Sales tactics that actually move numbers in 2026

Most sales tactics fail for boring reasons: bad data, sloppy cadence, and reps improvising the basics.

In 2026, the teams winning aren't magical. They're consistent, benchmark-driven, and annoyingly disciplined.

Here's the playbook I'd run for a typical mid-market B2B SDR/AE team if I had to move pipeline in 30 days.

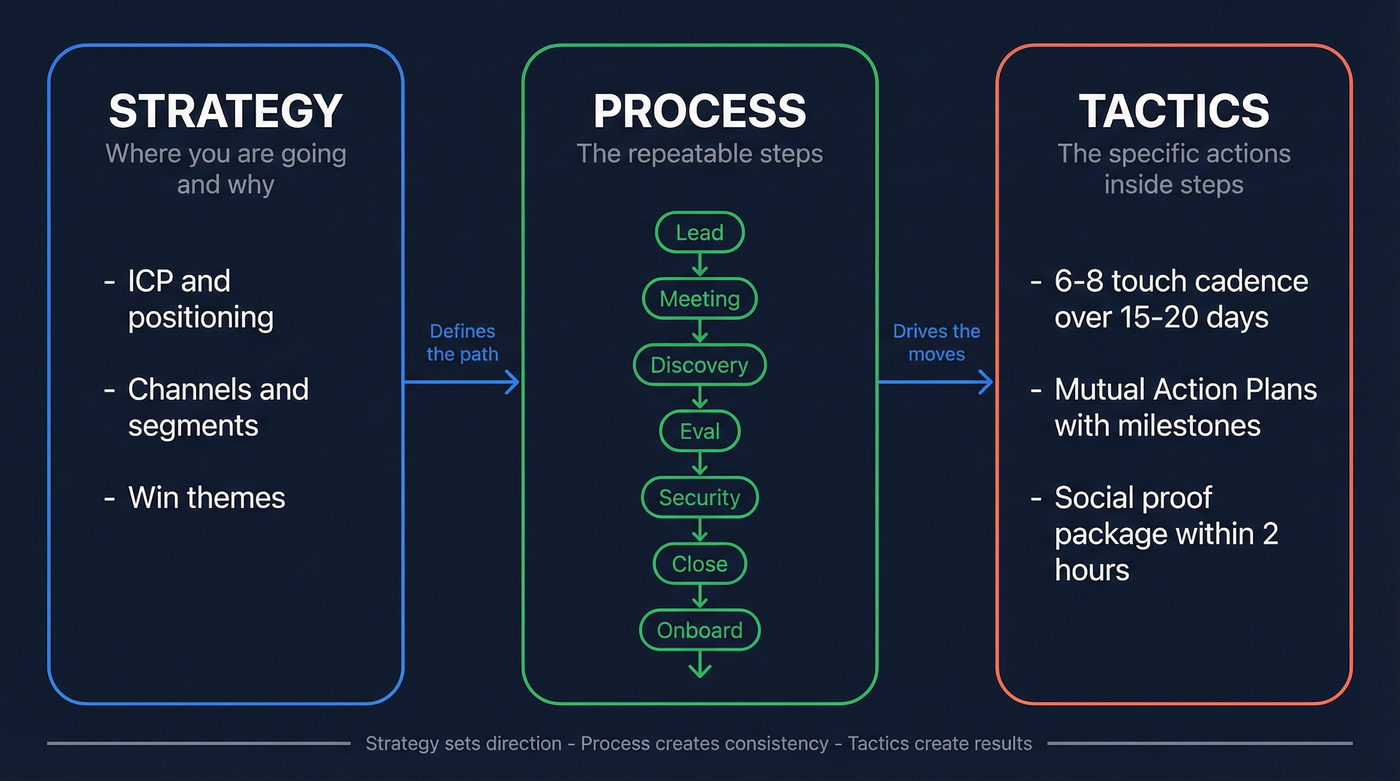

Sales tactics vs. sales strategy vs. sales process

Sales tactics are the moves. Sales process is the path. Sales strategy is the "why this path, for this market, right now." (If you need a full framework, start with sales strategy.)

- Strategy = where you're going and why (ICP, positioning, channels, segments, win themes)

- Process = the repeatable steps (lead -> meeting -> discovery -> eval -> security -> close -> onboard)

- Tactics = the specific actions inside steps (cadence, scripts, MAPs, objection handling, proof packages)

A quick mapping (this is how you keep it real):

Tactic: 6-8 touch cadence over 15-20 days Process step: Prospecting -> meeting set Strategy goal: Predictable top-of-funnel without burning domain reputation

Tactic: Mutual Action Plan with security/legal/procurement milestones Process step: Evaluation -> close Strategy goal: Fewer stalls and cleaner forecasts

Tactic: Send a social proof package within 2 hours of discovery Process step: Post-discovery follow-up Strategy goal: Compress shortlist decisions and build trust fast

What you need (quick version)

Checklist (non-negotiables)

- Benchmarks for reply rate, bounce rate, Spam complaints, connect rate, and dial-to-meeting.

- One standard cadence: 6-8 touches over 15-20 days (no rep-by-rep freelancing). (For templates and rules, see SDR cadence best practices.)

- Mutual Action Plans on any deal that touches security, legal, or procurement.

- Emails that are 50-125 words: one idea, one CTA. (More examples in sales CTA.)

- Calling that's timed and targeted, not "spray dials." (Use these answer rate benchmarks to sanity-check calling performance.)

Implement this week (the 60-minute setup)

- Pull the last 30 days and write down:

- Reply rate

- Bounce rate

- Spam complaint rate

- Connect rate

- Meetings per 100 dials

Pick one cadence and lock it in your sequencer.

Add a MAP template to every late-stage opportunity (and make it co-owned by the buyer).

Fix list quality first. Data quality is a lever because keeping bounces under 2% protects deliverability and stops reps from chasing ghosts. (If you need a SOP, use this email verification list workflow.)

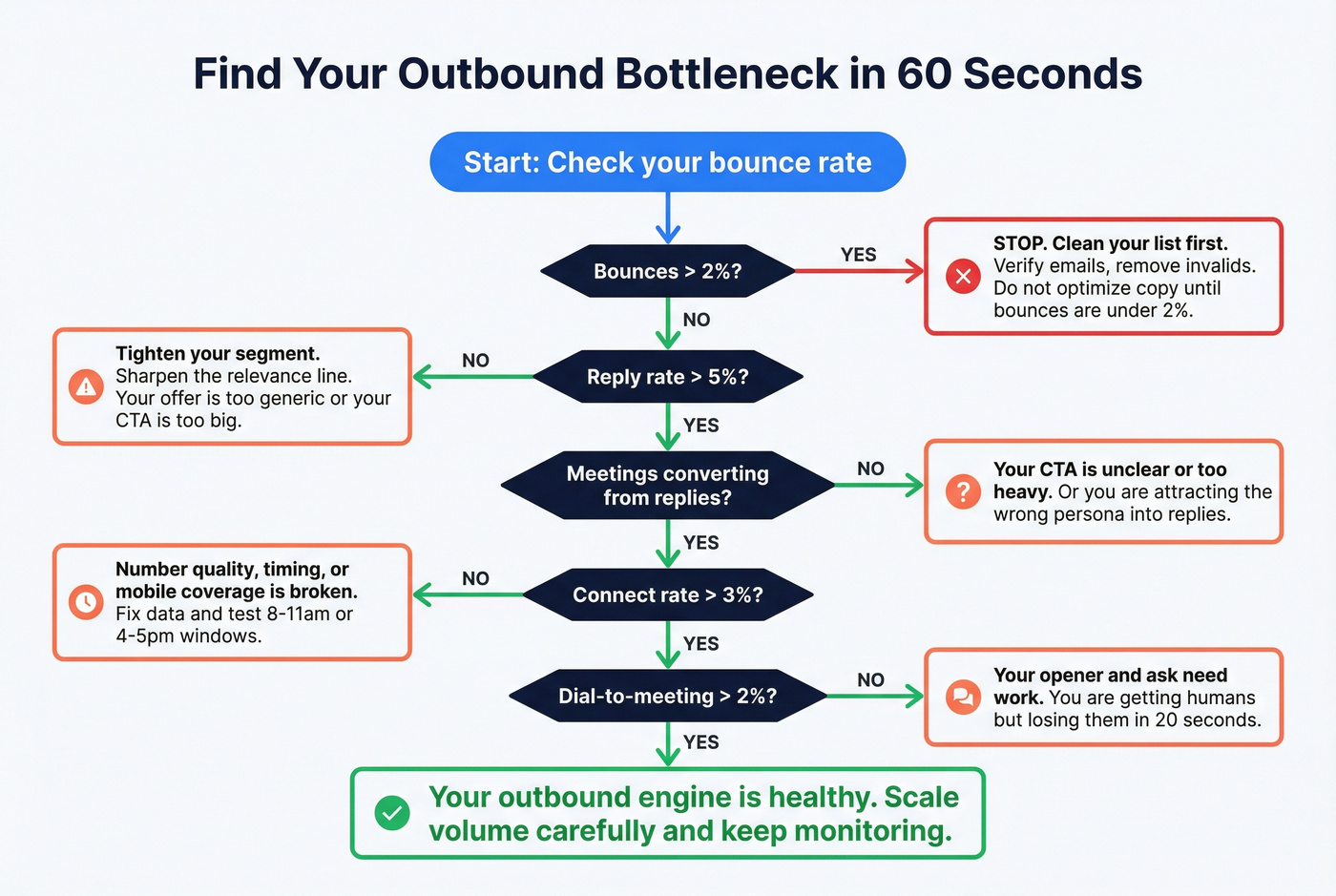

A simple scoreboard example (so you know what to fix)

Use this as a fast diagnosis:

- Reply rate 2% + bounce 3.5% -> stop copy tweaks; clean the list and re-verify before sending another batch.

- Reply rate 7% + meetings low -> your CTA's too big or you're pulling the wrong persona into replies.

- Connect rate 2% -> number quality/timing is broken; you're dialing the wrong layer.

- Connect rate 8% + dial-to-meeting 1% -> opener + ask are weak; you're getting humans and losing them in the first 20 seconds.

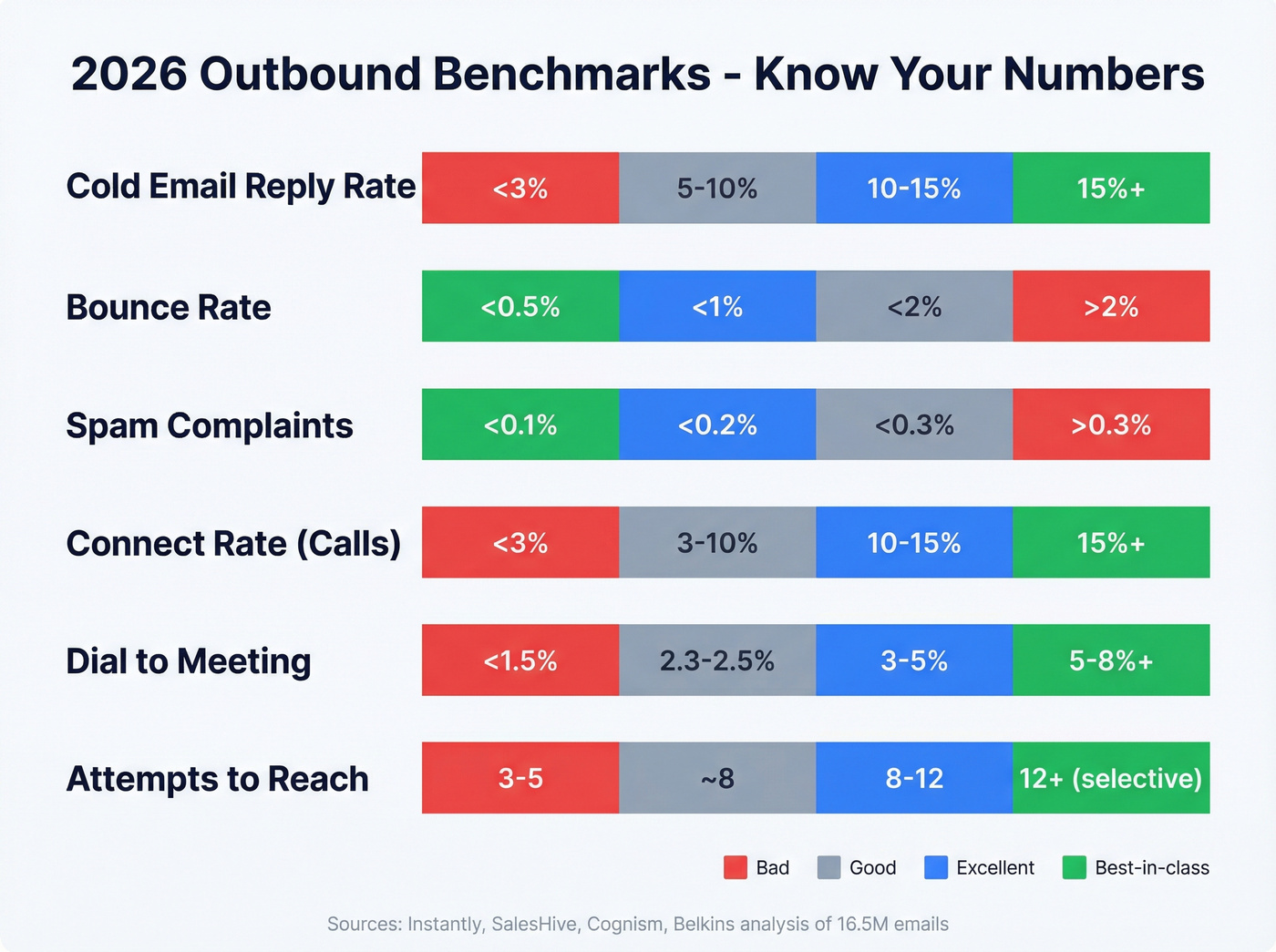

2026 benchmarks: what "good" looks like (email + calls)

Benchmarks aren't vanity. They're your early warning system.

If reply rate looks fine but bounces are high, you're quietly wrecking deliverability and future performance. If reps are dialing 60/day but connect rate's 2%, you don't have an effort problem - you've got a targeting, timing, or data problem.

Outbound benchmark table (use these as operating ranges)

| Metric | Bad | Good | Excellent | Best-in-class |

|---|---|---|---|---|

| Cold email reply rate | <3% | 5-10% | 10-15% | 15%+ |

| Bounce rate | >2% | <2% | <1% | <0.5% |

| Spam complaints | >0.3% | <0.3% | <0.2% | <0.1% |

| Connect rate (calls) | <3% | 3-10% | 10-15% | 15%+ |

| Dial -> meeting | <1.5% | 2.3-2.5% | 3-5% | 5-8%+ |

| Attempts to reach | 3-5 | ~8 | 8-12 | 12+ (selective) |

Email reply-rate and deliverability thresholds are widely cited in Instantly's benchmark roundup. Call funnel ranges (connect rate, dial->meeting, and the "~8 attempts" rule) show up consistently in cold-calling benchmark writeups from SalesHive and Cognism. Belkins' benchmark analysis of 16.5M emails puts "average" replies in the mid-single digits, so 10%+ is genuinely strong.

Diagnostic scoreboard (find the bottleneck fast)

If reply rate is low (<5%)

- Tighten the segment and sharpen the relevance line. Your offer's too generic or your CTA's too big.

If reply rate is fine (5-10%) but meetings are low

- Your CTA's unclear, your next step's too heavy, or you're attracting the wrong persona.

If bounces are >2%

- Your list's dirty. Fix data before you "optimize copy."

If connect rate is <3%

- Your numbers are wrong, your timing's wrong, or you're missing mobile coverage. (Deep dive: B2B phone number.)

If dial-to-meeting is <2% but connect is fine

- Your opener and ask need work. You're getting humans, then losing them.

Bounce rate's the silent killer because it compounds: one bad week can drag down inbox placement for weeks after, which means your "same copy" suddenly performs worse and everyone starts rewriting emails instead of fixing the real issue. (More on the mechanics in email deliverability.)

In our experience, the fastest way to stabilize outbound is boring: verify first, export only "valid," then sequence. That habit alone keeps deliverability in the safe zone. (If you want the step-by-step, see how to verify an email address.)

Prospeo is built for exactly that workflow. It's the B2B data platform built for accuracy, with 98% email accuracy, 143M+ verified emails, and a 7-day refresh cycle (the industry average is about 6 weeks), plus spam-trap/honeypot removal and catch-all handling so you're not gambling with domain reputation.

Every tactic in this playbook - cadence, calls, follow-ups - breaks if your bounce rate is above 2%. Prospeo's 5-step verification, spam-trap removal, and 7-day refresh cycle keep you in the safe zone so your reps execute the system instead of chasing ghosts.

Fix the data first. Everything else compounds from there.

Prospecting sales tactics (outbound operating system)

Outbound works in 2026 when it looks like an operating system, not a motivational poster. Start here, because top-of-funnel discipline is what creates enough qualified shots on goal for closing to matter. (If you're building the full motion, use this outbound sales engine blueprint.)

One concrete example: a 4-rep SDR team I worked with didn't change their pitch at all. They cleaned the list, standardized one cadence, and forced one CTA. Meetings went up because randomness went down.

Look, if your data's messy, everything else is theater.

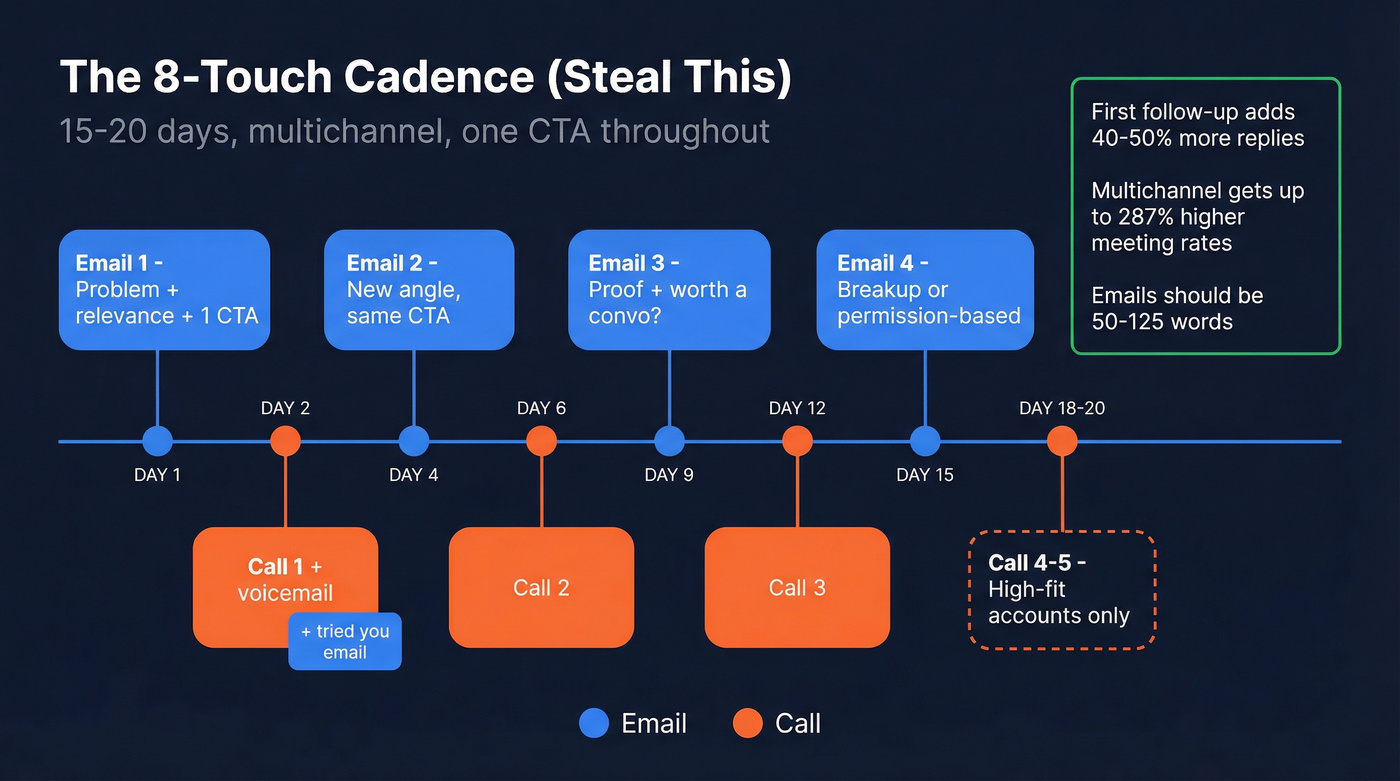

The default cadence (steal this)

- Length: 15-20 days

- Touches: 6-8

- Calls: 3-5 attempts

- Email length: 50-125 words

- Follow-ups: the first follow-up adds 40-50% more replies

- Multichannel: up to 287% higher reply/meeting rates vs single-channel

A practical 8-touch example:

- Day 1: Email #1 (problem + relevance + 1 CTA)

- Day 2: Call #1 + voicemail (optional) + short "tried you" email

- Day 4: Email #2 (new angle, same CTA)

- Day 6: Call #2

- Day 9: Email #3 (proof + "worth a convo?")

- Day 12: Call #3

- Day 15: Email #4 (breakup / permission-based)

- Day 18-20: Call #4-5 (only for high-fit accounts)

Before any of that: build and verify the list. If you're pulling contacts from a database, you want strong filters and freshness so you aren't sequencing stale records and then blaming "messaging" for what is really just bad inputs.

Prospeo's leads database (300M+ professional profiles, 30+ search filters, and a 7-day refresh cycle) makes it easy to build a tight segment, verify it, and push only clean contacts into your sequencer without a bunch of spreadsheet gymnastics.

Cold email tactics that lift replies without risking deliverability

Subject relevance beats cleverness. "{topic} at {company}" and "quick question on {workflow}" beat gimmicks. Your goal's "open + read," not "open + eye roll." (Need examples? Use these cold email subject lines.)

One idea per email. Stacking three value props forces the buyer to choose. They won't.

One CTA, and make it small. "Open to a 12-minute call next week?" beats "Can we schedule a demo?" because it's easier to say yes to.

Follow-ups must add value. No guilt. No "bumping this." Add a new angle, proof, or a permission check.

A follow-up sequence that works:

- Follow-up #1: different angle (same CTA)

- Follow-up #2: proof (one metric, one sentence)

- Follow-up #3: permission ("Should I close the loop?")

Deliverability guardrails (don't negotiate with these):

- Spam complaints under 0.3%

- Bounces under 2%

- Don't scale volume until those are stable

Hot take: if you're selling a low-price product and blasting 5,000 cold emails a week, you aren't "doing outbound." You're buying a deliverability problem you'll pay for all year. (If you're scaling, read how to scale outbound sales.)

Cold calling tactics that improve connects (not just dials)

Connect rate is mostly math: timing + number quality + persona. Once you connect, your opener decides whether you get 20 seconds or 2. (More scripts + KPIs in our B2B cold calling guide.)

A permission-based opener that works across segments:

- "Hey {Name}, it's {You}. Mind if I tell you why I called, and you can tell me if I'm off base?"

Then the 10-second relevance line:

- "I'm reaching out because we're helping {peer companies} reduce {specific pain} in {specific workflow}. Quick question - how are you handling {X} today?"

And the ask:

- "If it's not a priority, I'll let you go. If it is, are you open to a quick working session this week?"

Most teams obsess over "objection handling" and ignore the basics: calling the right person, with a reason that makes sense in 10 seconds.

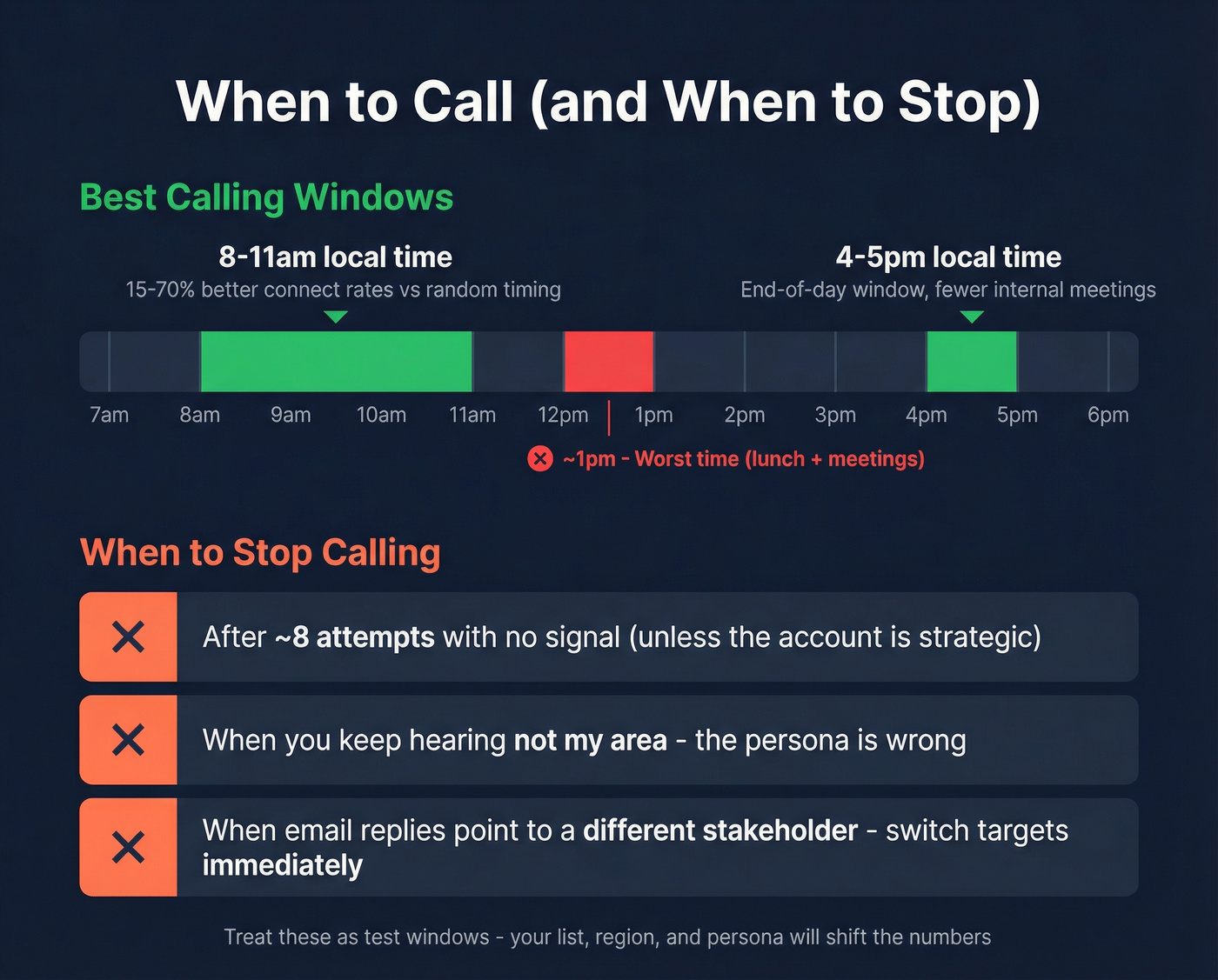

When to call (and when to stop calling)

Timing is a lever. Use it.

Two windows to start with:

- 8-11am local time

- 4-5pm local time

Some datasets show modest lifts (~15% better connects) and others show 40-70% lifts for 8-9am or 4-5pm versus random times. Treat these as test windows; your list, region, and persona matter.

Worst time that keeps showing up:

- Around 1pm (lunch + internal meetings)

Stop calling when:

- You've hit ~8 attempts with no signal and the account isn't strategic.

- The persona's wrong (you keep getting "not my area").

- Email replies point to a different stakeholder - switch targets immediately.

Gatekeeper + "send me an email" handling

Gatekeepers aren't villains. They're doing their job. Your job is to make the next step easy.

Gatekeeper (2 lines + next step):

- "Totally fair. I'm trying to reach {Name} about {specific outcome} for {Company}. What's the best way to get 10 minutes on their calendar?"

If they push back:

- "Should I send a short note first, or is there a better time/day when they actually take calls?"

"Send me an email" response (version 1, direct):

- "Happy to. What should the email focus on - cost reduction, speed, or risk? I'll keep it to three bullets."

"Send me an email" response (version 2, routing):

- "I can. If I send it, are you the right person to forward it, or should I address it to {Name} directly?"

Those lines turn "send an email" from a brush-off into a routing question.

Tactic: name the elephant (budget freezes, layoffs, tool fatigue)

Buyers are thinking it anyway. Say it once, calmly, and move on.

Email line:

- "Quick note: if budget's frozen or you're in 'no new tools' mode, tell me and I'll back off. If the priority is reducing {cost/risk/time} this quarter, I've got one idea."

Call line:

- "Before I jump in - are you in a 'no new spend' quarter, or are you still funding projects that pay back fast?"

This works because it lowers defensiveness. It also saves you weeks of polite-but-fake evaluation cycles.

Tactic: use AI to generate angles, not to spam

AI's useful when it helps you think, not when it helps you send more. (More guardrails in AI cold email campaigns.)

Gong's analysis of 7.1M opportunities found frequent AI users generate 77% more revenue. The practical takeaway: use AI to produce better inputs (angles, objections, proof), then keep the message human and short.

A simple AI workflow that doesn't create garbage:

- Ask for 3 angles per persona (cost, risk, speed).

- Ask for one proof point you can credibly support.

- Ask for two "small CTAs" (12-minute call, quick sanity check, forward-to-owner).

- You pick one angle, rewrite it in your voice, and send.

Discovery tactics that turn interest into a real problem

Discovery isn't about being likable. It's about building a shared understanding of the problem, the cost of doing nothing, and the path to a decision.

The best discovery calls feel calm. The worst feel like a rep chasing a checklist.

The "consistency" rule for talk/listen

Gong's big insight isn't "talk less." It's "be consistent."

Low performers swing wildly: they average 54% talk time in won deals but jump to 64% talk time in lost deals. That's what panic sounds like.

A clean target:

- Aim for 45-55% talk time

- Give a 45-60 second upfront frame, then ask questions

Self-check:

- Pick 10 discovery calls.

- Track your talk ratio and where you talk (intro vs mid-call vs end).

- If your talk spikes when objections show up, you aren't handling objections - you're steamrolling.

High-signal discovery questions

You want questions that create decisions, not questions that create "interesting conversation."

Pain (what's broken):

- "What's the trigger that made you take this meeting now?"

- "Where does this process break most often?"

Impact (why it matters):

- "What happens if this stays the same for the next 90 days?"

- "Who feels the pain the most - CS, RevOps, finance, the reps?"

Current workflow (what they actually do):

- "Walk me through the last time this happened - step by step."

- "What tools are involved, and where do handoffs fail?"

Decision process (how they buy):

- "Who else has to sign off for this to happen?"

- "What're security/legal/procurement going to ask for?"

Timeline (what forces movement):

- "Is there a date this needs to be live by?"

- "What changes internally if it slips a quarter?"

Discovery do/don't (the stuff that changes win rate)

Do: quantify the cost of "fine."

- "If this stays 'fine' for two more quarters, what does it cost you in time, risk, or missed revenue?"

Don't: accept vague pain. If they say "we want to improve efficiency," push once:

- "Efficiency where - handoffs, reporting, outreach volume, or conversion?"

Do: lock the next step before you recap.

- "If we can confirm X and Y, are you comfortable bringing in {security/procurement/economic buyer} next?"

Don't: end with 'I'll send something over.' That's how deals drift into the swamp.

Consensus tactics (buying committee, multi-threading, social proof)

Gong's analysis of 1.8M opportunities makes this painful: you aren't selling to a person - you're selling to a committee, and committees hate blame. (If you want the full system, use ABM multi-threading in sales.)

- 77% of deals involve multiple contacts

- Closed-won deals have 2x as many buyer contacts as closed-lost

- Strategic enterprise deals average 17 contacts

- Multi-threading boosts win rates by 130% in deals over $50K

Buyers also self-educate hard. Gartner Digital Markets found that 90% of buyers say social proof heavily influences shortlist decisions, and separate Gartner Digital Markets survey data (over 2,000 software buyers) shows reviews are a major trust input, with a strong preference for recent and third-party-verified reviews.

Multi-threading plan: 5 roles to add and why

Use this mini-table as your "who to add next" cheat sheet:

| Role to add | Why they matter | What they care about |

|---|---|---|

| Economic buyer | Budget + priority | ROI, risk, timing |

| Champion | Drives internal momentum | credibility, ease |

| IT/Security | Can block late | controls, reviews |

| Finance/Procurement | Slows paperwork | terms, vendors |

| End user | Adoption risk | workflow, effort |

Make intros normal:

- "To make this easy internally, who should we loop in early - security, procurement, or the team lead who'll live in it?"

Social proof package to send after the call

Send this within 2 hours of discovery. Not tomorrow.

A tight package:

- 1 relevant review link (recent, verified if possible)

- A 1-page overview (problem -> approach -> outcomes)

- A 4-sentence case snippet (same segment, same pain)

- A simple implementation outline (week 1-2-3)

Shortlist compression reality

Shortlists are smaller and getting smaller.

Gartner Digital Markets shows average vendor engagements dropped 3.2 -> 2.5. TrustRadius found 63% of shortlists include 2-3 products, and 78% of buyers pick products they've heard of before research.

Your job is to:

- get on the shortlist early, and

- make it easy for the committee to defend choosing you.

Closing tactics (reduce indecision + prevent stalls with MAPs)

Late-stage deals don't die because the product suddenly got worse. They die because nobody owns the path to "yes." You're not convincing someone; you're removing friction and ambiguity from the buying process.

Challenger's selling challenges research (survey of nearly 500 B2B sellers) nails the real issue: gaining buyer commitment is the #1 negotiation concern (60%), above protecting price (53%).

That's why MAPs work. They turn "we're interested" into "we're executing."

The Mutual Action Plan (MAP) template (copy/paste)

Paste this into a doc and co-edit it with the buyer.

Mutual Action Plan - {Account} / {Project}

Goal (buyer language):

- Example: "Reduce lead response time from 24h to 2h by May 15."

| Milestone | Owner | Due date | Dependencies |

|---|---|---|---|

| Confirm success criteria | Buyer + Seller | Stakeholders aligned | |

| Technical validation | Buyer IT + Seller SE | Access, sandbox | |

| Security review | Buyer Security | Security packet | |

| Legal redlines | Buyer Legal | MSA, DPA | |

| Procurement / vendor setup | Buyer Proc | W-9, vendor forms | |

| Exec sign-off | Economic buyer | Business case | |

| Kickoff + implementation | Buyer PM + Seller CS | SOW signed | |

| Go-live | Buyer team | Training complete |

Risks / blockers (live list):

- Security questionnaire turnaround

- Legal redlines cycle time

- Internal resourcing

Comms plan:

- Weekly 15-min checkpoint

- Slack/email channel for blockers

MAP rule: one owner per action. "Team" isn't an owner.

MAP as qualification

A MAP isn't just a closing tool. It's a truth serum.

If a buyer won't name owners, acknowledge dependencies, and put dates next to milestones, you've got a deal that's emotionally positive and operationally fake.

I've seen MAPs save quarters of forecast embarrassment because they expose "we like you" vs "we're buying." (If you're tightening stage discipline, see deal health.)

Ethical urgency scripts

Don't fake urgency. Buyers can smell "end of month" desperation from orbit, and it makes you look small.

Ethical urgency ties to their deadline:

- "You mentioned you need this live before the next hiring wave. If that's still true, security review needs to start by {date}. Want me to draft the plan so it's easy to say yes internally?"

Expansion tactics (upsell, cross-sell, referrals)

Expansion is the cheapest revenue you'll ever earn - if you time it right.

McKinsey's growth benchmarking notes a few economics that show up again and again:

- Retaining a customer costs less than a third of acquiring one.

- Existing customers generate about 10% more revenue than new ones.

- In one McKinsey case, cross-sell/category penetration increased sales 20% and profits 30%.

Expansion checklist + timing triggers

- 30 days post go-live: "Are we hitting the success criteria we agreed on?"

- First measurable win: ask for a referral to a peer team ("Who else has this problem?")

- Usage plateau: propose an add-on tied to the plateau ("To get the next 20%, you'll need X.")

- Org change (new leader / new region): re-sell the outcome, not the product

Keep it buyer-centric: expansion should feel like the next logical step, not quota season.

Ethical tactics + tactics to avoid (with safe replacements)

Unethical tactics aren't just gross - they're expensive. The FTC's Penalty Offense Authority allows civil penalties up to $50,120 per violation after Notice for certain deceptive practices.

Zendesk's ethical principles are the right baseline: be honest, follow through, and don't belittle competitors.

Avoid -> do this instead

| Avoid tactic | Why it backfires | Do this instead |

|---|---|---|

| Fake deadlines | Destroys trust | Tie urgency to buyer date |

| Bait-and-switch | Legal + brand risk | Be explicit on scope |

| Trash competitors | Makes you look insecure | Neutral comparisons |

| Overpromising | Creates churn | Set clear expectations |

| "Gotcha" discovery | Feels manipulative | Curiosity + clarity |

| Dark-pattern pricing | Procurement escalates | Transparent ranges |

Ethical micro-behaviors (what "ethical" looks like in real calls)

- Put the next step in writing: owner, date, and what "done" means.

- Recap risks as plainly as benefits ("Security review is usually the long pole - let's plan for it.").

- If you don't know, say so, and commit to a follow-up by a specific time.

- Don't invent competitor claims. If you can't prove it, don't say it.

- Don't trap buyers in meetings. Ask permission to continue: "Want to go 5 minutes longer, or should we pick this up later?"

- If the buyer says "not now," respect it and set a clean re-open date.

Skip the "pressure" tricks if you're selling anything with a real sales cycle. They work once, then they poison your pipeline with distrust and churn.

Scripts library (word swaps + micro-scripts)

These are small swaps, but they lower resistance fast. Think of them as sales tips and tactics you can deploy without changing your whole pitch.

Word swaps (say this / not that)

Say: "I hear you, and so..." Not: "I hear you, but..."

Say: "Would you be open to a quick look?" Not: "Are you interested?"

Say: "How does that sound?" Not: "Does that make sense?"

Say: "Just out of curiosity..." Not: "Why did you...?" (can sound accusatory)

Micro-scripts (copy/paste)

Permission-based cold call opener

- "Mind if I tell you why I called, and you can tell me if I'm off base?"

Soft CTA in email

- "Open to a 12-minute call next week to see if this is relevant?"

Objection: "We already have a vendor."

- "Makes sense. When you chose them, what mattered most - cost, speed, or risk? I'm trying to see if there's any gap worth discussing."

Objection: "No budget."

- "Understood. Is it 'no budget for anything,' or 'no budget unless it pays back fast'? If it's the second, what payback window do you need - 30, 60, or 90 days?"

Objection: "Not a priority."

- "Got it. What is a priority right now in your world? If I can connect this to that, worth a quick look - if not, I'll close the loop."

Next-step lock (end of discovery)

- "If we do X next, do you want to bring in security/procurement now, or after the technical validation?"

"Send me an email" response (two versions)

- "Happy to - what should it focus on: speed, cost, or risk? I'll keep it to three bullets."

- "I can. If I send it, are you the right person to forward it, or should I address it to {Name} directly?"

Quick recap (save this, run it)

If you only fix five things, fix these: (1) keep bounces under 2%, (2) standardize a 6-8 touch cadence over 15-20 days, (3) make your CTA small and consistent, (4) run discovery to quantify impact and map the decision process, and (5) use a Mutual Action Plan anytime security/legal/procurement shows up.

Everything else - AI, personalization, objection handling - works better when those fundamentals are locked.

FAQ

What are sales tactics (and how are they different from strategy)?

Sales tactics are the specific actions you take (cadences, scripts, MAPs, proof packages), while strategy is the plan for winning a market (ICP, positioning, channels) and process is the repeatable path from lead to close. A tactic should map to a process step and a strategy goal, or it's just activity.

What's a good cold email reply rate in 2026?

A good B2B cold email reply rate in 2026 is 5-10%, excellent is 10-15%, and best-in-class is 15%+ on tight segments. Protect deliverability with spam complaints under 0.3% and bounces under 2%, or your reply rate will decay over time.

How many touches should a sales cadence have?

A solid default cadence is 6-8 touches over 15-20 days, including 3-5 call attempts, with short emails (50-125 words). The first follow-up typically adds 40-50% more replies, so stopping after one email leaves meetings on the table.

What is a Mutual Action Plan (MAP) and when should I use it?

A Mutual Action Plan is a shared close plan that lists milestones, owners, dates, and dependencies (especially security, legal, and procurement). Use it anytime a deal has multiple stakeholders or formal approvals; if the buyer won't co-own a MAP, that's a qualification warning sign.

How do I keep bounce rate under 2% (and protect deliverability)?

Keeping bounces under 2% requires verifying before every send, suppressing invalid/catch-all risk where appropriate, and not scaling volume until spam complaints stay under 0.3% for 2-3 straight sends.

You need accurate mobiles for that 8-touch cadence to work. Prospeo gives you 125M+ verified mobile numbers with a 30% pickup rate - plus 143M+ emails at 98% accuracy - so your connect rates actually hit the benchmarks above.

Stop blaming the script when the numbers are wrong.