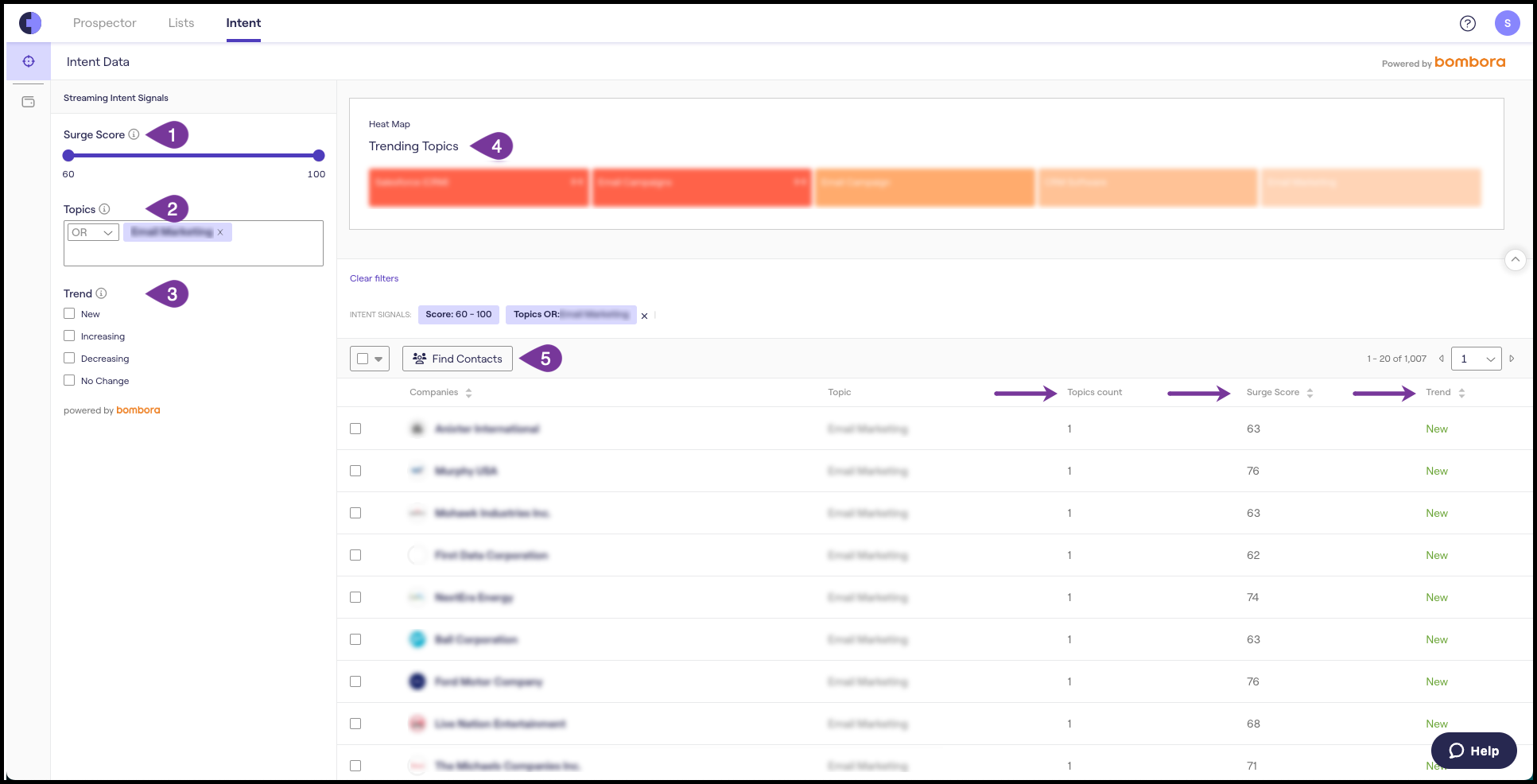

Cognism's Diamond Data is their premium tier: phone-verified mobile numbers with claimed ~98% phone accuracy, Bombora intent data, and a Diamonds-on-Demand service where you can request verification for specific contacts.

LeadGenius's counter-positioning is aggressive. Their blog argues that "what Cognism calls diamond, LeadGenius calls baseline." They characterize Diamond Data as contacts meeting "a minimal threshold of accuracy" built from "recycled data partnerships." Punchy line, but unsubstantiated - LeadGenius provides no third-party data to back this claim.

Similarly, LeadGenius claims "revenue teams using static databases spend 70% of their time cleaning, filtering, and validating data." That stat appears nowhere outside LeadGenius's own marketing. Treat it accordingly.

Diamond Data is real and measurably better than Cognism's standard tier for phone connect rates. But it's the more expensive tier, and it doesn't fix the underlying US data gap.

Pricing - The Numbers Neither Vendor Publishes

Neither Cognism nor LeadGenius puts pricing on their website. Here's what they actually cost - plus cost-per-lead math that makes the difference concrete.

What Cognism Actually Costs

Cognism runs two tiers (historically called Platinum and Diamond, recently rebranded to Grow and Elevate), both on annual contracts:

- Platinum / Grow: $15,000/year platform fee + $1,500/user/year. Up to 25M contacts, but no phone-verified mobiles, no intent data, no dedicated CSM.

- Diamond / Elevate: $25,000/year platform fee + $2,500/user/year. Adds Diamond-verified mobiles, Bombora intent, AI segmentation, and a dedicated CSM.

A 5-person team on Diamond runs roughly $37,500/year. Enterprise implementations with 10+ seats can hit $30,000-$100,000+/year. Add $500-$1,500 for implementation fees.

The renewal trap: prices typically escalate 10-15% annually unless you've locked a multi-year deal. Discounts up to 29% are possible if you push hard at end-of-quarter. Always negotiate.

What LeadGenius Actually Costs

LeadGenius pricing is even more opaque. Based on Vendr transaction data from 7 deals across 4 unique purchasers:

- Average contract: $21,570/year

- Maximum observed: $81,000/year

- Recent shift from credits-per-record to cents-per-record campaign pricing

One useful signal: a Vendr customer cut their costs by 50%+ year-over-year by citing poor delivered value as negotiation leverage. If your first engagement underdelivers, use that in renewal conversations.

Watch for silent auto-renewals and 60-90 day cancellation notice requirements on both platforms. Miss the window and you're locked in for another year.

Cost-Per-Lead Comparison

This is where the math gets brutal:

| Annual Cost | ~$37,500 | ~$22,000 | ~$195-$495/mo |

| Est. Leads/Year | ~10,000 | ~5,000-10,000 | ~50,000+ |

| Cost Per Lead | ~$3.75 | ~$2.20-$4.40 | ~$0.01 |

| Contract | Annual | Project-based | No contract |

Real talk: if your average deal size is under $10K, you probably can't justify either platform's pricing. The cost-per-lead math only works when you're closing deals large enough to absorb $3-4 per contact in data costs. Most SMB and mid-market teams are better served by self-serve tools at a fraction of the cost - especially if you’re already investing in lead generation pricing discipline.

Compliance and Trust

Cognism's Compliance Edge (and Its Class Action)

Cognism's compliance infrastructure is genuinely strong. GDPR and CCPA compliant, SOC 2 accredited, and DNC screening across 15 countries - more than any other provider in this space. For teams selling into regulated European markets, this matters.

But there's a footnote most comparison articles skip. In September 2022, a class action was filed - Kis et al. v. Cognism, Inc. - alleging Cognism offered residents' contact information to free trial and non-paying users in violation of state privacy laws. The case reached a settlement in 2025, with payouts ranging from $22.50 (California, Nevada) to $150 (Alabama) across seven covered states.

As part of the settlement, Cognism agreed to implement a user-friendly opt-out mechanism for consumers to request data removal. This doesn't disqualify Cognism - every major data provider faces legal scrutiny - but it's worth knowing if your legal team asks about vendor risk.

LeadGenius's Compliance Positioning

LeadGenius covers GDPR, LGPD, and CCPA compliance. Their interesting angle: they position themselves as a "data processor" rather than a "data controller," which shifts some compliance liability away from clients. Smart positioning for enterprise buyers whose legal teams scrutinize vendor agreements.

They don't offer anything equivalent to Cognism's 15-country DNC screening. No known legal actions against LeadGenius.

Integrations and Workflow

The integration story reflects the architectural difference between these tools.

| Capability | Cognism | LeadGenius |

|---|---|---|

| Salesforce | Yes | Yes |

| HubSpot | Yes | Yes |

| Outreach | Yes | Yes |

| Salesloft | Yes | No |

| Microsoft Dynamics | Yes | No |

| Pipedrive | Yes | No |

| Marketo | No | Yes |

| Zapier | Yes | Yes |

| Chrome Extension | Full-featured | Unclear |

| CRM Field Mapping | Manual | Pre-mapped on delivery |

Cognism users report sync delays and duplicate records when pushing large CRM lists. LeadGenius pre-maps data to your CRM fields before delivery, which reduces cleanup but adds lead time.

The core tradeoff: if your SDRs need to prospect independently every day, Cognism's architecture wins. If your marketing ops team runs quarterly ABM campaigns against curated account lists, LeadGenius's model makes more sense.

G2 Ratings - What 1,308 Reviews Actually Tell You

| Category | Cognism | LeadGenius |

|---|---|---|

| Meets Requirements | 8.7 | 8.3 |

| Ease of Use | 9.0 | 9.1 |

| Ease of Setup | 9.1 | 8.9 |

| Ease of Admin | 9.0 | 9.2 |

| Quality of Support | 9.1 | 9.1 |

| Good Business Partner | 9.2 | 9.5 |

| Product Direction | 9.2 | 7.4 |

Most categories are close enough to be noise - especially given LeadGenius's 14-review sample size. But the Product Direction gap (9.2 vs 7.4) is a red flag. That's a 1.8-point spread, and it suggests LeadGenius's existing users aren't confident in where the product is heading. For a tool you're committing $22K+/year to, roadmap confidence matters.

Cognism's 1,294 reviews paint a clear picture: 72% five-star, strong on ease of use (206 mentions), but with persistent data accuracy complaints (90 mentions of "Inaccurate Data"). The market segment skew is telling - 75% of Cognism reviewers are European, which explains why overall sentiment stays positive despite US data gaps. If you want to pressure-test this, start with a simple B2B contact data decay audit before you buy anything.

We've seen teams make vendor decisions based on G2 scores alone. Don't. Especially when one side has 92x more reviews than the other.

Who Should Choose What

Choose Cognism If

- You sell primarily into Europe and the UK

- Your SDR team cold-calls and needs phone-verified mobiles that actually connect

- GDPR compliance and DNC screening are non-negotiable for your legal team

- You want a self-serve platform with a Chrome extension reps can use daily

- You have $15K-$40K/year in budget

Best-fit scenario: A 10-person SDR team in London targeting mid-market accounts across DACH and Nordics. Your reps make 50+ calls a day, and connect rates directly impact pipeline. Diamond-verified mobiles are worth the premium here. Cognism is the obvious choice.

Walk away if your market is primarily North America. The data gap is real and cheaper tools outperform Cognism in the US.

Choose LeadGenius If

- You need bespoke datasets for niche verticals that standard databases miss

- Your team doesn't need self-serve daily access - you run campaign-level data pulls

- You value human curation and are willing to wait 2-4 weeks for delivery

- You have $22K+/year and patience for a managed service model

Best-fit scenario: An enterprise marketing team running ABM into a vertical with 200 target accounts globally. You need buying committee maps for supply chain decision-makers in LATAM - data that doesn't exist in any standard database. LeadGenius's human researchers can build that dataset from scratch.

Walk away if you need data today, your reps need to self-serve, or you want a tool with a proven track record backed by hundreds of reviews.

When Neither Is Right

If you're a US-focused sales team that needs verified emails and direct dials today - not in 3 weeks, and not for $20K/year - neither Cognism nor LeadGenius fits. Prospeo covers 300M+ professional profiles with 98% email accuracy and 125M+ verified mobiles, refreshing data every 7 days. You get 30+ search filters including buyer intent across 15,000 topics, technographics, and job changes. The free tier gives you 75 emails per month. No contracts, no sales calls. If you’re evaluating options, compare against other B2B data providers and run a quick email verification list SOP on sample exports.

For budget-friendly all-in-one outbound with built-in sequencing, Apollo.io runs ~$49-$119/user/month. For enterprise ABM with deep org charts and intent data, ZoomInfo starts around $15K-$40K/year.

The real problem with both Cognism and LeadGenius? You're locked into annual contracts before you can validate the data. Prospeo lets you test 100 credits free - same 30+ filters, same Bombora intent data, same 98% verified emails. No sales calls, no 2-4 week wait times.

Verify the data quality yourself in 60 seconds - zero commitment.

FAQ

What's the main difference between Cognism and LeadGenius?

Cognism is a self-serve SaaS platform your reps log into daily for prospecting. LeadGenius is a managed data service - you scope a project, wait 2-4 weeks, and receive curated datasets. Cognism suits daily outbound workflows; LeadGenius suits campaign-level data builds for niche verticals.

Is Cognism worth the price for US-based teams?

For US-only teams, often not. Cognism's North American data accuracy runs 60-70% based on G2 reviews, compared to 85%+ in Europe. Self-serve alternatives like Prospeo deliver 98% email accuracy in the US at roughly $0.01/lead - a fraction of Cognism's $3.75 cost per contact.

How accurate is LeadGenius data?

LeadGenius claims high accuracy through human-in-the-loop verification, and one cited engagement caught 35% stale contacts before CRM delivery. With only 14 G2 reviews, though, independent validation is limited. Users still report dead leads and undisclosed geographic coverage gaps.

Can I negotiate pricing with either vendor?

Yes - aggressively. Cognism offers discounts up to 29% at end-of-quarter, and LeadGenius customers have halved costs by citing poor delivered value during renewals. Both escalate pricing 10-15% annually. Negotiate before signing, and watch for silent auto-renewal clauses with 60-90 day cancellation windows.

What's a good free alternative to both Cognism and LeadGenius?

Prospeo offers a free tier with 75 verified emails per month and 100 Chrome extension credits - enough to run real outbound campaigns. Apollo.io also has a free plan with limited credits. Neither Cognism nor LeadGenius offers any free access, and both require sales calls before you can evaluate the product.