Investor Outreach: A Measurable Fundraising System (2026 Playbook)

Investor outreach used to mean guessing email formats and praying. Now the hard part isn't "how do I contact them?" - it's building a system that gets replies without torching your domain reputation or your time.

Treat it like a pipeline (not a vibe) and you'll move faster, sound sharper, and create momentum you can actually measure.

Here's the thing: most founders don't lose because their company is bad. They lose because their outreach is sloppy, untracked, and sent to the wrong people.

Which "investor outreach" do you mean?

Most people mean startup fundraising: you're raising a Seed/Series A, you need meetings, and you're trying to turn a cold list into a warm process.

But "investor outreach" also means public-company investor relations (IR): targeting institutions, running non-deal roadshows, and managing shareholder engagement. The overlap is real (targeting discipline, message clarity, tracking), but the rules aren't. Public companies have to stay on the right side of Reg FD and protect material non-public information (MNPI). You can't selectively disclose material updates to a subset of investors and call it "outreach."

Decision box (pick your lane):

- If you're a startup raising Seed/A: read on. This playbook's built for replies -> meetings -> term sheets.

- If you're doing public-company IR: your outreach is about (1) targeting the right institutions, (2) timing around earnings/proxy seasons, and (3) logging engagement context (e.g., "in blackout," "busy during earnings," "prefers group calls") so you don't misread silence as disinterest.

- If you're IR: coordinate messaging and disclosures with counsel/IR leadership. This isn't legal advice.

Everything below is written for startup fundraising outreach, with a few IR guardrails where they matter.

What you need for investor outreach (quick version)

Do only these things and you'll already be ahead of most founders:

- Pick a primary channel and stick to it. In VC cold outreach tests, contact forms beat email, and generic dealflow inboxes perform worst. Stop sending your best pitch to

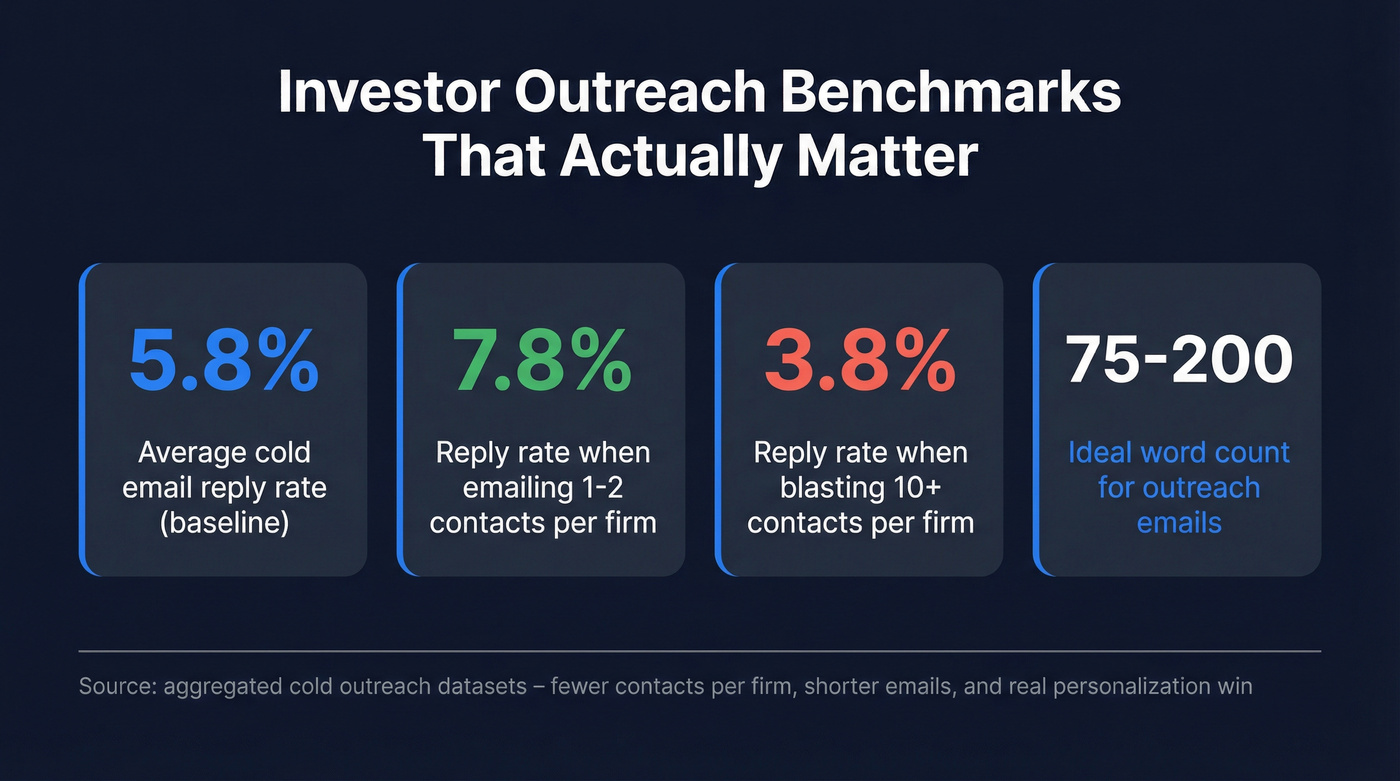

deals@unless you've got no alternative. - Email fewer people per firm, not more. Emailing 1-2 contacts per company drives ~7.8% replies, while blasting 10+ drops to ~3.8%. Same game here: one partner + one principal beats carpet-bombing the whole firm.

- Start with a baseline benchmark. Average cold email reply rate sits around 5.8% across large datasets. If you're at 1-2%, it's not "the market." It's your fit, your list quality, or your deliverability.

- Personalize the first 2 lines. Reply rates jump when outreach is shorter and actually tailored.

- Write short. 75-200 words, 6-8 sentences, one CTA. Anything longer reads like you're trying to sell the meeting.

- Run waves, not a blast. Wave 1 for feedback, Wave 2 for likely leads, Wave 3 for dream firms after you've tightened the story.

- Track it like a funnel. Sent/submitted -> accepted -> inboxed (estimated) -> replied -> positive reply -> meeting -> diligence -> term sheet. (If you want a tighter tracking model, borrow ideas from pipeline tracking.)

- Use a controlled deck link by default. Links keep you in control and give you engagement signal; attach a PDF only if an investor asks.

- Protect deliverability before Wave 1. Verify emails so bounces don't wreck your domain reputation and you don't lose good investor contact information to bad data. (Here’s a deeper SOP for email verification.)

Build your investor target list (without spray-and-pray)

Spray-and-pray feels productive because you're "doing outreach." It's also how you end up with 300 sends, 4 replies, and a bruised ego.

A good investor list is a targeting artifact, not a directory export.

Ideal investor profile (IIP) in 10 minutes

Write this on one page before you touch a database:

- Stage fit: pre-seed, seed, Series A, etc.

- Check size fit: typical first check and follow-on capacity.

- Thesis fit: what they're actively excited about (vertical, business model, go-to-market motion).

- Geography fit: where they actually invest (not where their website says they invest).

- Lead vs follow: know whether you're asking for a lead, a co-lead, or a "help us fill the round" check.

Most "no" replies aren't about your company. They're about fit.

Tighten fit up front and your outreach copy magically "gets better." (If you need a quick refresher on defining fit, see ICP vs persona.)

Where to source names (fast)

You don't need a fancy workflow. You need a repeatable one:

- Crunchbase: fast initial list by stage/industry + recent activity.

- PitchBook: deeper coverage, but priced like an enterprise system.

- Fund sites: partners/principals/associates + stated focus.

- Funding announcements: who led, who participated, which partner showed up.

- Portfolio pages: find pattern matches to your company.

Avoid these as primary targets:

deals@/ generic dealflow inboxes (worst-performing channel)- Generic "submit your deck" portals unless you can't find a better route

Clean contact data is part of targeting. If your list bounces, your domain reputation drops, and your best investors never even see Wave 2. (More on list decay and why it matters: contact data decay.)

Prioritization score (who to contact first)

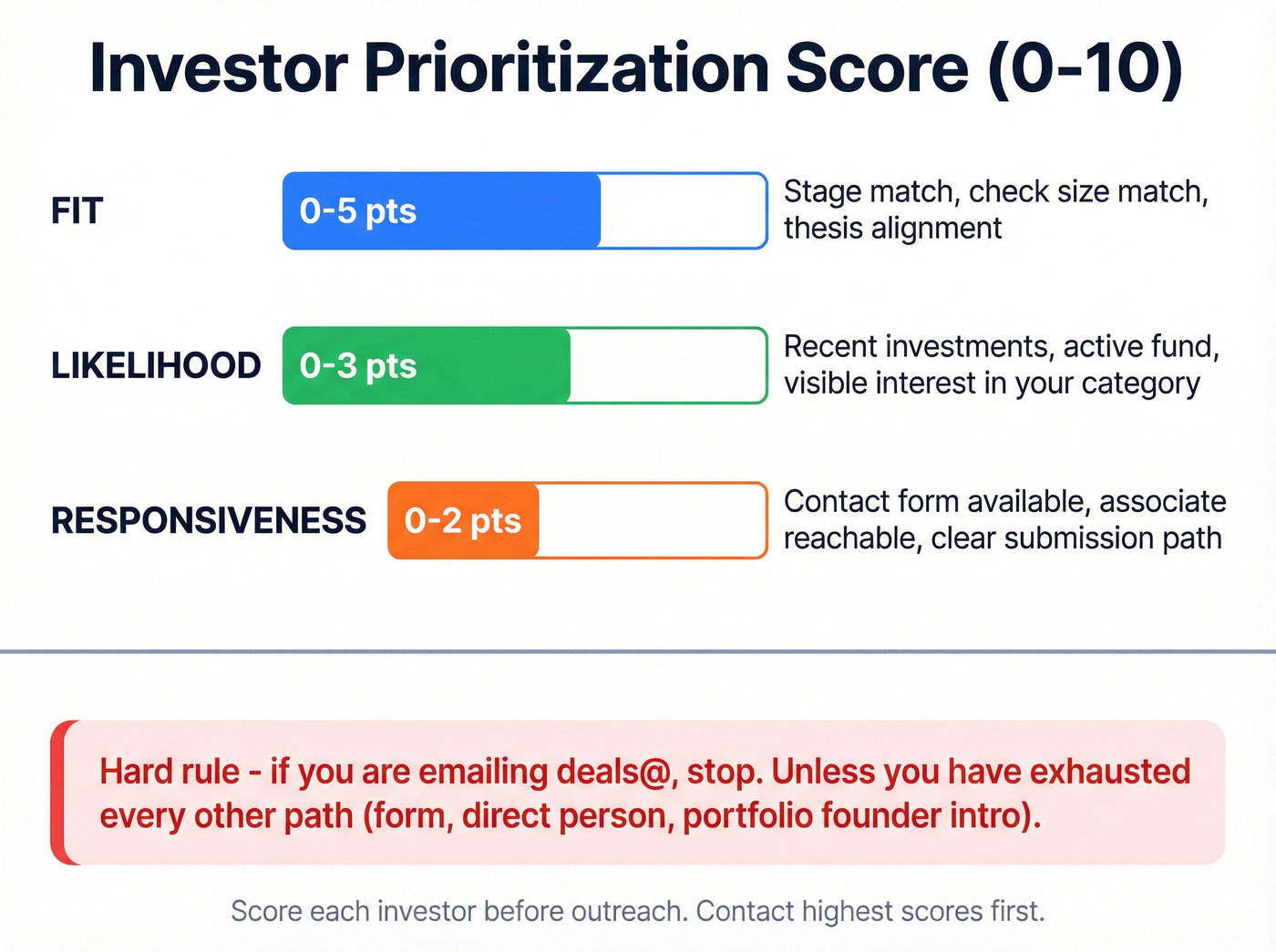

Use a simple 0-10 score so you're not guessing:

- Fit (0-5): stage + check size + thesis match

- Likelihood (0-3): recent investments, active fund, visible interest in your category

- Responsiveness (0-2): contact form available, associate/principal reachable, clear submission path

Hard rule: if you're emailing deals@, stop unless you've exhausted every other path (form, direct person, portfolio founder intro). deals@ is where good pitches go to die.

Wave 1 teardown checklist (before you hit send)

Use this like a pre-flight check:

- List: 1-2 contacts per firm max (partner + principal/associate)

- Fit: you can name why they invest in your category in one sentence

- Proof: you have one real signal (revenue, pilots, LOIs, usage, waitlist, regulatory milestone - something concrete)

- CTA: one ask (fit-check call), not "thoughts?" + "can I send a deck?" + "can you intro me?" (If you want tighter asks, use a sales CTA framework.)

- Deliverability: bounce risk under control (if bounce >2%, pause and fix data)

Suggested outreach stack (with realistic pricing)

| Tool | What it's for | Typical price |

|---|---|---|

| Prospeo | email finding + verification (credit-based) | Free tier (75 emails + 100 Chrome extension credits/month); typically ~$0.01 per verified email |

| DocSend | deck link + analytics | ~$10-$50/user/mo |

| Crunchbase | investor research | ~$30-$100/mo |

| Google Sheets | starter CRM / pipeline | Free |

| Airtable / Notion | pipeline tracking | $0-$20/user/mo |

| Apollo | outbound tooling (optional - don't blast investors) | ~$49-$99/user/mo |

| PitchBook | deep investor intel | ~$10k-$30k+/yr |

| Drive / Dropbox | data room | $0-$20/user/mo |

Use verified business contact data responsibly and honor opt-outs. Keep outreach targeted (again: 1-2 contacts per firm) to avoid spam signals and reputation damage.

Investor outreach strategy: the wave plan (soft raise -> active raise)

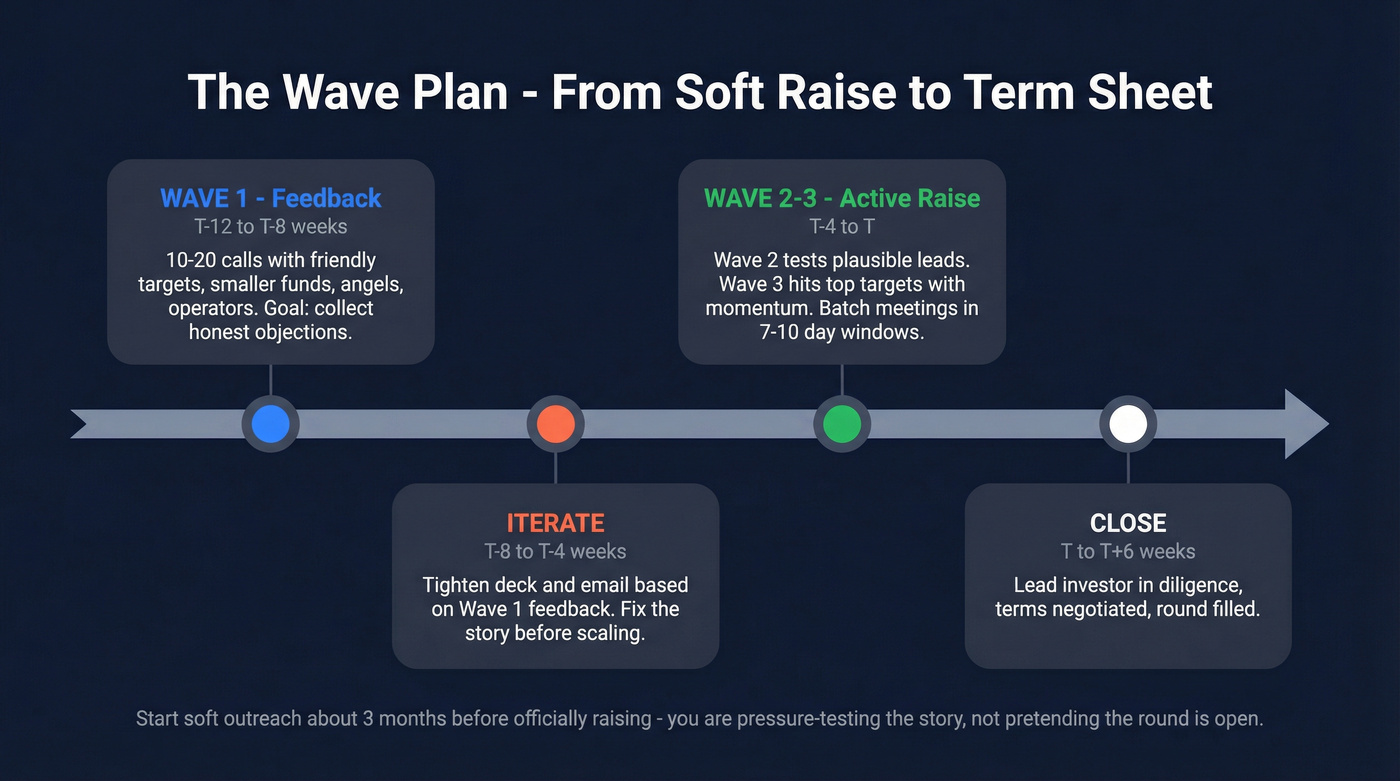

Start "soft" outreach about ~3 months before you're officially raising. You're not pretending the round is open; you're pressure-testing the story, collecting objections, and building a short list that recognizes you when the round actually moves.

Wave logic (the part most founders skip):

- Wave 1 (feedback wave): friendly targets, smaller funds, angels, operators. You want honest objections.

- Wave 2 (litmus wave): plausible leads. You're testing whether the tightened story converts to meetings.

- Wave 3 (momentum wave): top targets. You go here after you've iterated and you can point to movement.

A simple timeline that works:

| Time | Goal | Output |

|---|---|---|

| T-12 to T-8 weeks | Soft raise | 10-20 calls |

| T-8 to T-4 weeks | Iterate | tighter deck + email |

| T-4 to T | Active raise | lead + momentum |

| T to T+6 weeks | Close | diligence + terms |

Look, if your deal size is small and your round is modest, you don't need a "perfect" process - you need speed and clarity.

Momentum mechanics (how to create an "auction" without bluffing)

Momentum isn't fake scarcity. It's structured scheduling, and it works because it reduces decision friction: investors don't have to guess whether you're serious, whether other firms are leaning in, or whether they'll look silly spending time on something that isn't moving.

- Batch meetings into 7-10 day windows so investors feel the round moving.

- Use ethical urgency: "We're scheduling partner meetings next week" is true only if you've actually scheduled them.

- Send "round is moving" updates only when you have real movement: a lead in diligence, a committed check, or a clear timeline for decisions.

- Never invent deadlines. Investors can smell it, and it kills trust faster than a weak metric.

In our experience, the cleanest momentum comes from calendar discipline, not bravado: you run Wave 2, you stack meetings, you send one crisp update when something changes, and you stop rewriting the deck every other night.

Your investor list is only as good as your contact data. Prospeo verifies emails through a 5-step process - 98% accuracy, refreshed every 7 days - so your Wave 1 lands in the right inbox, not in a bounce log that tanks your domain reputation. At ~$0.01 per verified email, cleaning your investor list costs less than a single bad bounce.

Keep your bounce rate under 2% before you hit send on Wave 1.

Investor outreach emails that get replies (structure + templates)

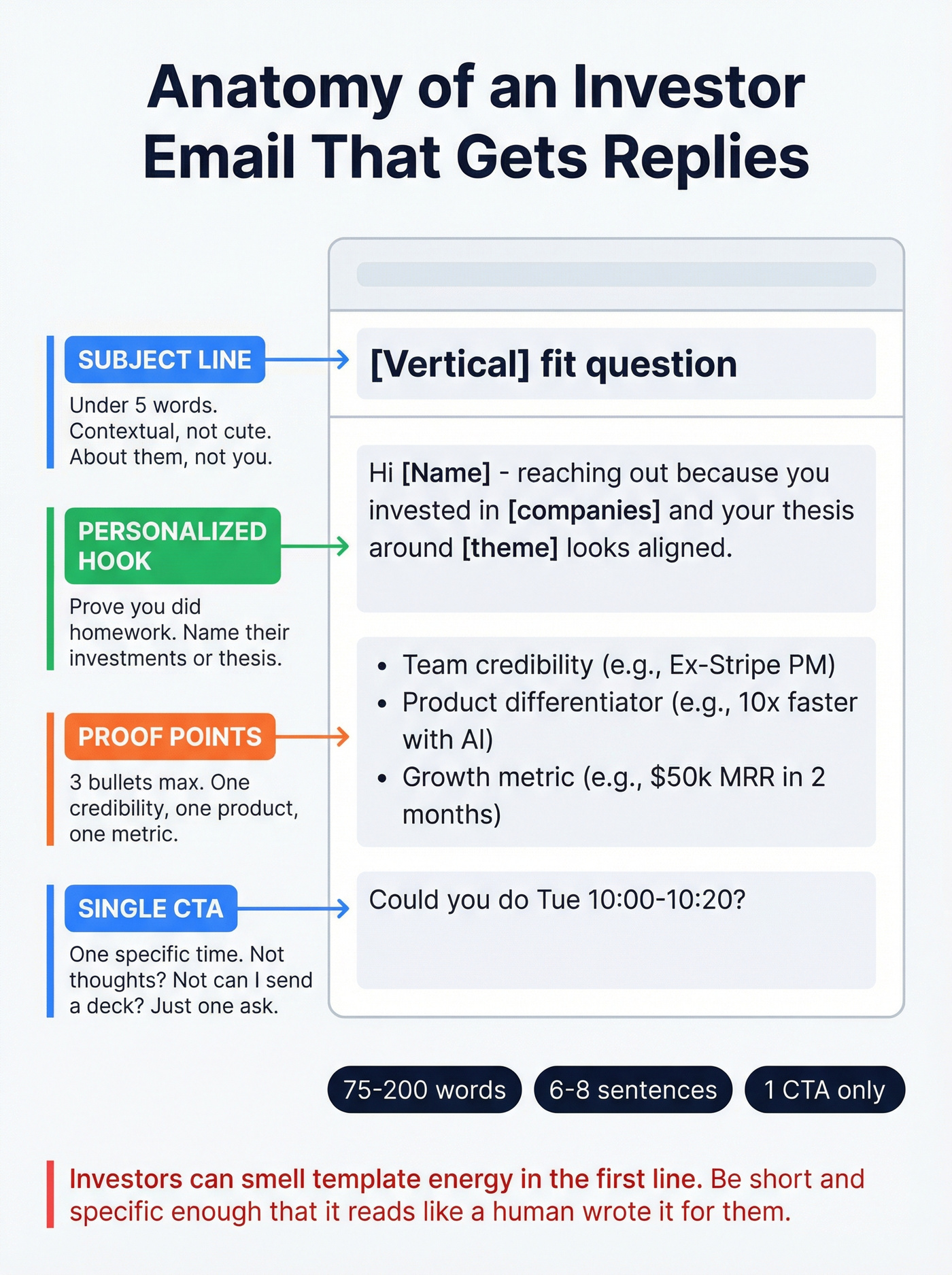

You're not writing marketing copy. You're writing a fast fit-check that makes it easy to say yes (or no).

Use these constraints:

- 75-200 words

- 6-8 sentences

- short paragraphs (2-3 sentences)

- one CTA

- subject lines under 5 words (If you want more ideas, see cold email subject lines.)

Investors can smell template energy in the first line. Your job's to be short and specific enough that it reads like a human wrote it for them.

Subject line patterns (copy/paste)

Keep it under ~5 words. Make it contextual, not cute:

- "Intro + quick ask?"

- "Fintech buyer fit question"

- "Congrats on launch - 1 idea"

- "Following up post [event]"

- "[Vertical] pilot question"

Hot take: "Raising Seed" is a weak subject line. It's about you, not them.

The "fit-check" email template (copy/paste)

Subject: [Vertical] fit question

Hi [Name] - reaching out because you've invested in [1-2 relevant companies] and your thesis around [theme] looks aligned.

We're building [one-line product] for [ICP], and we're seeing early pull:

- Team: [1 credibility bullet]

- Product: [1 crisp what-it-does bullet]

- Growth: [1 metric or proof point]

We're putting together a [Seed/Series A] round and I'd love a quick fit-check. If it's relevant, happy to share the deck link.

Could you do Tue 10:00-10:20, Wed 2:00-2:20, or Thu 4:00-4:20 [timezone]?

Thanks, [Name] [Title] | [Company] [Calendar link] | [Deck link if you're comfortable]

Concrete proof-point examples (use one, not five):

- SaaS: "$18k MRR, 12% MoM growth, 3 design partners converting to paid."

- Marketplace: "Supply live in 2 cities; 41% repeat rate on the demand side."

- Biotech: "IND-enabling studies started; signed CRO; clear milestone timeline for the next 90 days."

Personalization that's fast (and not creepy)

Personalization should take 30-60 seconds, not 10 minutes. Use the first two lines for one of these:

- Thesis match: "Your focus on X is why I'm reaching out..."

- Recent event: "Saw you led Y / wrote about Z..."

- Portfolio adjacency: "We're similar to [portfolio co] but with [clear difference]..."

Avoid:

- personal-life details

- overly specific "I saw you liked..." signals

- fake familiarity

Follow-up sequence (timing + scripts + stop rules)

Most founders under-follow-up because they don't want to be annoying. The first follow-up is where a lot of replies come from.

After follow-up #3/#4, returns drop hard. So you want a short, disciplined sequence, not a 12-touch zombie campaign. (If you want more cadence patterns, use a follow up email sequence model.)

Default 5-touch cadence table

| Touch | When | Purpose |

|---|---|---|

| 1 | T+0 | initial fit-check |

| 2 | T+24h | quick nudge |

| 3 | Day 3-5 | add proof point |

| 4 | Day 10-14 | traction update |

| 5 | Day 21-28 | close-the-loop |

Stop rule I actually follow: if bounce >2%, pause the campaign immediately. Don't power through follow-ups on a damaged list.

5-7 sentence follow-up scripts

Keep follow-ups to 5-7 sentences, one ask, one proof point.

Follow-up #1 (T+24h nudge)

Subject: Re: fit question Hi [Name] - quick bump in case this got buried. We're seeing [one proof point: growth %, customer name, revenue, pilot]. Is [category] something you're looking at right now? If yes, happy to do a 15-20 min fit-check. Tue/Wed/Thu still work on my side.

Follow-up #2 (Day 3-5 add value)

Subject: [Vertical] quick data point Hi [Name] - one quick data point we're seeing: [insight]. It's showing up across [ICP] and it's driving [outcome]. If you're open to it, I'd love your take in a short call. Could you do [two time windows]?

Follow-up #3 (Day 10-14 traction update)

Subject: Update: [metric] Hi [Name] - quick update since my last note: we hit [metric milestone] and [one more proof point]. We're opening conversations for the round now and I'm prioritizing investors with strong thesis fit. Worth a quick fit-check this week? [2 time slots] work for me.

Follow-up #4 (Day 21-28 close-the-loop / breakup)

Subject: Close the loop? Hi [Name] - I don't want to spam you. Should I (a) send a short monthly update, or (b) assume it's not a fit and close this out? If it's a fit, happy to work around your schedule for a quick call.

Two extra templates founders forget (and then regret)

These two emails keep momentum clean once someone engages.

Post-meeting thank-you (send within 0-24h)

Subject: Thanks + next step Hi [Name] - thanks for the time today.

My takeaways: (1) you're most interested in [X], (2) you want to see [Y], and (3) the main risk to address is [Z].

Next step on my side: I'll send [deck/data room link] + [one doc] and follow up on [date]. Does that work? If helpful, I can also loop in [cofounder/technical lead] for a deeper dive.

Materials / data room link (when they ask for deck, model, or diligence docs)

Subject: Materials for [Company] Hi [Name] - here's what you asked for:

- Deck: [link]

- Metrics/model: [link]

- Product/demo: [link] If you want to go deeper, what's the one question you'd like answered on the next call? Happy to do [two time windows].

Common objections (and the best 2-line replies)

This is what it sounds like in real life:

| Objection | Reply you can send |

|---|---|

| "Not our stage." | "Got it - thanks. What stage would you want to see us at (revenue, customers, approvals)? I'll follow up when we hit it." |

| "Send a deck." | "Sending now. If it's a fit, what's the fastest path to a partner-level decision - one call, or should we start with [principal/associate]?" |

| "Circle back in a few months." | "Will do. What 1-2 milestones should I hit before I reach back out so it's a productive re-open?" |

Benchmarks & KPIs (what "good" looks like in 2026)

Benchmarks keep you sane. Without them, every non-response feels personal.

Two baselines matter:

- Investor-specific upper bound: cold outreach can hit 30%+ response and 5-15% call rate when fit is tight and you use contact forms well.

- General cold email: average reply rate sits around 5.8% across large datasets.

Also: deliverability is the hidden tax. Roughly 17% of cold emails never reach the inbox. That's not copy. That's plumbing. (If you want a deeper breakdown, see email deliverability.)

Channel hierarchy (ranked)

- Contact forms (best)

- Direct emails to a specific person (good if deliverability's solid)

- Generic dealflow inboxes (worst)

Juniors can be great entry points. Response rates are similar across senior/junior, and juniors often move faster on scheduling.

KPI table (track by wave)

To avoid false precision, split "accepted" from "inboxed."

| KPI | Wave 1 | Wave 2 | Wave 3 |

|---|---|---|---|

| Sent/submitted | 30-60 | 40-80 | 30-60 |

| Accepted (SMTP delivered) | 95-99% | 95-99% | 95-99% |

| Inboxed (estimated) | 80-90% | 80-90% | 80-90% |

| Bounce | <2% | <2% | <2% |

| Reply | 6-15% | 8-20% | 10-25% |

| Positive reply | 2-8% | 3-10% | 4-12% |

| Meetings | 1-5% | 3-8% | 5-15% |

Hard position: if Wave 1 reply rate's under 5%, don't move to Wave 2. Fix targeting first. Scaling a broken message is how you waste a month and convince yourself fundraising is "impossible" this year.

Simple decision system (who gets follow-ups vs updates)

- High fit + engaged (replied / asked Q / clicked deck): full cadence

- High fit + no engagement: 2 follow-ups, then monthly updates

- Low fit + any engagement: one polite reply, then stop

- No fit signals (wrong stage/check): don't send follow-up #3/#4

Deliverability & list hygiene (don't burn your domain)

If your deliverability's bad, this whole thing feels like shouting into the void.

I've seen teams spend weeks rewriting emails, only to find out later they were bouncing at 6-10% because someone exported a messy list, skipped verification, and kept sending follow-ups anyway. That's not "grit." That's self-sabotage.

30-minute setup checklist (plus warm-up rules)

Do this once, then stop thinking about it:

- SPF set correctly

- DKIM enabled for your sending domain

- DMARC policy in place (start with monitoring, then tighten)

- Use plain text-ish formatting (no heavy HTML)

- Keep links minimal (one deck link is fine)

Warm-up rules of thumb (operational, not theoretical):

- New domain: start 10-20 emails/day, ramp weekly; avoid sudden spikes.

- Stick to one sending address; don't rotate accounts to game limits.

- Don't change domains mid-raise unless you absolutely have to.

Tracking pixel tradeoff

Turning open tracking off can lift replies (and it reduces filter risk). Practical compromise:

- Turn open tracking off

- Track link clicks (deck link)

- Use DocSend engagement as your interest signal instead of pixel opens

Turning off open tracking can improve response rates by ~3%.

Practical workflow: verify contacts before Wave 1

This is where founders accidentally hurt themselves: they build a list, send Wave 1, bounce 6-10%, and now every follow-up fights a damaged sender reputation.

Prospeo is the publisher's tool ("The B2B data platform built for accuracy"), and it's genuinely useful here because it keeps list hygiene boring: 98% email accuracy, 5-step verification (including spam-trap/honeypot removal), and a 7-day refresh cycle so records don't rot while you're still iterating Wave 1. (If you’re comparing options, start with email verifier websites.)

Workflow that takes 10 minutes:

- Export your investor list (CSV) from Crunchbase / your research.

- Verify and keep only Valid (optionally keep "Risky" for later).

- Send Wave 1 only to verified addresses.

- Log bounces and opt-outs so you don't re-send later.

What to look for in the results screen:

- Export Valid for Wave 1 (protects your domain).

- Keep Risky for later waves or use them for contact forms (no bounce risk).

- Drop Invalid entirely.

Skip this if you're only using contact forms and never emailing. Otherwise, verification pays for itself the first time it saves your domain from a bad export.

Collateral that matches how investors actually read

Investors spend under 3 minutes on a deck. Optimize for skimmability, not completeness:

- Typical deck is ~20 slides

- Aim for ~50 words per slide

- Organize around ~12 sections

Deck checklist (12 sections)

- Title (company + one-liner)

- Problem

- Solution

- Product (what it does)

- Why now

- Market size

- Business model

- Traction

- Go-to-market

- Competition

- Team

- The ask (round size + use of funds)

Opinion: the best decks read like a memo with pictures. If your slides require narration to make sense, you don't have a deck - you've got speaker notes.

Data room structure

Use Dropbox or Drive. Make it easy to navigate.

Suggested folders:

- 00_Deck (latest)

- 01_Financials (model, KPIs)

- 02_Product (demo video, roadmap)

- 03_Customers (case studies, references if allowed)

- 04_Legal (cap table, incorporation docs)

- 05_Security/Compliance (only if relevant)

What not to include early:

- Anything sensitive you don't want forwarded

- Customer contracts with confidential terms (until later diligence)

Don't attach PDFs (unless asked)

Attachments get forwarded, stripped of context, and you lose control. Use a controlled link by default:

- update the deck without re-sending

- restrict downloads

- see engagement patterns that inform follow-ups

Tracking system: investor CRM schema + "warm intro substitutes"

If you're not tracking outreach, you're not fundraising - you're just emailing.

A lightweight CRM is enough. Airtable's my default because it's fast to customize and easy to filter/sort when you're sleep-deprived. Google Sheets works fine if you keep it clean. (If you need a baseline structure, here’s a sales pipeline explainer you can borrow from.)

CRM columns (copy this table)

| Column | Example |

|---|---|

| Firm | Example Ventures |

| Partner | Jane Doe |

| Role | Partner/Principal |

| Thesis fit | 1-5 |

| Source | Crunchbase |

| Channel | form/email |

| Wave | 1/2/3 |

| Last touch | 2026-02-17 |

| Next step | follow-up #2 |

| Status | Engaged |

| Notes | Objection, asks |

| Deck link | DocSend URL |

| Engagement | clicked/none |

| Investor contact information | direct email / contact form URL / professional profile URL |

Pipeline stages

Keep stages simple so you'll actually use them:

- Targeted

- Contacted

- Engaged

- Meeting

- Diligence

- Term sheet

- Closed / Lost

Portfolio-founder-first motion (warm intro substitute)

The best "warm intro substitute" is contacting portfolio founders first, asking for experience, then earning the intro.

Script:

Subject: Quick question about [Investor] Hi [Founder] - I'm considering reaching out to [Investor/Firm] and saw you worked with them at [Company]. Could I ask you two quick questions about your experience? If you're open, I'd love 15 minutes this week. Thanks - [Name]

Timing: follow up once after 5-7 days.

Round math (sanity check)

Typical dilution per round is 10-30%, average around ~20%. A simple heuristic: raise amount / 20% = implied post-money.

So if you want to raise $3M, you're implicitly targeting about a $15M post-money. That doesn't make it "true," but it forces your story, traction, and round size to line up.

You just built your IIP and sourced 50 target firms. Now you need the partner's actual email - not deals@. Prospeo's Chrome extension (used by 40,000+ pros) pulls verified emails and direct dials from investor profiles and fund websites in one click, so you reach the decision-maker, not the dealflow graveyard.

Stop pitching generic inboxes. Reach the partner directly.

Investor outreach FAQ

How many investors should I contact to get meetings?

If you want 10 meetings, you'll typically contact about 70-200 investors based on fit, channel (forms beat deals@), and inbox placement. Start with 80-120 as a practical default, and keep it tight: 1-2 contacts per firm usually beats blasting the whole partnership.

What's the best follow-up cadence for investors?

A simple 5-touch cadence works: T+0, T+24h, day 3-5, day 10-14, and day 21-28, then stop and switch to monthly updates. Keep each follow-up to 5-7 sentences, add one new proof point, and repeat one clear ask for a 15-20 minute call.

Should I send my deck as an attachment?

Use a controlled deck link by default so you can update it, restrict downloads, and see engagement; attach a PDF only when an investor asks. As a rule: one link, one CTA, and no extra files until there's real interest.

What's a good free tool to reduce bounces before I email investors?

Prospeo's free tier includes 75 email credits plus 100 Chrome extension credits per month, and it verifies addresses in real time with 98% accuracy. If your bounce rate's above 2%, pause sending and verify the list first - saving your domain is worth more than "getting through the list."

What changes if I'm doing public-company investor outreach (IR)?

Public-company IR outreach is constrained by Reg FD and MNPI, so you can target institutions and schedule meetings but can't selectively disclose material updates. Use a tight logging system (who, when, what topics, blackout notes) and coordinate talking points with counsel/IR leadership, especially around earnings and guidance.

Summary: make investor outreach boring (and you'll win)

The founders who win don't hack fundraising. They make it operational.

Build a tight list, contact 1-2 people per firm, run waves, keep emails short, follow up with discipline, and track everything like a funnel. Do that, and investor outreach stops being emotional roulette and starts being a measurable system you can iterate.