Cold Call Outsourcing: What Every Vendor Page Won't Tell You

Most pages ranking for cold call outsourcing are sales pitches dressed as guides. This one isn't.

Here's the thesis nobody selling you outsourced cold calling will say out loud: you don't need a cold calling agency. You need a cold calling system. Outsource the dialing, keep the strategy, own your data. The difference between a great vendor and a terrible one isn't the callers - it's the data they're dialing. Vendors would rather talk about their "proprietary methodology" than admit they're burning 30% of your budget on dead numbers.

82% of companies plan to outsource at least part of their lead generation this year. Meanwhile, Cognism's 2026 State of Cold Calling report showed conversation-to-meeting rates dropping from 4.82% in 2024 to roughly 2.3% more recently. That's not a rounding error - that's a structural shift. The system you build, the vendor you pick, the data you hand them, the model you choose - all of it matters more than ever.

Outsourcing cold calling can boost sales results by 43% while cutting lead costs by up to 60%. But only if you build the system right.

What you need (quick version)

- Budget reality: Outsourced SDR retainers run $3,000-$6,500/month. In-house SDRs cost $9,800-$14,200/month fully loaded. Pay-per-meeting models run $175-$350 per qualified meeting.

- Start small: Run a 2-4 week pilot with 1-3 callers before committing. Define "qualified meeting" criteria before the first dial - not after you've paid for 30 meetings that go nowhere.

- Data is the bottleneck: Your outsourced team is only as good as the contacts you give them. Roughly 100,000 mobile numbers get reassigned daily. Verify every contact before handing off a list.

What Cold Call Outsourcing Actually Is (And What to Keep In-House)

Hiring an external team to make outbound calls on your behalf - that's the simple version. But the execution splits into three distinct service tiers, and confusing them is how companies end up disappointed.

Lead generation is the broadest tier: finding and qualifying prospects who might be a fit. Appointment setting is narrower - the outsourced team's only job is booking meetings for your closers. Direct sales is the rarest model, where the vendor actually closes deals on your behalf, typically for transactional products.

Most B2B companies want appointment setting. That's the sweet spot.

Cold calling isn't telemarketing. Cold calling is targeted, B2B, consultative. Telemarketing is volume-driven, often B2C, and script-heavy. If a vendor uses the terms interchangeably, that's a yellow flag.

Here's the split that actually works:

Outsource these:

- Lead research and list building

- Cold calling and initial qualification

- Appointment setting and follow-ups

- CRM updates and activity logging

- Re-engagement of stale leads

Keep these in-house:

- Closing calls and negotiations

- Custom proposals and pricing discussions

- Enterprise conversations requiring deep product knowledge

- Relationship management with existing accounts

- Sales leadership and forecasting

The pattern is clear: outsource the volume work, keep the judgment work. Your outsourced team should be feeding your closers, not replacing them.

The Real Cost of Outsourced Cold Calling in 2026

This is the section every vendor page buries.

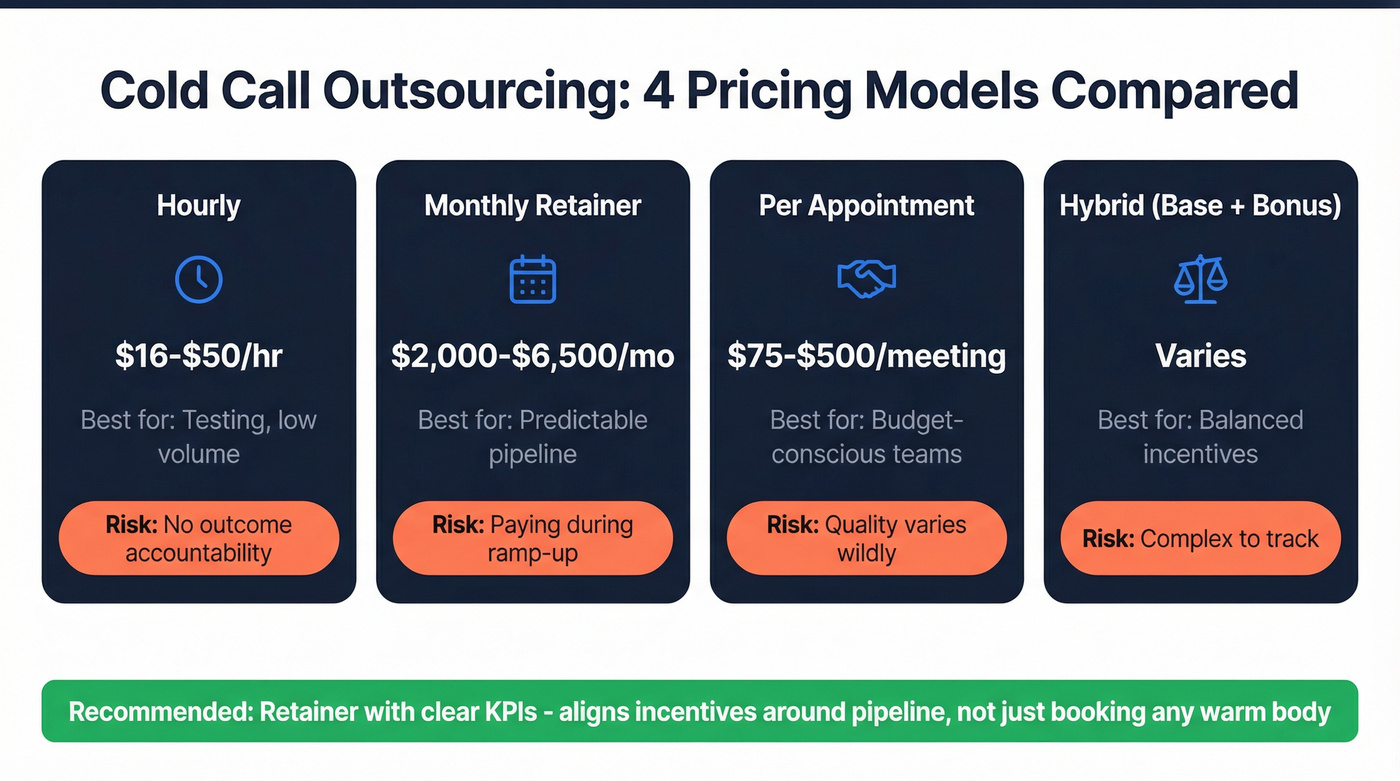

Pricing Models Compared

| Model | Price Range | Best For | Watch Out For |

|---|---|---|---|

| Hourly | $16-$50/hr | Testing, low volume | No outcome accountability |

| Monthly retainer | $2,000-$6,500/mo | Predictable pipeline | Paying during ramp-up |

| Per appointment | $75-$500/meeting | Budget-conscious teams | Quality varies wildly |

| Hybrid (base + bonus) | Varies | Balanced incentives | Complexity in tracking |

A note on the "per appointment" row: some vendors distinguish between "per appointment" (any meeting booked) and "pay-per-meeting" (qualified meetings only, typically $175-$350). If a vendor quotes per-appointment pricing, demand their definition of "qualified" in writing.

The hourly model ($16.12/hr is the US average for appointment setters) gives you zero outcome accountability. You're paying for dials, not meetings. Fine for a two-week test. Terrible for a six-month engagement.

My recommendation: retainer with clear KPIs. It aligns incentives around building pipeline, not just booking any warm body into a meeting. Pair the retainer with specific targets - dials per day, connect rate, qualified meetings per month, show-up rate. Pay-per-appointment sounds appealing but incentivizes volume over quality every time.

Be wary of any vendor offering per-appointment pricing below $100. At that price point, the math only works if they're booking low-quality meetings at volume. I've heard of one agency that was caught offering billboard ad space to prospects just to get them to take calls. That's not pipeline generation - that's fraud with extra steps.

In-House vs. Outsourced - The Full Math

| Cost Component | In-House (Monthly) | Outsourced (Monthly) |

|---|---|---|

| Cash compensation | $6,250-$8,750 | Included in retainer |

| Employer burden | $1,375-$1,900 | Included |

| Tooling (CRM, dialer, data) | $475-$1,000 | Included |

| Enablement/training | $100-$200 | Included |

| Management allocation | $1,250-$1,875 | Included |

| Sales ops | $300-$650 | Included |

| Total | $9,800-$14,200 | $3,000-$6,500 |

The in-house number surprises people. They think "SDR salary is $75K" and forget about employer taxes, benefits, the CRM seat, the dialer license, conversation intelligence tools, the manager's time, and the sales ops support. As Belkins put it: "The unicorn employee who can handle every aspect of modern sales doesn't exist."

And "productive" is doing heavy lifting in that sentence. In-house SDRs take 3-4 months to ramp after hire. SDR annual attrition runs 35-40%. Every time someone leaves, you've got a 2-3 month coverage hole plus another 3-4 months of ramp. When you outsource sales reps, you eliminate the ramp risk entirely - the vendor absorbs hiring, training, and attrition costs.

Running cold calling internally costs $20,000-$30,000/month when you factor in everything. Professional B2B cold calling services run $6,000-$15,000/month for comparable output. And 71% of organizations that outsourced reported higher conversion rates, plus 28% faster sales cycles.

I'm not saying in-house is always wrong. If you've got a mature enablement function, locked ICP and messaging, and you're optimizing for institutional knowledge, build internally. But if you need pipeline in the next 90 days and don't have the enablement bandwidth to train and manage SDRs? Outsourcing wins on math alone.

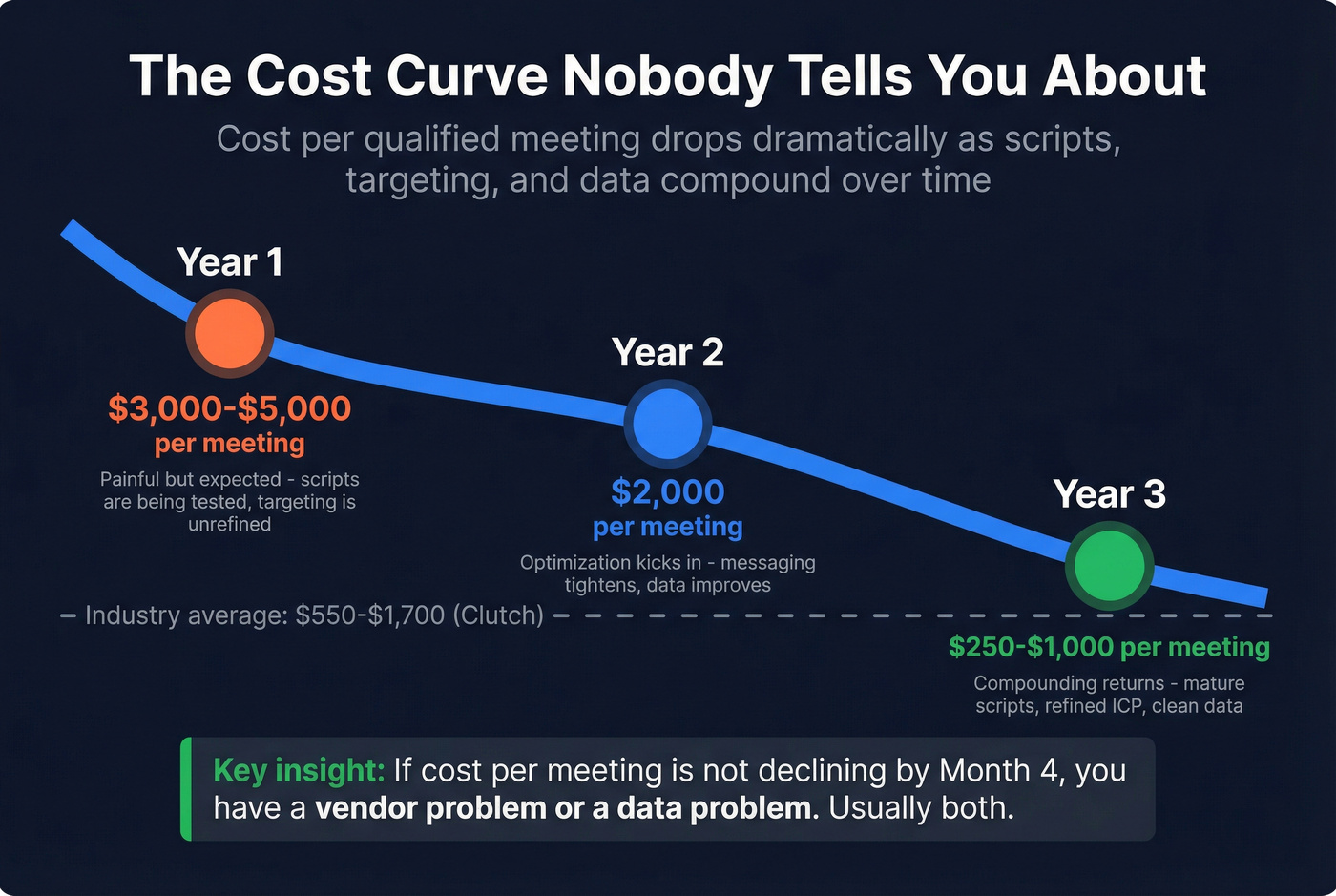

The Cost Curve Nobody Tells You About

Here's what vendors won't put on their pricing page: Year 1 is expensive. Painfully expensive.

Belkins published their internal cost curve. Year 1: expect $3,000-$5,000 per meeting booked. Year 2: that optimizes down to roughly $2,000 per meeting. Year 3: you can reach $250-$1,000 per meeting as scripts, targeting, and data all compound.

The Clutch average across providers sits at $550-$1,700 per qualified appointment. But that average hides massive variance by industry and deal size.

A US SaaS startup targeting CFOs at mid-market firms with $50K+ deal sizes? Roughly $400 per qualified meeting. A manufacturing supplier targeting EU distributors with smaller contracts? $80-$150 per meeting. Enterprise campaigns cost 2-3x as much per meeting as SMB campaigns.

Don't judge your outsourced program by Month 1 economics. Judge it by the trajectory. If cost-per-meeting isn't declining by Month 4, you've got a vendor problem or a data problem. Usually both.

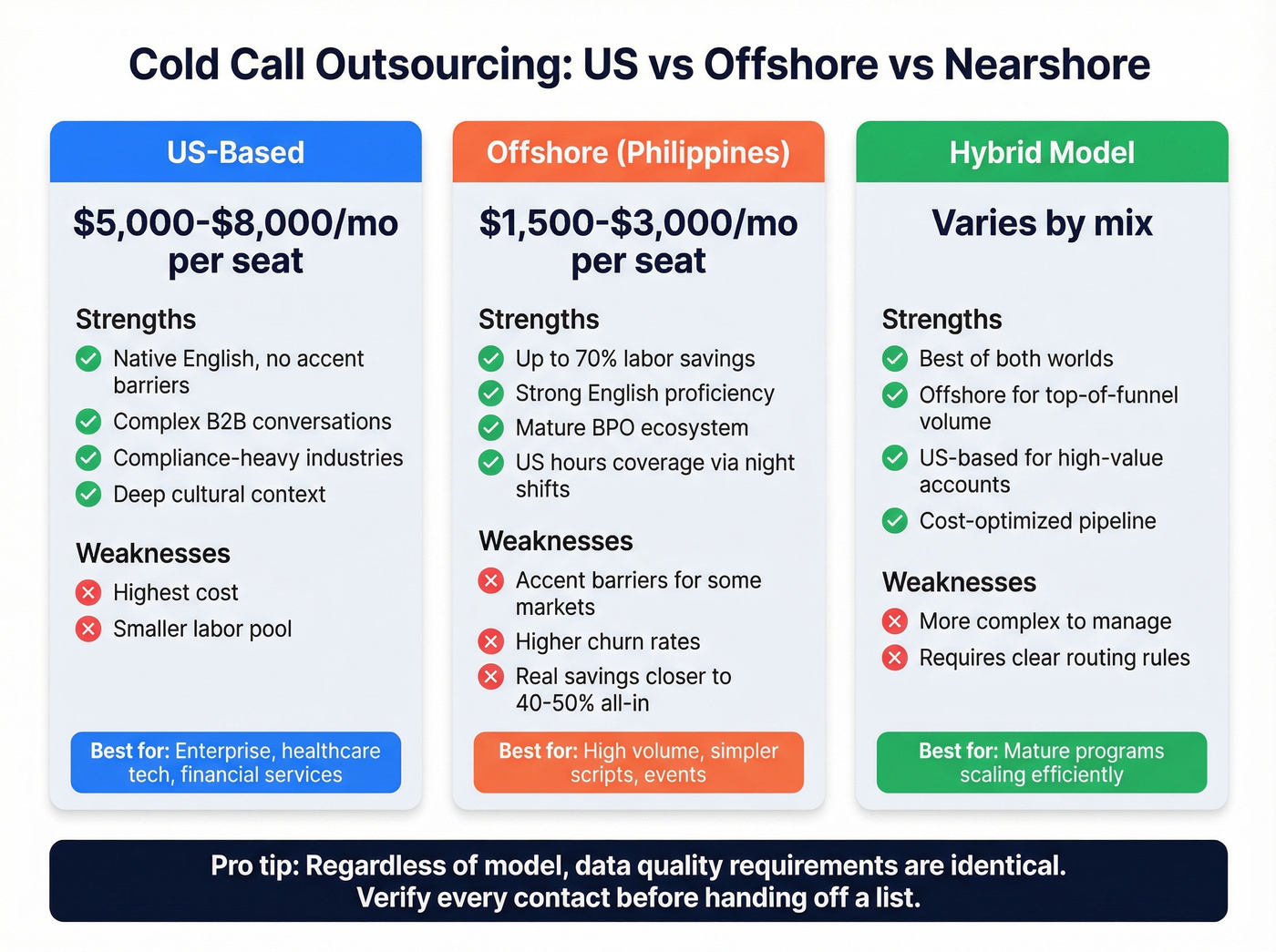

US vs. Offshore vs. Nearshore - Which Model Fits?

| Model | Monthly Cost/Seat | Labor Savings | Best For |

|---|---|---|---|

| US-based | $5,000-$8,000 | Baseline | Complex B2B, compliance-heavy |

| Offshore managed | $1,500-$3,000 | Up to 70% | High-volume, simpler scripts |

| Offshore freelance | $800-$1,800 | 60-70% | Budget testing, basic qual |

The Philippines dominates the offshore cold calling market for good reason: strong English proficiency, a mature BPO ecosystem, cultural alignment with Western business norms, and easy US business hours coverage via night shifts.

But the 70% labor savings number comes with asterisks. Factor in training time, quality oversight, higher churn rates, and accent barriers for certain markets, and the real savings are closer to 40-50%. Add a management and compliance premium ($300-$700/month), and offshore managed centers run $1,800-$3,700 all-in.

For complex B2B sales with nuanced conversations - enterprise software, financial services, healthcare tech - US-based or nearshore callers are worth the premium. For high-volume, lower-complexity campaigns like event registrations, webinar invites, or basic qualification, offshore delivers genuine savings without meaningful quality loss.

Here's the thing: the hybrid model is where most mature programs land. Offshore for top-of-funnel volume and initial qualification, US-based for high-value accounts and complex conversations. Whether you outsource calls to a domestic team or an offshore BPO, the data quality requirements are identical.

You just read that 100,000 mobile numbers get reassigned daily. Your outsourced team is only as good as the data you hand them. Prospeo's 125M+ verified mobiles hit a 30% pickup rate - nearly 3x the industry average - refreshed every 7 days, not every 6 weeks.

Fix the data bottleneck before your first outsourced dial.

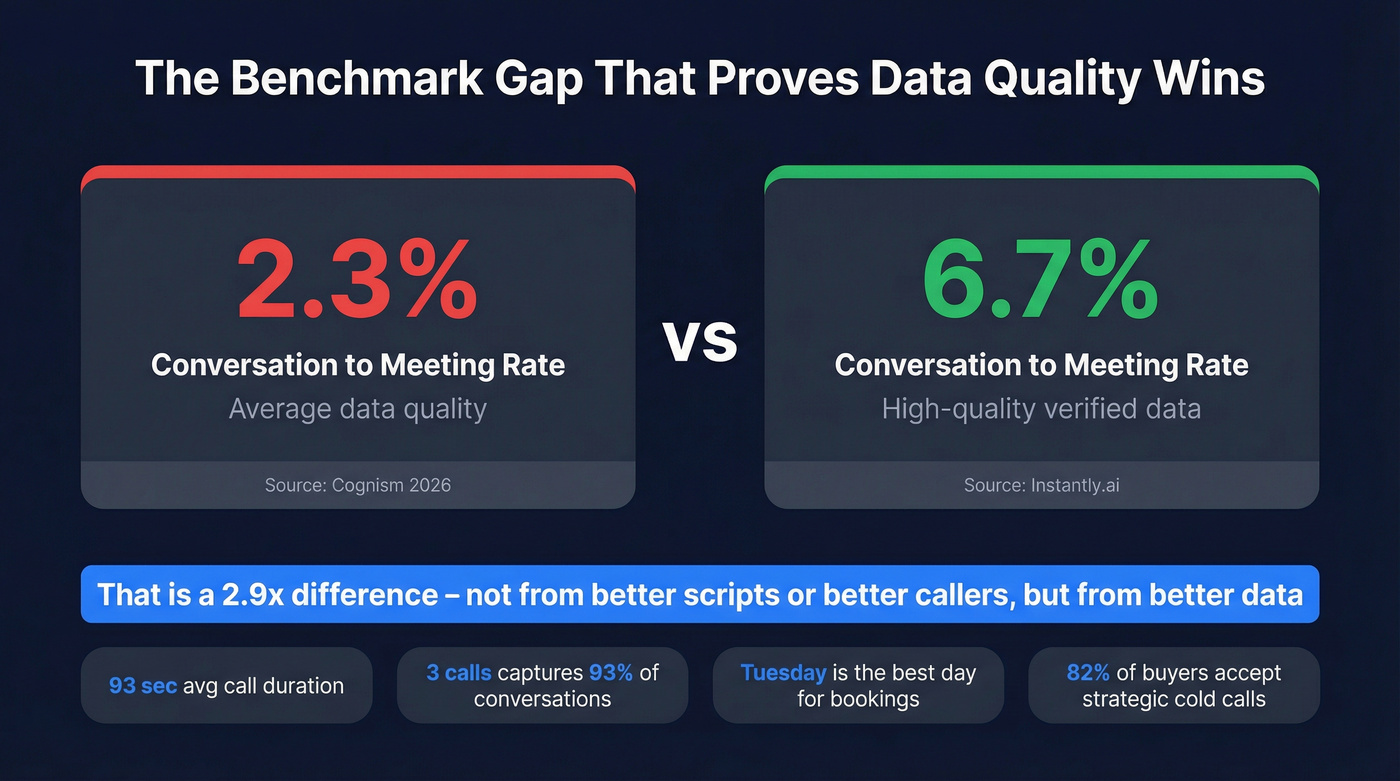

Cold Calling Benchmarks You Need Before Signing Anything

Before you sign a vendor contract, you need to know what "good" looks like.

The Numbers That Matter

Cognism's cold calling data showed a conversation-to-meeting rate of roughly 2.3%, down from 4.82% in 2024. Instantly.ai's benchmarks show 6.7% conversation-to-meeting rate, with a 16.6% connect rate across 55,000+ dials using quality data.

That gap - 2.3% vs. 6.7% - is the single most important data point in this entire article.

It's not about scripts or caller talent. It's about data quality.

Other benchmarks worth knowing:

- Average cold call duration: 93 seconds (up from 83 seconds in 2024)

- Optimal call attempts: 3 calls captures 93% of total conversations

- Best day for bookings: Tuesday

- 82% of buyers accept meetings from strategic cold calls

- 57% of C-level and VP-level buyers prefer phone contact

- 69% of B2B buyers are open to accepting cold calls from new providers

- 82% of B2B decision-makers feel salespeople are unprepared for calls - preparation is your competitive edge

What the Benchmark Gap Really Tells You

This is where most outsourced programs silently fail. Your vendor books 15 meetings a month, but only 4 are qualified - because they're dialing from a list where 30% of the numbers are dead. Data decays 2-3% per month. Roughly 100,000 mobile numbers get reassigned by wireless carriers every single day.

Your outsourced callers can only be as good as the numbers they're dialing.

AI Cold Calling - The Third Option

AI-powered cold calling has gone from novelty to legitimate option in the past 18 months. But it's not a silver bullet.

Performance Benchmarks by Model

| Model | Dials/Day | Connect Rate | Meeting Conv. | Cost/Meeting |

|---|---|---|---|---|

| Telemarketing | 100-200 | 3-6% | 2-5% | $600-$1,200 |

| SDR programs | 200-400 | 5-10% | 10-15% | $300-$600 |

| AI-enabled SDRs | 400-750 | 10-15% | 15-25% | $150-$300 |

AI-enabled SDRs using parallel dialing can push 400-750 dials per day, with cost-per-meeting running $150-$300 - roughly half the cost of traditional SDR programs.

When AI Fails

AI cold calling breaks in three specific scenarios.

Finite TAMs where reputation matters. If you're selling into K-12 education, there are a limited number of school districts. An AI misstep doesn't just lose one deal. It damages your reputation across the entire market.

Complex enterprise deals. When a prospect throws a nuanced objection about their existing tech stack, integration requirements, or budget cycle, AI stumbles. Human SDRs adapt in real time.

Conversations requiring emotional intelligence. A prospect who just got bad news, who's frustrated with their current vendor, who needs to vent before they'll listen - these moments require human judgment that AI can't replicate.

The right answer for most teams: hybrid. AI for top-of-funnel volume and basic qualification. Humans for high-touch engagement and complex conversations.

The Compliance Risk You Can't Afford to Ignore

If your cold calling agency violates TCPA, you are liable.

TCPA lawsuits surged roughly 95% in 2025 compared to the prior year. Class actions spiked 285% in September alone. The penalties are brutal:

- $500 per call for standard violations

- $1,500 per call for willful violations

- Up to $50,120 per call for DNC violations

Do the math on a 10,000-dial campaign where something goes wrong. That's $5 million in exposure at the low end.

AI voices are regulated. The FCC clarified in February 2024 that AI-generated voices qualify as "artificial or prerecorded" under TCPA.

State laws are multiplying. Texas SB 140 (effective September 1, 2025) expanded "telephone solicitation" to include texts, tied violations to the Deceptive Trade Practices Act with treble damages, and requires registration plus a $10,000 security bond. At least 15 states now enforce their own mini-TCPA statutes with varying requirements.

The legal landscape is fracturing. The Supreme Court's McLaughlin v. McKesson ruling means district courts are no longer bound by FCC interpretations in civil TCPA cases. An Illinois court said texts aren't "telephone calls" under TCPA DNC rules. An Oregon court reached the opposite conclusion on the same day. Good luck making sense of that.

Practical compliance checklist for your vendor contract:

- Calling hours restricted to 8 AM-9 PM in the prospect's time zone

- Internal DNC list maintained and honored immediately

- Cross-checking against federal and state DNC registries

- Prior express written consent documented for any automated calls

- Accurate caller ID displayed on every call

- Opt-out requests honored immediately

- Data freshness checks before every campaign (those 100,000 daily number reassignments create real liability)

The hiring company bears liability alongside the vendor. Put compliance requirements in your contract. Audit them. This is true whether you outsource cold calling to a domestic agency or an offshore BPO.

How to Evaluate a Cold Calling Vendor

We've reviewed enough vendor proposals and post-mortems to know which questions separate serious buyers from easy marks.

"What's your average connect rate, conversation rate, and cost-per-qualified-meeting?"

Good answer: specific numbers with context. Red flag: vague claims about "industry-leading results." (If you want a deeper rubric, start with answer rate and what it implies about list quality.)

"How do you source and verify your calling data?"

Good answer: named data providers, verification process, refresh frequency. Red flag: "proprietary database" with no details. (Also see B2B contact data decay if you're auditing refresh cadence.)

"Walk me through your TCPA compliance process."

Good answer: specific procedures. Red flag: "We follow all applicable laws." (If you're unsure where the legal line is, read Is Cold Calling Legal?.)

"What happens if we're not seeing results by week 6?"

Good answer: defined optimization process. Red flag: "6-12 months to mature" as a blanket excuse.

"Do we own the data, scripts, and sequences you develop?"

Good answer: yes, with clear IP terms.

"What CRM integrations do you support, and will I have real-time access to reporting dashboards?"

Good answer: native integrations with your CRM (Salesforce, HubSpot) and a live dashboard. (If your ops team is stuck, cold calling CRM integration is the blueprint.)

Red flags that should kill a deal:

- Won't share connect rate, conversion rate, or cost-per-meeting benchmarks

- Requires annual contracts without offering a pilot period

- Can't explain TCPA compliance beyond surface-level platitudes

- Uses the same generic scripts across all clients

- No CRM integration or real-time reporting access

For proof that outsourced calling can work at scale: Callbox worked with a logistics company and generated 3 new deals worth $6 million in pipeline.

Best calling windows: Tuesday 8-10 AM (18% response rate), Wednesday 4-6 PM (20%), Thursday 4-6 PM (22%). If your vendor isn't prioritizing these windows, ask why. (More timing tactics: outbound calling strategy.)

Top Cold Calling Outsourcing Companies Compared

I haven't done deep engagements with every vendor on this list, but I've seen enough proposals, results, and post-mortems to give you a useful starting point. (If you want a broader shortlist, compare against our roundup of cold calling companies.)

SalesRoads

SalesRoads is the safe pick for mid-market B2B teams with real budget. 17+ years in business, 100,000+ appointments set, and a 4.9/5 on Clutch across 65 verified reviews. Typical projects run $50,000-$199,999. Strengths: communication, project management, caller quality. The knock? Initial setup can be bumpy - multiple reviewers noted a ramp period before things clicked. But once it does, the output is consistent. If you're spending $50K+ on a cold calling engagement and need a vendor you won't have to babysit, SalesRoads belongs on your shortlist.

Martal Group

Use this if: You're an SMB or mid-market SaaS company testing outbound for the first time. Skip this if: You need enterprise-grade QA or want to own your sequences and prospect lists.

Retainers run $5,000-$12,000+/month, or $400-$1,200 per held meeting on a pay-per-meeting model. 2,000+ B2B clients across 50+ verticals. Good for getting started. Not great for long-term partnership - they retain your sequences and prospect lists, which creates lock-in you'll regret later.

SalesHive

SalesHive offers one of the clearest tier structures in the market. US-based teams: $7,000-$12,000/month. Philippines-based teams: $4,500-$7,000/month. Straightforward, no hidden fees. If transparent pricing is your top priority, start here.

Superhuman Prospecting

Month-to-month contracts with flexible packages based on dial volume, including a Flex subscription offering 300-2,000 calls monthly. All cold callers are US-based direct hires (not freelancers). Good option for teams that want domestic callers without a long-term commitment.

Other Notable Providers

EBQ positions as a full-service revenue operations partner - not just cold calling. Belkins is worth watching for their cost optimization over time (remember that Year 1 to Year 3 curve). Sales Focus Inc. starts at $3,950/month, making them one of the more accessible entry points for dedicated outsourced SDRs.

Vendor Comparison Summary

| Vendor | Pricing | Best For | Clutch Rating | Contract |

|---|---|---|---|---|

| SalesRoads | $50K-$200K/project | Mid-market B2B | 4.9/5 (65 reviews) | Project-based |

| Martal Group | $5K-$12K+/mo | SMB/mid-market SaaS | Mixed | Flexible |

| SalesHive | $4.5K-$12K/mo | Transparent pricing | Not public | Monthly |

| Superhuman | Volume-based packages | Budget startups | Not public | Month-to-month |

| EBQ | Mid-market retainers | Full-service RevOps | Not public | Quarterly+ |

| Belkins | Cost curve leader | Long-term optimization | Not public | 6-month+ |

| Sales Focus Inc. | From $3,950/mo | Accessible entry point | Not public | Monthly+ |

How to Implement Outsourced Cold Calling: 8-Step Blueprint

I've seen teams waste months on this. Here's the compressed version of what actually works.

Step 1: Define your ICP with painful specificity. Industry, company size, titles, tech stack, buying triggers. Vague ICPs produce vague results. (If you need a template, start with ideal customer.)

Step 2: Define "qualified meeting" before the first dial. Write it down. Get your closers to sign off. If you skip this step, you'll spend Month 2 arguing about what counts. (A tighter scoring model: lead qualification framework.)

Step 3: Provide clean, verified data. Build your prospect list using a B2B data platform like Prospeo - 30+ search filters including buyer intent and technographics - then verify every contact before your outsourced team touches it. Stale data is the #1 reason outsourced campaigns underperform. (If you’re building a direct-dial list, use this B2B phone number guide.)

Step 4: Build human-sounding scripts. Letting prospects talk roughly 70% of the time boosts success rates by nearly 20%. (For deeper scripts + KPIs, see our B2B cold calling guide.)

Step 5: Train for objections before going live. Training and coaching can improve conversion rates by up to 38%. (If you want a structured program, use cold calling training.)

Step 6: Set performance metrics. Track these daily: dials per day (expect 150-250 per rep), contact rate, conversation rate, qualified meeting rate, and show-up rate. The show-up rate is the metric most teams forget - 75% is the benchmark. If yours is below 60%, your meeting qualification criteria are too loose.

Step 7: Establish daily feedback loops with closers. Your closers know which meetings were garbage and which were gold. That signal needs to flow back to the calling team within 24 hours, not at a monthly review.

Step 8: Start small, stabilize, then scale. Begin with 1-3 callers for a 2-4 week pilot. Once you've validated the process and the economics work, scale the team or layer in additional channels alongside your outsourced sales calls.

For proof this works: Inside Sales Solutions ran this playbook with TouchPoint Medical and generated 400+ meetings and $800K in closed-won value.

At $3,000-$5,000 per meeting in Year 1, every dead number your vendor dials is money incinerated. Prospeo delivers 98% email accuracy and verified direct dials at $0.01/contact - so your outsourced callers spend time selling, not listening to disconnected tones.

Cut your cost-per-meeting by giving callers data that actually connects.

FAQ

How long does it take to see results from outsourced cold calling?

Most vendors go live in 2-4 weeks, with meaningful pipeline data emerging by month 2-3. In-house teams take ~3 months to hire and another 3-4 months to ramp. Expect the first month to be mostly optimization - script testing, data refinement, and calibration on what "qualified" means in practice.

Is outsourced cold calling worth it for startups?

Yes, if your ICP is defined and your deal size justifies the cost. At $3,000-$6,500/month outsourced versus $9,800-$14,200 fully loaded in-house, the math favors outsourcing until you build internal enablement. For teams selling deals under $15K, pay-per-meeting models ($175-$350) keep risk low.

Who is liable if an outsourced vendor violates TCPA?

You are. The hiring company bears liability alongside the vendor. TCPA penalties run $500-$1,500 per call, with DNC violations reaching $50,120 per call. Put compliance requirements in your contract and audit quarterly.

What data should I provide to an outsourced cold calling team?

Verified prospect lists with direct dials and confirmed emails - plus company firmographics, prospect title, and intent signals. If your list is more than 30 days old, re-verify before handing it off. Data decays fast, and bad numbers don't just waste dials - they create TCPA exposure.

Should I choose US-based or offshore cold callers?

US-based callers ($5,000-$8,000/month) are worth the premium for complex B2B conversations in enterprise software, financial services, or healthcare. Offshore ($1,500-$3,000) delivers 50-70% labor savings for high-volume, simpler campaigns. Most mature programs use a hybrid model.