How to Get Verified Decision Maker Contacts in 2026 (Without Bounces)

You can pay five figures a year for "data" and still miss the one person who can approve budget. Then your first sequence hard-bounces at 6% and your domain reputation takes the hit.

Verified decision maker contacts aren't "a list." They're a standard, a workflow, and a feedback loop you run every week.

Here's the thing: most teams don't have a sourcing problem. They've got a hygiene problem.

What you need (quick version)

Use this as your non-negotiable checklist. Skip steps and you'll pay for it in bounces, spam placement, and wasted rep hours.

- A strict definition of "verified": verified = role + deliverability + reachability + recency

- Hard bounce guardrails (track weekly, not monthly):

- <2% = safe

- 2-5% = warning

- >5% = critical

- <1% = ideal if you care about inbox placement

- A verification layer that does more than "syntax checks"

- A suppression/opt-out list that's always applied before sending

- A catch-all policy (keep vs discard vs alternate channel)

- A refresh cadence that matches reality (weekly beats "monthly refresh" every time)

- A source you can trust (and a way to measure it by source)

What "verified decision-maker contacts" actually means (a strict standard)

Most teams treat "verified" like a vendor label. That's how you end up emailing the wrong person at the right company with an email that technically exists, but doesn't reach anyone who can buy.

Here's the strict standard that holds up in production.

Verified decision-maker contact = a contact record that is:

- Role-accurate: the person is a real decision-maker (or part of the buying group) for what you sell, right now.

- Deliverable: the email address can receive mail without hard-bouncing.

- Reachable: you can realistically get a response via at least one channel (email, mobile, or an alternate path like a switchboard + extension).

- Recent: the data was updated recently enough that job changes and mailbox deactivations don't wreck you.

Recency is the part most teams ignore. "Monthly refresh" sounds responsible; in practice it's stale. In fast-moving segments (SaaS, agencies, anything VC-backed), people change roles constantly and mailboxes get shut off quickly, so a record that looked fine in January can be a bounce (or the wrong person) by February.

The teams with the lowest bounce rates don't have "the best database." They have the best refresh + verification + suppression discipline.

Decision-maker accuracy also isn't just title matching. "VP" can be a budget owner or a vanity title, and I've seen teams burn weeks chasing a "Head of Growth" who was really an IC with a fancy title while the actual buyer sat in RevOps two desks away. (If you want a deeper framework for how buying groups actually work, see B2B decision making.)

Definition callout: "Verified decision-maker contacts" means the role is correct, the email is deliverable, the person is reachable, and the record is recent enough to trust.

You just read why refresh cadence and 5-step verification separate real data from bounce factories. Prospeo runs every check in that stack - SMTP handshake, catch-all detection, spam-trap filtering, risk scoring - on a 7-day refresh cycle across 300M+ profiles. The result: 98% email accuracy and hard bounce rates under 2% out of the box.

Replace your hygiene problem with decision-maker contacts you can actually send to.

The verification stack (minimum checks before you send)

Email validation and email verification get used interchangeably, and that causes bad decisions.

- Validation is the shallow stuff: "does this look like an email address?"

- Verification is the operational stuff: "will this mailbox accept mail, and how risky is it?"

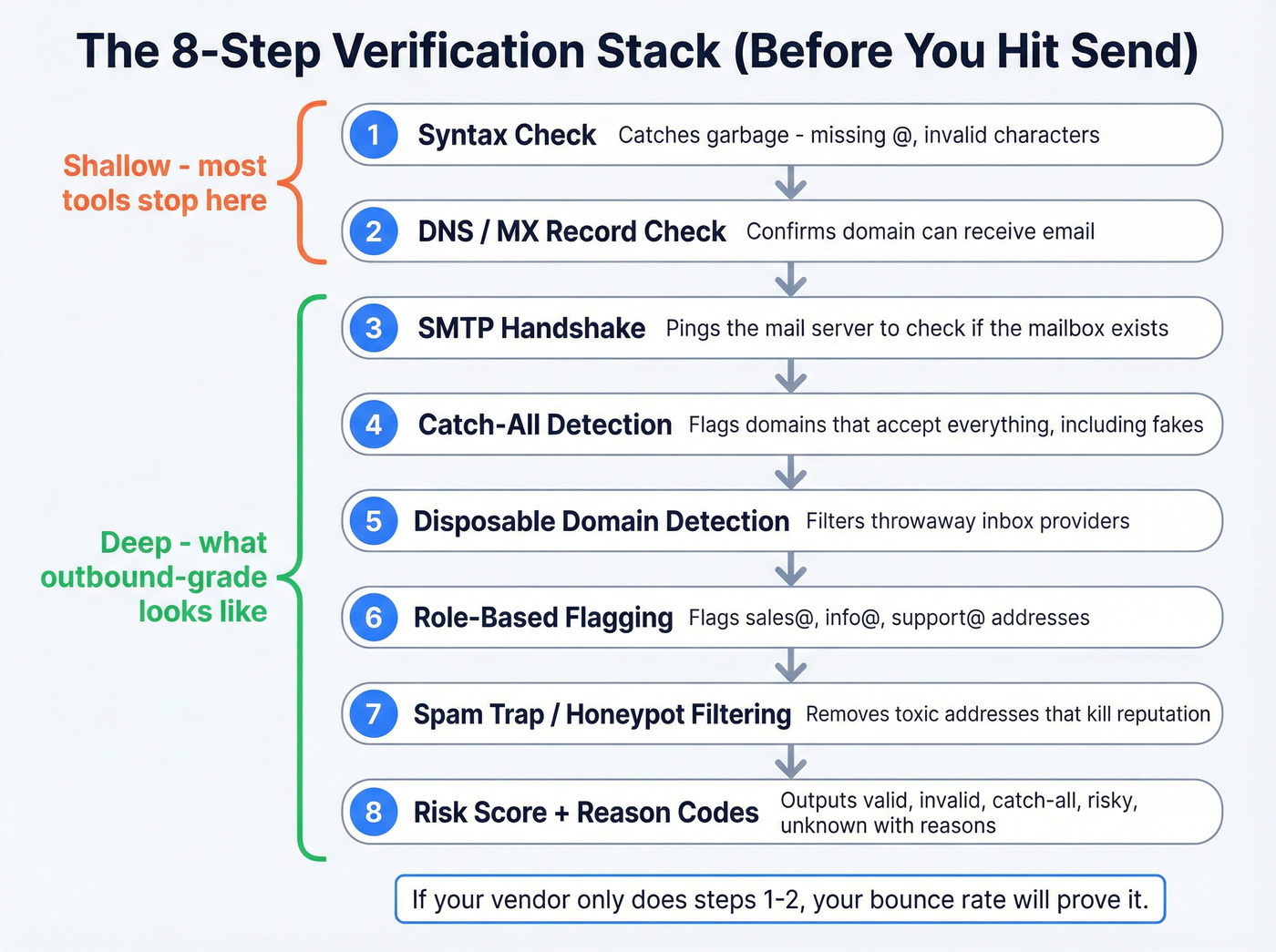

A real verification stack runs like this:

Syntax check Catches obvious garbage (missing @, invalid characters, broken domains). Baseline, not a differentiator.

DNS / MX record check Confirms the domain is configured to receive email. No MX records usually means you're dead on arrival.

SMTP handshake (mailbox-level signal) This is where tools separate. The verifier pings the mail server to see whether the mailbox exists or is accepted.

Some providers "accept all" at SMTP and silently drop later. That's why you don't treat "accepted" as "safe" without the next checks.

- Catch-all detection Catch-all domains accept everything, including fake addresses. That means "SMTP accepted" doesn't equal "deliverable." You need a catch-all flag so you can treat those addresses differently.

Operational rule: if a domain is catch-all, assume the email is unproven until your system gives you a risk bucket and you've seen real sends succeed.

Disposable domain detection Filters out throwaway inbox providers. In B2B outbound, disposable emails are almost always noise or risk.

Role-based flagging (sales@, info@, support@) Sometimes role inboxes are useful (partnerships@ can be real). Most of the time they're a routing problem. Flag them so they don't sneak into exec sequences.

Spam-trap / honeypot risk filtering (or an equivalent "toxic address" layer) This is the edge case that burns teams: an address can be syntactically valid and even "deliverable," but still be toxic for reputation. If your verification vendor can't explain how they handle traps/honeypots, you're taking unnecessary risk.

Risk score + reason codes The best systems don't just say valid/invalid. They output buckets like valid / invalid / catch-all / risky / unknown plus a score and a reason so you can decide what to do at scale.

Vendor output requirements (what to demand before you buy)

If your verifier can't output these fields, it's not outbound-grade:

- Status bucket: valid / invalid / catch-all / risky / unknown

- Risk score: 0-100 (or equivalent)

- Reason codes: e.g., mailbox_not_found, domain_invalid, catch_all, smtp_blocked, role_based, disposable

- Timestamp: when it was verified

- Domain flags: catch-all, free provider, disposable, accept-all behavior

- Suggested action: send / quarantine / don't send

I've watched teams "verify" a list with a lightweight validator, celebrate a low invalid count, then get crushed by catch-alls and reputation issues two weeks later. This stack prevents that. (For a full SOP, see email verification list.)

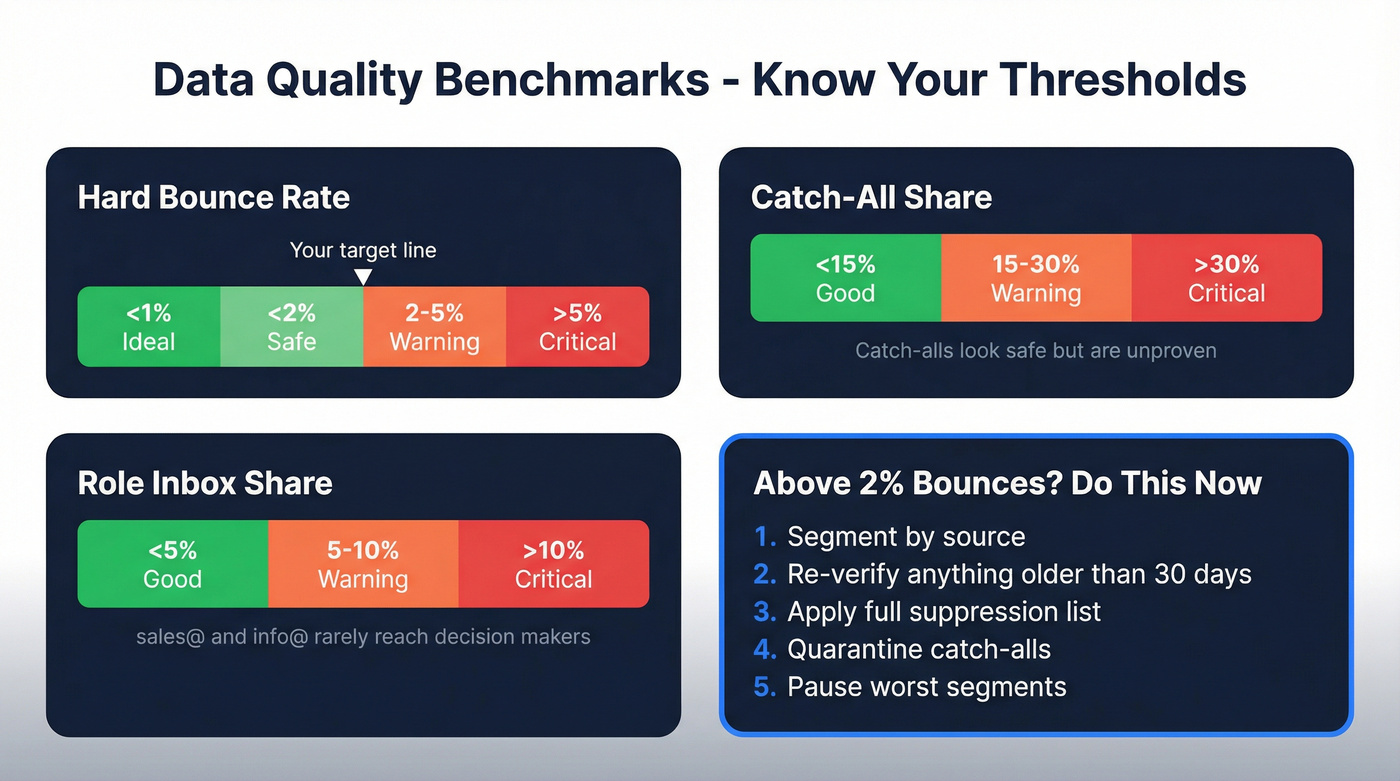

Benchmarks that prove your data's actually verified

If you don't measure bounce rate like a KPI, you're guessing. Deliverability punishes guessing.

These are the thresholds we use with RevOps teams, and they're simple enough that nobody can hide behind "it depends."

| Metric | Good | Warning | Critical | What it means |

|---|---|---|---|---|

| Hard bounce rate | <2% | 2-5% | >5% | Data quality issue |

| Ideal hard bounce | <1% | - | - | Strong hygiene |

| Catch-all share | <15% | 15-30% | >30% | Risky domains |

| Role inbox share | <5% | 5-10% | >10% | Bad targeting |

If you're above 2% hard bounces, do this (in order):

- Segment by source (Tool A vs Tool B vs manual vs old CRM). Don't average away the problem.

- Re-verify everything older than 30 days, especially fast-turnover roles.

- Apply suppression (opt-outs, past bounces, do-not-contact, competitors, internal domains).

- Quarantine catch-alls into a separate sequence with lower volume and safer copy.

- Stop sending to the worst segment until you fix it.

Continuing to blast a 6% bounce list is how domains die. If you're seeing SMTP-level failures like recipient rejection, troubleshoot with 550 Recipient Rejected.

How to build verified decision maker contacts (a pipeline, not a list)

A verified pipeline is a loop. Lists are dead the moment you export them.

Use this workflow:

- Source: pull targets from a database, firmographic source, or manual research (including C-level contacts when the deal needs executive sponsorship)

- Enrich: fill missing fields (title, seniority, department, company size, tech stack)

- Verify: run the verification stack and get valid/invalid/catch-all/risky

- Suppress: remove opt-outs, prior bounces, and "do not contact" records

- Send: sequence with volume controls and channel mix

- Monitor: hard bounces + replies + spam complaints

- Feedback loop: push outcomes back to your source scoring (by provider, domain type, segment)

Catch-all playbook (the part that quietly wrecks teams)

Catch-alls aren't "bad." They're just uncertain.

- Keep catch-alls when the role fit is strong and you have an alternate path (mobile, switchboard, or a second email pattern).

- Discard catch-alls when you're near the 2% bounce line or you're warming a new domain.

- Alternate channel: if it's a catch-all exec, lead with mobile or a short routing email ("Who owns X?") instead of a full pitch.

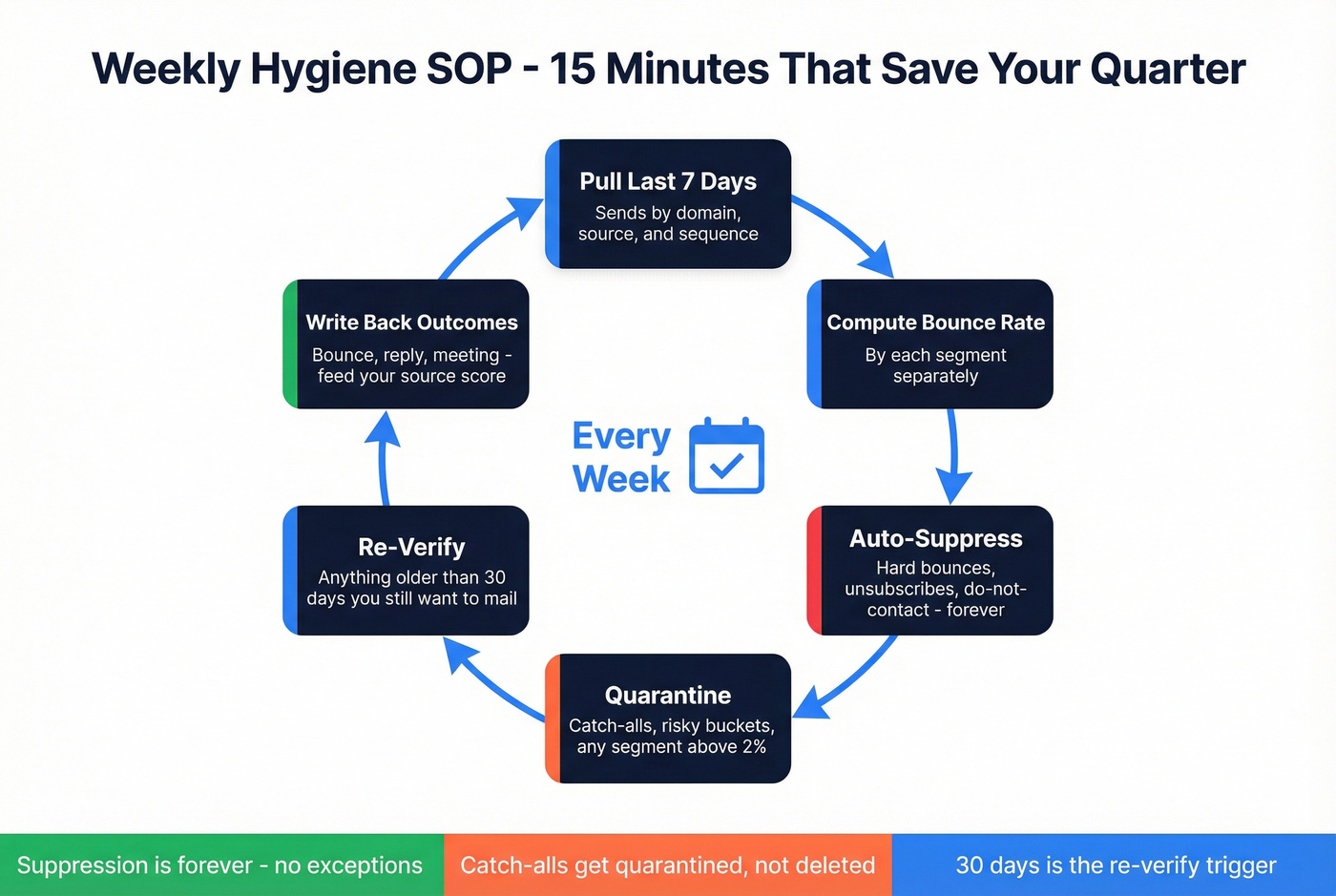

Weekly hygiene SOP (15 minutes that saves your quarter)

Run this every week. Put it on the calendar like pipeline review.

- Pull last 7 days of sends by domain + source + sequence.

- Compute hard bounce rate for each segment.

- Auto-suppress:

- all hard bounces (forever)

- all unsubscribes/opt-outs (forever)

- all "do not contact" flags (forever)

- Quarantine:

- catch-all + risky buckets

- any segment above 2% bounces

- Re-verify anything older than 30 days that you still want to mail.

- Write back outcomes (bounce, reply, meeting) to your "source score."

Source scoring sheet (simple fields that actually change outcomes)

If you want data quality to improve month over month, track these fields per source/provider:

- % valid (post-verification)

- % catch-all

- Hard bounce rate (actual sends)

- Reply rate (email)

- Connect rate (phone)

- Wrong-person rate (title mismatch, wrong department)

- Median age of record at send (days since verified)

- Duplicate rate (how much cleanup your CRM needs)

Suppression isn't optional. It's the difference between "we do outbound" and "we get blocked." Your suppression list should include opt-outs, unsubscribes, prior hard bounces, and internal domains, and it should be applied automatically before every send. If you want a broader governance framework, read how to keep CRM data clean.

Where Prospeo fits in a sane stack: it's a clean source + enrichment + real-time verification layer with a 7-day refresh cadence (industry average is 6 weeks), so you're not building sequences on stale records. If you're prospecting from web sources, the Chrome extension is the fastest capture-to-verify path I've used: grab the contact, verify it, and move on before you lose the thread. (If you’re evaluating options, compare against other B2B data providers.)

We've run bake-offs where the "biggest" dataset lost because it created a mess downstream (duplicates, stale titles, bounce spikes). The winning stack was the one that kept hygiene tight and refresh frequent, even if it had fewer total records on paper.

Three ways to get decision-maker contacts (choose based on your starting point)

Most teams need one source + one verification layer. The mistake is buying five sources and verifying none of them well.

Option 1: Database search + filters

Use this if: you need net-new decision-makers fast and you want repeatable targeting by role + company signals. Skip this if: your ICP's tiny and niche - you'll pay for lots of irrelevant records.

My take: if you're building pipeline this month, this is the default. It's the only option that scales without turning your reps into researchers. If you need a list of options, start with these B2B email lookup tools.

Option 2: CRM/CSV enrichment

Use this if: you already have accounts/leads but your records are missing titles, phones, or current emails. Skip this if: your CRM's a junk drawer and you haven't deduped - enrichment will amplify the mess.

My take: enrichment is the highest ROI when your account list is right and your contact layer is wrong. If you’re building workflows, see lead enrichment tools.

Option 3: Manual sourcing + verification layer

Use this if: you're going after high-value accounts and need precision (buying committees, specific initiatives). Skip this if: you need volume this week - manual sourcing doesn't scale without process.

My take: manual sourcing wins deals when you pair it with strict verification and a tight "who owns this?" routing message. Manual sourcing without verification is just expensive guessing. For scripts, use how to ask for the right contact person.

Tools that help you get verified decision-maker contacts (2026 shortlist)

ZoomInfo's still the default in a lot of enterprise orgs, and it's genuinely powerful. It's also the easiest way for smaller teams to overbuy. Expect it to land around $15k-$60k+/year depending on seats and modules; exact pricing isn't published.

Real talk: if your average deal's closer to a few thousand than a few dozen thousand, you probably don't need a ZoomInfo-sized suite. You need clean verified contacts, a refresh cadence you can trust, and ruthless suppression.

This shortlist is the practical stack for getting reliable buyer contacts without turning RevOps into a procurement project.

Quick comparison (pricing + metering reality)

Rule of thumb: if a vendor doesn't publish refresh cadence, treat records as stale after 30 days and re-verify before sending.

| Tool | Best for | Verification signal | Refresh signal | Metering | Starting price |

|---|---|---|---|---|---|

| Prospeo | Source + verify | 5-step + traps + catch-all | 7-day refresh | ~$0.01/email; 10 credits/mobile | Free; ~$39/mo+ |

| Apollo | DB + sequencing | Medium | Treat stale after 30d | Exports + mobiles | $0; $49/user/mo+ |

| Crunchbase | Account-first | Medium | Monthly | Contacts add-on | Add-on $29/mo (100 contacts) |

| Zeliq | Predictable credits | Medium | Treat stale after 30d | 1/email; 10/mobile | $59/mo |

| Lusha | Fast reveals | Medium | Treat stale after 30d | 1/email; 10/phone | Free; ~$39-$79/mo |

| Kaspr | EU prospecting | Medium | Treat stale after 30d | Phones + exports | $49/user/mo |

| RocketReach | Simple lookups | Low-med | Treat stale after 30d | Lookups | $69/mo+ |

| NeverBounce | Bulk verification | High | N/A | Per verify | ~$0.003-$0.008/email |

| Hunter.io | Finder + verify | High | N/A | Searches + verify | $34/mo to start |

| Go4Database | Cheap volume | Low | Treat stale after 14d | Contacts/mo | $35/mo |

| ZeroBounce | Verification | High | N/A | Per verify | ~$0.003-$0.01/email |

| Snov.io | Outreach + finder | Medium | Treat stale after 30d | Credits | ~$35-$75/mo |

| Skrapp.io | Email finder | Medium | Treat stale after 30d | Credits | ~$49-$99/mo |

Prospeo (Tier 1)

Prospeo is the B2B data platform built for accuracy, and it shows where outbound teams actually feel it: 98% email accuracy, a 7-day data refresh cycle, and 5-step verification that treats catch-alls and toxic addresses as first-class problems (catch-all handling plus spam-trap removal and honeypot filtering). That combination is how you keep bounce rates down without slowing reps to a crawl, because you're not constantly cleaning up "valid-but-useless" records after the fact.

Coverage is deep enough to be a primary source: 300M+ professional profiles, 143M+ verified emails, and 125M+ verified mobile numbers. It's used by 15,000+ companies and 40,000 Chrome extension users, and the mobile channel performs: 30% pickup rate across regions. If you're running enrichment workflows, the match rates are strong too: 92% API match rate, and 83% of leads come back with contact data, with 50+ data points returned per enrichment.

Pricing's self-serve and transparent: ~$0.01 per verified email and 10 credits per mobile. The free tier includes 75 emails + 100 Chrome extension credits/month, which is enough to test it in your real workflow (not a toy demo) before you spend a dollar.

My call: best default source + verification stack for SMB and mid-market outbound if you care about freshness, accuracy, and avoiding annual contracts. (If you want the full breakdown, see Prospeo pricing.)

Apollo (Tier 1)

Apollo's the obvious starting point for many SMB outbound teams because it combines database + sequencing in one place. The trade-off is metering: the free plan talks about "unlimited email credits," but exports and mobiles are metered, which is where real usage lives once you get serious.

Pricing's clear: $49 Basic, $79 Pro, and $119 Org (minimum 3 users). If reps live inside Apollo, it's a clean setup. If you're feeding Outreach/Salesloft and exporting constantly, export caps become the bottleneck.

What users complain about: export/mobile credit burn and messy downstream CRM writes when governance is loose.

My call: best if you're sequencing inside Apollo. Skip it if your motion's export-heavy into another outbound platform.

Crunchbase (Tier 1)

Crunchbase is company-first. If your workflow starts with "find the right accounts" (funding, headcount growth, category) and then you want a few key people, it's a strong layer. Their contact data is refreshed monthly, positioned as reviewed by data experts, and monitored for compliance.

The pricing mechanic is unusually clear: contact data is an add-on with monthly caps that don't accrue. Add-ons are 100 contacts = $29/mo, 250 = $59/mo, 500 = $99/mo. If your usage is spiky, you'll feel that non-accruing cap immediately.

What users complain about: paying for contact caps they don't fully use in quiet months.

My call: best for account intelligence and clean firmographics. Don't buy it expecting a contact firehose.

Zeliq (Tier 1)

Zeliq's the cleanest "unit economics" model in this category because credits map directly to value. $59/mo includes 750 credits. A verified email is 1 credit, a mobile is 10 credits, and extra credits are explicit (for example, 2,500 credits for $109).

That makes forecasting simple: if you need 2,000 verified emails/month, you can do the math before you buy. It also forces good behavior: you stop spending mobile credits on low-fit titles.

My call: best if you want predictable credit math and lightweight operations. Skip it if you need enterprise governance or a broader suite.

Lusha (Tier 2)

Lusha's a fast "reveal contact" tool reps like because it's simple. Metering's straightforward: 1 credit for a verified email and 10 credits for a phone number, with a free plan that includes 70 credits/month. Unused credits roll over up to a 2x cap, which is genuinely useful for uneven prospecting weeks.

Pricing is tiered and seat-based; a realistic starting range for most teams is ~$39-$79/user/month depending on credits and features.

My call: best as a rep-level add-on when you need quick reveals and don't want a full database contract.

Kaspr (Tier 2)

Kaspr's popular for teams prospecting in Europe and wanting a straightforward credit model without enterprise overhead. Pricing starts at $49/mo Starter and $79/mo Business. Both tiers include "unlimited B2B email credits," but phones/direct emails are credit-based and exports have caps.

My call: best for EU-focused prospecting when you're realistic about phone credit consumption.

RocketReach (Tier 2)

RocketReach is a straightforward lookup tool with clean tiers: $69/mo for 100 lookups, $119/mo for 250, $209/mo for 500.

One recurring complaint is wrong-person matching for personal inboxes: "valid email, wrong human." For B2B work emails it can still be useful, but spot-check and verify before sending.

My call: best for simple, occasional lookups. Don't use it as your only source for high-stakes exec targeting.

NeverBounce + Hunter.io (Tier 2)

These are verification layers, not primary sources. The workflow is simple: source contacts anywhere, then double-check before sending to keep hard bounces under 2%.

- NeverBounce is built for bulk list cleaning: ~$0.003-$0.008 per email, with the lower end showing up at higher volumes.

- Hunter.io is great when you're doing a mix of finding + verifying: $34/mo to start, scaling with usage.

My call: if you run outbound at any real volume, you need a dedicated verification layer somewhere in your stack, even if you also buy a database. If you’re comparing vendors, start with these email verifier websites.

Go4Database (Tier 3)

Go4Database is cheap volume: $35/mo (Nano) or $59/mo (Micro). One reviewer reported ~25% bounces. Treat it as unverified raw material, not a ready-to-send dataset.

My call: only use it if you're willing to verify aggressively, send cautiously, and accept that you're buying volume, not quality.

ZeroBounce / Snov.io / Skrapp.io (Tier 3)

- ZeroBounce is another solid verification option: ~$0.003-$0.01 per email, with lower pricing at higher volume tiers.

- Snov.io is a lightweight finder + outreach tool: realistic starting range ~$35-$75/mo depending on credits and sending features.

- Skrapp.io is a lightweight email finder: realistic starting range ~$49-$99/mo depending on credits.

My call: fine as supporting tools. Don't confuse "finder + sender" with a verified decision-maker pipeline.

Your verification stack demands catch-all handling, honeypot filtering, and reason codes - not just syntax checks. Prospeo's proprietary 5-step verification delivers all of it at $0.01 per email, with 125M+ verified mobile numbers as a backup channel when email alone won't cut it.

Get the reachable, role-accurate contacts your pipeline depends on.

Compliance playbook for contacting decision-makers (US, UK, EU)

Compliance isn't a footer. It's part of "verified," because the fastest way to lose the right to contact decision-makers is to ignore opt-outs and lawful basis.

Use this decision tree, then follow the do/don't checklist.

Decision tree (high level)

If you're emailing US recipients:

- CAN-SPAM applies to B2B. Penalties go up to $53,088 per email.

- You must include opt-out and honor it within 10 business days.

- Your opt-out mechanism must process requests for at least 30 days after you send the message.

- You're still responsible for compliance even if a third party sends emails for you (agency, contractor, platform).

If you're emailing UK recipients:

- PECR depends on subscriber type: corporate subscribers vs sole traders/individual subscribers.

- Corporate B2B outreach is generally allowed without prior consent under PECR rules, but UK GDPR still applies.

- ICO guidance is under review due to the Data (Use and Access) Act effective 19 June 2026. As of 2026, treat existing ICO guidance as the practical baseline and re-check updates before you scale UK outreach.

If you're emailing EU recipients:

- GDPR requires a lawful basis. For B2B prospecting, legitimate interests is common, but you must justify it and respect objections.

Minimum transparency checklist (EU/UK practical standard):

- Who you are (legal entity + contact details)

- Why you're contacting them (purpose)

- What data you used and where you got it (source category)

- How to opt out / object (and that you'll honor it)

- How long you keep the data (a retention window you actually follow)

Do / don't checklist (practical)

Do:

- Include a working opt-out in every email.

- Honor opt-outs within 10 business days (US) and immediately operationally (everywhere).

- Include a valid physical postal address (US requirement; also a trust signal elsewhere).

- Keep a suppression list and never re-import opted-out contacts.

- For UK/EU, document your legitimate interests reasoning (a lightweight LIA: purpose, necessity, balancing test).

- Make the outreach role-relevant. Spray-and-pray is where compliance and deliverability both break.

Don't:

- Email sole traders in the UK like they're corporate. Under PECR they're treated like individuals and consent rules bite harder.

- Hide your identity, spoof headers, or use deceptive subject lines (CAN-SPAM).

- Buy a list and assume "public data" means "no GDPR obligations." Public still counts as personal data if it identifies a person.

The teams that stay out of trouble do boring things consistently: suppression discipline, clear opt-outs, and relevance.

FAQ: Verified decision-maker contacts

What's the difference between "verified" and "validated" emails?

Validated emails only check formatting rules (syntax) and basic structure. Verified emails run deeper deliverability checks like domain/MX, SMTP, and catch-all/disposable detection, then output a risk bucket you can operate on. If you're sending cold outreach, validation alone won't protect you from hard bounces and catch-all risk.

What should I do with catch-all domains marked "risky"?

Treat catch-all risky emails as a separate segment. Keep them only for high-fit targets, lower your send volume, and prefer alternate channels (mobile or switchboard) first. If your hard bounce rate's near 2%, quarantine catch-all sends until you're back in the safe zone.

What hard bounce rate is acceptable for cold outreach?

Under 2% is the safe operational threshold, 2-5% is a warning that your data/verification is slipping, and above 5% is critical and will damage deliverability. Under 1% is the standard if you want consistent inbox placement and stable sending domains.

What's a good free tool for finding verified contacts?

For small teams, Prospeo's free plan includes 75 email credits plus 100 Chrome extension credits per month, with real-time verification and a 7-day refresh cycle. Apollo and Lusha also have free tiers, but exports/phones get metered quickly, so you'll still want a strict verification + suppression step before sending.

How often should I refresh or re-verify contacts?

Re-verify anything older than 30 days before you send. If you're prospecting high-turnover roles (sales leadership, growth, RevOps, IT/security in fast-moving orgs), re-verify every 7-14 days. The goal isn't perfection; it's keeping hard bounces under 2% without slowing your team down.

Summary: the fastest path to verified decision maker contacts

Verified decision maker contacts come from a repeatable pipeline: role accuracy, real verification (not just syntax), catch-all rules, suppression, and a refresh cadence that matches how fast people change jobs. Track hard bounces weekly, keep them under 2% (under 1% if you're serious), and treat "verified" as an operating standard, not a vendor promise.